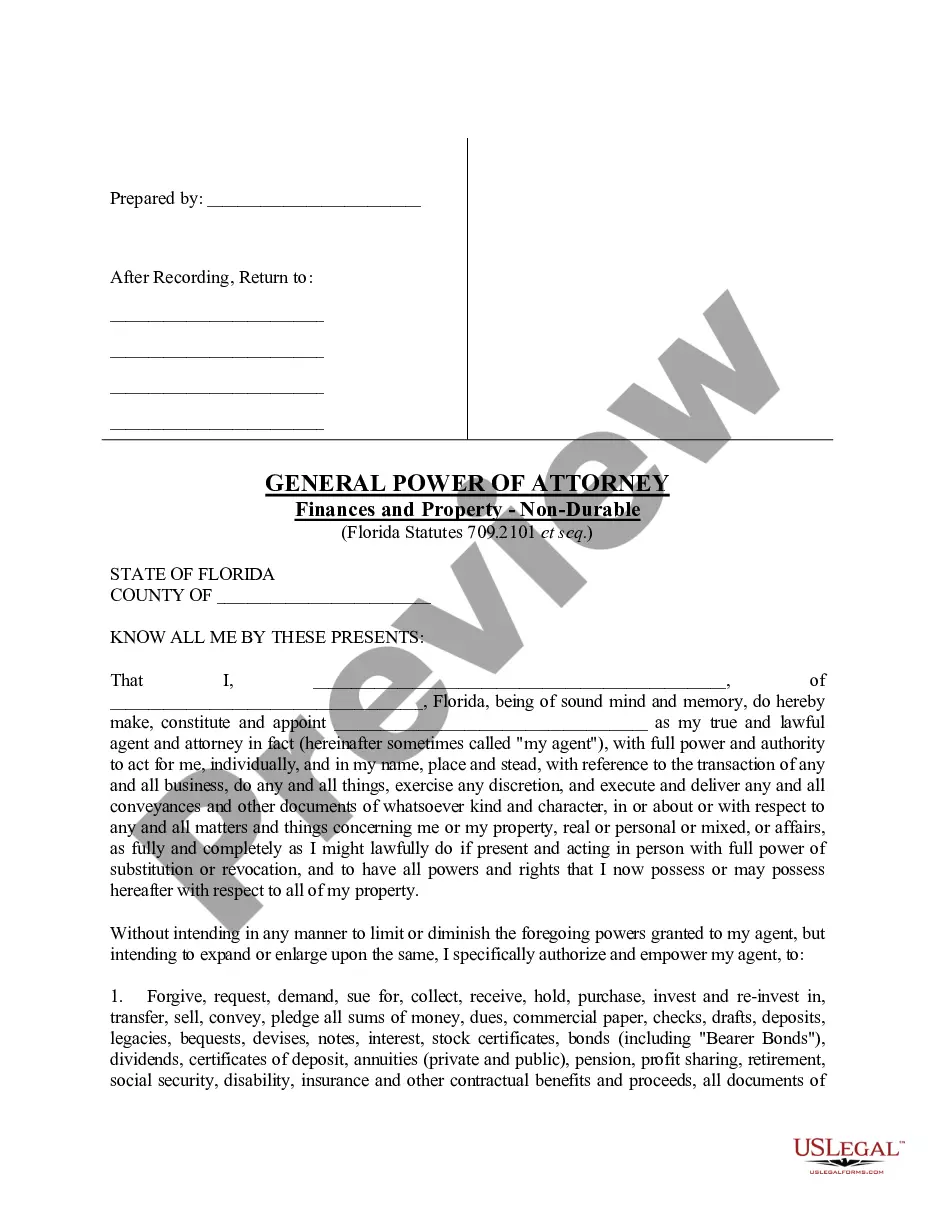

A Power of Attorney form is used by one individual to designate another individual as their agent with authority to perform certain legal acts on their behalf. This document, a General Power of Attorney, can be used to designate an individual to perform the named tasks including financial matters, real or personal property transfers, banking, legal matters, or other powers.

Lakeland Florida General Power of Attorney for Property and Finances - Nondurable

Description

How to fill out Florida General Power Of Attorney For Property And Finances - Nondurable?

If you’ve previously utilized our service, Log In to your account and secure the Lakeland Florida General Power of Attorney for Property and Finances - Nondurable on your device by clicking the Download button. Ensure your subscription is active. If not, renew it based on your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You maintain perpetual access to every document you have purchased: you can locate it in your profile within the My documents section whenever you need to access it again. Utilize the US Legal Forms service to effortlessly locate and save any template for your personal or business needs!

- Ensure you’ve located a suitable document. Browse the description and utilize the Preview feature, if available, to verify if it fulfills your requirements. If it doesn’t meet your criteria, use the Search option above to find the correct one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and submit payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your Lakeland Florida General Power of Attorney for Property and Finances - Nondurable. Select the file format for your document and save it to your device.

- Fill out your document. Print it or utilize professional online editors to complete and sign it digitally.

Form popularity

FAQ

A nondurable power of attorney, often referred to as a non-durable POA, is a legal document that grants someone authority to act on another person's behalf in specific financial matters. It remains in effect until the principal revokes it or passes away, but it does not survive incapacity. This can be particularly beneficial for short-term situations. To ensure proper execution and understanding of a Lakeland Florida General Power of Attorney for Property and Finances - Nondurable, consider using uslegalforms.

To fill out a power of attorney form, begin by entering the principal's information and the specific powers granted. Include details about the agent acting on behalf of the principal and make sure to sign and date the document. Utilizing a Lakeland Florida General Power of Attorney for Property and Finances - Nondurable template can streamline this process considerably, making it easier. You can access user-friendly forms through uslegalforms.

