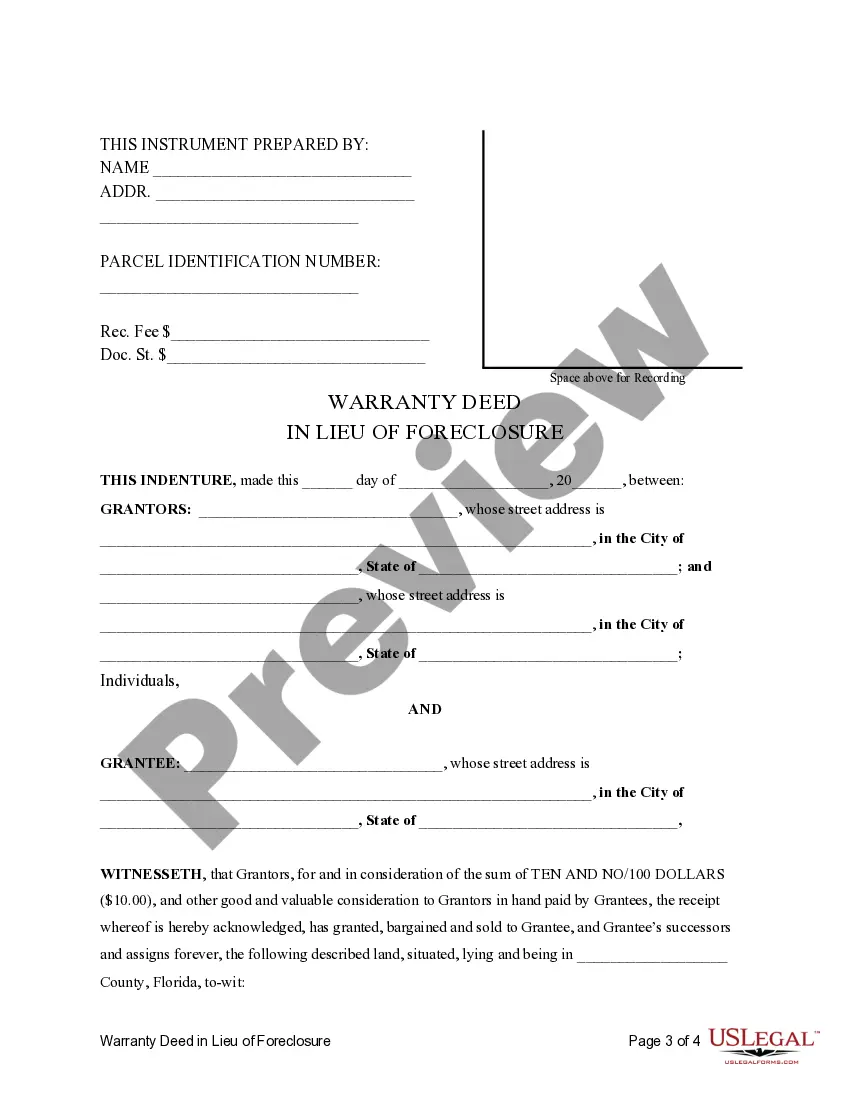

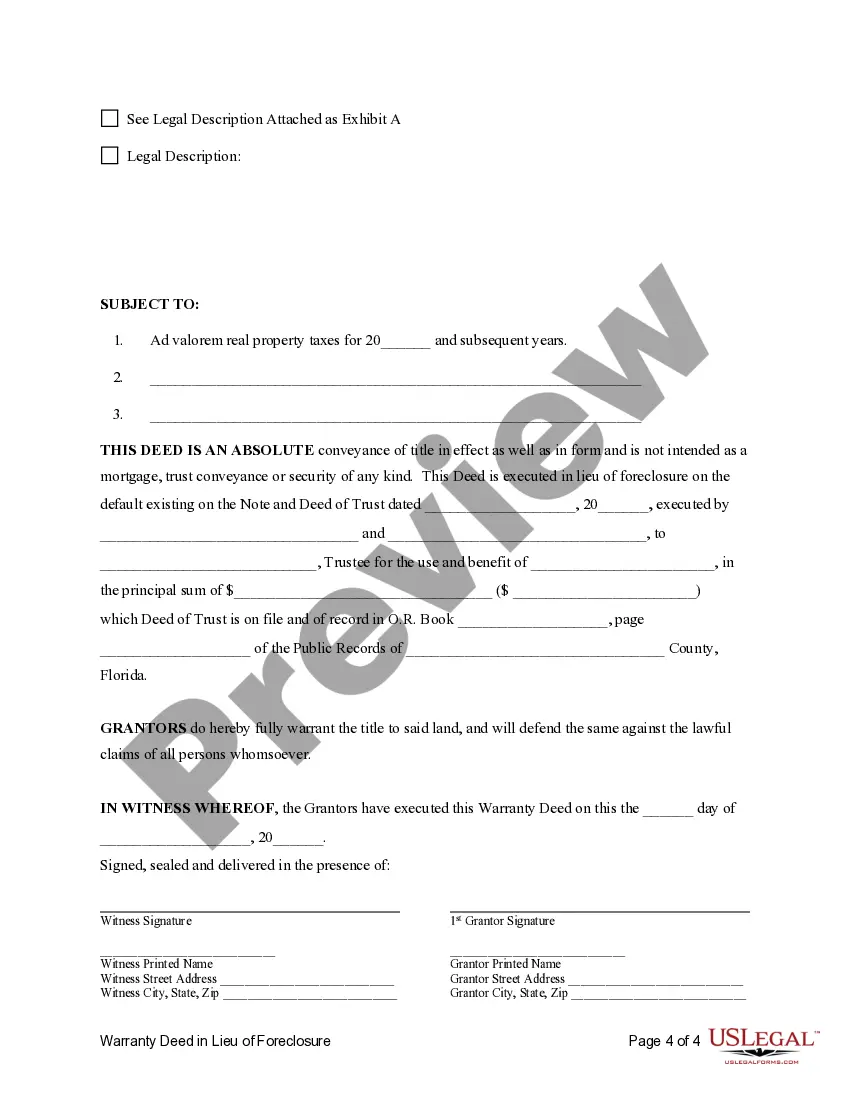

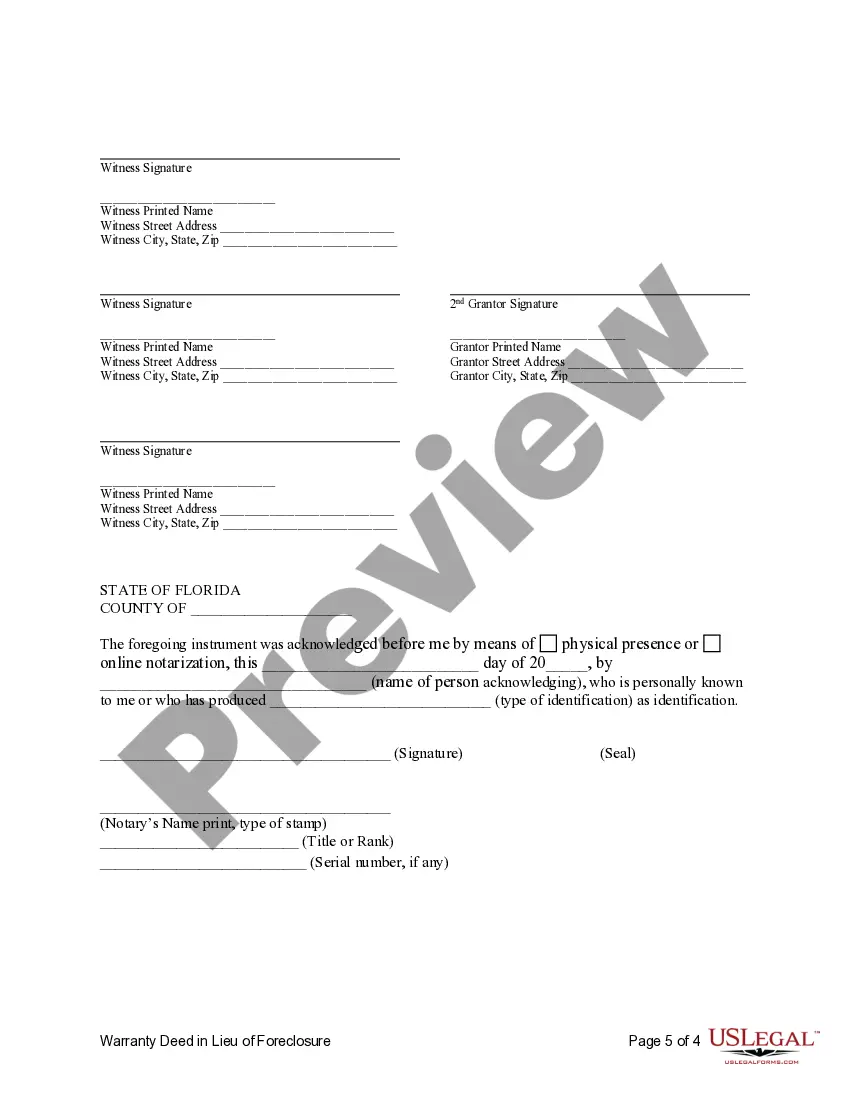

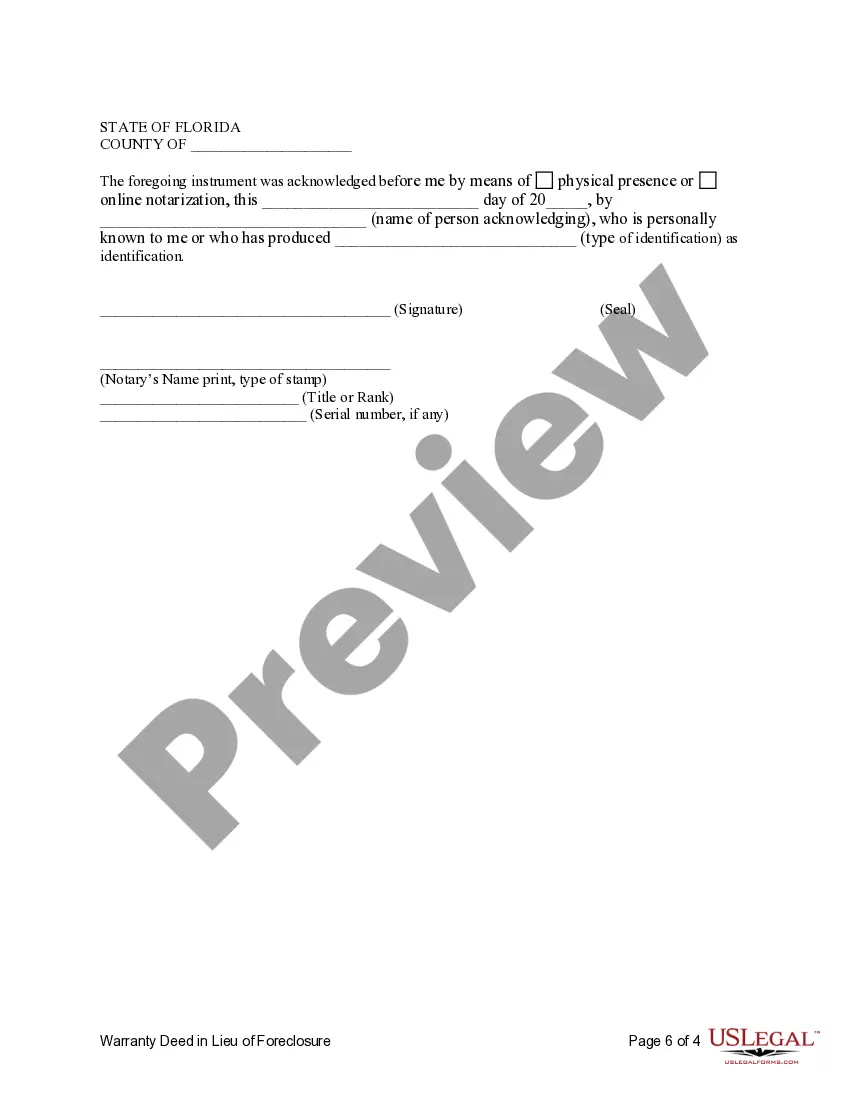

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Warranty Deed in Lieu of Foreclosure, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

A Lakeland Florida Warranty Deed in Lieu of Foreclosure is a legal document that allows a borrower, facing foreclosure on their property, to voluntarily transfer ownership of the property to the lender in exchange for the cancellation of their outstanding mortgage debt. This agreement is typically entered into when a borrower is unable to fulfill their financial obligations and wants to avoid the negative consequences of foreclosure. In Lakeland, Florida, there are two primary types of Warranty Deeds in Lieu of Foreclosure that individuals may encounter. First is the General Warranty Deed in Lieu of Foreclosure, and second is the Special Warranty Deed in Lieu of Foreclosure. The General Warranty Deed in Lieu of Foreclosure grants the lender