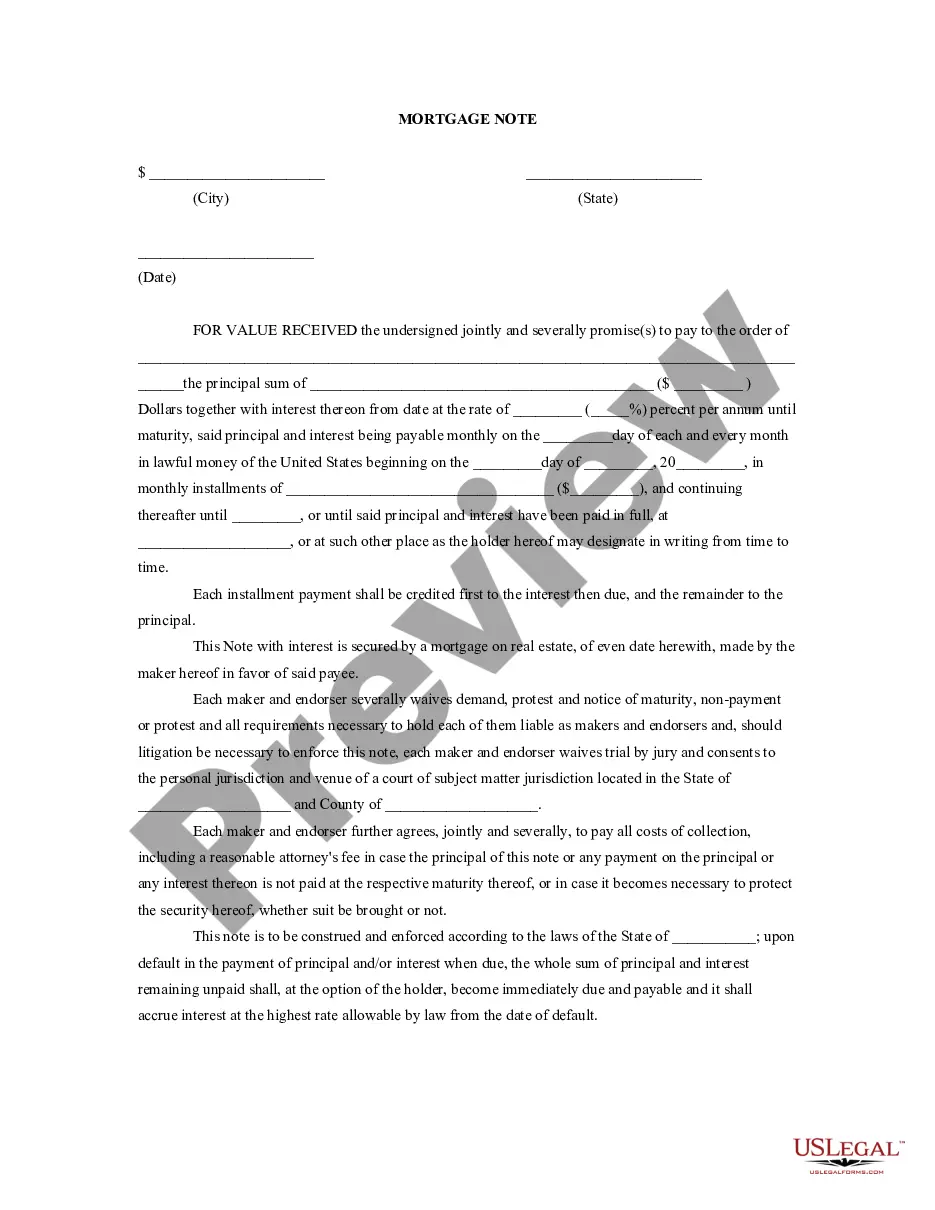

Mortgage Note: This is a general mortgage note to be used when purchasing real estate. It outlines the Seller and Buyer's individual obligations, as well as the interest rate associated with the loan, and/or mortgage note. This form is available in both Word and Rich Text formats.

