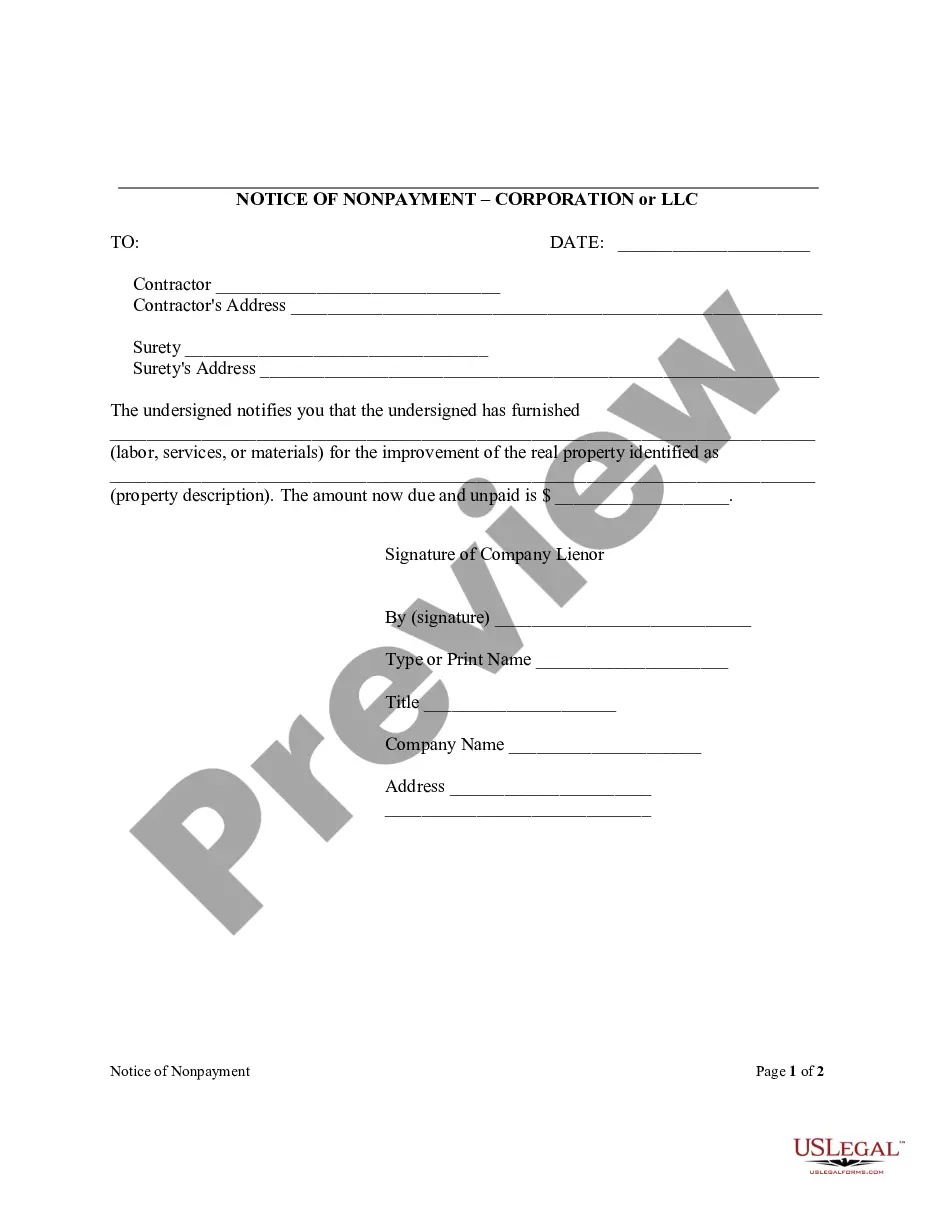

Lakeland Florida Notice of Nonpayment - Corporation or LLC

Description

How to fill out Florida Notice Of Nonpayment - Corporation Or LLC?

We consistently seek to reduce or evade legal complications when handling intricate legal or financial matters.

To achieve this, we enlist legal assistance, which often comes at a high cost.

Nonetheless, not every legal issue is of the same level of complexity. Many can be managed independently.

US Legal Forms is an online resource of current DIY legal documents covering a range of needs from wills and power of attorney to business incorporation articles and dissolution petitions.

Simply Log In to your account and click the Get button beside it. If you happen to misplace the document, you may always download it again from the My documents section.

- Our platform empowers you to manage your own affairs without the necessity of legal advice.

- We offer access to legal templates that are not always readily available to the public.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

- You can benefit from US Legal Forms whenever you wish to acquire and obtain the Lakeland Florida Notice of Nonpayment - Corporation or LLC or any other document swiftly and securely.

Form popularity

FAQ

The NTO (Notice to Owner) process in Florida involves notifying relevant parties about pending construction projects and outstanding payments. It is a necessary step for contractors and subcontractors to safeguard their rights to payment. The Lakeland Florida Notice of Nonpayment - Corporation or LLC plays a vital role in this process, ensuring that all parties receive the appropriate notifications. Understanding the NTO process can be beneficial for businesses looking to operate smoothly within Florida's legal framework.

