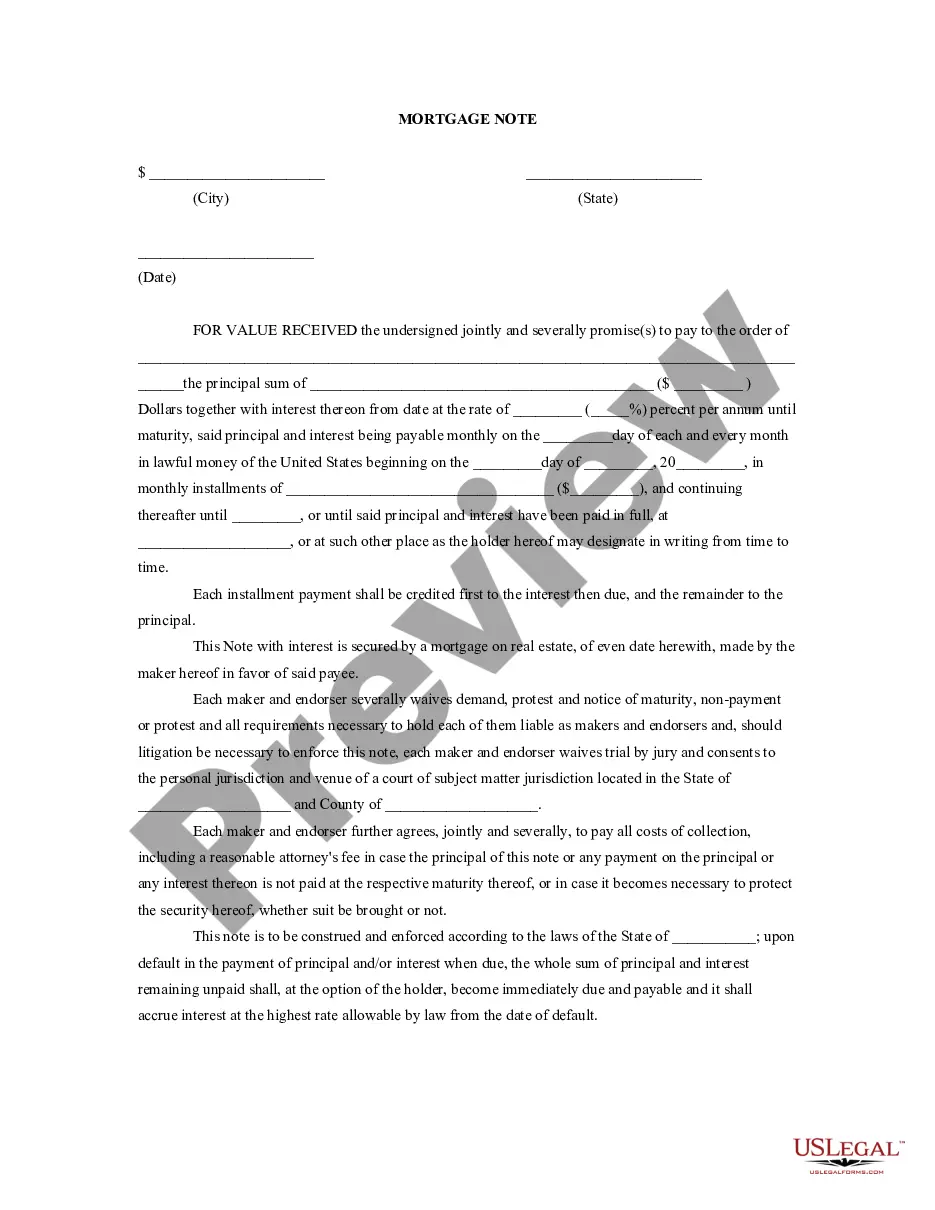

Mortgage Note: This is a general mortgage note to be used when purchasing real estate. It outlines the Seller and Buyer's individual obligations, as well as the interest rate associated with the loan, and/or mortgage note. This form is available in both Word and Rich Text formats.