A Lakeland Florida Mortgage Note is a legal document that serves as evidence of a debt instead of an actual mortgage. It outlines the terms and conditions of a mortgage loan made by a lender to a borrower in the Lakeland, Florida area. This document acts as a promissory note, stating the borrower's promise to repay the loan amount with interest over a specific period of time. Lakeland Florida Mortgage Notes are commonly used in real estate transactions, where the borrower receives a loan from a lender to purchase a property in Lakeland, Florida. The note contains important information such as the loan amount, interest rate, loan duration, repayment schedule, and any applicable fees or penalties. It legally binds the borrower to fulfill their repayment obligations. There are different types of Lakeland Florida Mortgage Notes, each serving a specific purpose: 1. Fixed-rate Mortgage Note: This type of mortgage note specifies a fixed interest rate that remains constant throughout the loan term. Borrowers benefit from a predictable monthly mortgage payment, as the interest rate does not change. 2. Adjustable-rate Mortgage Note (ARM): An ARM can have a varying interest rate over time, typically based on market conditions. The interest rate may fluctuate periodically, resulting in changes to the borrower's monthly mortgage payment. 3. Balloon Mortgage Note: This type of mortgage note features a fixed interest rate for an initial period, followed by a larger, lump-sum payment (balloon payment) at the end of the loan term. Borrowers typically refinance or sell the property before the balloon payment becomes due. 4. Interest-only Mortgage Note: This note allows the borrower to make interest-only payments for a specified period, typically the initial years of the loan. Afterward, the borrower must begin making principal and interest payments. 5. Reverse Mortgage Note: This type of mortgage note is available to eligible seniors who own their homes in Lakeland, Florida. It allows homeowners to convert a portion of their home equity into tax-free loan proceeds, which are repaid when the homeowner sells the property, moves out, or passes away. Lakeland Florida Mortgage Notes are crucial in the realm of property ownership and financial transactions. They protect both the lender's and borrower's interests by outlining the terms and conditions of the loan, ensuring repayment transparently.A Lakeland Florida Mortgage Note is a legal document that serves as evidence of a debt instead of an actual mortgage. It outlines the terms and conditions of a mortgage loan made by a lender to a borrower in the Lakeland, Florida area. This document acts as a promissory note, stating the borrower's promise to repay the loan amount with interest over a specific period of time. Lakeland Florida Mortgage Notes are commonly used in real estate transactions, where the borrower receives a loan from a lender to purchase a property in Lakeland, Florida. The note contains important information such as the loan amount, interest rate, loan duration, repayment schedule, and any applicable fees or penalties. It legally binds the borrower to fulfill their repayment obligations. There are different types of Lakeland Florida Mortgage Notes, each serving a specific purpose: 1. Fixed-rate Mortgage Note: This type of mortgage note specifies a fixed interest rate that remains constant throughout the loan term. Borrowers benefit from a predictable monthly mortgage payment, as the interest rate does not change. 2. Adjustable-rate Mortgage Note (ARM): An ARM can have a varying interest rate over time, typically based on market conditions. The interest rate may fluctuate periodically, resulting in changes to the borrower's monthly mortgage payment. 3. Balloon Mortgage Note: This type of mortgage note features a fixed interest rate for an initial period, followed by a larger, lump-sum payment (balloon payment) at the end of the loan term. Borrowers typically refinance or sell the property before the balloon payment becomes due. 4. Interest-only Mortgage Note: This note allows the borrower to make interest-only payments for a specified period, typically the initial years of the loan. Afterward, the borrower must begin making principal and interest payments. 5. Reverse Mortgage Note: This type of mortgage note is available to eligible seniors who own their homes in Lakeland, Florida. It allows homeowners to convert a portion of their home equity into tax-free loan proceeds, which are repaid when the homeowner sells the property, moves out, or passes away. Lakeland Florida Mortgage Notes are crucial in the realm of property ownership and financial transactions. They protect both the lender's and borrower's interests by outlining the terms and conditions of the loan, ensuring repayment transparently.