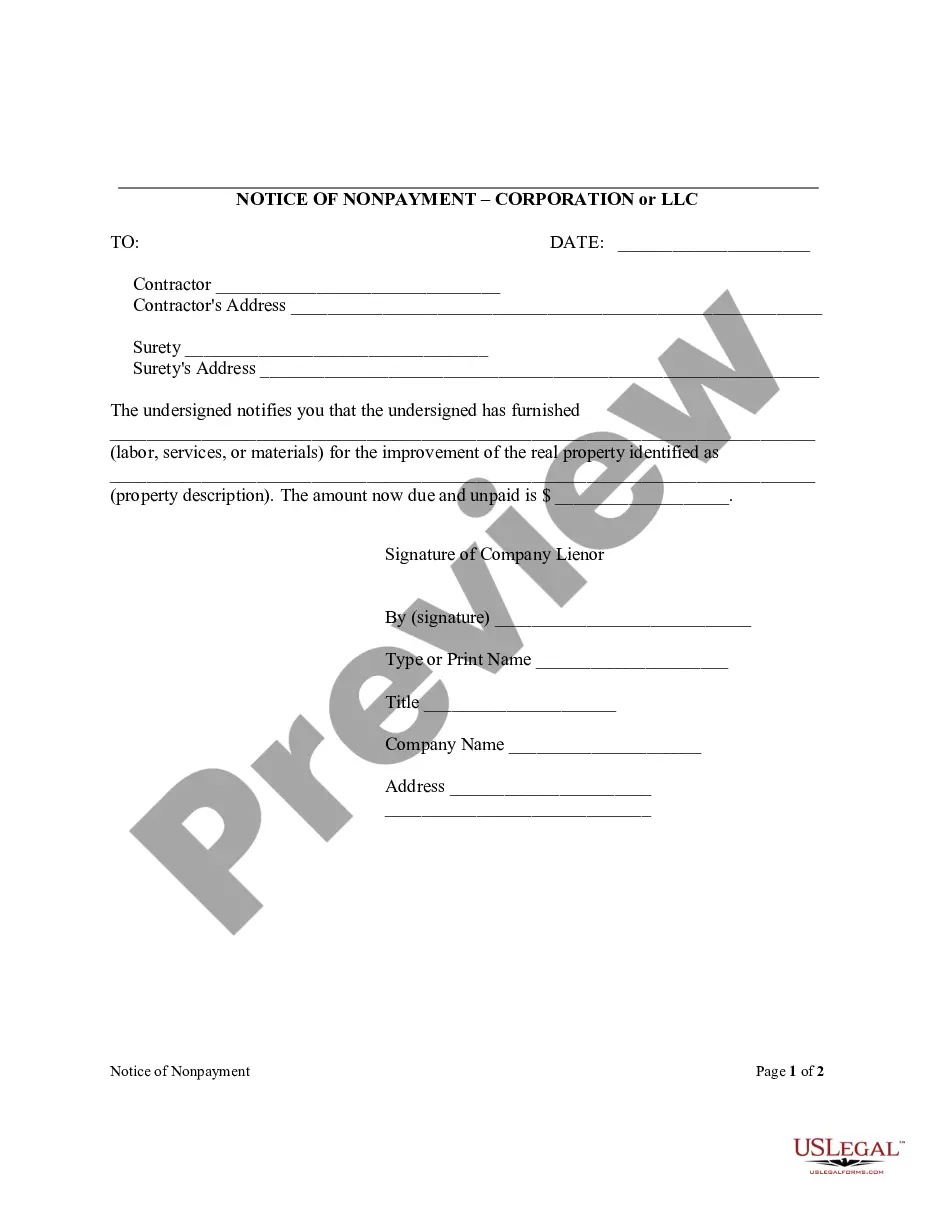

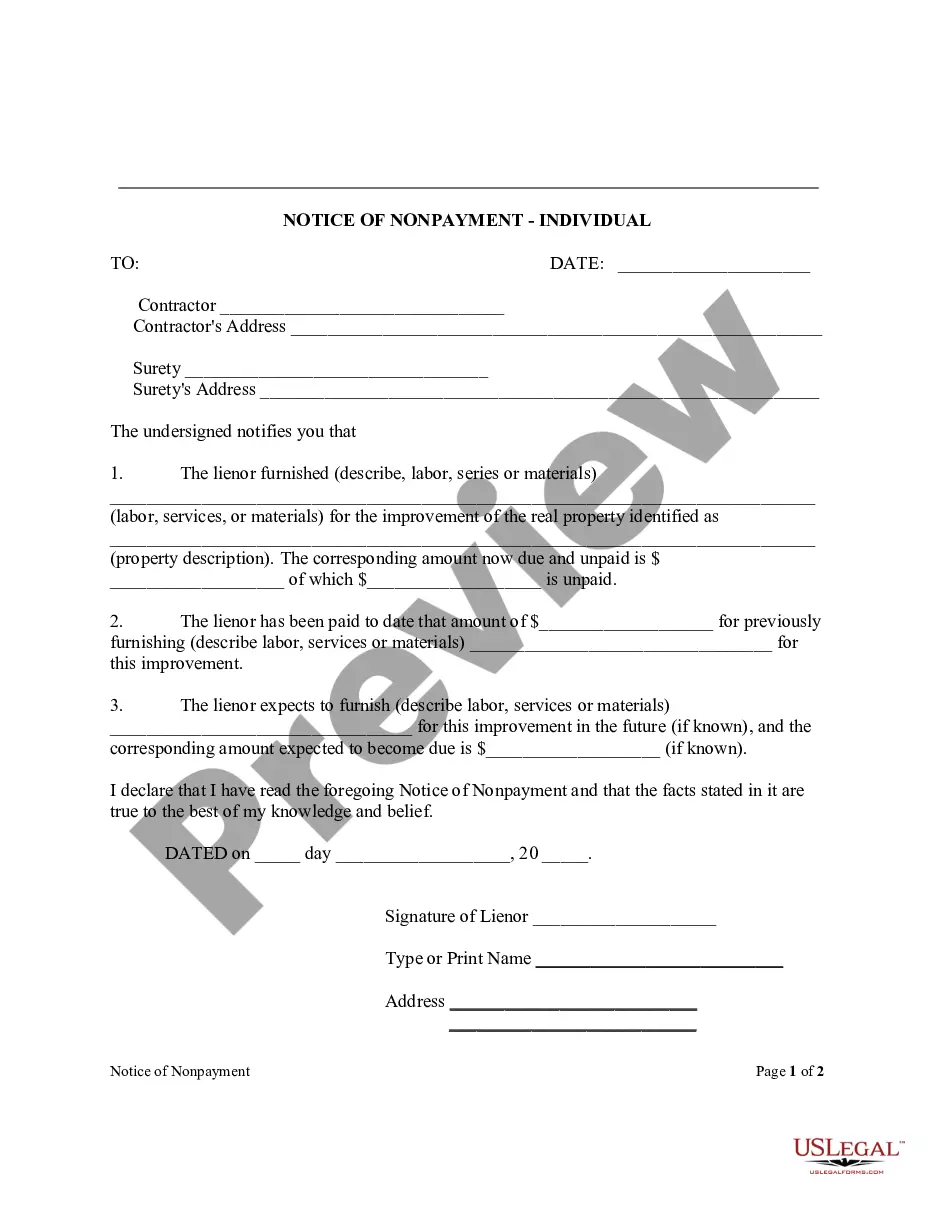

Broward Florida Notice of Nonpayment - Corporation or LLC

Description

How to fill out Florida Notice Of Nonpayment - Corporation Or LLC?

