Hialeah Llc

Description

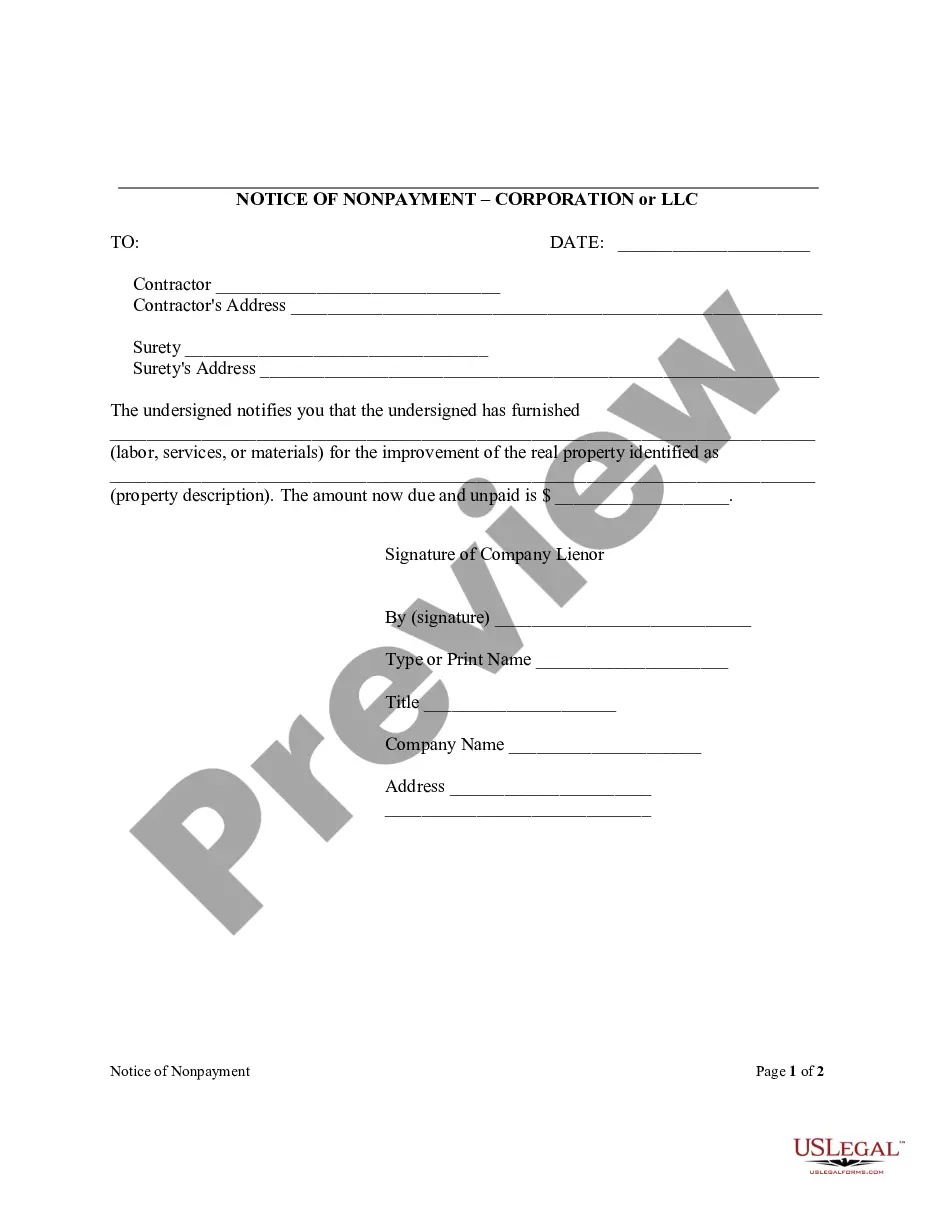

How to fill out Hialeah Florida Notice Of Nonpayment - Corporation Or LLC?

If you’ve previously made use of our service, sign in to your account and retrieve the Hialeah Florida Notice of Nonpayment - Corporation or LLC on your device by selecting the Download button. Ensure your subscription is current. If not, update it as per your payment schedule.

If this is your initial encounter with our service, adhere to these straightforward steps to acquire your document.

You have uninterrupted access to all documents you have purchased: you can find them in your profile under the My documents menu whenever you need to use them again. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or business requirements!

- Confirm you’ve identified the correct document. Review the details and utilize the Preview option, if available, to verify if it satisfies your needs. If it does not, utilize the Search feature above to find the appropriate one.

- Purchase the template. Select the Buy Now button and opt for either a monthly or yearly subscription plan.

- Create an account and finalize your payment. Enter your credit card information or select the PayPal option to complete your transaction.

- Obtain your Hialeah Florida Notice of Nonpayment - Corporation or LLC. Choose the file format for your document and store it on your device.

- Complete your document. Print it out or make use of professional online editors to fill it out and electronically sign it.

