This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Warranty Deed in Lieu of Foreclosure, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

Foreclosure Orlando

Description

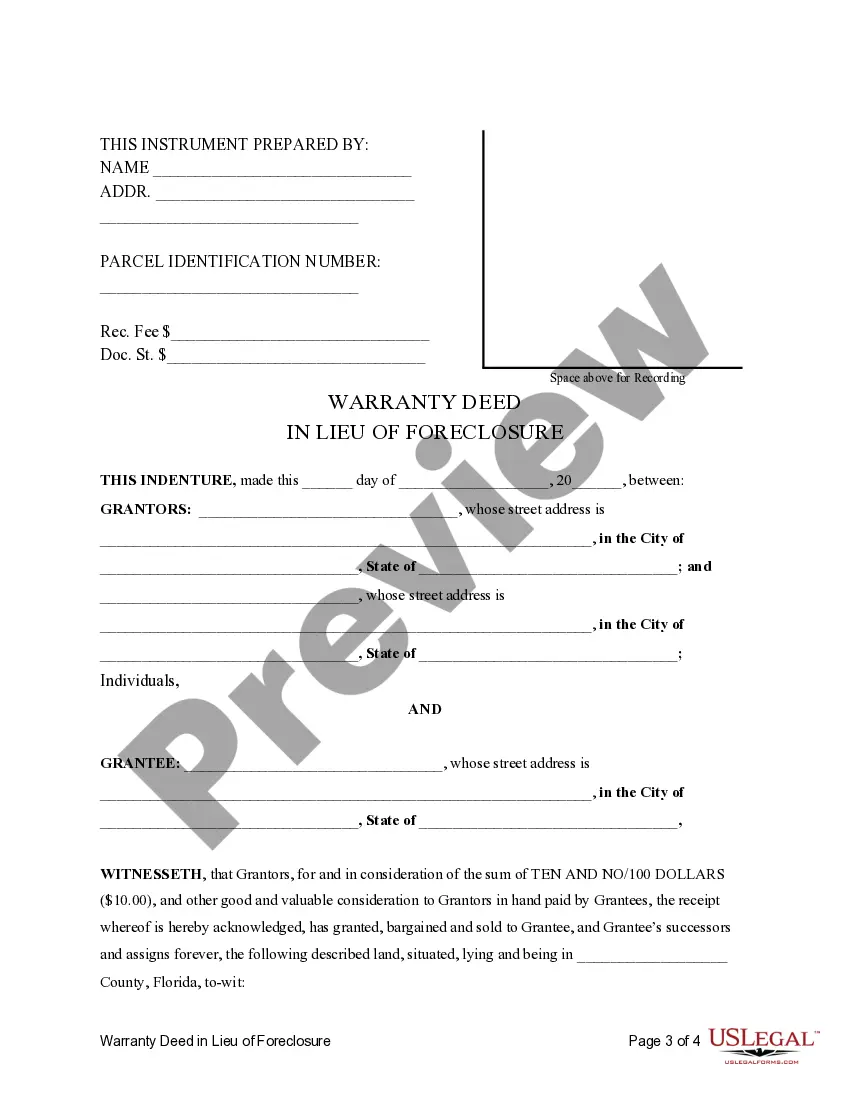

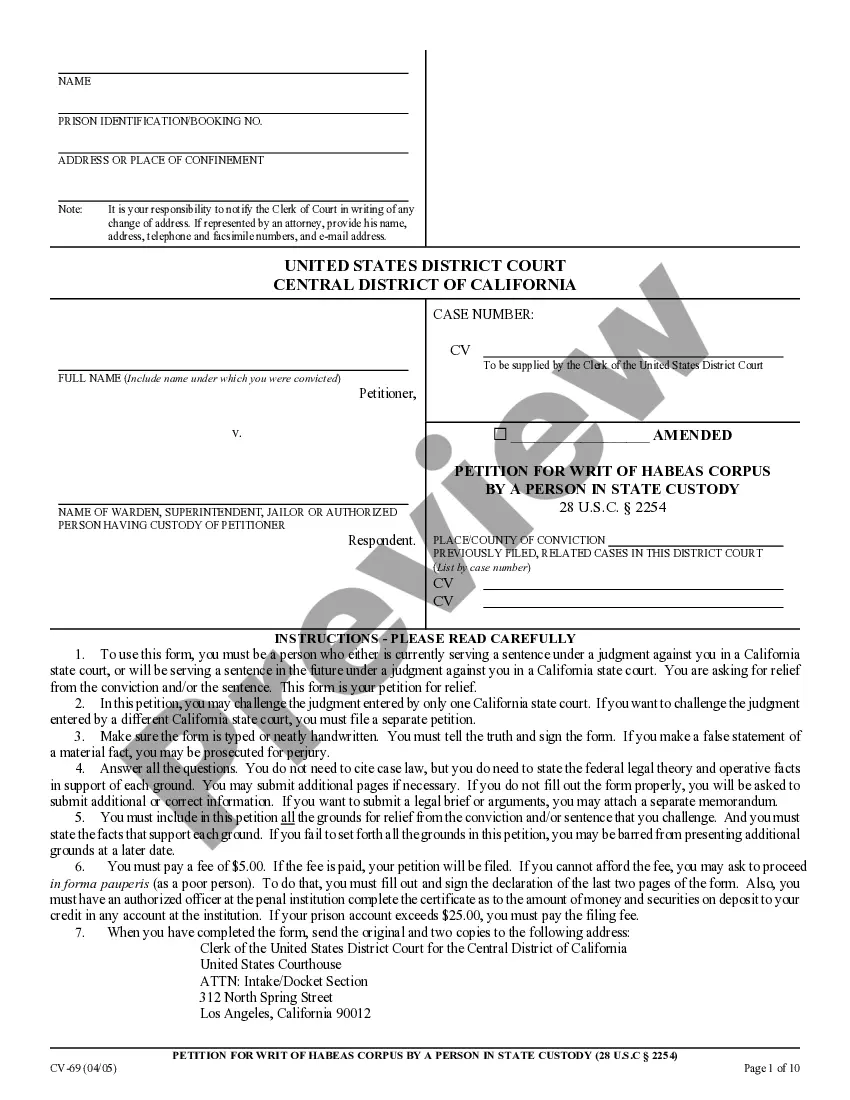

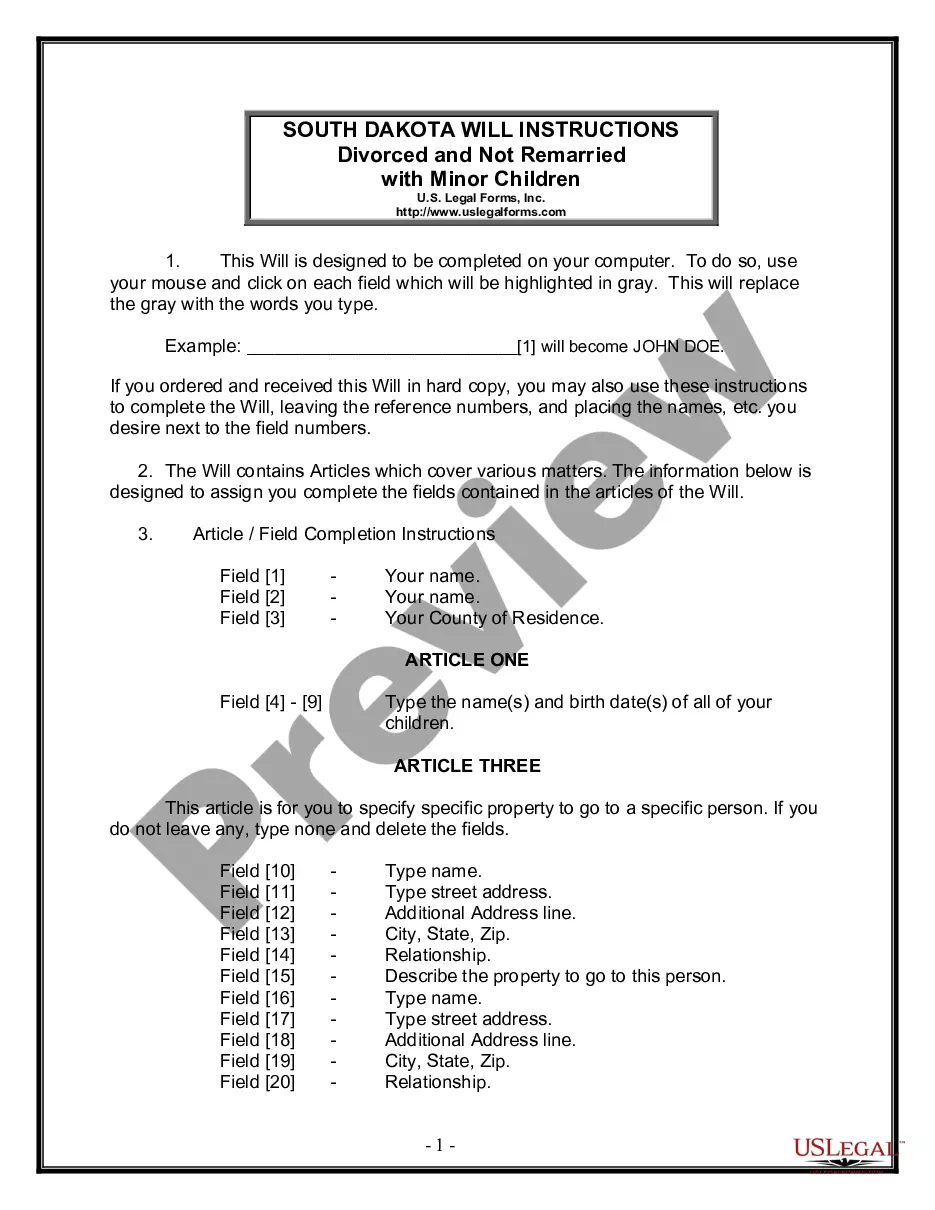

How to fill out Orlando Florida Warranty Deed In Lieu Of Foreclosure?

Do you require a dependable and affordable legal documents provider to obtain the Orlando Florida Warranty Deed in Lieu of Foreclosure? US Legal Forms is your ideal choice.

Whether you are seeking a simple agreement to establish guidelines for living with your partner or a collection of forms to facilitate your divorce proceedings in court, we have you covered.

Our platform features over 85,000 current legal document templates for individual and business purposes. All templates that we supply are not generic and are tailored to the specifications of distinct states and regions.

To retrieve the form, you must Log In to your account, locate the necessary template, and click the Download button adjacent to it. Please remember that you can access your previously acquired document templates at any time from the My documents section.

You can now create your account. After that, select the subscription plan and move forward to payment.

Once the payment is completed, download the Orlando Florida Warranty Deed in Lieu of Foreclosure in any available format. You can return to the website anytime and redownload the form at no additional cost.

- Are you unfamiliar with our website? No problem.

- You can set up an account in minutes, but first, ensure to do the following.

- Check whether the Orlando Florida Warranty Deed in Lieu of Foreclosure adheres to the laws of your state and locality.

- Review the details of the form (if available) to understand its purpose and intended audience.

- Reinitiate the search if the template does not fit your legal requirements.

Form popularity

FAQ

Less damage to your credit: A deed in lieu agreement stays on your credit report for 4 years while a foreclosure sticks around for 7 years. Taking a deed in lieu agreement can allow you to buy a new home sooner than if you go through a foreclosure.

