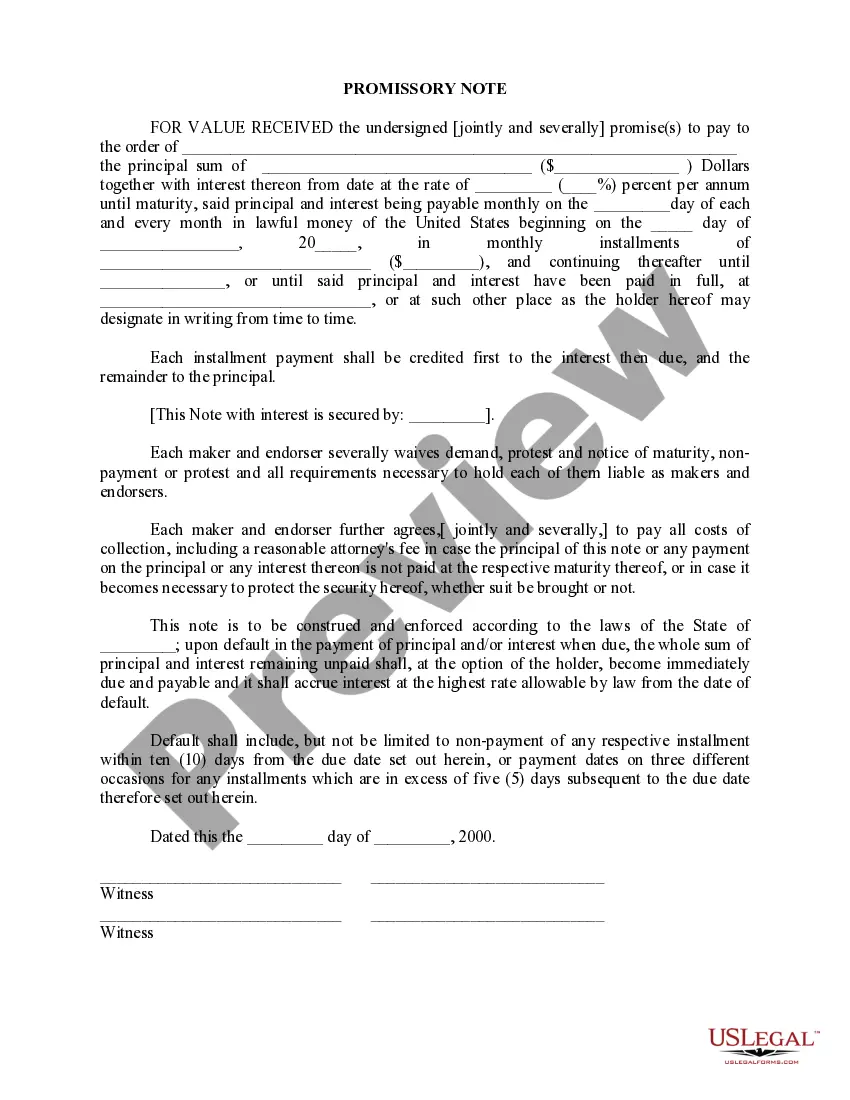

A promissory note is a written promise to pay a debt. In this particular agreement, the undersigned (jointly and severally) promise(s) to pay a certain sum of money with interest. The principal and interest will be paid in monthly installments until the amount is paid in full. Each maker and endorser will pay all costs of collection, including a reasonable attorney's fee in case the principal of this note or any payment on the principal or any interest is not paid at the respective maturity date.

A Cape Coral Florida Promissory Note is a legal document that outlines the terms of repayment of a loan between a lender and a borrower. It serves as evidence of the debt owed by the borrower to the lender and includes crucial details such as the principal amount, interest rate, payment schedule, and any other conditions agreed upon by both parties. There are two main types of Cape Coral Florida Promissory Notes: Secured and Unsecured. 1. Secured Promissory Note: This type of promissory note is backed by collateral, which provides security for the lender in case the borrower defaults on the loan. The collateral can be any valuable asset such as real estate, vehicles, or other valuable possessions. In the event of default, the lender has the legal right to seize the collateral to recover the outstanding debt. Secured promissory notes are generally preferred by lenders because they offer an added layer of protection. 2. Unsecured Promissory Note: Unlike secured notes, unsecured promissory notes do not require collateral as a form of security. Borrowers are not required to pledge any assets, making it a more flexible option for individuals who may not possess valuable assets or do not wish to put them at risk. However, due to the higher risk involved for the lender, unsecured promissory notes usually come with higher interest rates. Both types of promissory notes can be used for various purposes such as personal loans, business loans, mortgages, or any other lending arrangements. It is important for both parties to carefully review and understand the terms and conditions specified in the promissory note, ensuring clarity and agreement before signing the document. In Cape Coral, Florida, promissory notes play a vital role in facilitating financial transactions and providing legal protection for both lenders and borrowers. Whether opting for a secured or unsecured promissory note, it is advisable to consult with legal professionals or financial advisors to ensure compliance with local regulations and to protect one's interests in the event of default or breach of loan agreements.A Cape Coral Florida Promissory Note is a legal document that outlines the terms of repayment of a loan between a lender and a borrower. It serves as evidence of the debt owed by the borrower to the lender and includes crucial details such as the principal amount, interest rate, payment schedule, and any other conditions agreed upon by both parties. There are two main types of Cape Coral Florida Promissory Notes: Secured and Unsecured. 1. Secured Promissory Note: This type of promissory note is backed by collateral, which provides security for the lender in case the borrower defaults on the loan. The collateral can be any valuable asset such as real estate, vehicles, or other valuable possessions. In the event of default, the lender has the legal right to seize the collateral to recover the outstanding debt. Secured promissory notes are generally preferred by lenders because they offer an added layer of protection. 2. Unsecured Promissory Note: Unlike secured notes, unsecured promissory notes do not require collateral as a form of security. Borrowers are not required to pledge any assets, making it a more flexible option for individuals who may not possess valuable assets or do not wish to put them at risk. However, due to the higher risk involved for the lender, unsecured promissory notes usually come with higher interest rates. Both types of promissory notes can be used for various purposes such as personal loans, business loans, mortgages, or any other lending arrangements. It is important for both parties to carefully review and understand the terms and conditions specified in the promissory note, ensuring clarity and agreement before signing the document. In Cape Coral, Florida, promissory notes play a vital role in facilitating financial transactions and providing legal protection for both lenders and borrowers. Whether opting for a secured or unsecured promissory note, it is advisable to consult with legal professionals or financial advisors to ensure compliance with local regulations and to protect one's interests in the event of default or breach of loan agreements.