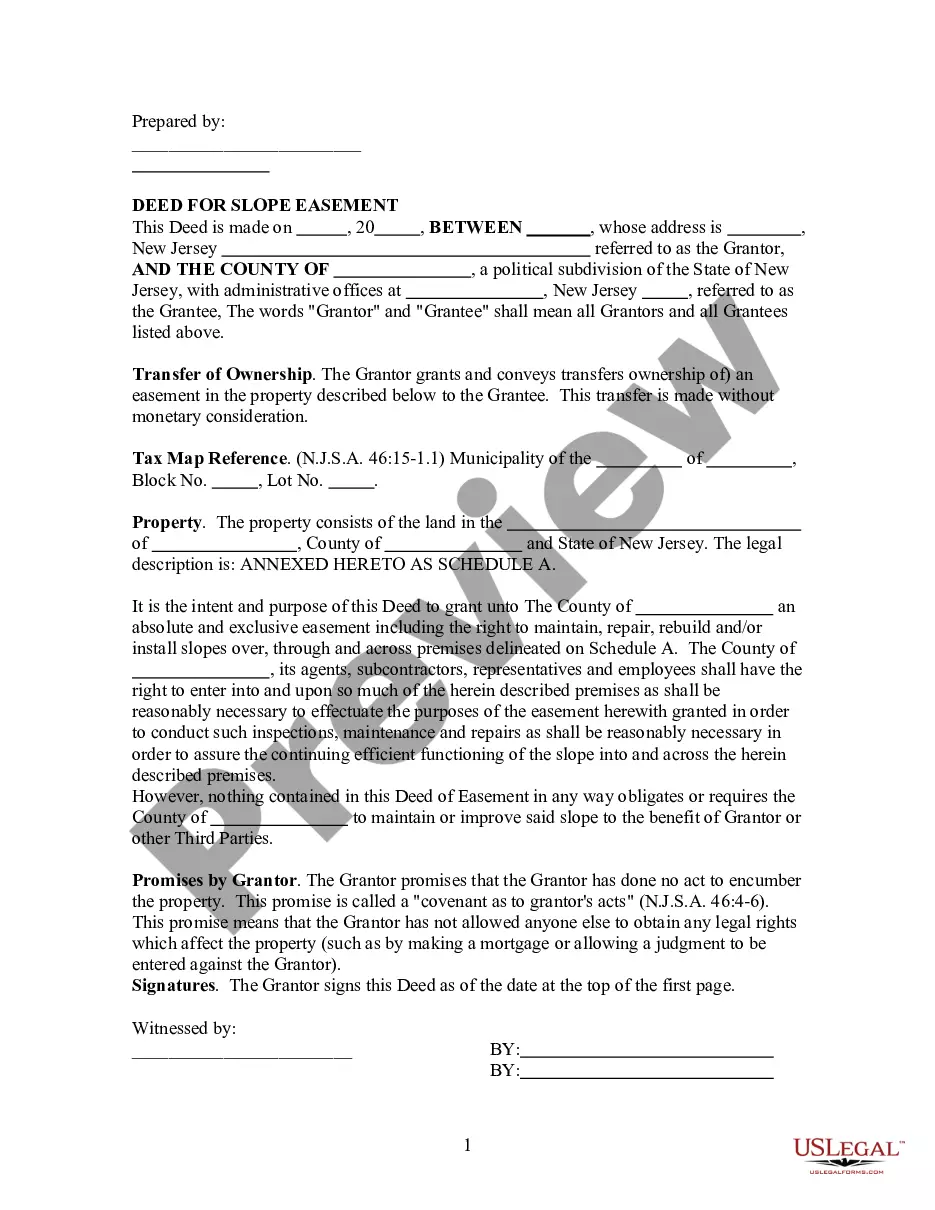

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Warranty Deed in Lieu of Foreclosure, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