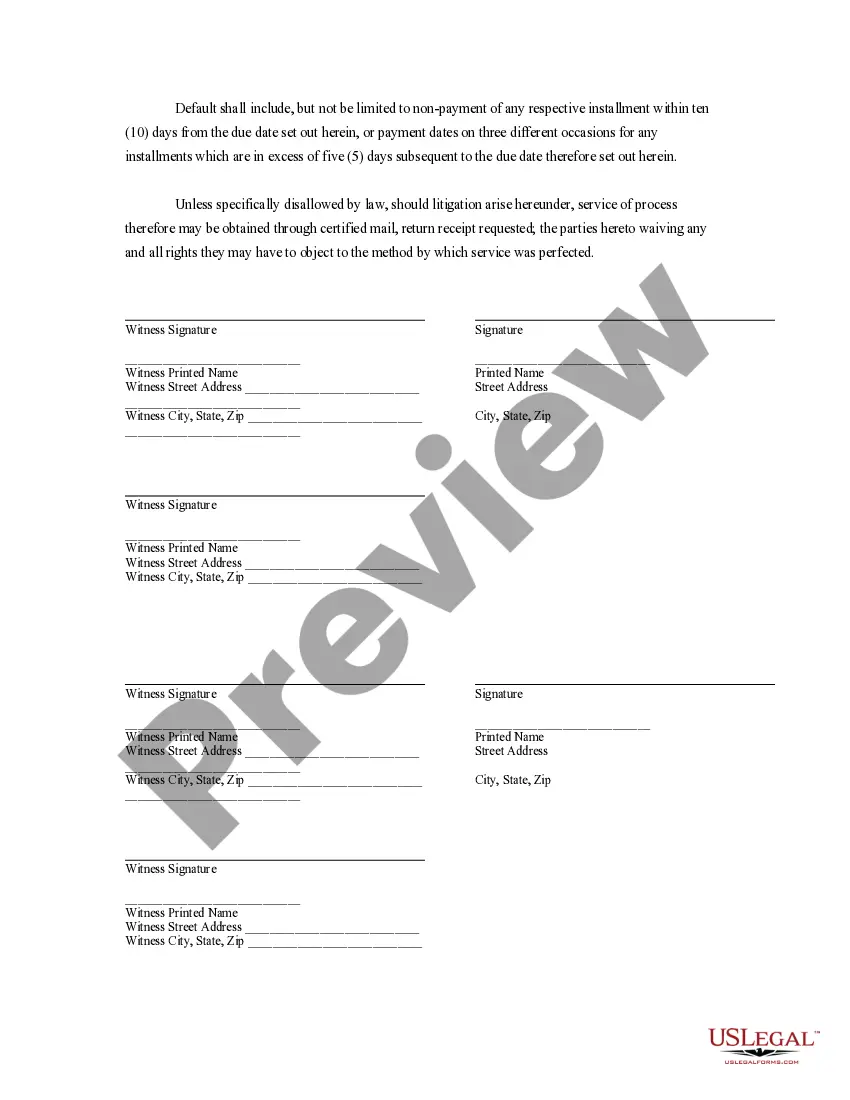

Cape Coral Florida Mortgage Note — All You Need to Know Introduction: A Cape Coral Florida Mortgage Note refers to a legal document that outlines the terms and conditions of a mortgage loan within the Cape Coral area in Florida. It serves as evidence of the debt owed by the borrower to the lender and serves as a promise to repay the loan according to the agreed-upon terms. Mortgage notes play a crucial role in real estate transactions, offering security to lenders and borrowers alike. Key Components of a Cape Coral Florida Mortgage Note: 1. Loan Amount: The mortgage note specifies the total loan amount borrowed by the debtor from the lender to finance the purchase of a property in Cape Coral, Florida. 2. Interest Rate: The note includes the interest rate applied to the loan, determining the additional cost borrowers must pay for borrowing the money. The interest rate can be fixed or adjustable, depending on the terms agreed upon. 3. Repayment Terms: The mortgage note outlines the repayment schedule, including the frequency of payments, whether monthly, bi-weekly, or otherwise. It also states the number of years it will take to fully repay the loan. 4. Payment Due Dates: The note clearly states the dates on which the borrower is obligated to make their loan payments. Late payment penalties, grace periods, and any fees associated with missed payments should also be included. 5. Property Description: The mortgage note provides a detailed description of the property used as collateral for the loan, including its address, legal description, and any relevant information about the property's condition. 6. Prepayment Penalties: Some mortgage notes may include provisions regarding penalties for early loan repayment. These penalties may be beneficial for lenders, ensuring a minimum return on their investment, but can be disadvantageous for borrowers seeking to pay off their loan before the agreed term expires. 7. Default and Foreclosure Provisions: In the event of default, the note outlines the rights and remedies available to the lender. This may include foreclosure proceedings, seizure of the property, and the lender's ability to collect any outstanding balance from the borrower. Types of Cape Coral Florida Mortgage Notes: 1. Fixed-Rate Mortgage Notes: These notes have a fixed interest rate for the entire loan term, ensuring that borrowers pay a consistent amount each month. This type provides stability and predictability in terms of repayment amounts. 2. Adjustable-Rate Mortgage Notes (ARM): An ARM note has an interest rate that may fluctuate over time. The rates commonly change annually or sooner based on market conditions. Borrowers may benefit from lower initial interest rates, but must be prepared for potential rate adjustments and subsequent payment changes. 3. Balloon Payment Notes: This type of note involves regular payments for a set period, with a significant lump-sum payment due at the end. Balloon payment notes often have lower monthly payments initially but require borrowers to plan for the large final payment or risk refinancing the balance. 4. Interest-Only Mortgage Notes: These notes allow borrowers to only pay the interest on the loan for a certain period, typically 5-10 years. After this period, the borrower starts repaying the principal as well, resulting in higher monthly payments. In conclusion, a Cape Coral Florida Mortgage Note is a critical legal document establishing the terms of a mortgage loan in Cape Coral, Florida. The document encompasses essential elements such as the loan amount, interest rate, repayment terms, property description, and default provisions. Different types of mortgage notes include fixed-rate, adjustable-rate, balloon payment, and interest-only notes. Understanding the specifics of a mortgage note is vital for both borrowers and lenders, ensuring transparency and a smooth real estate