full ownership and control over the property, absolving the borrower of any further responsibility for the loan. By executing this deed, the borrower relinquishes all their rights, claims, and interests in the property. On the other hand, the Special Warranty Deed in Lieu of Foreclosure differs slightly. It provides the lender with ownership of the property but only guarantees that the borrower was not responsible for any title issues or encumbrances during their period of ownership. This type of warranty deed offers a more limited protection than the general warranty deed. Both types of Warranty Deed in Lieu of Foreclosure can release the borrower from the burden of an unpaid mortgage, allowing them to avoid the time-consuming and potentially damaging process of foreclosure. However, it's important to note that entering into such an agreement may have implications on the borrower's credit score and future ability to secure financing. Whether considering a General Warranty Deed or a Special Warranty Deed in Lieu of Foreclosure, it is strongly recommended consulting with a qualified real estate attorney who specializes in foreclosure and deed transactions to ensure a smooth and legally compliant process.A Lakeland Florida Warranty Deed in Lieu of Foreclosure is a legal document that allows a borrower, facing foreclosure on their property, to voluntarily transfer ownership of the property to the lender in exchange for the cancellation of their outstanding mortgage debt. This agreement is typically entered into when a borrower is unable to fulfill their financial obligations and wants to avoid the negative consequences of foreclosure. In Lakeland, Florida, there are two primary types of Warranty Deeds in Lieu of Foreclosure that individuals may encounter. First is the General Warranty Deed in Lieu of Foreclosure, and second is the Special Warranty Deed in Lieu of Foreclosure. The General Warranty Deed in Lieu of Foreclosure grants the lender full ownership and control over the property, absolving the borrower of any further responsibility for the loan. By executing this deed, the borrower relinquishes all their rights, claims, and interests in the property. On the other hand, the Special Warranty Deed in Lieu of Foreclosure differs slightly. It provides the lender with ownership of the property but only guarantees that the borrower was not responsible for any title issues or encumbrances during their period of ownership. This type of warranty deed offers a more limited protection than the general warranty deed. Both types of Warranty Deed in Lieu of Foreclosure can release the borrower from the burden of an unpaid mortgage, allowing them to avoid the time-consuming and potentially damaging process of foreclosure. However, it's important to note that entering into such an agreement may have implications on the borrower's credit score and future ability to secure financing. Whether considering a General Warranty Deed or a Special Warranty Deed in Lieu of Foreclosure, it is strongly recommended consulting with a qualified real estate attorney who specializes in foreclosure and deed transactions to ensure a smooth and legally compliant process.