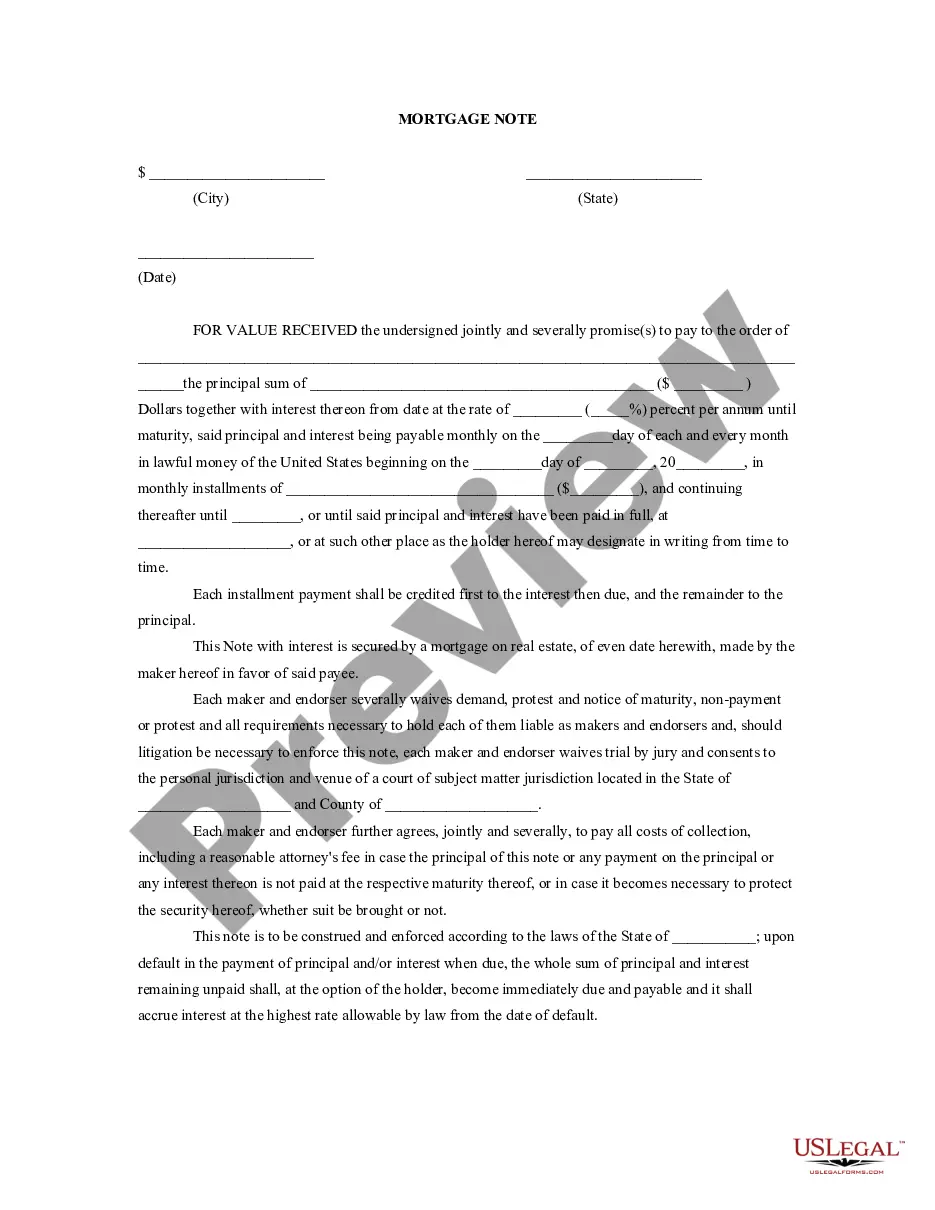

Mortgage Note: This is a general mortgage note to be used when purchasing real estate. It outlines the Seller and Buyer's individual obligations, as well as the interest rate associated with the loan, and/or mortgage note. This form is available in both Word and Rich Text formats.

