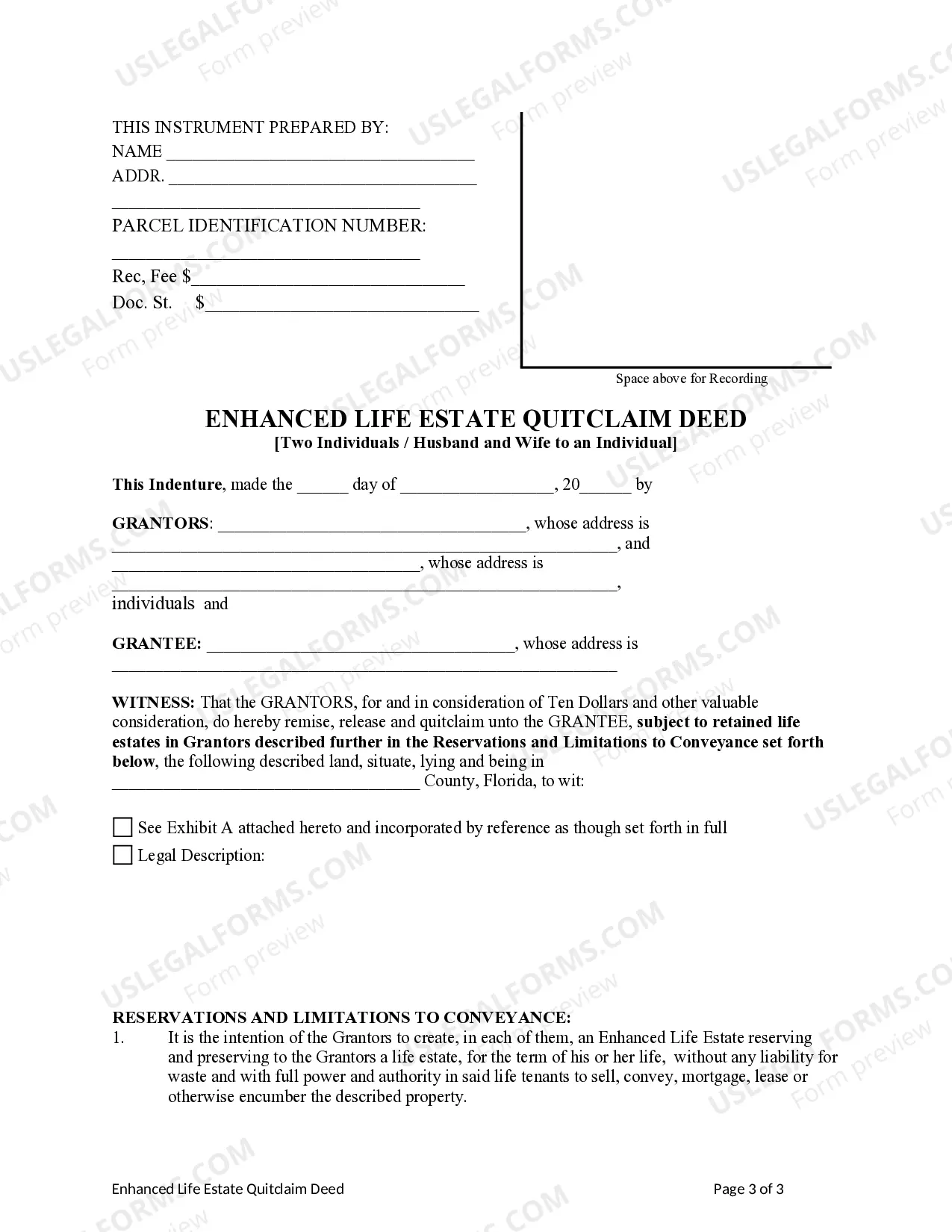

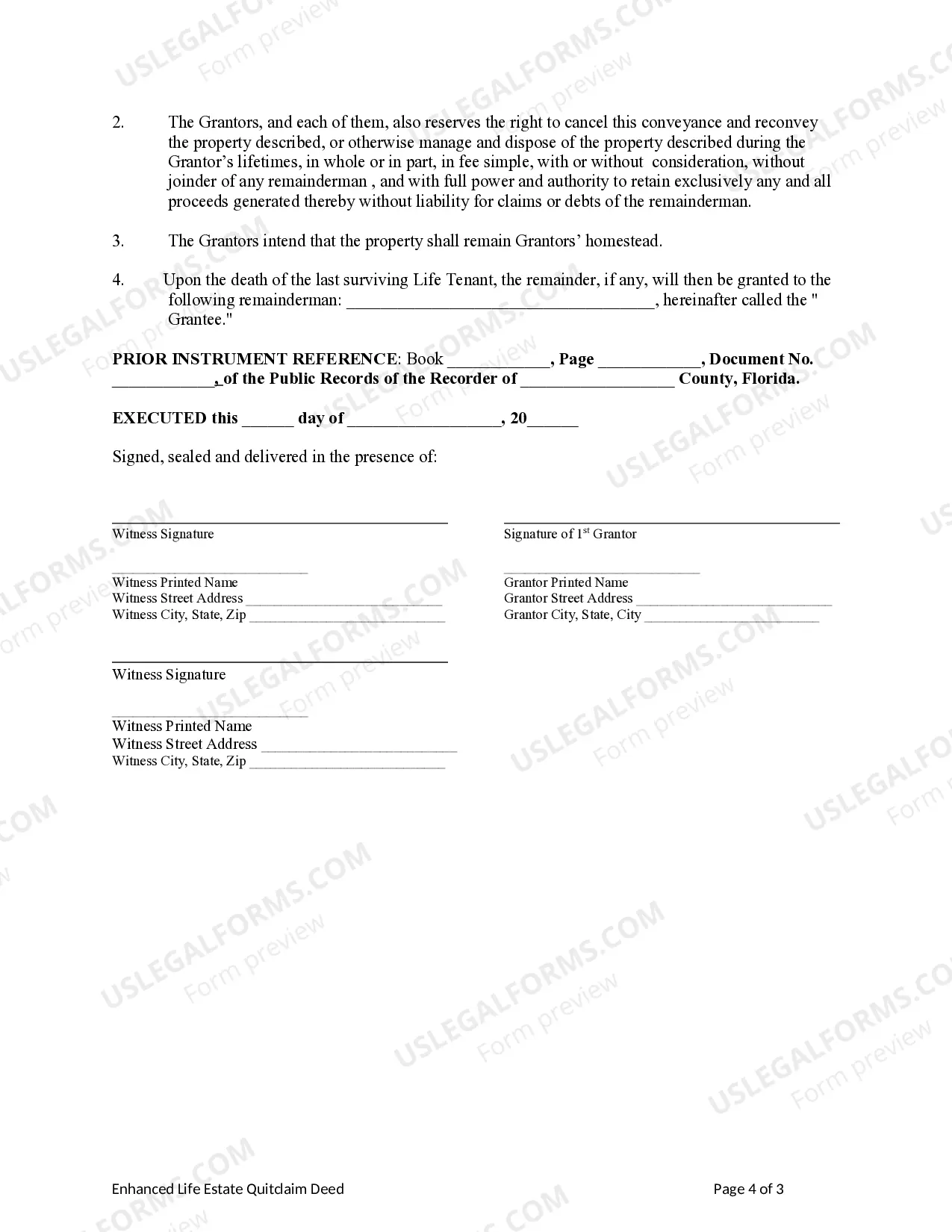

This form is an Enhanced Life Estate Deed where the Grantors are two individuals or husband and wife and the Grantee is an individual. Grantors convey the property to Grantee subject to a retained enhanced life estate in Grantors. Further, the Grantors retains for life the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

A Tallahassee Florida Enhanced Life Estate or Lady Bird Deed Quitclaimai— - Two Individual or Husband and Wife to Individual is a versatile legal instrument that allows property owners to transfer their real estate while maintaining control and benefits during their lifetime. This type of deed holds significant advantages over conventional quitclaim deeds, offering added flexibility and asset protection for individuals residing in Tallahassee, Florida. The Tallahassee Florida Enhanced Life Estate or Lady Bird Deed is known by different names, including: 1. Lady Bird Deed: Named after Lady Bird Johnson, who popularized this type of deed in Texas, it is also recognized as an enhanced life estate deed. 2. Enhanced Life Estate Deed: This term is generally used to describe the mechanism by which the granter retains the enhanced life estate rights in the property. Key Features of Tallahassee Florida Enhanced Life Estate or Lady Bird Deed: 1. Individual or Husband and Wife to Individual: This type of deed is specifically designed for individuals or married couples who wish to transfer their property to an individual beneficiary, whether a family member, friend, or someone else. 2. Transfer with Retained Rights: The granter maintains control and can freely use and manage the property during their lifetime, including the right to sell, mortgage, lease, or make changes to it without seeking consent from the beneficiary. 3. Enhanced Life Estate: Unlike regular life estate deeds, the Tallahassee Florida Enhanced Life Estate or Lady Bird Deed provides the granter with the added advantage of the "enhanced life estate." This means that the granter has the ability to reclaim, change, or revoke the deed if desired, even after it has been conveyed to the beneficiary. 