Are you searching for a reliable and cost-effective provider of legal documentation for the Broward Florida Notice of Nonpayment - Corporation or LLC? US Legal Forms is your ideal solution.

Whether you need a simple contract to establish guidelines for living with your partner or a collection of forms to facilitate your divorce proceedings, we have you covered. Our platform features over 85,000 current legal document templates for both personal and business use. All the templates we provide are customized and tailored to meet the specific laws of different states and counties.

To download the document, you must sign in to your account, find the required template, and click the Download button next to it. Please remember that you can access your previously acquired form templates at any time from the My documents section.

Is this your first visit to our site? No problem. You can create an account in minutes, but first, make sure to do the following.

You can now register your account. After that, select the subscription plan and move forward with the payment. Once the payment is processed, you can download the Broward Florida Notice of Nonpayment - Corporation or LLC in any of the available formats. You can revisit the website anytime to redownload the document without incurring additional charges.

Locating current legal forms has never been simpler. Try US Legal Forms today, and say goodbye to wasting hours sifting through legal paperwork online.

- Verify that the Broward Florida Notice of Nonpayment - Corporation or LLC meets the guidelines of your state and locality.

- Review the details of the form (if provided) to understand who and what the document is intended for.

- Restart your search if the template doesn't fit your particular needs.

Form popularity

FAQ

The Notice to Owner (NTO) process in Florida is designed to protect subcontractors and suppliers in the construction industry. This process allows them to secure their rights to payment by formally notifying the property owner of their involvement in a project. If you are dealing with a Broward Florida Notice of Nonpayment - Corporation or LLC, being aware of the NTO process can assist in navigating potential payment disputes.

A notice of noncompliance highlights a tenant's failure to follow lease agreements. It serves as a warning, allowing tenants to rectify their actions before facing more severe penalties. If you encounter issues related to a Broward Florida Notice of Nonpayment - Corporation or LLC, understanding this notice can provide clarity on how to resolve disputes effectively.

A notice to owner in Broward is a crucial document in construction and property management. It notifies property owners of pending work and potential claims for unpaid services. Familiarizing yourself with the Broward Florida Notice of Nonpayment - Corporation or LLC helps ensure that all parties involved understand their obligations and the proper procedures.

A nonpayment of rent notice in Florida serves as a formal communication to tenants. It informs them that their rent is overdue and urges them to make payment promptly. This notice is especially important in the context of a Broward Florida Notice of Nonpayment - Corporation or LLC, as it delineates the actions landlords can take if the situation does not resolve.

The purpose of a Notice of Commencement in Florida is to inform all stakeholders that construction has commenced on a specific property. This document helps establish timelines for lien rights and protects the interests of contractors and subcontractors. Particularly for cases involving Broward Florida Notice of Nonpayment - Corporation or LLC, it serves to clearly outline project initiation and deadlines. By filing the notice, you significantly enhance your ability to manage payment issues effectively.

In Florida, you file a Notice of Commencement with the Clerk of the Circuit Court in the county where the property is located. This ensures that the notice is publicly recorded, giving all parties involved the necessary information. If you're managing a construction project, particularly regarding Broward Florida Notice of Nonpayment - Corporation or LLC, proper filing is a critical step. Utilizing platforms like uslegalforms can simplify this process for you.

Failing to file a Notice of Commencement in Florida can lead to unexpected challenges in enforcing payment rights. You may lose your ability to file a lien, which is crucial for securing payment from property owners. This oversight can complicate matters, especially with Broward Florida Notice of Nonpayment - Corporation or LLC, where timely action is essential for protecting your interests. It’s wise to prioritize this step in your construction process.

If you don't file a notice of commencement in Florida, your right to file a lien may be compromised. This document serves as a formal declaration that construction has started and sets the timeline for potential liens. Without it, parties affected by nonpayment may face difficulty recovering their funds. Therefore, when dealing with Broward Florida Notice of Nonpayment - Corporation or LLC, ensure you file the notice to protect your rights.