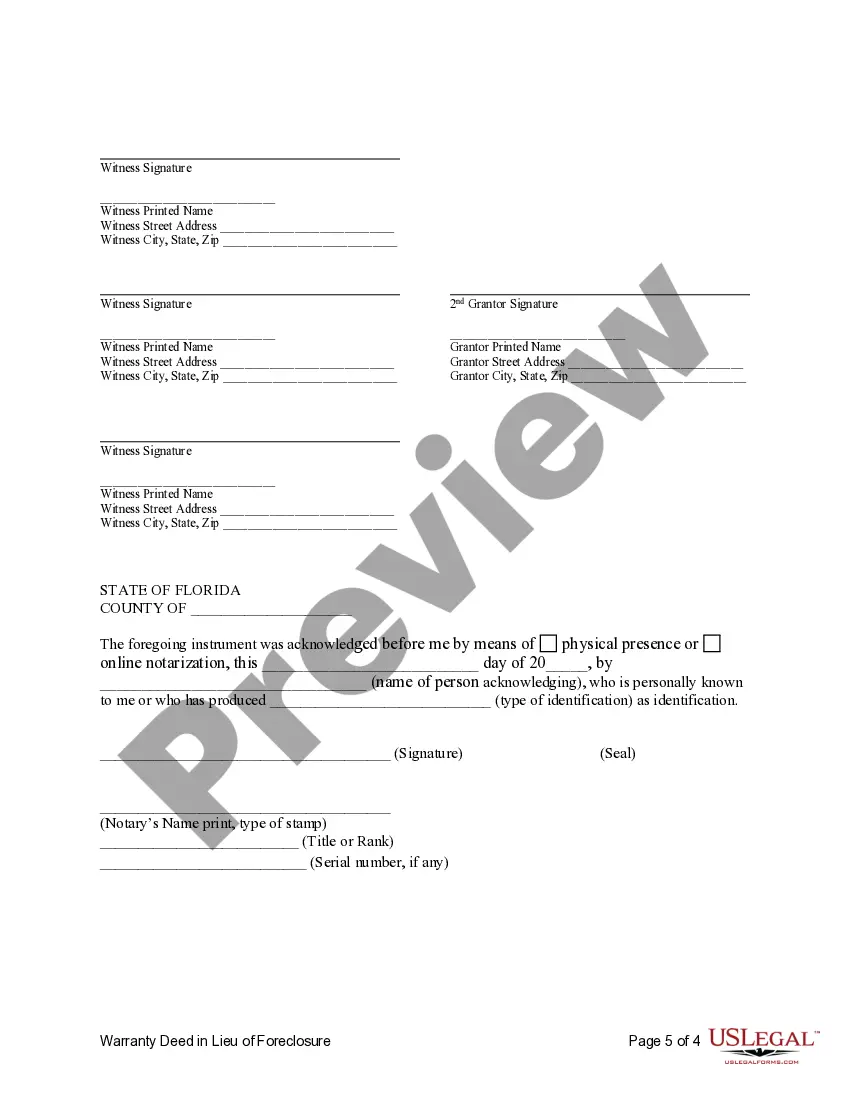

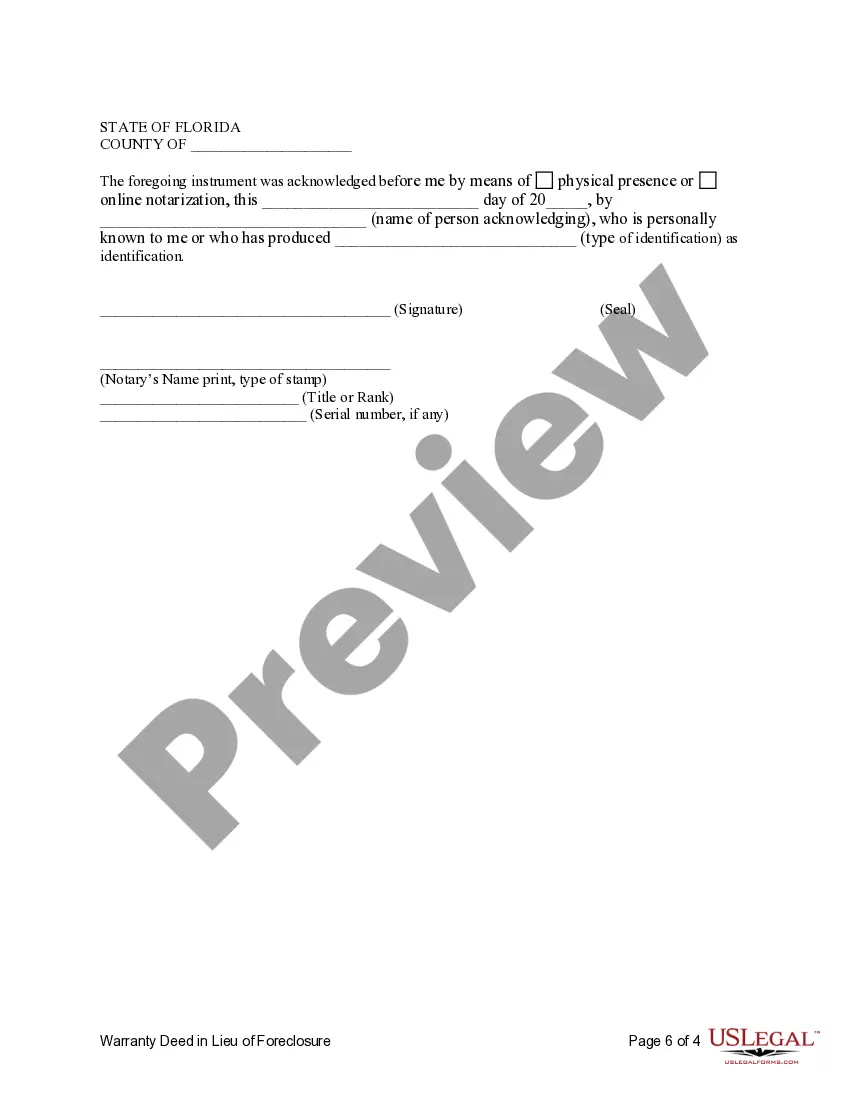

Jacksonville Florida Warranty Deed in Lieu of Foreclosure

Description

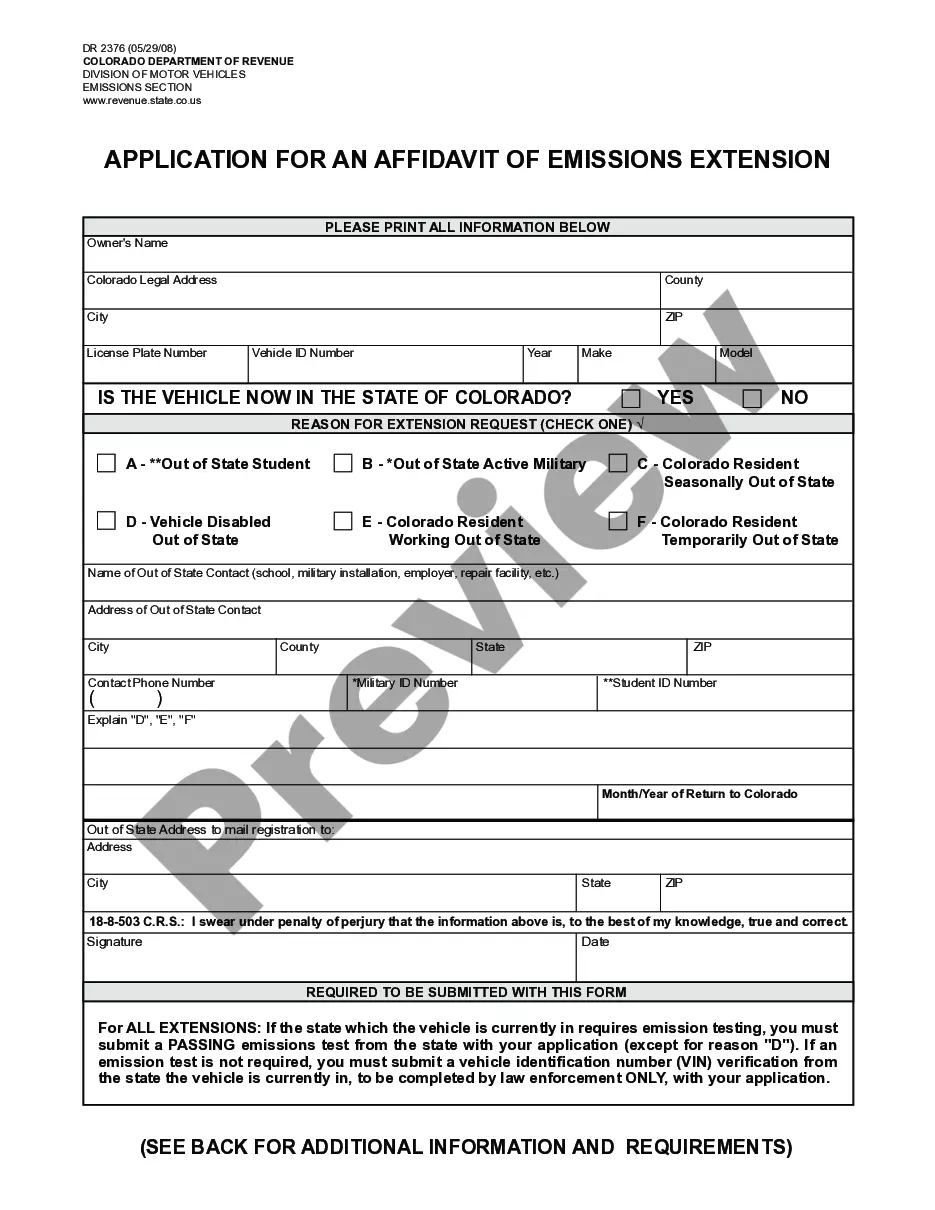

How to fill out Florida Warranty Deed In Lieu Of Foreclosure?

Finding authenticated templates relevant to your regional laws can be challenging unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal documents for both personal and business requirements and various real-world situations.

All the papers are correctly categorized by field of application and jurisdictional areas, making it simple and quick to find the Jacksonville Florida Warranty Deed in Lieu of Foreclosure.

Maintaining documentation organized and in accordance with legal specifications is critically important. Utilize the US Legal Forms library to always have vital document templates for any requirements readily available!

- Examine the Preview mode and document description.

- Ensure you’ve selected the right one that fulfills your requirements and aligns with your local jurisdiction standards.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the appropriate one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