A Pompano Beach Florida Mortgage Note is a legal document that represents a debt secured by a property located in Pompano Beach, Florida. It is essentially an agreement between a borrower (mortgagor) and a lender (mortgagee) that outlines the terms and conditions of the loan. The Pompano Beach Mortgage Note serves as evidence of the borrower's promise to repay the loan amount borrowed, typically provided by a financial institution or a private lender. It includes crucial information such as the loan amount, interest rate, repayment schedule, and any additional terms agreed upon between both parties. There are several types of Pompano Beach Florida Mortgage Notes available: 1. Fixed-rate Mortgage Note: This type of note comes with a fixed interest rate over the loan term. It ensures that the borrower's monthly payments remain the same throughout the repayment period, providing stability and predictability. 2. Adjustable-rate Mortgage (ARM) Note: In an ARM note, the interest rate fluctuates based on various market factors. Initially, the interest rate is fixed for a certain period, usually 3, 5, 7, or 10 years, and then it adjusts periodically based on an index. The borrower's monthly payments can increase or decrease depending on the market conditions. 3. Balloon Mortgage Note: A balloon note involves regular monthly payments based on a long-term amortization schedule. However, at the end of the loan term, typically ranging from 5 to 10 years, a significant lump sum payment or balloon payment is required to settle the remaining balance. Refinancing or selling the property is usually considered as an option to meet the balloon payment obligation. 4. Interest-only Mortgage Note: With an interest-only note, the borrower is only required to make monthly payments that cover the accrued interest for a specified period, typically five to ten years. After the interest-only period ends, the borrower needs to make full principal and interest payments thereafter, resulting in higher monthly payments. It is essential to carefully review and understand the terms and conditions outlined in a Pompano Beach Florida Mortgage Note before signing. Seeking professional advice from a mortgage broker or attorney can ensure that borrowers make informed decisions, choose the right type of mortgage note suited to their financial goals, and navigate the complexities of the mortgage process effectively.A Pompano Beach Florida Mortgage Note is a legal document that represents a debt secured by a property located in Pompano Beach, Florida. It is essentially an agreement between a borrower (mortgagor) and a lender (mortgagee) that outlines the terms and conditions of the loan. The Pompano Beach Mortgage Note serves as evidence of the borrower's promise to repay the loan amount borrowed, typically provided by a financial institution or a private lender. It includes crucial information such as the loan amount, interest rate, repayment schedule, and any additional terms agreed upon between both parties. There are several types of Pompano Beach Florida Mortgage Notes available: 1. Fixed-rate Mortgage Note: This type of note comes with a fixed interest rate over the loan term. It ensures that the borrower's monthly payments remain the same throughout the repayment period, providing stability and predictability. 2. Adjustable-rate Mortgage (ARM) Note: In an ARM note, the interest rate fluctuates based on various market factors. Initially, the interest rate is fixed for a certain period, usually 3, 5, 7, or 10 years, and then it adjusts periodically based on an index. The borrower's monthly payments can increase or decrease depending on the market conditions. 3. Balloon Mortgage Note: A balloon note involves regular monthly payments based on a long-term amortization schedule. However, at the end of the loan term, typically ranging from 5 to 10 years, a significant lump sum payment or balloon payment is required to settle the remaining balance. Refinancing or selling the property is usually considered as an option to meet the balloon payment obligation. 4. Interest-only Mortgage Note: With an interest-only note, the borrower is only required to make monthly payments that cover the accrued interest for a specified period, typically five to ten years. After the interest-only period ends, the borrower needs to make full principal and interest payments thereafter, resulting in higher monthly payments. It is essential to carefully review and understand the terms and conditions outlined in a Pompano Beach Florida Mortgage Note before signing. Seeking professional advice from a mortgage broker or attorney can ensure that borrowers make informed decisions, choose the right type of mortgage note suited to their financial goals, and navigate the complexities of the mortgage process effectively.