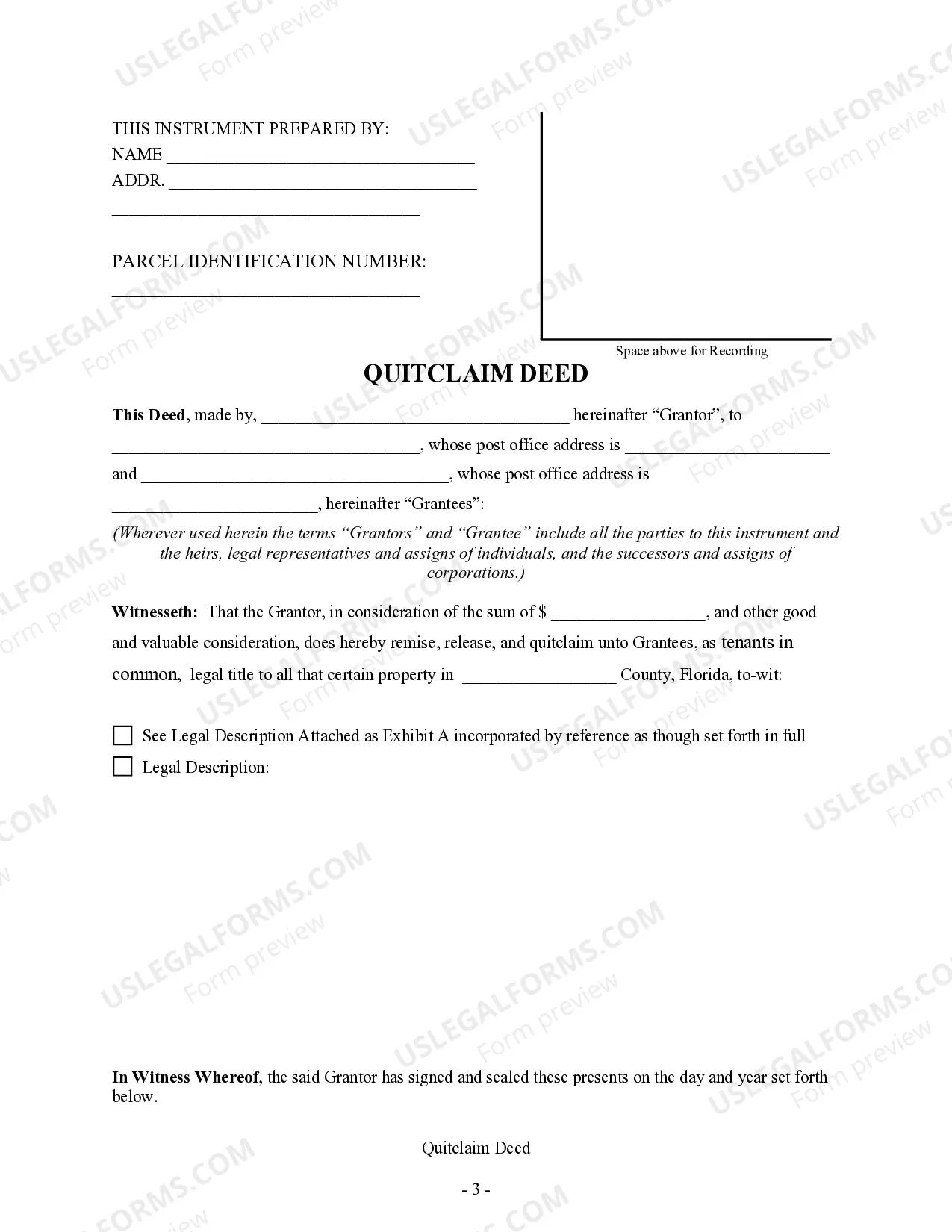

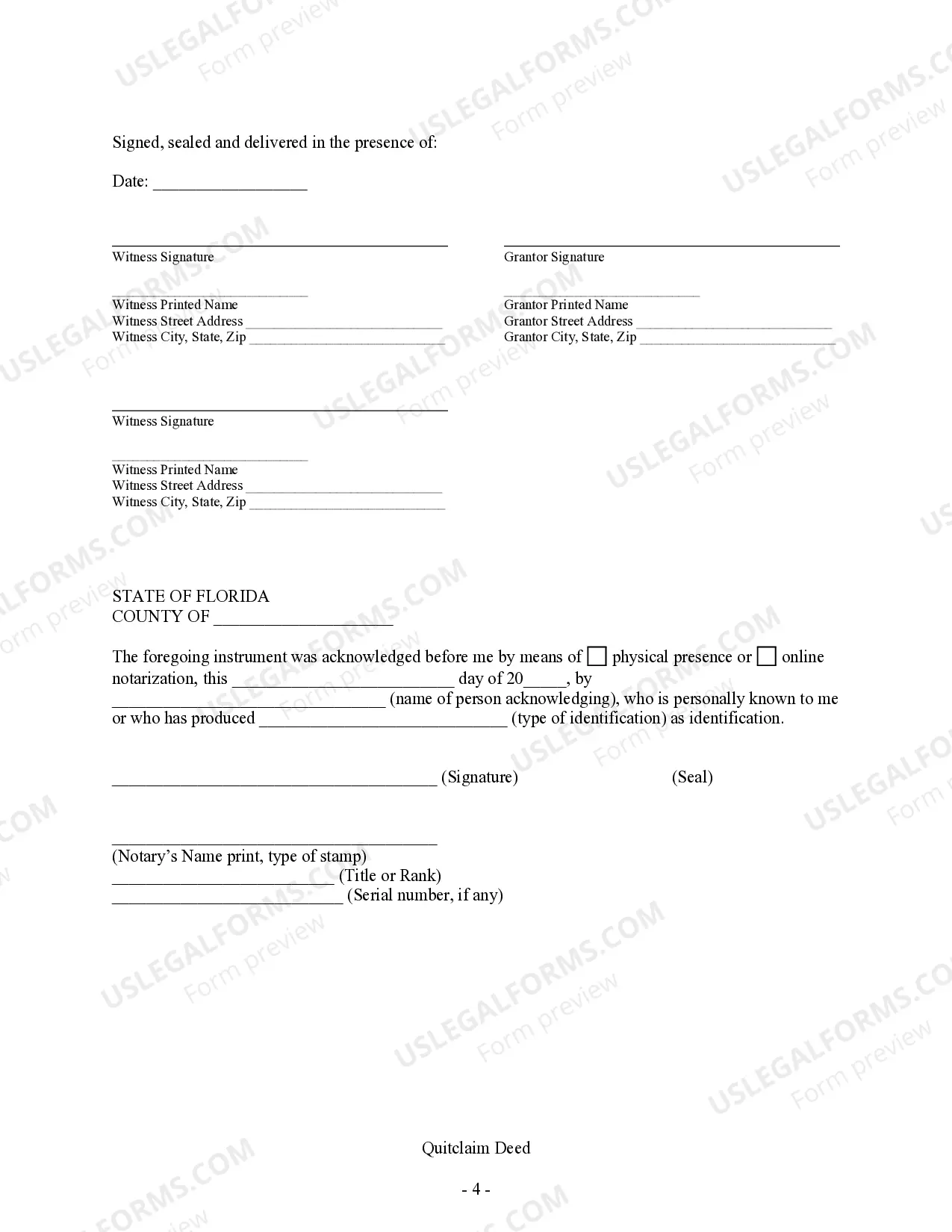

This form is a Quitclaim Deed where the grantor is an individual and the grantees are two individuals. Grantor conveys and quitclaims the described property to grantees. The grantees take the property as tenants in common, as joint tenants with the right of survivorship, or, if married, as tenants by the entireties. This deed complies with all state laws.

In Palm Beach, Florida, the Quitclaim Deed — One Individual to Two Individuals is a legal document that allows an individual to transfer their ownership rights of a property to two different individuals. This type of deed is commonly used in real estate transactions when one person wants to transfer their share of ownership to two others, such as spouses, family members, or business partners. The Palm Beach Quitclaim Deed — One Individual to Two Individuals provides a clear record of the transfer and helps ensure that both parties understand their rights and responsibilities. It is important to note that a quitclaim deed only transfers the granter's interest in the property and does not guarantee or verify the title of the property. This means that there may be potential limitations or encumbrances on the property, so it is crucial for the parties involved to conduct a thorough title search and seek legal advice before finalizing the transaction. Different types of Palm Beach Florida Quitclaim Deed — One Individual to Two Individuals may include: 1. Joint Tenancy with Rights of Survivorship: This type of quitclaim deed grants equal ownership to both individuals, and in the event of one person's death, the surviving individual automatically inherits the deceased person's share, without the need for probate. 2. Tenants in Common: With this type of quitclaim deed, both individuals hold a specific percentage of ownership in the property. Unlike joint tenancy, the shares do not automatically transfer to the surviving individual in case of death. Each individual has the right to sell, mortgage, or transfer their share independently. 3. Community Property: In the state of Florida, community property laws do not exist. However, married couples can choose to hold joint ownership utilizing provisions of community property laws from other states, such as California. In such cases, a quitclaim deed would outline the transfer of one individual's interest to both spouses, ensuring equal ownership and shared rights. 4. Tenants by the Entire ties: This form of joint ownership is available to married couples in Florida. It offers protections and benefits similar to joint tenancy, the primary difference being that creditors of one spouse cannot seize the property for debts incurred solely by that spouse. When considering a Palm Beach Florida Quitclaim Deed — One Individual to Two Individuals, it is essential to consult with a real estate attorney or a qualified professional to understand the specific requirements and implications of the chosen type of deed. They can guide the parties involved through the legal process, ensuring a smooth transfer of ownership and providing necessary protection for all parties.