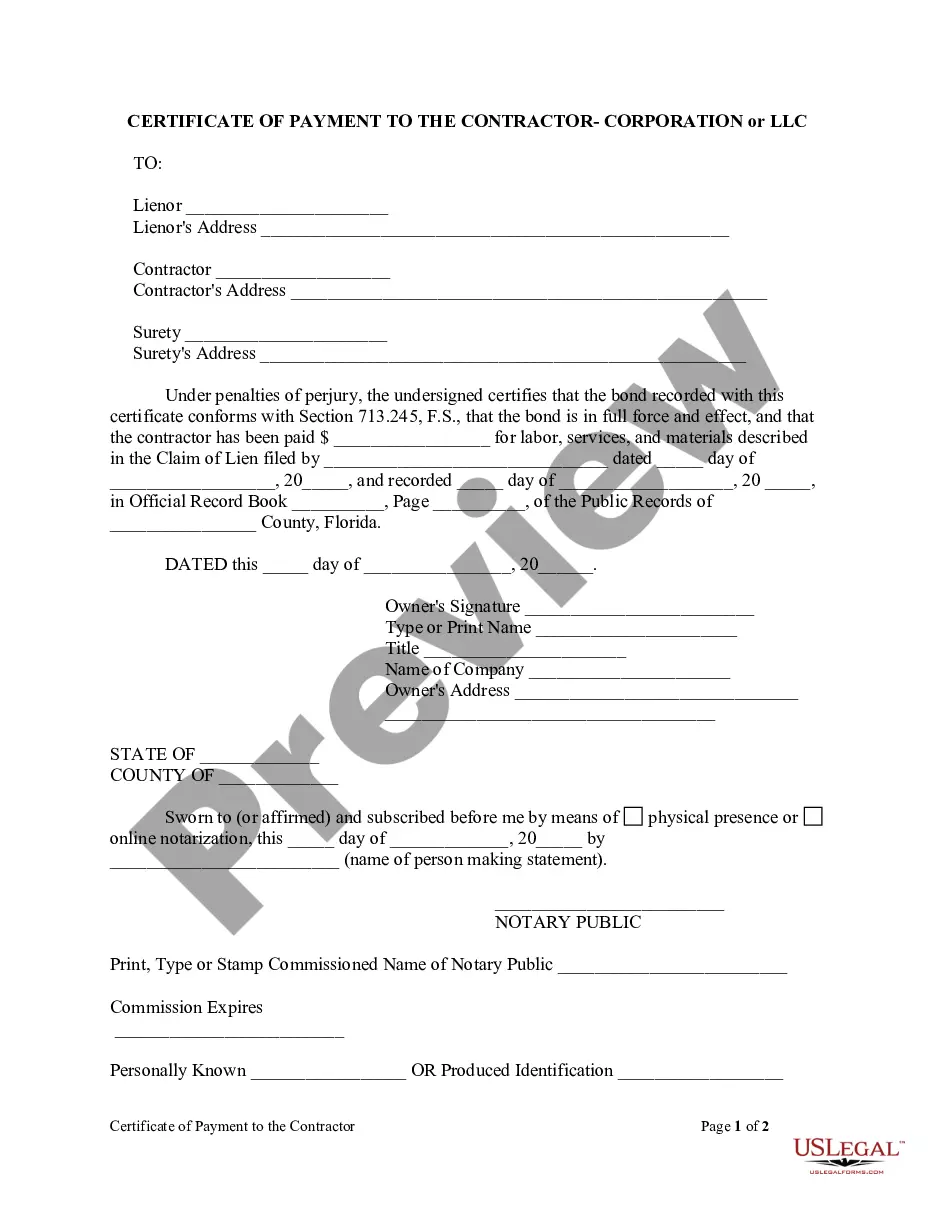

Within 90 days after a claim of lien is recorded for labor, services, or materials for which the contractor has been paid, the corporate or LLC owner or contractor may record a notice of bond as specified in s. 713.23(2), together with a copy of the bond and a sworn statement of Certificate Of Payment To Contractor Form. 713.245 Conditional payment bond.