4. Probate Avoidance: One of the primary benefits of utilizing this type of deed is to avoid the lengthy and costly probate process. Upon the death of the granter, the property automatically transfers to the beneficiary outside of probate, eliminating the need for court involvement. 5. Medicaid Planning: The Tallahassee Florida Enhanced Life Estate or Lady Bird Deed can be a valuable estate planning tool for Medicaid eligibility. By retaining the enhanced life estate, the granter can potentially protect their property from being subject to Medicaid recovery after their passing. In conclusion, the Tallahassee Florida Enhanced Life Estate or Lady Bird Deed Quitclaimai— - Two Individual or Husband and Wife to Individual is a powerful legal tool that offers greater control, flexibility, and asset protection to property owners in Tallahassee, Florida. By using this mechanism, individuals or married couples can seamlessly transfer their property to an individual beneficiary, while retaining enhanced life estate rights and avoiding the probate process.A Tallahassee Florida Enhanced Life Estate or Lady Bird Deed Quitclaimai— - Two Individual or Husband and Wife to Individual is a versatile legal instrument that allows property owners to transfer their real estate while maintaining control and benefits during their lifetime. This type of deed holds significant advantages over conventional quitclaim deeds, offering added flexibility and asset protection for individuals residing in Tallahassee, Florida. The Tallahassee Florida Enhanced Life Estate or Lady Bird Deed is known by different names, including: 1. Lady Bird Deed: Named after Lady Bird Johnson, who popularized this type of deed in Texas, it is also recognized as an enhanced life estate deed. 2. Enhanced Life Estate Deed: This term is generally used to describe the mechanism by which the