In Florida, a special warranty deed transfers title in fee simple to the grantee with warranties and covenants of title that are limited to only the acts of the grantor or that result from the acts of the grantor. A special warranty deed is a form of deed customarily used in commercial real property transactions.

inlieu of foreclosure is an arrangement where you voluntarily turn over ownership of your home to the lender to avoid the foreclosure process. inlieu of foreclosure may help you avoid being personally liable for any amount remaining on the mortgage.

A deed in lieu of foreclosure is a legal procedure that allows a homeowner to transfer ownership of their property to the mortgage lender or loan servicer to satisfy the outstanding debt on the mortgage.

What is the most likely disadvantage to a lender in accepting Deed in Lieu of Foreclosure? Rationale: The liability for existing liens on the property is the most likely disadvantage.

In Florida, the redemption period after the foreclosure sale is a brief 10 days. With the help of an experienced foreclosure attorney, those choosing to pursue a pre-foreclosure redemption can take advantage of this window of opportunity and potentially reclaim the house.

Your credit score may drop by a range of 50 to 125 points after a deed in lieu of foreclosure, depending on where it stood before the deed in lieu, according to FICO data. The impact is slightly less severe than a foreclosure filing, though, which may drop your credit score by as many as 160 points.

Less damage to your credit: A deed in lieu agreement stays on your credit report for 4 years while a foreclosure sticks around for 7 years. Taking a deed in lieu agreement can allow you to buy a new home sooner than if you go through a foreclosure.

Your mortgage servicer might offer the following options as an alternative to foreclosure: Forbearance. This option temporarily suspends payments, allowing you time to make up the shortfall.Repayment Plan.Loan Modification.Refinance.Partial Claim.Forgiving a Payment.

Similar to the General Warranty Deed, the Special Warranty Deed conveys fee simple title and has the same five covenants of title. Where the Special Warranty Deed differs is that the application of the five covenants of title is limited to only the time period during which the seller owned the property.

A statutory warranty deed is different from a warranty deed because it is a shorter form made available through your state's statutes and it may not outright list the promise that the title is guaranteed to be clear. Instead, because it is a statutory form, this guarantee is implied and is still legally enforceable.