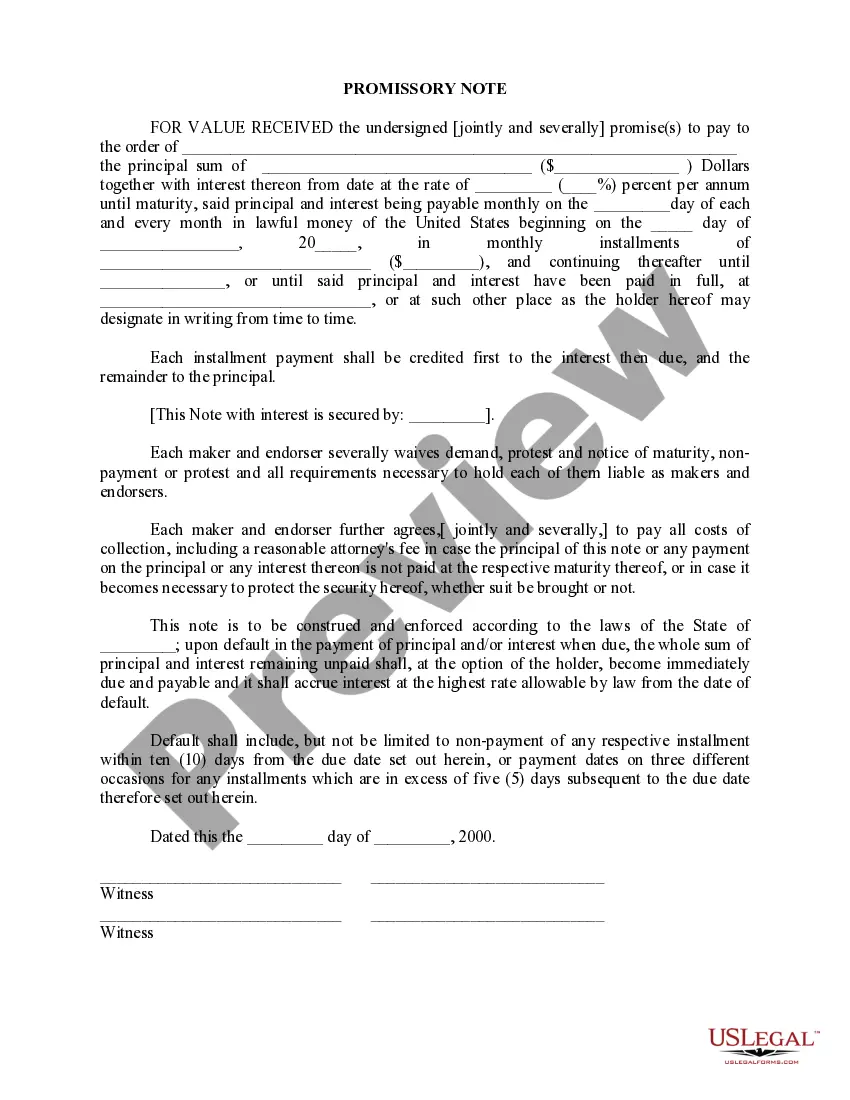

A promissory note is a written promise to pay a debt. In this particular agreement, the undersigned (jointly and severally) promise(s) to pay a certain sum of money with interest. The principal and interest will be paid in monthly installments until the amount is paid in full. Each maker and endorser will pay all costs of collection, including a reasonable attorney's fee in case the principal of this note or any payment on the principal or any interest is not paid at the respective maturity date.

A Miami-Dade Florida Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Miami-Dade County, Florida. This promissory note can be categorized into two types: Secured and Unsecured. 1. Secured Promissory Note: This type of promissory note includes collateral provided by the borrower to secure the loan. The collateral can be any valuable asset such as real estate, vehicles, or investments. By securing the note with collateral, the lender has the right to claim the assets in case of default on loan payments. Secured notes provide lenders with added security and typically offer lower interest rates compared to unsecured notes. 2. Unsecured Promissory Note: Unlike secured promissory notes, unsecured notes do not require any collateral from the borrower. This means that the lender relies solely on the borrower's creditworthiness and trust to lend money. Due to the higher risk for lenders, unsecured notes generally have higher interest rates compared to secured notes. Borrowers who do not possess substantial assets or are not willing to provide collateral may opt for unsecured promissory notes. Miami-Dade Florida Promissory Notes, whether secured or unsecured, contain crucial information such as the loan amount, interest rate, repayment terms, late fees, and any additional charges associated with the loan. Both parties must carefully review and agree upon these terms before signing the promissory note. It's important to note that the legal requirements and procedures for promissory notes in Miami-Dade County, Florida may vary from other jurisdictions. Consulting with a qualified attorney or financial advisor is recommended to ensure compliance with local regulations and to protect both the borrower and the lender's rights.A Miami-Dade Florida Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Miami-Dade County, Florida. This promissory note can be categorized into two types: Secured and Unsecured. 1. Secured Promissory Note: This type of promissory note includes collateral provided by the borrower to secure the loan. The collateral can be any valuable asset such as real estate, vehicles, or investments. By securing the note with collateral, the lender has the right to claim the assets in case of default on loan payments. Secured notes provide lenders with added security and typically offer lower interest rates compared to unsecured notes. 2. Unsecured Promissory Note: Unlike secured promissory notes, unsecured notes do not require any collateral from the borrower. This means that the lender relies solely on the borrower's creditworthiness and trust to lend money. Due to the higher risk for lenders, unsecured notes generally have higher interest rates compared to secured notes. Borrowers who do not possess substantial assets or are not willing to provide collateral may opt for unsecured promissory notes. Miami-Dade Florida Promissory Notes, whether secured or unsecured, contain crucial information such as the loan amount, interest rate, repayment terms, late fees, and any additional charges associated with the loan. Both parties must carefully review and agree upon these terms before signing the promissory note. It's important to note that the legal requirements and procedures for promissory notes in Miami-Dade County, Florida may vary from other jurisdictions. Consulting with a qualified attorney or financial advisor is recommended to ensure compliance with local regulations and to protect both the borrower and the lender's rights.