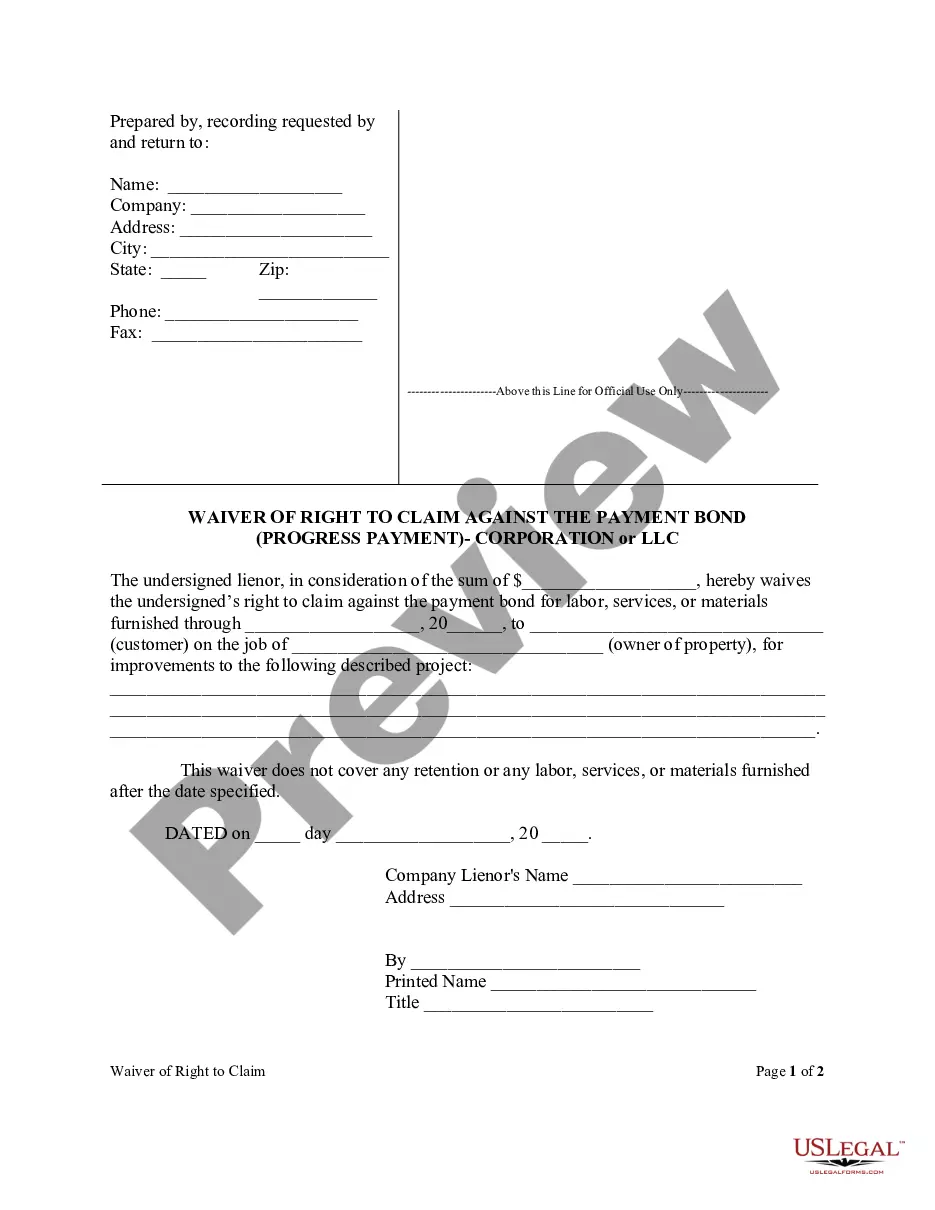

A Gainesville Florida Waiver of Right to Claim Against the Payment Bond (Progress Payment) is a legal document that can be utilized by a corporation or limited liability company (LLC) involved in construction projects. This waiver serves as a means to release the party responsible for the payment bond from any potential future claims related to progress payments. In the construction industry, payment bonds are often required to ensure that subcontractors and suppliers are paid for their work and materials on a project. These bonds provide a measure of protection for all parties involved and help to minimize financial disputes. However, circumstances may arise where a corporation or LLC wishes to relinquish their claim rights against the payment bond for a progress payment. It is crucial for contractors and subcontractors to understand the different types of waivers relevant to Gainesville, Florida. There are two main types: 1. Conditional Waiver of Right to Claim Against the Payment Bond (Progress Payment): When a contractor or subcontractor receives a progress payment on a project in Gainesville, they may choose to sign a conditional waiver. By doing so, they agree to waive their right to file any claim or lawsuit against the payment bond issuer for the specific progress payment received. However, this waiver only becomes effective once the payment has been successfully processed and cleared by the relevant financial institution. 2. Unconditional Waiver of Right to Claim Against the Payment Bond (Progress Payment): An unconditional waiver, on the other hand, differs from the conditional waiver as it immediately relinquishes any potential claim rights against the payment bond issuer, regardless of whether the payment has been cleared or not. This type of waiver is typically signed when there is a high level of trust between the parties involved, and it provides a faster resolution in terms of payment and release of potential claims. Both waivers should contain accurate and detailed information, such as the legal names of the corporation or LLC involved, the project name, its location, the payment amount being waived, and the date of the waiver. Additionally, it is advisable to consult with legal professionals before signing any waiver, as they can provide guidance specific to Gainesville, Florida's legal requirements and ensure that the waiver protects the interests of the corporation or LLC.