Form popularity

FAQ

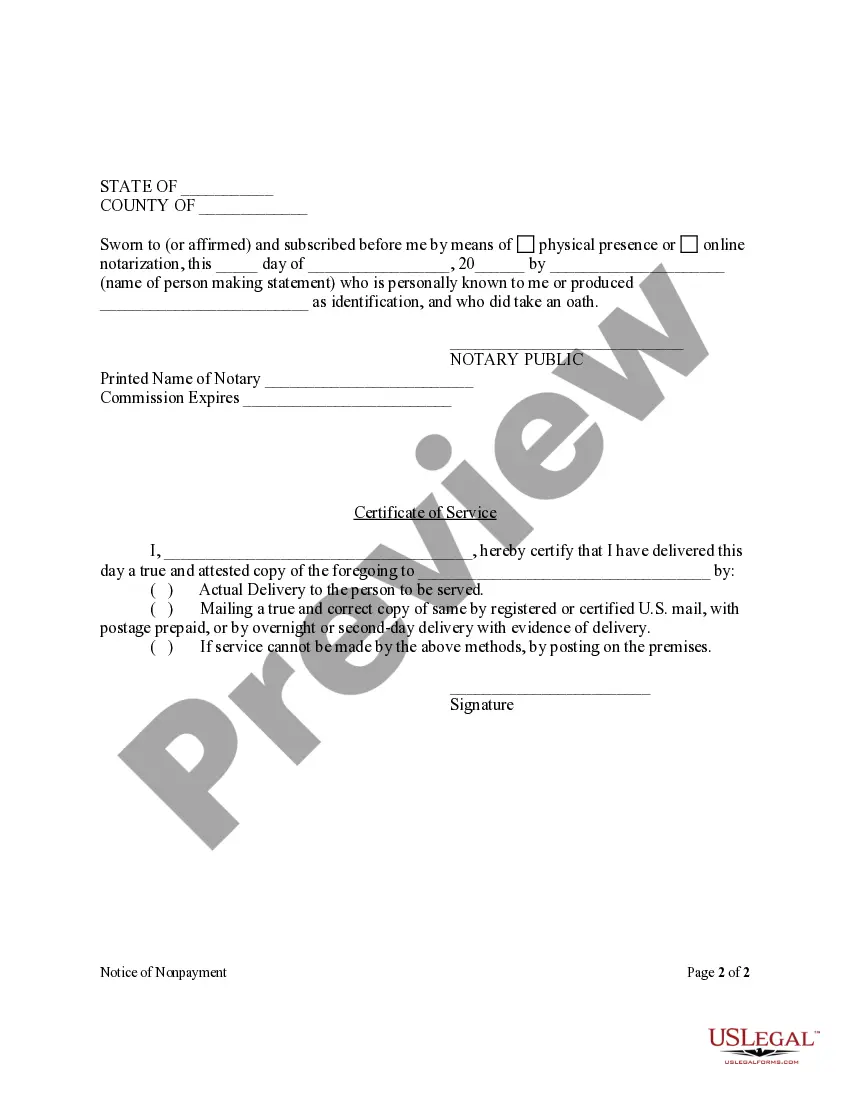

To file a Notice to Owner (NTO) in Florida, prepare the notice and deliver it to the property owner. Be sure to include all necessary details about the work performed and the parties involved. For the Hialeah Florida Notice of Nonpayment - Corporation or LLC, using US Legal Forms can simplify this process and ensure compliance with all legal requirements.

The timeline for obtaining a writ of possession in Florida can vary, but generally, it involves a series of legal steps that can take several weeks. Once you file for possession, you should expect delays based on the court's schedule and potential disputes. Proper documentation, such as the Hialeah Florida Notice of Nonpayment - Corporation or LLC, may expedite the process significantly.

The timeline for a notice to owner (NTO) in Florida is straightforward. You must send the NTO within 45 days after the last work or materials were provided. If you follow these steps correctly, you strengthen your claim under the Hialeah Florida Notice of Nonpayment - Corporation or LLC framework, making it easier to secure payments.

In Florida, you generally have 45 days from the last day you provided services or materials to file a notice to owner (NTO). For the Hialeah Florida Notice of Nonpayment - Corporation or LLC, it's imperative to act quickly. Waiting too long may jeopardize your ability to enforce your rights and collect outstanding payments.

Yes, Florida requires a notice of intent to lien before filing a lien. This notice informs the property owner that there is a payment dispute. For Hialeah Florida Notice of Nonpayment - Corporation or LLC, sending this notice is crucial for preserving your right to seek payment. It sets the stage for any necessary legal action.

In Florida, you typically cannot file a lien without providing a notice to the owner. This notice is essential as it informs the property owner of your intent to seek payment under the Hialeah Florida Notice of Nonpayment - Corporation or LLC. Failing to send this notice may affect your ability to recover funds. Therefore, it’s crucial to follow the proper legal steps to secure your rights.

The Prompt Payment Act in Florida requires timely payments to contractors and subcontractors for their services. Under this act, a contractor must receive payment within a specified period after submitting an invoice. If payment is delayed, the party owes interest on the unpaid amount, making it important to be aware of the Hialeah Florida Notice of Nonpayment - Corporation or LLC. Understanding this act can help protect your interests and ensure you receive timely compensation.

When a contractor breaches a contract in Florida, the affected party has several options. They can choose to pursue legal action for breach of contract, seeking damages for financial losses. It's essential to document all communications and agreements related to the Hialeah Florida Notice of Nonpayment - Corporation or LLC to support your claims. You may also want to consult with a legal expert to understand your rights and possible outcomes.

In Florida, you must file a lien within 90 days of your last service or delivery of materials. This deadline is critical for enforcing any claims against a property. For those involved in Hialeah Florida Notice of Nonpayment - Corporation or LLC, adhering to this timeline is essential to ensure that you can protect your rights and receive compensation for your work.

Filling out a Notice of Commencement in Florida requires you to include specific details such as the property owner, contractor, and a description of the property. You must also provide the legal description and the start date for the project. By completing this correctly, particularly when related to Hialeah Florida Notice of Nonpayment - Corporation or LLC, you enhance your legal standing in construction matters.