Title: Understanding the Tallahassee Florida Demand for Copy of Bond — Corporation or LLC Description: In Tallahassee, Florida, the demand for a copy of bond can arise in various situations for both corporations and Limited Liability Companies (LCS). This article aims to provide a comprehensive overview of the different types of demands for a copy of bond and the corresponding requirements for corporations and LCS in Tallahassee. 1. Surety Bonds for Corporations: When a corporation operates in Tallahassee, it may be required to obtain a surety bond as a part of licensing or compliance requirements. Examples include: — Occupational License Bond: Certain business activities in Tallahassee, such as construction, contracting, or professional services, may necessitate an occupational license bond. This bond assures compliance with local regulations and guarantees financial recourse for clients or customers. — Bid or Contract Bonds: If a corporation participates in public construction projects or contracts with government agencies, they may be required to provide bid or contract bonds. These bonds protect the public interest in ensuring the completion of the project as per the terms and conditions agreed upon. 2. Surety Bonds for LCS: Similarly, LCS operating in Tallahassee may also require different types of surety bonds. Some common examples include: — Sales Tax Bond: Businesses engaging in retail activities may need to obtain a sales tax bond to guarantee the timely payment of taxes collected from customers. This bond provides financial security to the state and taxpayers. — PayrolBoundlessCs responsible for processing employee payroll may be required to secure a payroll bond. This bond protects employees by ensuring the accurate and timely payment of wages, taxes, and benefits. To obtain a copy of a bond for either corporations or LCS in Tallahassee, interested parties must follow the specific procedures established by the local governing authorities. Typically, the process involves the following steps: 1. Identify the issuing agency or authority: Determine the entity responsible for issuing and maintaining the bond records, such as the local licensing department, treasury department, or regulatory agencies. 2. Submit a written request: Prepare a formal written request to the appropriate department, clearly stating the purpose of the demand and providing any necessary documentation, like business identification numbers or contract details. 3. Pay requisite fees, if applicable: Some agencies may charge a fee for providing a copy of the bond. Verify the applicable fees and submit payment as instructed by the issuing agency. 4. Await processing: Allow sufficient time for the issuing agency to process the request. Processing times can vary depending on the agency's workload and the complexity of the demand. By understanding the specific requirements and procedures for obtaining a copy of bond, corporations and LCS can ensure compliance with Tallahassee's regulations and provide the necessary financial assurance. Remember, it is crucial to consult with legal and financial professionals for accurate guidance tailored to your specific circumstances.

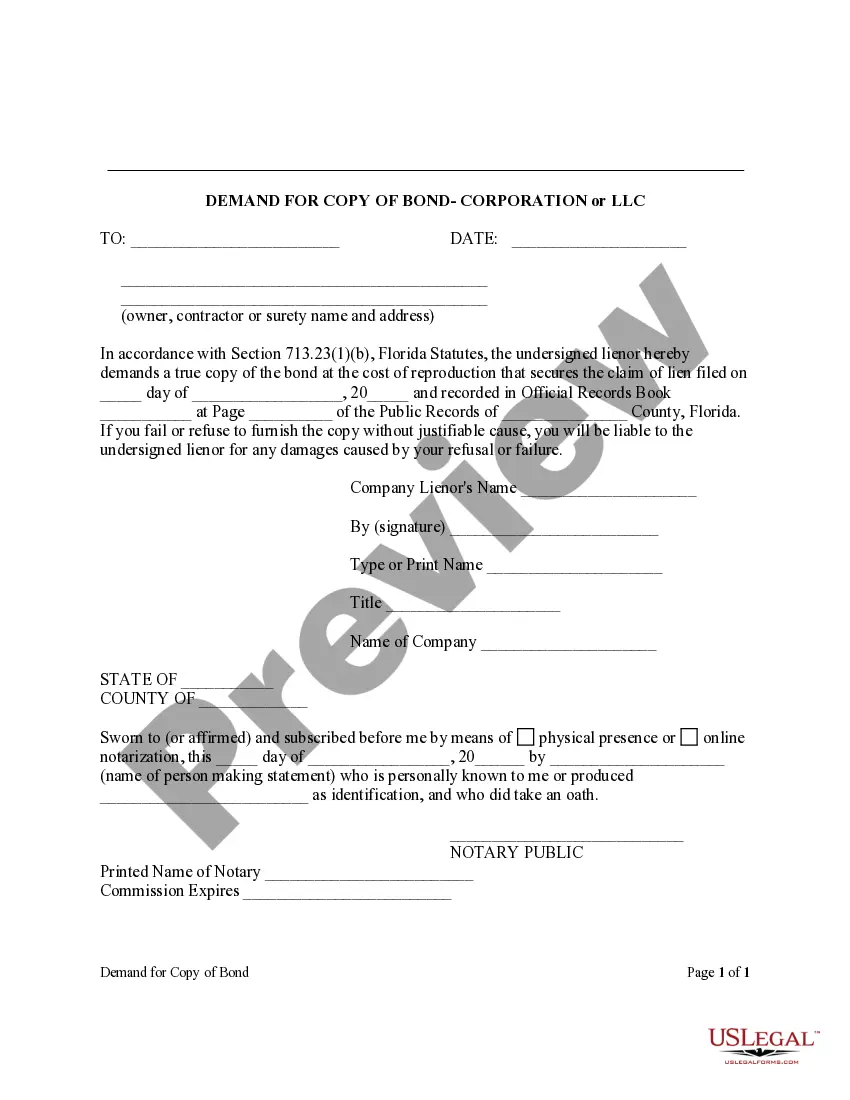

Tallahassee Florida Demand for Copy of Bond - Corporation or LLC

Description

How to fill out Tallahassee Florida Demand For Copy Of Bond - Corporation Or LLC?

Do you need a trustworthy and inexpensive legal forms supplier to get the Tallahassee Florida Demand for Copy of Bond - Corporation or LLC? US Legal Forms is your go-to option.

No matter if you need a simple arrangement to set regulations for cohabitating with your partner or a package of forms to advance your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed based on the requirements of separate state and area.

To download the form, you need to log in account, locate the needed form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime from the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Tallahassee Florida Demand for Copy of Bond - Corporation or LLC conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to learn who and what the form is good for.

- Start the search over in case the form isn’t suitable for your specific situation.

Now you can register your account. Then choose the subscription option and proceed to payment. Once the payment is completed, download the Tallahassee Florida Demand for Copy of Bond - Corporation or LLC in any provided file format. You can get back to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending hours researching legal paperwork online once and for all.