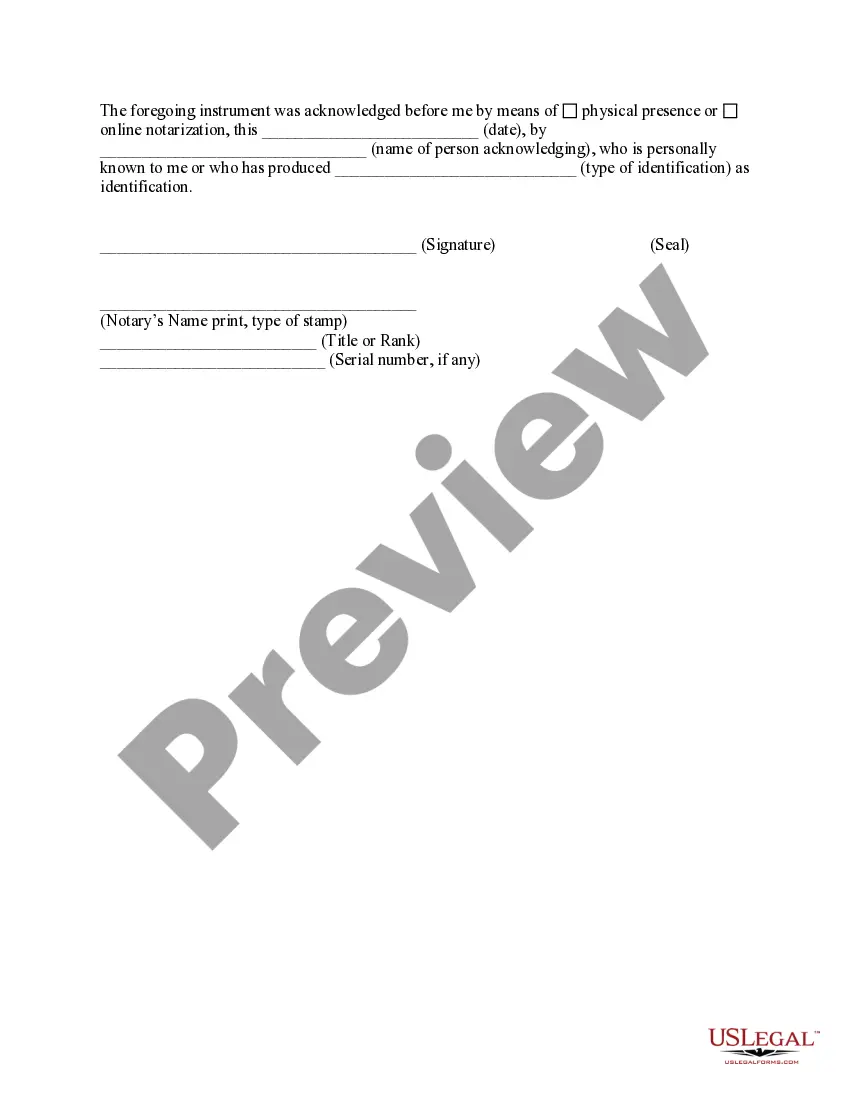

A Power of Attorney form is used by one individual to designate another individual as their agent with authority to perform certain legal acts on their behalf. This document, a General Power of Attorney, can be used to designate an individual to perform the named tasks including financial matters, real or personal property transfers, banking, legal matters, or other powers.

