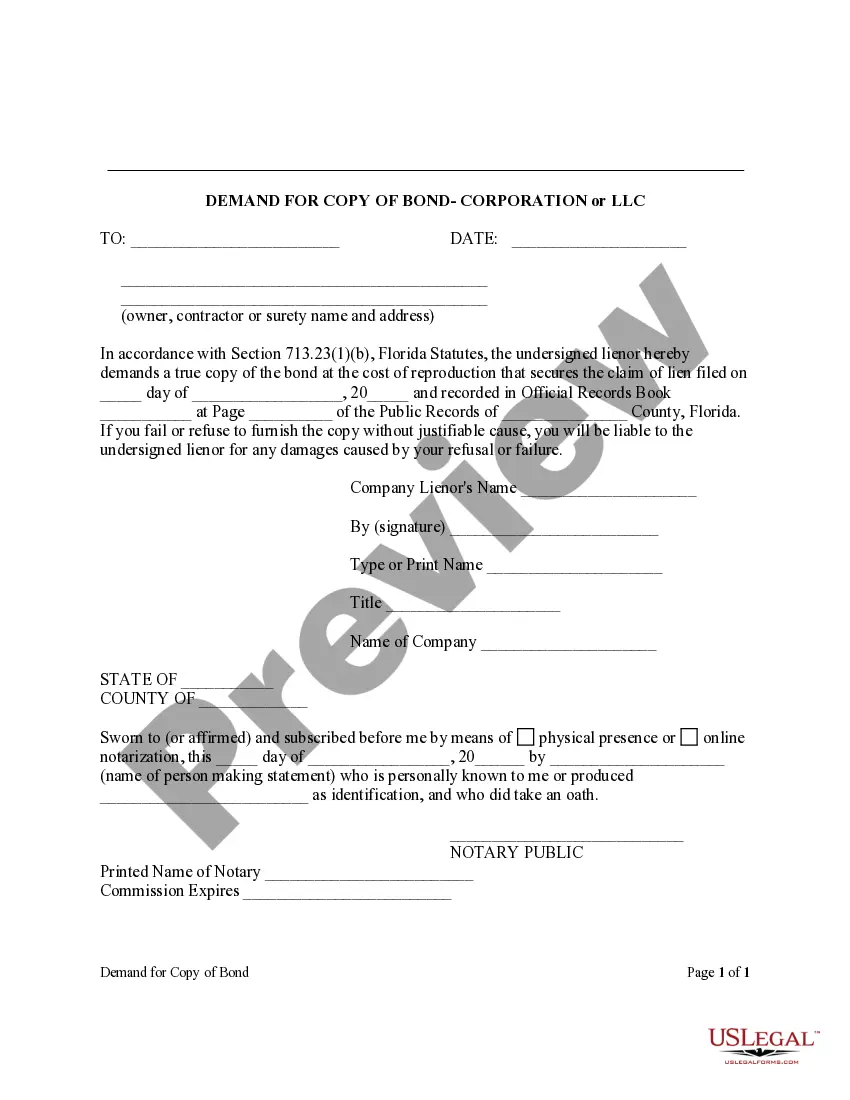

Title: Fort Lauderdale Florida Demand for Copy of Bond — Corporation or LLC: Overview and Types Introduction: Fort Lauderdale, Florida, is a vibrant city known for its attractive business climate and extensive legal frameworks. In certain situations, individuals or entities may require a copy of a bond belonging to a corporation or limited liability company (LLC) operating within the city. This article aims to provide a detailed description of what the demand for a copy of bond entails for corporations and LCS in Fort Lauderdale. Additionally, it will shed light on various types of demands that may arise in different circumstances. 1. Definition: A demand for a copy of bond refers to a formal request for a certified replica of a bond issued by a corporation or LLC registered in Fort Lauderdale, Florida. This demand is typically made when an individual or entity has a legal interest in the bond and requires access to its details and obligations. 2. Process and Legal Grounds: a. Corporations: In Fort Lauderdale, Florida, demands for a copy of bond made to corporations generally follow the legal framework outlined under the Florida Business Corporation Act (FCA). The requesting party must justify their legal interest in the bond and submit a formal written demand according to the Act's provisions. b. LCS: For demands made to LCS, the procedures typically adhere to the guidelines established under the Florida Revised Limited Liability Company Act (FLA). Similar to corporations, a written demand outlining the legal interest must be submitted to the relevant LLC in conformity with FLA requirements. 3. Types of Demand for Copy of Bond: a. Surety Bonds: Surety bonds, also known as performance bonds, are a common type of bond demanded in the business world. Contractors, vendors, or those involved in construction projects may seek a copy of a surety bond to ensure compliance and performance from a corporation or LLC undertaking the project. b. Fiduciary Bonds: Fiduciary bonds may be necessary in situations where corporations or LCS are appointed as fiduciaries, such as administrators, trustees, or guardians. Interested parties may demand a copy of the bond to confirm the bonded party's compliance with their fiduciary duties. c. License and Permit Bonds: Certain occupations and professions require individuals or entities to obtain licenses or permits, often backed by bonds. Interested parties, such as clients, customers, or regulatory bodies, may demand a copy of these bonds to ensure financial protection in case of misconduct or non-compliance. d. Financial Guarantee Bonds: Corporations or LCS in Fort Lauderdale engaging in financial services, such as banking or insurance, might require financial guarantee bonds. These bonds protect customers and investors from potential financial loss caused by the entity's actions or negligence. Demands for copies of these bonds often arise from customers or regulatory authorities. Conclusion: Demands for copies of bonds issued to corporations or LCS in Fort Lauderdale, Florida, require a formal written request demonstrating a legal interest in the bond. Various types of demands exist, such as surety bonds for construction projects, fiduciary bonds for appointed roles, license and permit bonds for regulated professions, and financial guarantee bonds for financial service providers. Understanding the nature of the bond and its purpose aids interested parties in asserting their rights and interests effectively.