The primary disadvantage of a non-durable power of attorney is that it becomes invalid if the principal becomes incapacitated. This limitation can be problematic if long-term decision-making is required for property and finances. Understanding the implications of a Lakeland Florida General Power of Attorney for Property and Finances - Nondurable is vital to ensure that your needs are fully met. Consult with legal professionals or resources like uslegalforms for assistance.

To fill out a POA check, you need to indicate that you are signing on behalf of the principal, not as yourself. Write the principal's name, followed by your signature and the words 'as attorney-in-fact.' This practice is crucial in the context of a Lakeland Florida General Power of Attorney for Property and Finances - Nondurable, as it helps clarify your authority in financial matters. For detailed guidance, uslegalforms offers helpful resources.

Yes, you can write your own power of attorney in Florida. However, it is essential to ensure that it meets all legal requirements to be valid. The Lakeland Florida General Power of Attorney for Property and Finances - Nondurable can be particularly useful for managing property and financial decisions during specific times. Consider using platforms like uslegalforms for reliable templates.

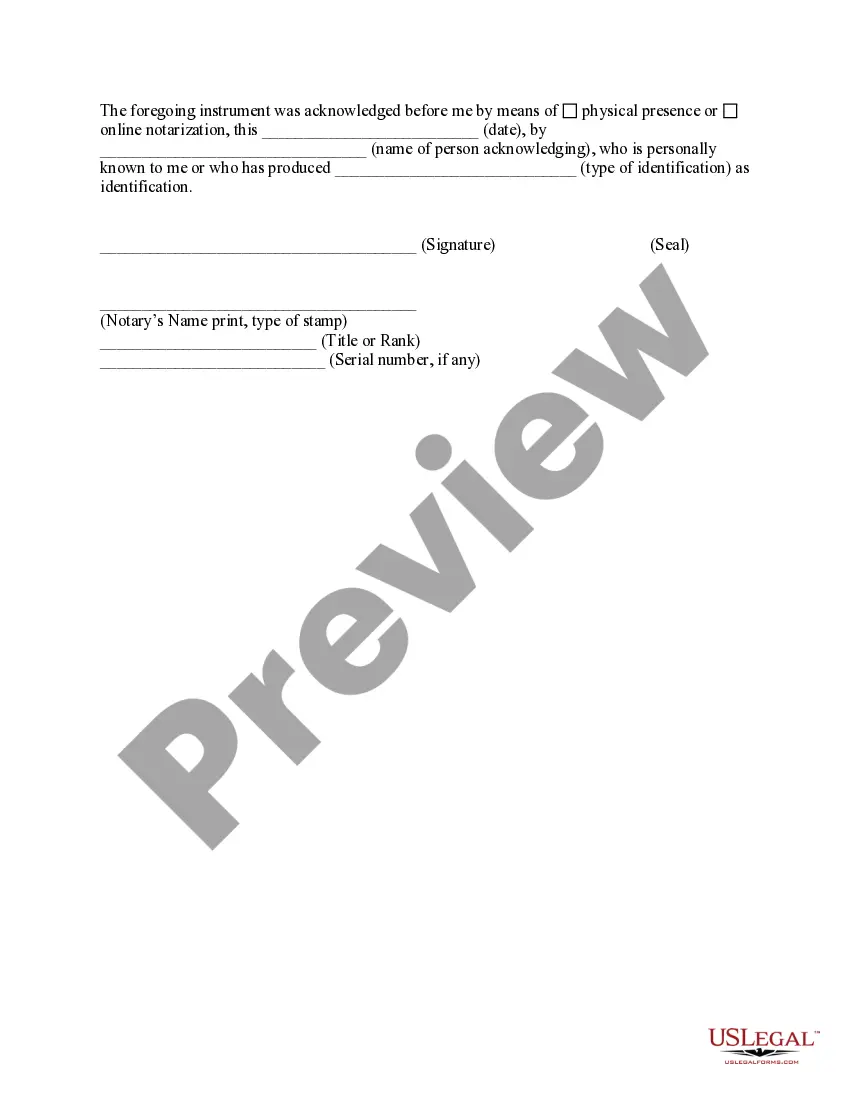

Getting a general power of attorney in Florida involves several steps, especially for a Lakeland Florida General Power of Attorney for Property and Finances - Nondurable. First, you need to complete the appropriate forms, which outline your specific powers. You can obtain these forms from online platforms like US Legal Forms, which provide user-friendly templates. After completing the forms, ensure you sign them in front of a notary to validate your power of attorney.

Yes, you can obtain a Lakeland Florida General Power of Attorney for Property and Finances - Nondurable without a lawyer. However, it is crucial to understand that navigating the process independently requires careful attention to the legal requirements. Using resources like US Legal Forms can simplify the process, ensuring all necessary forms are completed correctly. This approach allows you to have the flexibility and control over your financial matters.

In the context of a Lakeland Florida General Power of Attorney for Property and Finances - Nondurable, a legal power of attorney cannot make decisions regarding your personal medical care, represent you in a marriage, or create or change a will. These actions require direct involvement and authorization from you. Knowing these restrictions is critical for anyone considering granting power of attorney.

A durable power of attorney remains effective even if the principal becomes incapacitated, while a nondurable power of attorney ceases upon incapacity. The Lakeland Florida General Power of Attorney for Property and Finances - Nondurable is intended for specific situations where authority is only needed for a determined period. Understanding these distinctions helps you choose the best option for your needs.

To obtain a general power of attorney in Florida, start by filling out the proper documentation that stipulates your intentions. This document must be signed in front of a notary public for validation. Utilizing resources from uslegalforms can simplify this process, ensuring compliance with Florida laws for a Lakeland Florida General Power of Attorney for Property and Finances - Nondurable.