Gainesville Florida Waiver of Right to Claim Against the Payment Bond (Progress Payment) - Corporation or LLC

Description

How to fill out Gainesville Florida Waiver Of Right To Claim Against The Payment Bond (Progress Payment) - Corporation Or LLC?

If you have previously accessed our service, sign in to your account and store the Gainesville Florida Waiver of Right to Claim Against the Payment Bond (Progress Payment) - Corporation or LLC on your device by clicking the Download button. Ensure that your subscription remains active. If it has expired, renew it as per your payment plan.

If this is your inaugural experience with our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to use it again. Utilize the US Legal Forms service to easily find and save any template for your personal or business requirements!

- Ensure you’ve identified an appropriate document. Browse the description and use the Preview function, if available, to verify it meets your criteria. If it does not suit your needs, utilize the Search tab above to discover the correct one.

- Purchase the form. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process a payment. Input your credit card information or the PayPal option to finalize the transaction.

- Obtain your Gainesville Florida Waiver of Right to Claim Against the Payment Bond (Progress Payment) - Corporation or LLC. Select the file format for your document and save it to your device.

- Fill out your form. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

In Florida, the bond process involves securing a payment bond before starting work on a construction project. This bond assures that contractors and subcontractors will be compensated for their work. Should any party not receive payment, they can claim against the bond, such as with the Gainesville Florida Waiver of Right to Claim Against the Payment Bond (Progress Payment) - Corporation or LLC. Understanding this process is vital for protecting your financial interests in any construction endeavor.

A waiver and release upon final payment in Florida is a legal document that releases a contractor or subcontractor's right to claim against the payment bond after receiving full payment. This document ensures the payer that they will not face further claims related to the project. The Gainesville Florida Waiver of Right to Claim Against the Payment Bond (Progress Payment) - Corporation or LLC plays a significant role in this process. It’s a crucial step to protect both parties involved.

To fill out a conditional waiver of a lien, start by gathering the necessary information including the property location and details of the work completed. Clearly state your intention to waive your right to claim against the payment bond, specifically the Gainesville Florida Waiver of Right to Claim Against the Payment Bond (Progress Payment) - Corporation or LLC. Make sure to include all required signatures and dates to validate the document. If you need assistance, consider using uslegalforms to ensure accuracy.

Filling out a conditional waiver and release on progress payment is straightforward. First, ensure you have the correct form that specifically pertains to the Gainesville Florida Waiver of Right to Claim Against the Payment Bond (Progress Payment) - Corporation or LLC. Next, provide the necessary details such as your business name, the project information, and the amount you received. Finally, sign the document, which will officially release your lien rights while maintaining your ability to file a claim against the payment bond if needed.

A bond waiver in construction is a document that waives the right to make a claim against the payment bond for work performed. This typically occurs when a party receives full payment and agrees not to file a bond claim. It is essential to understand how this relates to your Gainesville Florida Waiver of Right to Claim Against the Payment Bond (Progress Payment) - Corporation or LLC, as it affects your rights in future transactions. To secure your interests, consult Uslegalforms for comprehensive information and legal documents.

To put a claim on a surety bond, first, review the terms of the bond to understand the claim procedures. Then, prepare a detailed claim statement that outlines the basis of your claim clearly. Make sure to include any supporting documentation, such as invoices or contracts. Uslegalforms provides templates and guides that simplify this process, ensuring you include the Gainesville Florida Waiver of Right to Claim Against the Payment Bond (Progress Payment) - Corporation or LLC under the relevant circumstances.

To file a bond claim in Florida, start by gathering all relevant documents that demonstrate your claim. You must notify the surety company in writing, outlining the details of your claim. This notification is critical for initiating the process and should include your Gainesville Florida Waiver of Right to Claim Against the Payment Bond (Progress Payment) - Corporation or LLC if applicable. You can find various resources on the Uslegalforms platform to help you with the paperwork and ensure you meet all necessary requirements.

To complete a lien waiver, start by reading the document to understand its implications, especially regarding the Gainesville Florida Waiver of Right to Claim Against the Payment Bond (Progress Payment) - Corporation or LLC. Fill in required information such as your name, address, and relevant project details. After reviewing your entries for correctness, obtain necessary signatures from authorized parties. Using US Legal Forms can simplify this process through easy-to-follow templates.

Filling out a waiver of lien in Florida is straightforward. Begin by accurately entering your name, the project details, and the amount you are waiving, specifically relating to the Gainesville Florida Waiver of Right to Claim Against the Payment Bond (Progress Payment) - Corporation or LLC. Double-check all entries for accuracy, and ensure the document is signed by authorized individuals. Utilize the resources at US Legal Forms for professionally designed templates to guide you.

Filing a bond claim in Florida involves a few clear steps. First, confirm your eligibility based on your involvement in the project requiring the Gainesville Florida Waiver of Right to Claim Against the Payment Bond (Progress Payment) - Corporation or LLC. Next, gather necessary documentation, including your contract and invoices, then formally submit your claim to the surety company. For seamless processes, explore the document templates available at US Legal Forms.