This form is a Quitclaim Deed where the grantor is the trustee of a trust acting in that capacity to transfer real property to the grantee which is another trust. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

Tallahassee Florida Quitclaim Deed - Trust to Trust

Description

How to fill out Florida Quitclaim Deed - Trust To Trust?

Are you in search of a reliable and affordable supplier of legal documents to acquire the Tallahassee Florida Quitclaim Deed - Trust to Trust? US Legal Forms is your ideal choice.

Whether you're looking for a straightforward agreement to establish rules for living with your partner or a set of documents to facilitate your separation or divorce through the legal system, we have everything you need. Our platform features over 85,000 current legal document templates for both personal and commercial purposes. All templates we provide are not universal and are tailored in accordance with the specifications of particular states and counties.

To obtain the form, you need to Log In to your account, find the desired form, and click the Download button next to it. Please keep in mind that you can access your previously purchased document templates at any time in the My documents section.

Is this your first time visiting our site? No problem. You can easily set up an account, but first, ensure you do the following.

You can now create your account. Next, choose a subscription plan and continue to payment. After completing the payment, download the Tallahassee Florida Quitclaim Deed - Trust to Trust in any available file format. You can revisit the website at any point and redownload the form free of charge.

Acquiring current legal documents has never been simpler. Try US Legal Forms today, and put an end to wasting time researching legal documents online for good.

- Verify that the Tallahassee Florida Quitclaim Deed - Trust to Trust meets the laws of your state and locality.

- Review the details of the form (if accessible) to understand who and what the form is applicable for.

- Restart the search if the form does not suit your particular needs.

Form popularity

FAQ

Yes, you can create your own quitclaim deed in Florida. Completing a quitclaim deed, such as the Tallahassee Florida Quitclaim Deed - Trust to Trust, allows for a straightforward transfer of property rights. Ensure you meet the state requirements, like listing the grantor and grantee correctly, and have the deed notarized. Using resources from platforms like USLegalForms can provide you with clear instructions and templates to make your task easier.

In Florida, it is not mandatory for an attorney to prepare a deed, including the Tallahassee Florida Quitclaim Deed - Trust to Trust. You have the option to complete and file the deed yourself, provided you follow the correct procedures. However, an attorney can offer valuable insights and help prevent potential errors. If you feel uncertain, consulting with a legal professional may be a wise choice.

The time it takes to complete a quitclaim deed in Florida can vary, but it typically ranges from a few days to a couple of weeks. For a Tallahassee Florida Quitclaim Deed - Trust to Trust, the process may be quicker if all documentation is in order and properly submitted. Once you have prepared the deed, you will need to record it with the county clerk, which can add some additional time. Utilizing platforms like US Legal Forms can streamline this process and help you manage timelines effectively.

You do not necessarily need a lawyer to handle a quitclaim deed in Florida, specifically for a Tallahassee Florida Quitclaim Deed - Trust to Trust transaction. Many people choose to complete the process on their own using reliable online resources. However, consulting with a lawyer can provide you peace of mind and ensure all legal requirements are met. Ultimately, it depends on your comfort level and understanding of the property transfer process.

Many individuals have utilized the Tallahassee Florida Quitclaim Deed - Trust to Trust for various purposes, including transferring property among family members or establishing trust arrangements. The benefits include a straightforward transfer process with minimal formalities, making it accessible for many. If you’re considering this option, reviewing resources and templates on platforms like USLegalForms can provide valuable insights.

In Florida, there isn't a specific statute of limitations for recording a Quit Claim Deed; however, it is advisable to record the deed as soon as possible. Recording protects the grantee's rights to the property and helps avoid potential disputes. For a comprehensive understanding, consider exploring resources on the Tallahassee Florida Quitclaim Deed - Trust to Trust available through USLegalForms.

