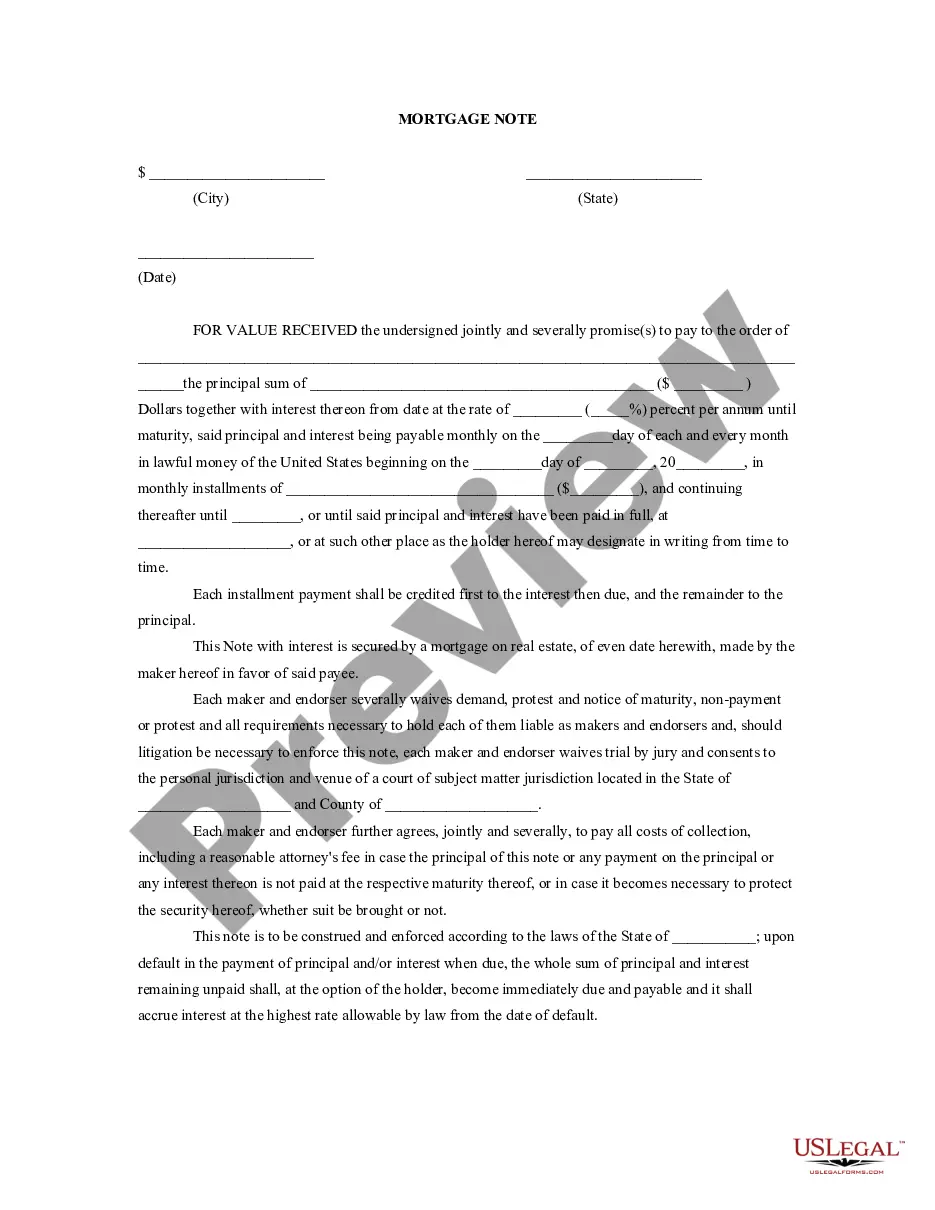

Mortgage Note: This is a general mortgage note to be used when purchasing real estate. It outlines the Seller and Buyer's individual obligations, as well as the interest rate associated with the loan, and/or mortgage note. This form is available in both Word and Rich Text formats.

A Tallahassee Florida Mortgage Note is a legally binding document that serves as evidence of a loan given by a lender to a borrower for the purchase of a property in Tallahassee, Florida. This note outlines the terms of the loan, including the principal amount, interest rate, repayment schedule, and any other specific provisions agreed upon by both parties. Tallahassee, the vibrant capital of Florida, offers a diverse range of real estate opportunities for residents and investors alike. Whether you are purchasing a home, refinancing an existing loan, or investing in rental properties, understanding the different types of Tallahassee Florida Mortgage Notes can help you make informed financial decisions. Here are a few types of Tallahassee Florida Mortgage Notes: 1. Fixed-Rate Mortgage Note: This type of mortgage note entails an interest rate that remains constant throughout the loan term. Borrowers enjoy predictable monthly payments, making it easier for them to budget their finances. Fixed-rate mortgage notes are popular among those seeking long-term stability. 2. Adjustable-Rate Mortgage Note: Also known as an ARM, an Adjustable-Rate Mortgage Note offers an interest rate that fluctuates based on market conditions. These notes often have an initial fixed-rate period followed by periodic adjustments. Borrowers may benefit from lower initial rates but should be prepared for potential rate increases in the future. 3. Interest-Only Mortgage Note: With an interest-only mortgage note, borrowers are initially required to pay only the interest on the loan for a specified period, typically between five and ten years. After this period, regular principal and interest payments commence. This type of note provides lower monthly payments during the interest-only period, but borrowers should consider the impact of larger payments when the full repayment period begins. 4. Balloon Payment Mortgage Note: A balloon payment mortgage note involves making smaller, regular payments for a specific period, usually five to seven years, after which a larger payment (balloon payment) becomes due. Borrowers who expect significant changes in their financial situations or plan to refinance their mortgage before the balloon payment is due might opt for this type of note. 5. Government-Backed Mortgage Notes: Tallahassee residents may also encounter government-backed mortgage notes such as FHA (Federal Housing Administration) or VA (U.S. Department of Veterans Affairs) loans. These mortgage notes are insured or guaranteed by the respective governmental agency, offering more flexible qualifications and potentially lower down payment requirements. When considering a Tallahassee Florida Mortgage Note, it is essential to carefully review the terms and consult with a mortgage professional who can provide expertise specific to your financial goals and circumstances. It is crucial to understand the interest rates, repayment options, and potential risks associated with each type of mortgage note before making a decision. In conclusion, a Tallahassee Florida Mortgage Note is a comprehensive document that outlines the terms and conditions of a home loan in Tallahassee. Understanding the various types of mortgage notes available can help borrowers navigate the real estate market more effectively and make informed decisions while achieving their homeownership or investment goals.