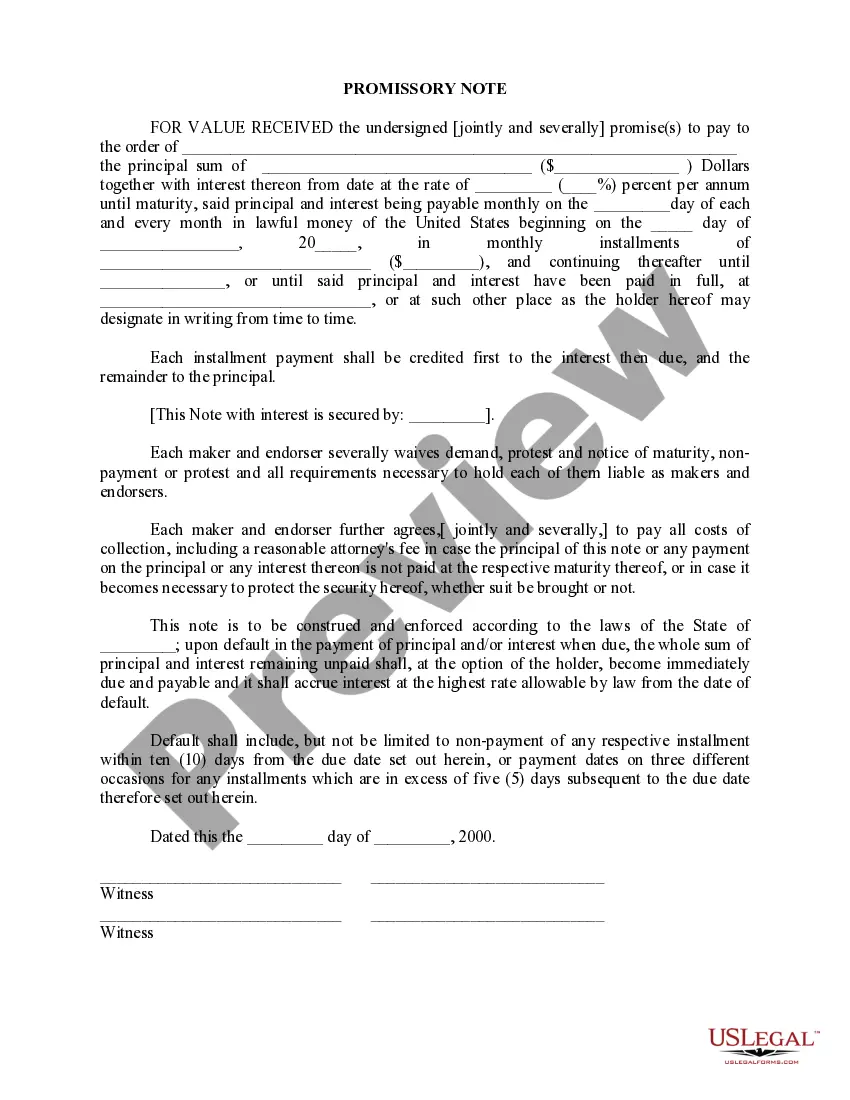

A promissory note is a written promise to pay a debt. In this particular agreement, the undersigned (jointly and severally) promise(s) to pay a certain sum of money with interest. The principal and interest will be paid in monthly installments until the amount is paid in full. Each maker and endorser will pay all costs of collection, including a reasonable attorney's fee in case the principal of this note or any payment on the principal or any interest is not paid at the respective maturity date.

A Miramar Florida promissory note is a legally binding agreement between a lender and a borrower that outlines the terms of a loan. It serves as evidence of a debt and promises the repayment of borrowed funds. Depending on the terms of the agreement, a Miramar Florida promissory note can be classified as either secured or unsecured. A secured promissory note in Miramar Florida is one that involves the use of collateral to secure the debt. The borrower pledges certain assets, such as real estate property or vehicles, as a guarantee that the loan will be repaid. If the borrower fails to fulfill their repayment obligations, the lender can seize the collateral to recover the outstanding amount. This provides a level of security for the lender, as they have an asset to fall back on in case of default. On the other hand, an unsecured promissory note in Miramar Florida does not require any collateral. This type of agreement is based solely on the borrower's promise to repay the loan according to the agreed-upon terms. Since there is no collateral involved, unsecured promissory notes come with a higher degree of risk for the lender. In case of default, the lender must rely on legal actions to recover the debt. Different variations of Miramar Florida promissory notes may have specific labels based on their purpose or terms. For instance, a promissory note used for a mortgage in Miramar Florida might be referred to as a "Florida Mortgage Promissory Note." Similarly, a promissory note used for a business loan in Miramar Florida could be called a "Miramar Florida Commercial Promissory Note." These labels help specify the intended use and the specific regulations that may apply. When creating a Miramar Florida promissory note, it is essential to carefully consider whether to make it secured or unsecured. Factors such as the borrower's creditworthiness, the size of the loan, and the lender's risk preferences should be taken into account. Both parties must clearly understand the terms and obligations outlined in the agreement to ensure a smooth and responsible lending process.A Miramar Florida promissory note is a legally binding agreement between a lender and a borrower that outlines the terms of a loan. It serves as evidence of a debt and promises the repayment of borrowed funds. Depending on the terms of the agreement, a Miramar Florida promissory note can be classified as either secured or unsecured. A secured promissory note in Miramar Florida is one that involves the use of collateral to secure the debt. The borrower pledges certain assets, such as real estate property or vehicles, as a guarantee that the loan will be repaid. If the borrower fails to fulfill their repayment obligations, the lender can seize the collateral to recover the outstanding amount. This provides a level of security for the lender, as they have an asset to fall back on in case of default. On the other hand, an unsecured promissory note in Miramar Florida does not require any collateral. This type of agreement is based solely on the borrower's promise to repay the loan according to the agreed-upon terms. Since there is no collateral involved, unsecured promissory notes come with a higher degree of risk for the lender. In case of default, the lender must rely on legal actions to recover the debt. Different variations of Miramar Florida promissory notes may have specific labels based on their purpose or terms. For instance, a promissory note used for a mortgage in Miramar Florida might be referred to as a "Florida Mortgage Promissory Note." Similarly, a promissory note used for a business loan in Miramar Florida could be called a "Miramar Florida Commercial Promissory Note." These labels help specify the intended use and the specific regulations that may apply. When creating a Miramar Florida promissory note, it is essential to carefully consider whether to make it secured or unsecured. Factors such as the borrower's creditworthiness, the size of the loan, and the lender's risk preferences should be taken into account. Both parties must clearly understand the terms and obligations outlined in the agreement to ensure a smooth and responsible lending process.