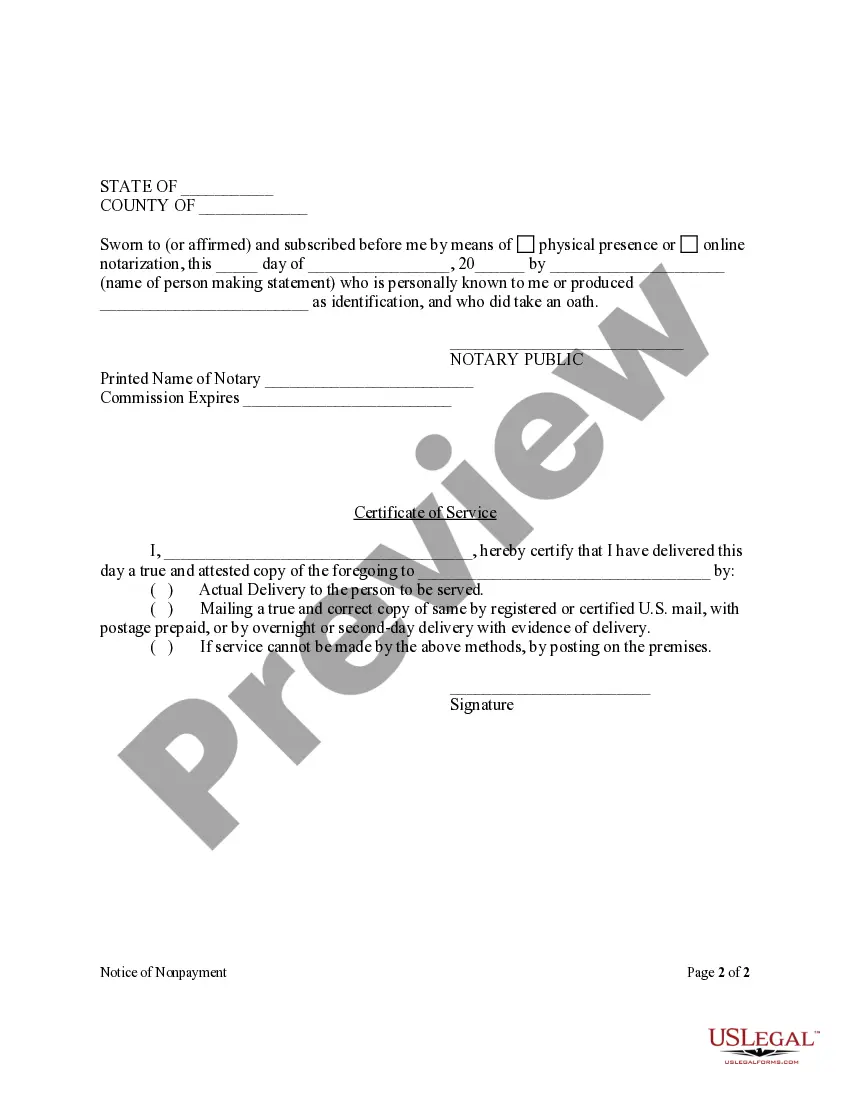

In Florida, you must file a Notice of Nonpayment within 45 days after the last supply of material or labor was provided. This timeframe is crucial for enforcing your rights as a Corporation or LLC. If you fail to submit the Broward Florida Notice of Nonpayment within this period, you risk losing your ability to claim payment. To make this process easier, consider using the US Legal Forms platform, which offers templates and guidance tailored to your needs.

A notice of nonpayment form in Florida is a document that alerts property owners about outstanding payment issues. Specifically, the Broward Florida Notice of Nonpayment - Corporation or LLC serves as an official notice that must be issued before pursuing further legal actions. This form is crucial for ensuring compliance with Florida laws, protecting your rights. Utilizing platforms like uslegalforms can simplify the process of preparing this important document.