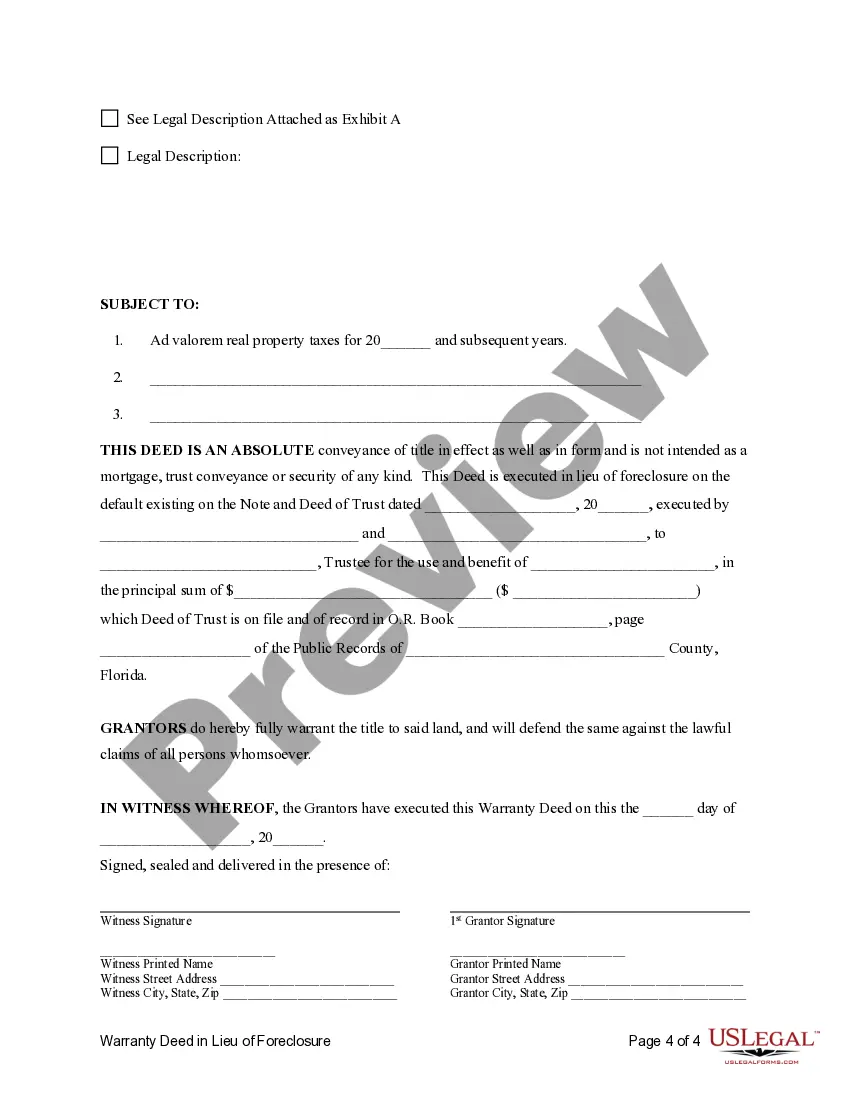

While the seller in a Warranty Deed must defend the title against all other claims and compensate the buyer for any unsettled debts or damages, the seller in a Special Warranty Deed is only responsible for debts and problems accrued or caused during his ownership of the property.

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.

inlieu of foreclosure is an arrangement where you voluntarily turn over ownership of your home to the lender to avoid the foreclosure process. inlieu of foreclosure may help you avoid being personally liable for any amount remaining on the mortgage.

What is the most likely disadvantage to a lender in accepting Deed in Lieu of Foreclosure? Rationale: The liability for existing liens on the property is the most likely disadvantage.

Drawbacks Of A Deed In Lieu No guarantee of acceptance: Your lender isn't obligated to accept your deed in lieu of foreclosure. Your credit will still take a hit: While a deed in lieu arrangement won't harm your credit as drastically as a foreclosure, you can still expect your score to drop.

A deed in lieu of foreclosure is a legal procedure that allows a homeowner to transfer ownership of their property to the mortgage lender or loan servicer to satisfy the outstanding debt on the mortgage.

Your mortgage servicer might offer the following options as an alternative to foreclosure: Forbearance. This option temporarily suspends payments, allowing you time to make up the shortfall.Repayment Plan.Loan Modification.Refinance.Partial Claim.Forgiving a Payment.

Your credit score may drop by a range of 50 to 125 points after a deed in lieu of foreclosure, depending on where it stood before the deed in lieu, according to FICO data. The impact is slightly less severe than a foreclosure filing, though, which may drop your credit score by as many as 160 points.

A deed in lieu of foreclosure is an option taken by a mortgagor?often a homeowner?usually as a means of avoiding foreclosure. It is a step that's usually taken only as a last resort, when the property owner has exhausted all other options, such as a loan modification or a short sale.