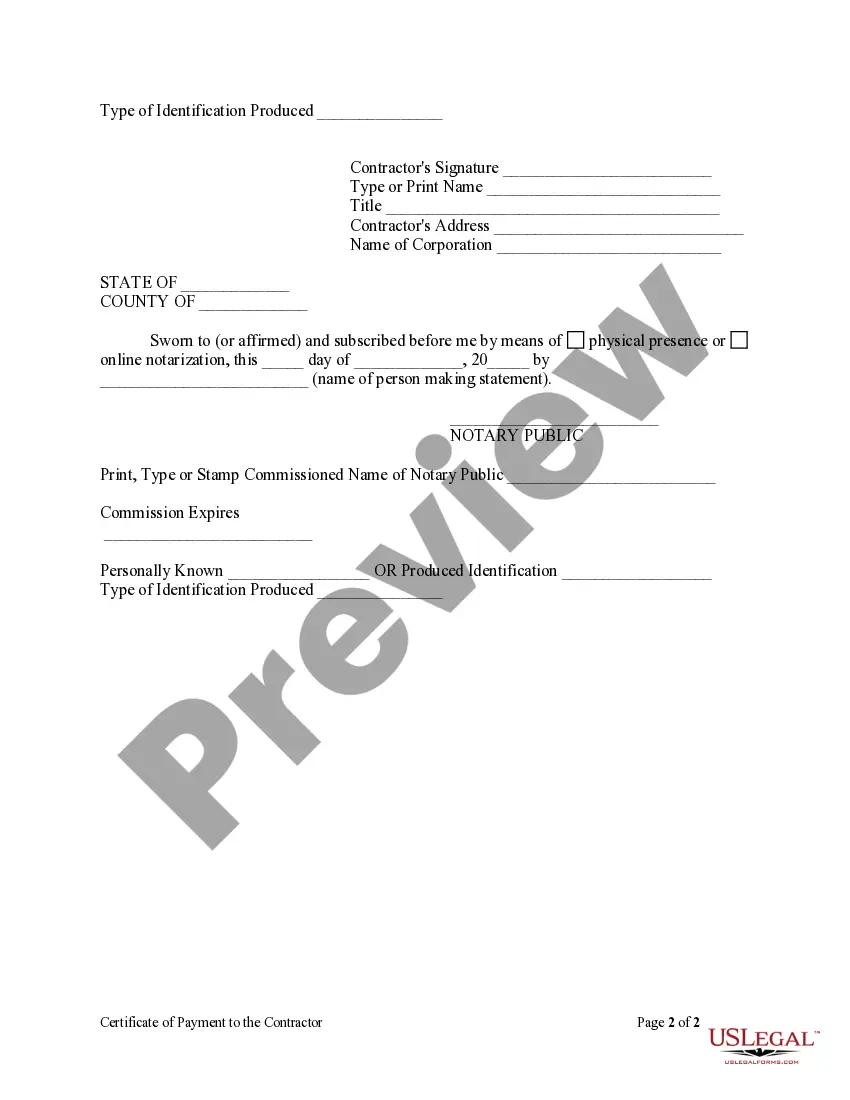

The Miami-Dade Florida Certificate of Payment to Contractor Form is a legally binding document used in the construction industry to certify and acknowledge payments made by a corporation or LLC (Limited Liability Company) to a contractor. This form is specifically designed to address issues related to Mechanic Liens, which are legal claims made by contractors or suppliers for unpaid services or materials provided for a construction project. The Certificate of Payment to Contractor Form serves as evidence of payment and helps protect both the corporation or LLC and the contractor from potential disputes or legal actions related to non-payment. By filling out this form accurately and promptly, the corporation or LLC ensures that the contractor receives timely payment, and in turn, the contractor can release any potential Mechanic Lien claims against the project. There may be different variations or iterations of the Miami-Dade Florida Certificate of Payment to Contractor Form, depending on the specific requirements and guidelines set by the Miami-Dade County or other local authorities. These variations may include changes to formatting, specific instructions provided, or additional sections to address additional details specific to the project or parties involved. The Certificate of Payment to Contractor Form typically includes the following key sections: 1. Project Information: This section captures details about the construction project, such as the project name, address, permit number, and other relevant identifiers. 2. Contractor Information: This section requires information about the contractor, such as their name, address, contact information, license number, and other pertinent details. 3. Corporation or LLC Information: Here, the form will require specific information about the corporation or LLC making the payment, including their legal name, address, contact details, and any relevant identification numbers. 4. Payment Details: This section prompts the corporation or LLC to provide payment information, including the payment amount, payment method, date of payment, and any relevant invoice or payment reference numbers. 5. Notarization and Certification: To ensure the authenticity and legality of the document, the form may contain a section for notarization and certification, where the corporation or LLC and relevant parties may need to sign and have their signatures verified by a notary public. It is crucial for corporations or LCS engaged in construction projects within Miami-Dade County, Florida, to utilize the specific variation of the Certificate of Payment to Contractor Form as prescribed by local authorities. By doing so and adhering to the requirements outlined within, corporations or LCS can effectively manage and document their payments to contractors, mitigating the risk of Mechanic Liens and potential legal complications.The Miami-Dade Florida Certificate of Payment to Contractor Form is a legally binding document used in the construction industry to certify and acknowledge payments made by a corporation or LLC (Limited Liability Company) to a contractor. This form is specifically designed to address issues related to Mechanic Liens, which are legal claims made by contractors or suppliers for unpaid services or materials provided for a construction project. The Certificate of Payment to Contractor Form serves as evidence of payment and helps protect both the corporation or LLC and the contractor from potential disputes or legal actions related to non-payment. By filling out this form accurately and promptly, the corporation or LLC ensures that the contractor receives timely payment, and in turn, the contractor can release any potential Mechanic Lien claims against the project. There may be different variations or iterations of the Miami-Dade Florida Certificate of Payment to Contractor Form, depending on the specific requirements and guidelines set by the Miami-Dade County or other local authorities. These variations may include changes to formatting, specific instructions provided, or additional sections to address additional details specific to the project or parties involved. The Certificate of Payment to Contractor Form typically includes the following key sections: 1. Project Information: This section captures details about the construction project, such as the project name, address, permit number, and other relevant identifiers. 2. Contractor Information: This section requires information about the contractor, such as their name, address, contact information, license number, and other pertinent details. 3. Corporation or LLC Information: Here, the form will require specific information about the corporation or LLC making the payment, including their legal name, address, contact details, and any relevant identification numbers. 4. Payment Details: This section prompts the corporation or LLC to provide payment information, including the payment amount, payment method, date of payment, and any relevant invoice or payment reference numbers. 5. Notarization and Certification: To ensure the authenticity and legality of the document, the form may contain a section for notarization and certification, where the corporation or LLC and relevant parties may need to sign and have their signatures verified by a notary public. It is crucial for corporations or LCS engaged in construction projects within Miami-Dade County, Florida, to utilize the specific variation of the Certificate of Payment to Contractor Form as prescribed by local authorities. By doing so and adhering to the requirements outlined within, corporations or LCS can effectively manage and document their payments to contractors, mitigating the risk of Mechanic Liens and potential legal complications.