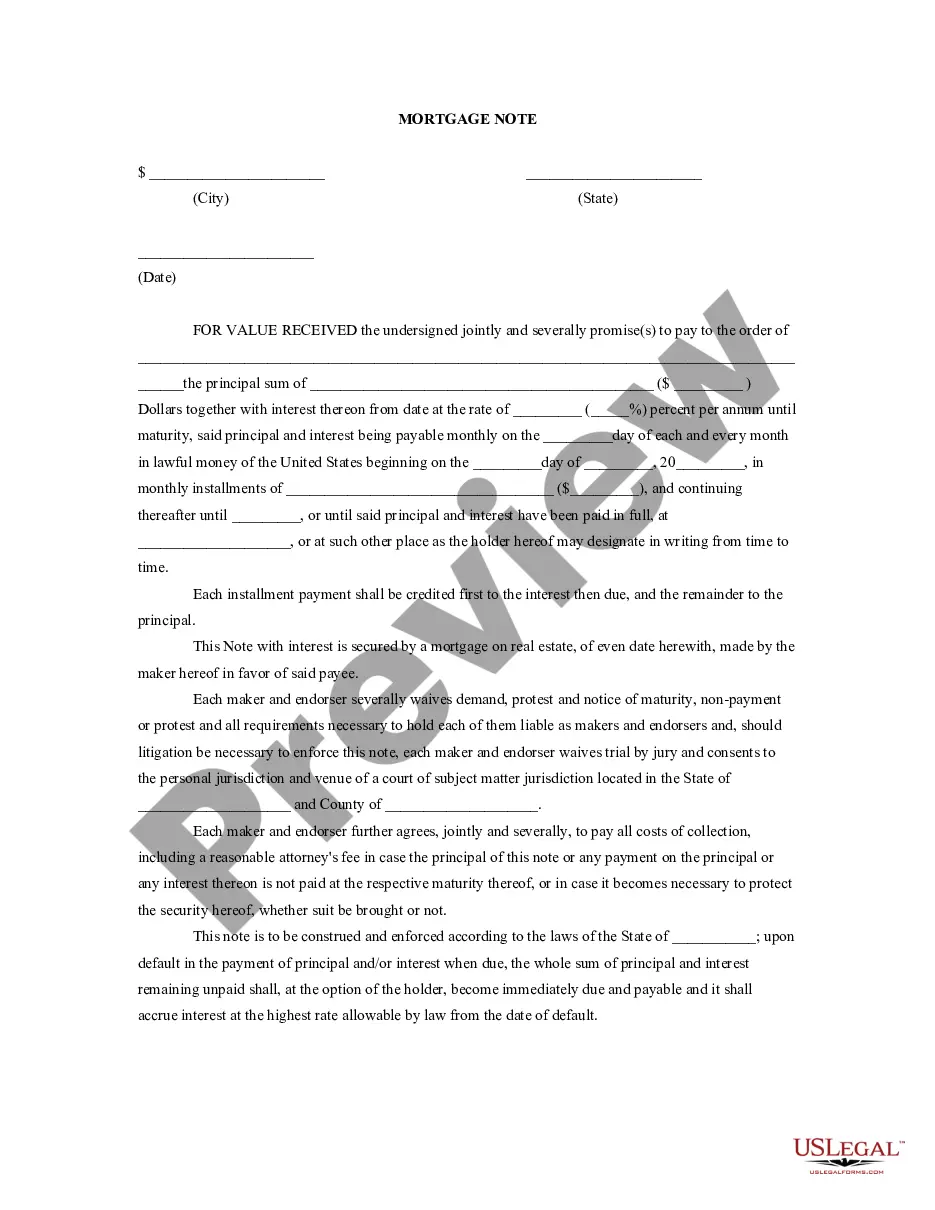

Mortgage Note: This is a general mortgage note to be used when purchasing real estate. It outlines the Seller and Buyer's individual obligations, as well as the interest rate associated with the loan, and/or mortgage note. This form is available in both Word and Rich Text formats.

