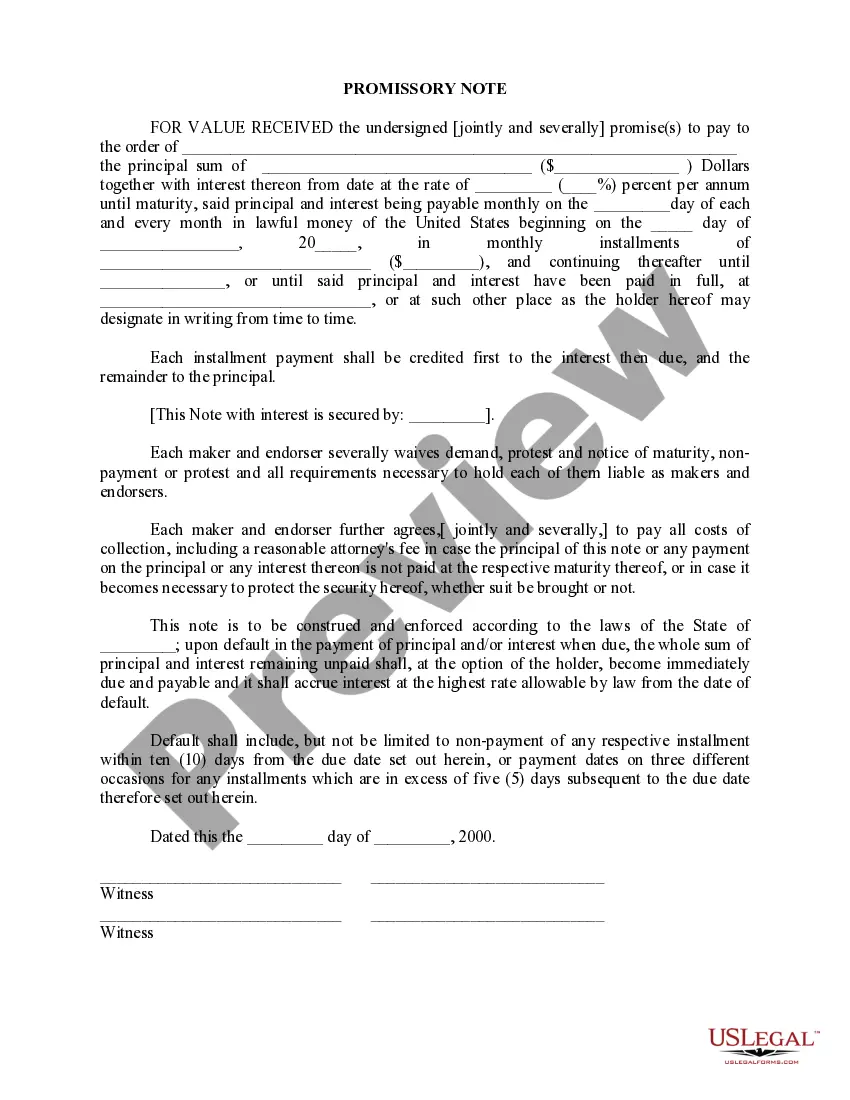

A promissory note is a written promise to pay a debt. In this particular agreement, the undersigned (jointly and severally) promise(s) to pay a certain sum of money with interest. The principal and interest will be paid in monthly installments until the amount is paid in full. Each maker and endorser will pay all costs of collection, including a reasonable attorney's fee in case the principal of this note or any payment on the principal or any interest is not paid at the respective maturity date.

A Hillsborough Florida Promissory Note is a legally-binding document that outlines the terms and conditions of a loan agreement between two parties: the lender and the borrower. In this context, Hillsborough refers to the county in Florida where the agreement is taking place. There are two main types of promissory notes: secured and unsecured. A Secured Promissory Note means that the loan is backed by collateral, such as real estate or a valuable asset, which the lender can claim if the borrower defaults on the loan. This type of note provides additional security for the lender in case of non-payment. On the other hand, an Unsecured Promissory Note does not involve any collateral. It is solely based on the borrower's promise to repay the loan amount on specified terms and conditions. Since there is no collateral involved, unsecured notes may carry higher interest rates to compensate for the increased risk taken by the lender. Details included in a Hillsborough Florida Promissory Note may vary depending on the specific requirements and negotiations between the parties involved. However, some common elements typically found in such documents include: 1. Loan Amount: The total amount of money being lent to the borrower. 2. Interest Rate: The percentage at which interest will be charged on the loan amount. 3. Repayment Terms: The agreed-upon schedule for repayment, including the frequency and amount of installment payments. 4. Late Payment Penalties: Any additional charges or interest that may be imposed if the borrower fails to make timely payments. 5. Maturity Date: The date by which the loan must be fully repaid. 6. Default and Remedies: The consequences and options available to the lender if the borrower fails to meet the terms of the agreement. 7. Governing Law: The specific laws and regulations of Hillsborough County, Florida that govern the promissory note. 8. Signatures: Both the lender and the borrower must sign the document to indicate their agreement to the terms outlined in the note. It is important for both parties to fully understand the terms and implications of a Hillsborough Florida Promissory Note before signing. Seeking legal advice is highly recommended ensuring that the document protects the rights and interests of both the lender and the borrower.A Hillsborough Florida Promissory Note is a legally-binding document that outlines the terms and conditions of a loan agreement between two parties: the lender and the borrower. In this context, Hillsborough refers to the county in Florida where the agreement is taking place. There are two main types of promissory notes: secured and unsecured. A Secured Promissory Note means that the loan is backed by collateral, such as real estate or a valuable asset, which the lender can claim if the borrower defaults on the loan. This type of note provides additional security for the lender in case of non-payment. On the other hand, an Unsecured Promissory Note does not involve any collateral. It is solely based on the borrower's promise to repay the loan amount on specified terms and conditions. Since there is no collateral involved, unsecured notes may carry higher interest rates to compensate for the increased risk taken by the lender. Details included in a Hillsborough Florida Promissory Note may vary depending on the specific requirements and negotiations between the parties involved. However, some common elements typically found in such documents include: 1. Loan Amount: The total amount of money being lent to the borrower. 2. Interest Rate: The percentage at which interest will be charged on the loan amount. 3. Repayment Terms: The agreed-upon schedule for repayment, including the frequency and amount of installment payments. 4. Late Payment Penalties: Any additional charges or interest that may be imposed if the borrower fails to make timely payments. 5. Maturity Date: The date by which the loan must be fully repaid. 6. Default and Remedies: The consequences and options available to the lender if the borrower fails to meet the terms of the agreement. 7. Governing Law: The specific laws and regulations of Hillsborough County, Florida that govern the promissory note. 8. Signatures: Both the lender and the borrower must sign the document to indicate their agreement to the terms outlined in the note. It is important for both parties to fully understand the terms and implications of a Hillsborough Florida Promissory Note before signing. Seeking legal advice is highly recommended ensuring that the document protects the rights and interests of both the lender and the borrower.