Fort Lauderdale, Florida General Power of Attorney for Property and Finances — Nondurable: A Comprehensive Guide In Fort Lauderdale, Florida, a General Power of Attorney for Property and Finances — Nondurable is a legal document that allows an appointed individual, known as the agent or attorney-in-fact, to manage the principal's property and financial affairs. This authority remains effective until it is revoked or terminated by the principal, becomes incapacitated, or passes away. The General Power of Attorney for Property and Finances — Nondurable provides the agent with the power to handle various financial matters on behalf of the principal. These may include managing bank accounts, handling real estate transactions, paying bills, managing investments, filing taxes, and making financial decisions. It is important to note that the General Power of Attorney for Property and Finances — Nondurable is different from other types of power of attorney in Fort Lauderdale. Other common types include Durable Power of Attorney, Limited Power of Attorney, and Springing Power of Attorney. 1. Durable Power of Attorney: This type of power of attorney remains in effect even if the principal becomes incapacitated. It allows the agent to continue managing the principal's property and finances during incapacity. 2. Limited Power of Attorney: In contrast to a general power of attorney, a limited power of attorney grants the agent specific powers and is limited to a particular activity or period. For instance, it could be used to authorize someone to handle a real estate transaction on the principal's behalf while they are out of the country. 3. Springing Power of Attorney: A springing power of attorney only becomes effective when a specific event or condition described in the document occurs. This can be useful in situations where the principal wants to ensure that their agent's authority is limited to a specific circumstance, such as in the case of medical incapacity. Obtaining a Fort Lauderdale, Florida General Power of Attorney for Property and Finances — Nondurable is a serious decision that requires careful consideration. It is crucial for individuals to choose someone they trust implicitly to act in their best interests and handle their financial matters responsibly. To ensure the legality and enforceability of the document, it is highly recommended consulting with an experienced attorney specializing in estate planning and power of attorney laws in Fort Lauderdale, Florida. In conclusion, a General Power of Attorney for Property and Finances — Nondurable in Fort Lauderdale, Florida allows individuals to appoint someone to handle their financial affairs temporarily. Different types of power of attorney, such as Durable Power of Attorney, Limited Power of Attorney, and Springing Power of Attorney, offer specific provisions and requirements depending on the principal's needs and circumstances. Seek professional guidance to ensure your power of attorney documents comply with all applicable laws and accurately reflect your intentions.Fort Lauderdale, Florida General Power of Attorney for Property and Finances — Nondurable: A Comprehensive Guide In Fort Lauderdale, Florida, a General Power of Attorney for Property and Finances — Nondurable is a legal document that allows an appointed individual, known as the agent or attorney-in-fact, to manage the principal's property and financial affairs. This authority remains effective until it is revoked or terminated by the principal, becomes incapacitated, or passes away. The General Power of Attorney for Property and Finances — Nondurable provides the agent with the power to handle various financial matters on behalf of the principal. These may include managing bank accounts, handling real estate transactions, paying bills, managing investments, filing taxes, and making financial decisions. It is important to note that the General Power of Attorney for Property and Finances — Nondurable is different from other types of power of attorney in Fort Lauderdale. Other common types include Durable Power of Attorney, Limited Power of Attorney, and Springing Power of Attorney. 1. Durable Power of Attorney: This type of power of attorney remains in effect even if the principal becomes incapacitated. It allows the agent to continue managing the principal's property and finances during incapacity. 2. Limited Power of Attorney: In contrast to a general power of attorney, a limited power of attorney grants the agent specific powers and is limited to a particular activity or period. For instance, it could be used to authorize someone to handle a real estate transaction on the principal's behalf while they are out of the country. 3. Springing Power of Attorney: A springing power of attorney only becomes effective when a specific event or condition described in the document occurs. This can be useful in situations where the principal wants to ensure that their agent's authority is limited to a specific circumstance, such as in the case of medical incapacity. Obtaining a Fort Lauderdale, Florida General Power of Attorney for Property and Finances — Nondurable is a serious decision that requires careful consideration. It is crucial for individuals to choose someone they trust implicitly to act in their best interests and handle their financial matters responsibly. To ensure the legality and enforceability of the document, it is highly recommended consulting with an experienced attorney specializing in estate planning and power of attorney laws in Fort Lauderdale, Florida. In conclusion, a General Power of Attorney for Property and Finances — Nondurable in Fort Lauderdale, Florida allows individuals to appoint someone to handle their financial affairs temporarily. Different types of power of attorney, such as Durable Power of Attorney, Limited Power of Attorney, and Springing Power of Attorney, offer specific provisions and requirements depending on the principal's needs and circumstances. Seek professional guidance to ensure your power of attorney documents comply with all applicable laws and accurately reflect your intentions.