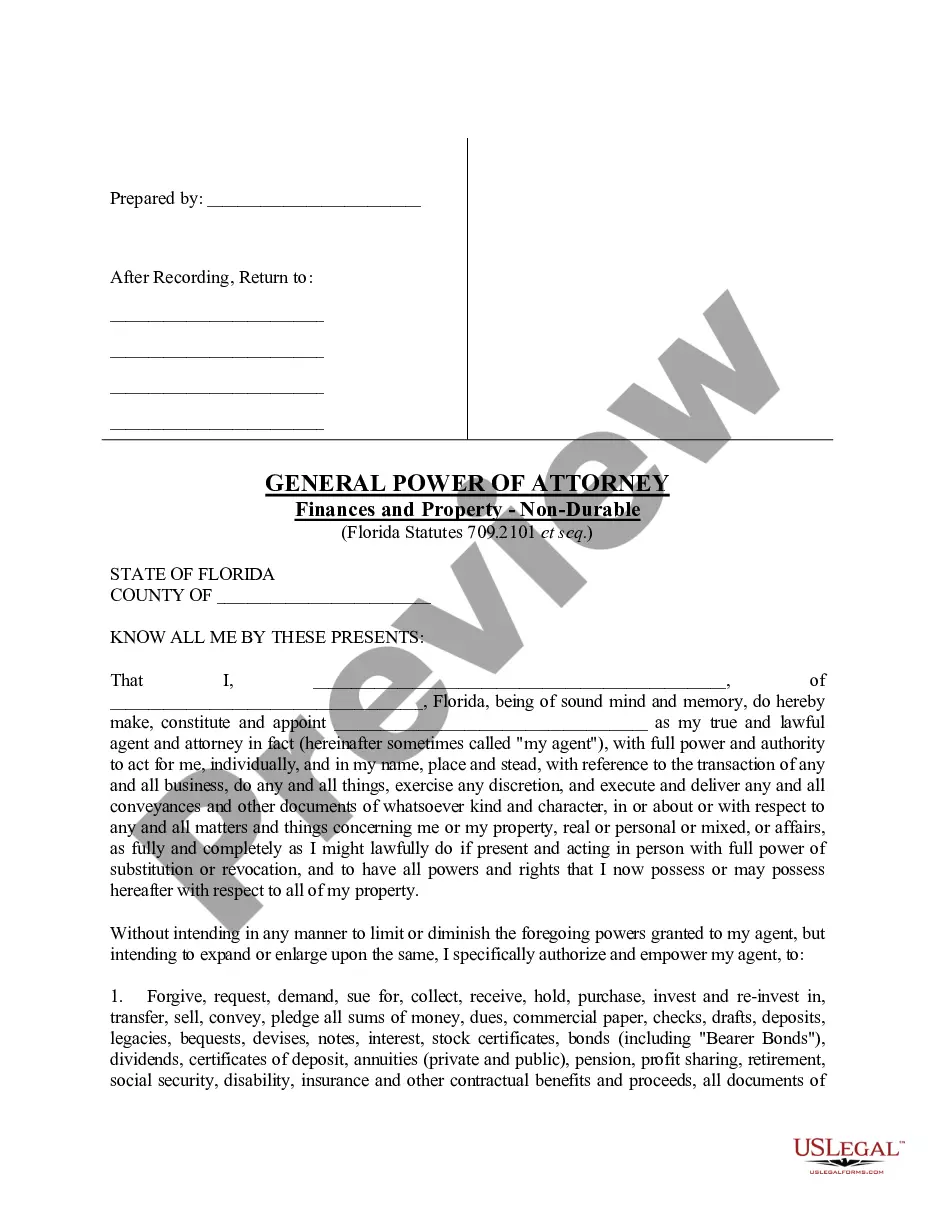

A Power of Attorney form is used by one individual to designate another individual as their agent with authority to perform certain legal acts on their behalf. This document, a General Power of Attorney, can be used to designate an individual to perform the named tasks including financial matters, real or personal property transfers, banking, legal matters, or other powers.

Cape Coral Florida General Power of Attorney for Property and Finances - Nondurable

Description

How to fill out Florida General Power Of Attorney For Property And Finances - Nondurable?

Utilize the US Legal Forms and gain immediate access to any form template you desire.