A Palm Bay Florida Mortgage Note is a legal document that outlines the terms and conditions of a mortgage loan in Palm Bay, Florida. It serves as a contract between the borrower and the lender, detailing the specifics of the loan agreement. The Palm Bay Florida Mortgage Note contains essential information such as the principal amount borrowed, the interest rate, the repayment schedule, and any additional fees or charges associated with the loan. It also highlights the consequences and remedies in case of default or non-payment, including the possibility of foreclosure. There are various types of Palm Bay Florida Mortgage Notes, each tailored to different financing needs and loan structures. Some of these types include: 1. Fixed-Rate Mortgage Note: This type of mortgage note involves a fixed interest rate that remains unchanged throughout the loan term. Borrowers benefit from predictable monthly payments, as the interest rate does not fluctuate with market conditions. 2. Adjustable-Rate Mortgage Note: In contrast to a fixed-rate mortgage note, an adjustable-rate mortgage note features an interest rate that may change periodically. This rate adjustment typically occurs after an initial fixed-rate period. Borrowers must carefully analyze the terms, caps, and adjustment intervals to understand the potential variations in their monthly payments. 3. Balloon Mortgage Note: A balloon mortgage note is characterized by lower monthly payments for a fixed period, usually five to seven years, followed by a larger lump sum payment at the end of the term. Borrowers may opt for this type of mortgage note if they plan to sell the property or refinance before the balloon payment is due. 4. Interest-Only Mortgage Note: With an interest-only mortgage note, borrowers pay only the interest costs for an initial period, typically five to ten years. After this period, the borrower must start paying both the principal and the interest. This type of note provides temporary relief in monthly payments but can result in higher payments later on. Regardless of the type of Palm Bay Florida Mortgage Note, it is crucial for borrowers to read and understand the terms and conditions thoroughly. Consulting with a mortgage professional and conducting diligent research can help borrowers select the most suitable mortgage note for their financial situation and goals.A Palm Bay Florida Mortgage Note is a legal document that outlines the terms and conditions of a mortgage loan in Palm Bay, Florida. It serves as a contract between the borrower and the lender, detailing the specifics of the loan agreement. The Palm Bay Florida Mortgage Note contains essential information such as the principal amount borrowed, the interest rate, the repayment schedule, and any additional fees or charges associated with the loan. It also highlights the consequences and remedies in case of default or non-payment, including the possibility of foreclosure. There are various types of Palm Bay Florida Mortgage Notes, each tailored to different financing needs and loan structures. Some of these types include: 1. Fixed-Rate Mortgage Note: This type of mortgage note involves a fixed interest rate that remains unchanged throughout the loan term. Borrowers benefit from predictable monthly payments, as the interest rate does not fluctuate with market conditions. 2. Adjustable-Rate Mortgage Note: In contrast to a fixed-rate mortgage note, an adjustable-rate mortgage note features an interest rate that may change periodically. This rate adjustment typically occurs after an initial fixed-rate period. Borrowers must carefully analyze the terms, caps, and adjustment intervals to understand the potential variations in their monthly payments. 3. Balloon Mortgage Note: A balloon mortgage note is characterized by lower monthly payments for a fixed period, usually five to seven years, followed by a larger lump sum payment at the end of the term. Borrowers may opt for this type of mortgage note if they plan to sell the property or refinance before the balloon payment is due. 4. Interest-Only Mortgage Note: With an interest-only mortgage note, borrowers pay only the interest costs for an initial period, typically five to ten years. After this period, the borrower must start paying both the principal and the interest. This type of note provides temporary relief in monthly payments but can result in higher payments later on. Regardless of the type of Palm Bay Florida Mortgage Note, it is crucial for borrowers to read and understand the terms and conditions thoroughly. Consulting with a mortgage professional and conducting diligent research can help borrowers select the most suitable mortgage note for their financial situation and goals.