Fort Lauderdale Florida Demand for Copy of Bond - Corporation or LLC

Description

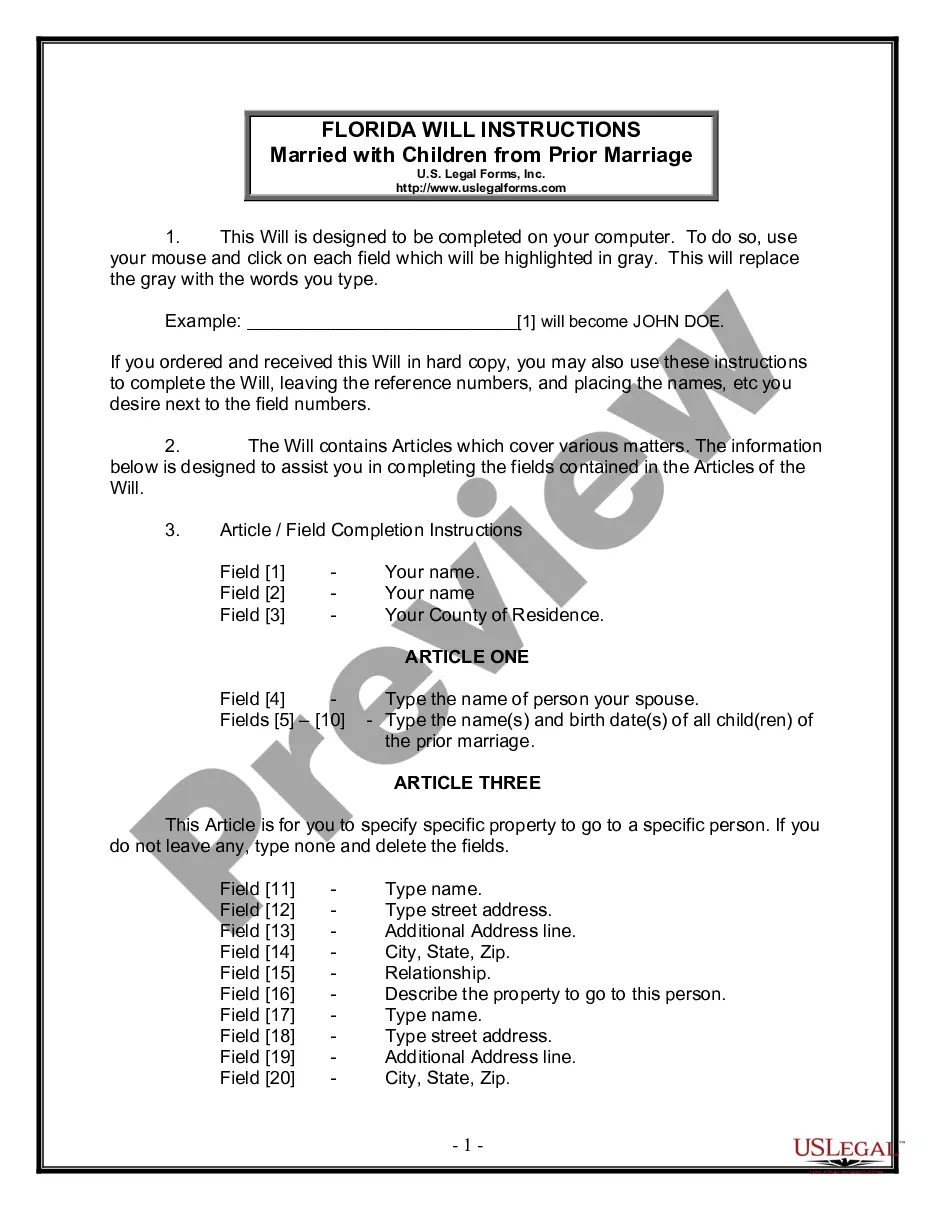

How to fill out Fort Lauderdale Florida Demand For Copy Of Bond - Corporation Or LLC?

If you are searching for a valid form template, it’s difficult to choose a more convenient platform than the US Legal Forms site – one of the most considerable libraries on the web. Here you can get thousands of templates for company and personal purposes by types and regions, or key phrases. Using our advanced search option, discovering the most recent Fort Lauderdale Florida Demand for Copy of Bond - Corporation or LLC is as elementary as 1-2-3. In addition, the relevance of each and every record is verified by a team of professional lawyers that regularly review the templates on our platform and update them based on the newest state and county demands.

If you already know about our system and have a registered account, all you should do to receive the Fort Lauderdale Florida Demand for Copy of Bond - Corporation or LLC is to log in to your account and click the Download button.

If you use US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have chosen the form you need. Look at its description and use the Preview option to see its content. If it doesn’t meet your requirements, utilize the Search field near the top of the screen to find the proper document.

- Affirm your choice. Choose the Buy now button. Next, choose the preferred pricing plan and provide credentials to register an account.

- Process the financial transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Receive the form. Choose the format and download it to your system.

- Make modifications. Fill out, edit, print, and sign the obtained Fort Lauderdale Florida Demand for Copy of Bond - Corporation or LLC.

Every form you save in your account does not have an expiration date and is yours permanently. You always have the ability to gain access to them via the My Forms menu, so if you need to get an extra copy for editing or printing, feel free to come back and export it once again anytime.

Make use of the US Legal Forms professional collection to get access to the Fort Lauderdale Florida Demand for Copy of Bond - Corporation or LLC you were looking for and thousands of other professional and state-specific templates in a single place!