Our user-friendly platform with a vast array of documents enables you to locate and obtain nearly any form template you need.

You can export, complete, and sign the Cape Coral Florida General Power of Attorney for Property and Finances - Nondurable in just a few minutes instead of spending hours online searching for an appropriate template.

Using our catalog is an excellent method to enhance the security of your document submissions.

If you haven't created a profile yet, follow the steps outlined below.

Locate the template you require. Ensure that it is the form you were searching for: check its title and description, and utilize the Preview option when available. Alternatively, use the Search box to find the needed one.

- Our experienced attorneys routinely review all records to verify that the templates are suitable for a specific state and adhere to current laws and regulations.

- How can you obtain the Cape Coral Florida General Power of Attorney for Property and Finances - Nondurable.

- If you hold a subscription, simply Log In to your account.

- The Download button will be activated on all documents you access.

- Additionally, you can view all previously saved records in the My documents section.

Form popularity

FAQ

The best form of power of attorney depends on your individual needs and circumstances. The Cape Coral Florida General Power of Attorney for Property and Finances - Nondurable is a preferable choice for many seeking broad authority without ongoing powers after incapacitation. However, your specific situation might call for different arrangements. Assess your goals carefully, and you might find that a tailored approach works best.

When deciding between a general power of attorney and a special power of attorney, think about the scope of authority you want to grant. A general power allows wide-ranging authority, while a special power limits rights to specific tasks or decisions. If you want a broad reach for financial matters, the Cape Coral Florida General Power of Attorney for Property and Finances - Nondurable might be the better option. Consider your requirements and desired control when making your choice.

The terms 'power of attorney' and 'lasting power of attorney' vary, with the latter generally referring to arrangements that persist through incapacity. Depending on your situation, either could suit your needs. For specific tasks, the Cape Coral Florida General Power of Attorney for Property and Finances - Nondurable offers the flexibility you may require. Assess your goals and consult with a professional to determine the best option for your case.

While you don’t necessarily need a lawyer to create a power of attorney in Florida, consulting a legal expert can provide peace of mind. A lawyer can ensure that your Cape Coral Florida General Power of Attorney for Property and Finances - Nondurable meets all legal requirements and serves your intended purpose. Additionally, they can help clarify the implications and responsibilities involved. Having legal support can simplify the process significantly.

In Florida, you are not required to record a power of attorney to make it valid. However, if you intend to use the Cape Coral Florida General Power of Attorney for Property and Finances - Nondurable for real estate transactions, recording it may simplify the process. It is wise to consult with a legal professional to determine the best course of action for your particular circumstances. Ensuring that your documents are easily accessible can also facilitate smoother transactions.

Choosing between a general and durable power of attorney often depends on your specific needs. The Cape Coral Florida General Power of Attorney for Property and Finances - Nondurable becomes ineffective if you become incapacitated, which might be suitable for temporary arrangements. On the other hand, a durable power of attorney remains in effect even if you lose the ability to make decisions yourself. Consider your situation carefully when making this choice.

Formatting a power of attorney involves clearly labeling the document, stating your full name, and identifying your agent. Include the specific powers granted and the effective date. To ensure your Cape Coral Florida General Power of Attorney for Property and Finances - Nondurable meets all legal standards, using a standard template from a trusted service like UsLegalForms can provide clarity and structure, saving you from potential errors.

Yes, you can create your own power of attorney in Florida. However, to ensure that your Cape Coral Florida General Power of Attorney for Property and Finances - Nondurable accurately reflects your wishes, consider using online services like UsLegalForms. These platforms provide accessible templates and guidance, making it easier to create a legally sound document tailored to your needs.

In Florida, a general power of attorney must be signed by the principal and can be notarized for added validation, especially for property and finance matters. Although notarization is not a strict requirement, having your Cape Coral Florida General Power of Attorney for Property and Finances - Nondurable notarized can enhance its credibility and acceptance in various scenarios. Always check specific requirements based on your situation to ensure compliance.

Filling out a Florida power of attorney form involves entering specific details like your name, the agent's name, and the powers you wish to grant. Make sure to clearly specify that this is your Cape Coral Florida General Power of Attorney for Property and Finances - Nondurable. Using a structured format provided by UsLegalForms can simplify this process and ensure accuracy, helping you avoid common pitfalls.