transaction process.Cape Coral Florida Mortgage Note — All You Need to Know Introduction: A Cape Coral Florida Mortgage Note refers to a legal document that outlines the terms and conditions of a mortgage loan within the Cape Coral area in Florida. It serves as evidence of the debt owed by the borrower to the lender and serves as a promise to repay the loan according to the agreed-upon terms. Mortgage notes play a crucial role in real estate transactions, offering security to lenders and borrowers alike. Key Components of a Cape Coral Florida Mortgage Note: 1. Loan Amount: The mortgage note specifies the total loan amount borrowed by the debtor from the lender to finance the purchase of a property in Cape Coral, Florida. 2. Interest Rate: The note includes the interest rate applied to the loan, determining the additional cost borrowers must pay for borrowing the money. The interest rate can be fixed or adjustable, depending on the terms agreed upon. 3. Repayment Terms: The mortgage note outlines the repayment schedule, including the frequency of payments, whether monthly, bi-weekly, or otherwise. It also states the number of years it will take to fully repay the loan. 4. Payment Due Dates: The note clearly states the dates on which the borrower is obligated to make their loan payments. Late payment penalties, grace periods, and any fees associated with missed payments should also be included. 5. Property Description: The mortgage note provides a detailed description of the property used as collateral for the loan, including its address, legal description, and any relevant information about the property's condition. 6. Prepayment Penalties: Some mortgage notes may include provisions regarding penalties for early loan repayment. These penalties may be beneficial for lenders, ensuring a minimum return on their investment, but can be disadvantageous for borrowers seeking to pay off their loan before the agreed term expires. 7. Default and Foreclosure Provisions: In the event of default, the note outlines the rights and remedies available to the lender. This may include foreclosure proceedings, seizure of the property, and the lender's ability to collect any outstanding balance from the borrower. Types of Cape Coral Florida Mortgage Notes: 1. Fixed-Rate Mortgage Notes: These notes have a fixed interest rate for the entire loan term, ensuring that borrowers pay a consistent amount each month. This type provides stability and predictability in terms of repayment amounts. 2. Adjustable-Rate Mortgage Notes (ARM): An ARM note has an interest rate that may fluctuate over time. The rates commonly change annually or sooner based on market conditions. Borrowers may benefit from lower initial interest rates, but must be prepared for potential rate adjustments and subsequent payment changes. 3. Balloon Payment Notes: This type of note involves regular payments for a set period, with a significant lump-sum payment due at the end. Balloon payment notes often have lower monthly payments initially but require borrowers to plan for the large final payment or risk refinancing the balance. 4. Interest-Only Mortgage Notes: These notes allow borrowers to only pay the interest on the loan for a certain period, typically 5-10 years. After this period, the borrower starts repaying the principal as well, resulting in higher monthly payments. In conclusion, a Cape Coral Florida Mortgage Note is a critical legal document establishing the terms of a mortgage loan in Cape Coral, Florida. The document encompasses essential elements such as the loan amount, interest rate, repayment terms, property description, and default provisions. Different types of mortgage notes include fixed-rate, adjustable-rate, balloon payment, and interest-only notes. Understanding the specifics of a mortgage note is vital for both borrowers and lenders, ensuring transparency and a smooth real estate transaction process.