granter retains the enhanced life estate rights in the property. Key Features of Tallahassee Florida Enhanced Life Estate or Lady Bird Deed: 1. Individual or Husband and Wife to Individual: This type of deed is specifically designed for individuals or married couples who wish to transfer their property to an individual beneficiary, whether a family member, friend, or someone else. 2. Transfer with Retained Rights: The granter maintains control and can freely use and manage the property during their lifetime, including the right to sell, mortgage, lease, or make changes to it without seeking consent from the beneficiary. 3. Enhanced Life Estate: Unlike regular life estate deeds, the Tallahassee Florida Enhanced Life Estate or Lady Bird Deed provides the granter with the added advantage of the "enhanced life estate." This means that the granter has the ability to reclaim, change, or revoke the deed if desired, even after it has been conveyed to the beneficiary. 4. Probate Avoidance: One of the primary benefits of utilizing this type of deed is to avoid the lengthy and costly probate process. Upon the death of the granter, the property automatically transfers to the beneficiary outside of probate, eliminating the need for court involvement. 5. Medicaid Planning: The Tallahassee Florida Enhanced Life Estate or Lady Bird Deed can be a valuable estate planning tool for Medicaid eligibility. By retaining the enhanced life estate, the granter can potentially protect their property from being subject to Medicaid recovery after their passing. In conclusion, the Tallahassee Florida Enhanced Life Estate or Lady Bird Deed Quitclaimai— - Two Individual or Husband and Wife to Individual is a powerful legal tool that offers greater control, flexibility, and asset protection to property owners in Tallahassee, Florida. By using this mechanism, individuals or married couples can seamlessly transfer their property to an individual beneficiary, while retaining enhanced life estate rights and avoiding the probate process.