Miami-Dade Florida Owner's 10-Day Notice to Contractor of Intent to Pay Lienors - Corporation or LLC

Description

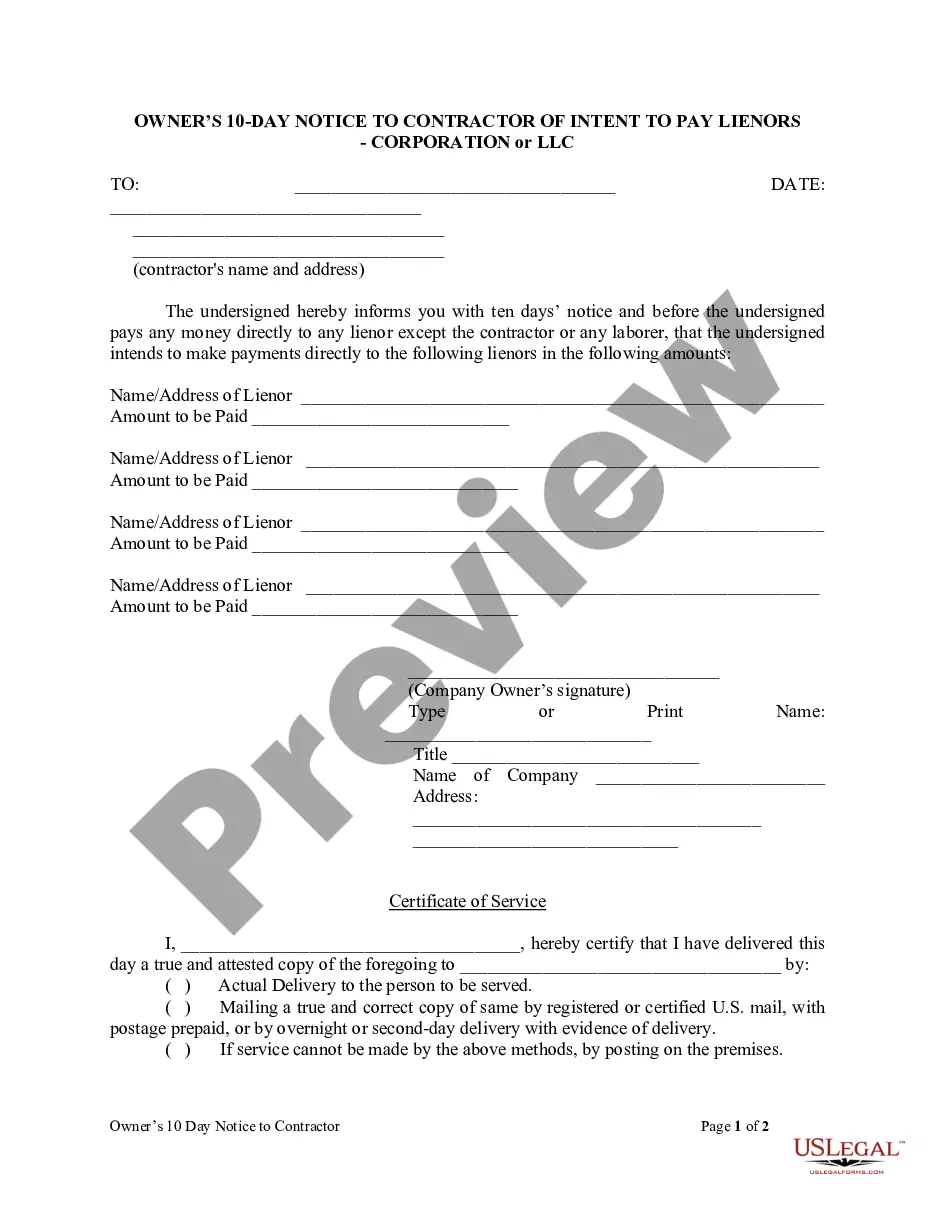

How to fill out Florida Owner's 10-Day Notice To Contractor Of Intent To Pay Lienors - Corporation Or LLC?

If you are searching for a legitimate document, it’s challenging to discover a finer location than the US Legal Forms website – one of the most extensive collections on the web.

Within this collection, you can uncover a vast array of templates for commercial and personal uses categorized by type and state, or keywords.

With our superior search feature, finding the most current Miami-Dade Florida Owner's 10-Day Notice to Contractor of Intent to Pay Lienors - Corporation or LLC is as straightforward as 1-2-3.

Receive the document. Choose the format and download it to your device.

Edit. Fill out, modify, print, and sign the obtained Miami-Dade Florida Owner's 10-Day Notice to Contractor of Intent to Pay Lienors - Corporation or LLC.

- If you are already familiar with our system and possess a registered account, all you need to obtain the Miami-Dade Florida Owner's 10-Day Notice to Contractor of Intent to Pay Lienors - Corporation or LLC is to sign in to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the instructions outlined below.

- Ensure you have selected the document you desire. Verify its details and utilize the Preview feature (if available) to review its contents. If it does not meet your requirements, use the Search feature at the top of the page to find the appropriate document.

- Validate your selection. Select the Buy now button. Next, choose the desired subscription plan and provide your information to create an account.

- Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

Contesting A Lien An owner has a right to file a Notice of Contest of Lien during the one-year period. Upon the filing of a Notice of Contest of Lien, a lienor must file a lawsuit to enforce the lien within 60 days. Failure of the lienor to timely file a lawsuit renders the lien invalid.

Your Florida NTO is not considered valid unless it is received by the 45th day, which means you must leave time for the NTO to reach not only the owner, but all required recipients.

A lien is valid for one year, unless a lienor files a lawsuit to enforce the lien prior to the expiration of the year. An owner has a right to file a Notice of Contest of Lien during the one-year period. Upon the filing of a Notice of Contest of Lien, a lienor must file a lawsuit to enforce the lien within 60 days.

A Notice to Owner (NTO) is a written notice prescribed by Florida Statute (713.06) that officially advises the owner of an improvement that the sender, usually a subcontractor or supplier not dealing directly with the owner, is looking to the owner to be sure the sender is paid before payment is made to the contractor

Florida contractors and suppliers must generally send a preliminary notice within the first 45 days on a construction project. In Florida, preliminary notice is called a Notice to Owner, or NTO.

In Florida, your Notice to Owner needs to be mailed within 45 days of when you completed your service or when you last received a payment. The notice must be served on the owner before filing the lien or within 15 days after you have filed the lien.

A Florida mechanics lien must be in the proper format and filed in the county recorder's office in the county where the property is located within the required timeframe. To record a lien in Florida, you will need to bring your completed Claim of Lien form to the recorder's office and pay the filing fee.

IF YOU FAIL TO PAY YOUR CONTRACTOR, YOUR CONTRACTOR MAY ALSO HAVE A LIEN ON YOUR PROPERTY. THIS MEANS IF A LIEN IS FILED YOUR PROPERTY COULD BE SOLD AGAINST YOUR WILL TO PAY FOR LABOR, MATERIALS, OR OTHER SERVICES THAT YOUR CONTRACTOR OR A SUBCONTRACTOR MAY HAVE FAILED TO PAY.

No, the Notice of Commencement in Florida does not need to be terminated or released, and there is no process for filing a ?Notice of Completion? or any other document to signify that the project has been completed.