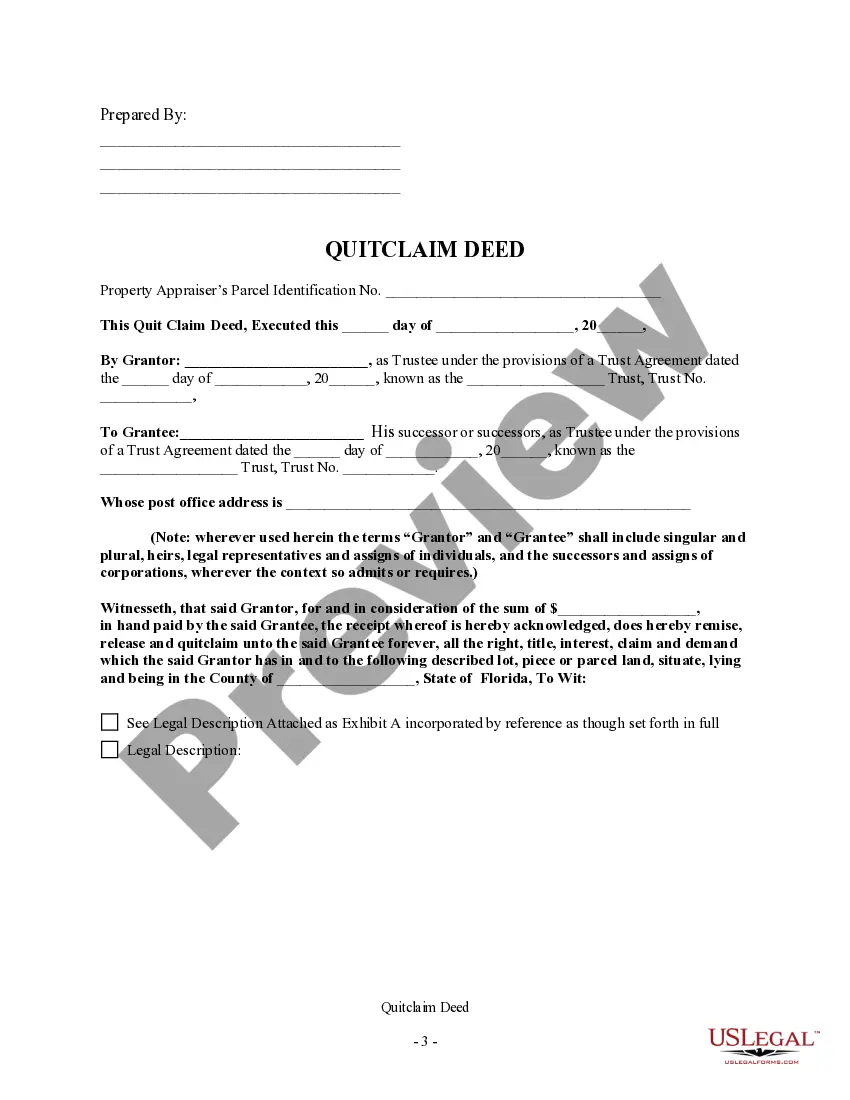

Filling out a Florida quitclaim deed involves providing essential information such as the grantor's and grantee's names, the property description, and any relevant terms of transfer. You can find templates and guidance on platforms like USLegalForms, which offer user-friendly documents tailored for the Tallahassee Florida Quitclaim Deed - Trust to Trust. Ensuring accuracy is vital to prevent complications later.

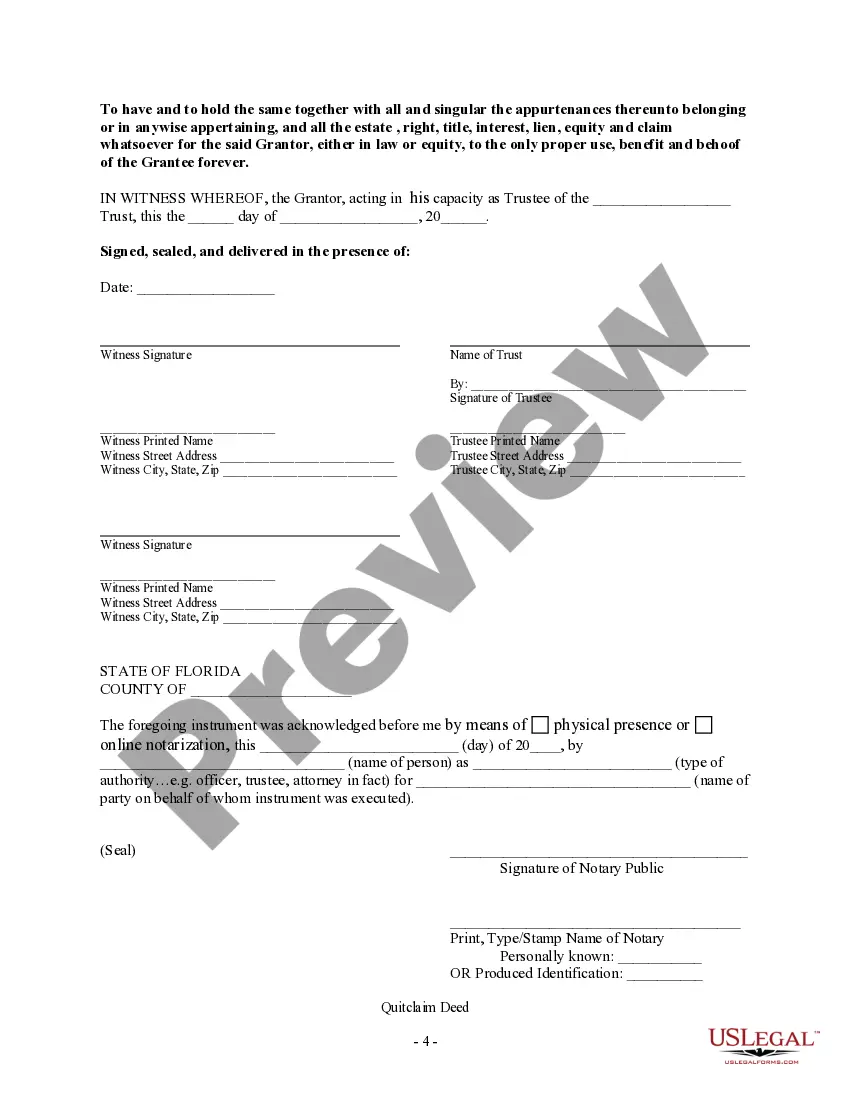

In Florida, a valid deed must clearly identify the parties involved, specifically the grantor and the grantee. It should include a legal description of the property and be signed by the grantor in the presence of a notary public. The Tallahassee Florida Quitclaim Deed - Trust to Trust also requires timely recording with the county clerk to protect ownership rights.

To execute a Tallahassee Florida Quitclaim Deed - Trust to Trust, you must be the property owner and sign the deed in front of a notary public. Additionally, you need to include the names of the grantor and grantee, a description of the property, and any encumbrances affecting the title. Ensuring compliance with local regulations is crucial to avoid future legal issues.

Yes, there is typically a transfer tax associated with a Tallahassee Florida Quitclaim Deed - Trust to Trust, which may vary based on the property's value. However, some transfers, such as those involving family members, can be exempt from this tax. It's essential to review local regulations and guidelines, and uslegalforms can provide helpful resources to guide you through this process efficiently.