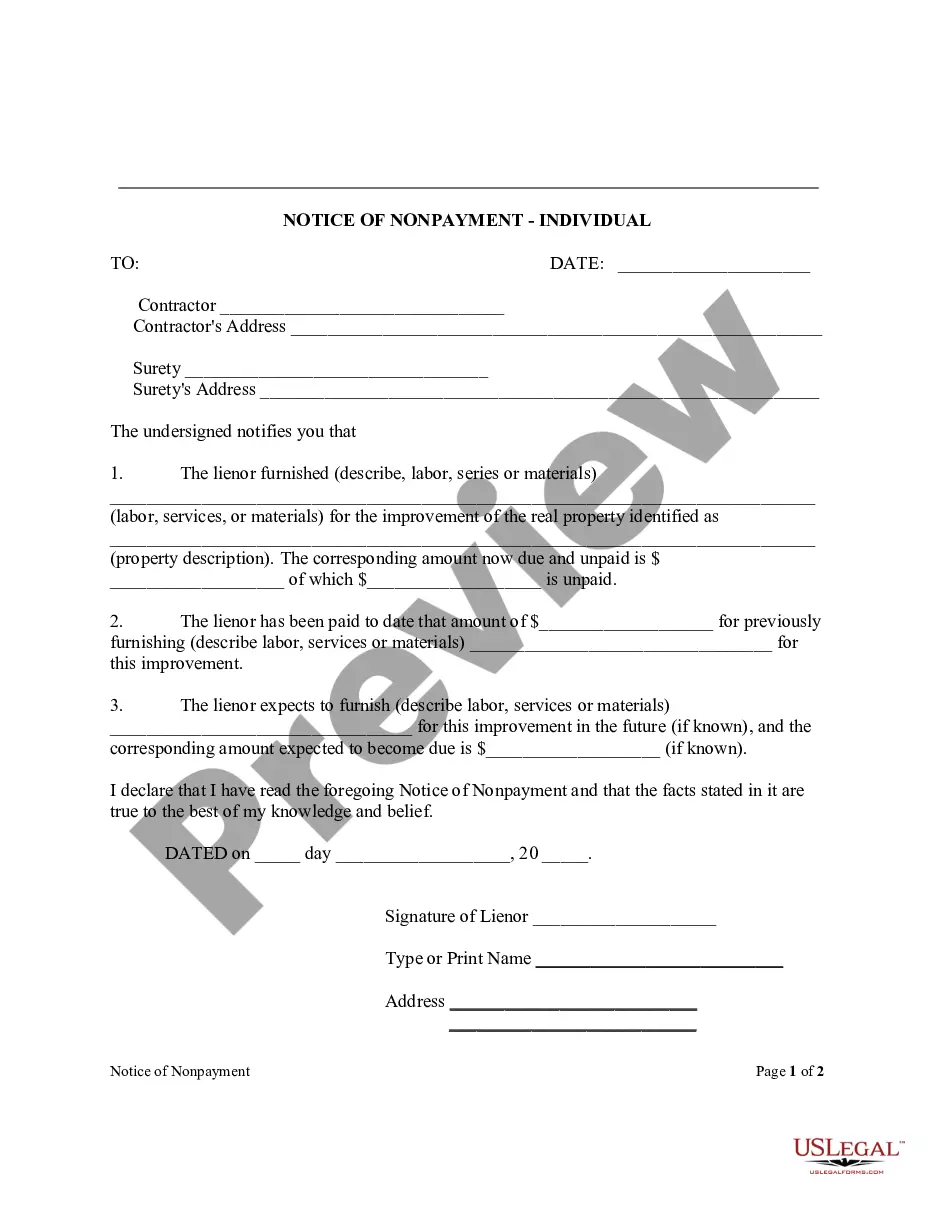

A notice of nonpayment form in Florida is a formal document used to inform a debtor about overdue payments. This form lays the foundation for possible legal actions like placing a lien if the debt remains unresolved. The Lakeland Florida Notice of Nonpayment - Corporation or LLC is a specific version designed for corporations or LLCs to ensure compliance with state regulations. Utilizing such forms promotes effective communication and prompt resolution of payment issues.

It is unlikely that someone can place a lien on your house without your knowledge in Florida. The law requires that property owners be notified in advance of any potential liens. By using the Lakeland Florida Notice of Nonpayment - Corporation or LLC, you can track outstanding debts and ensure that you remain informed about any claims against your property. This proactive approach helps protect your rights as an owner.

In most cases, filing a lien without prior notice to the owner is not permissible in Florida. The law mandates that owners be informed of any debts that may lead to a lien, allowing them the opportunity to respond. A Lakeland Florida Notice of Nonpayment - Corporation or LLC is essential for compliance with this requirement. Using this notice helps facilitate fair dealings and transparency between creditors and property owners.

Generally, a lien cannot be placed without notice in Florida. Proper notification ensures transparency and provides the property owner with a chance to settle the debt before any legal action is taken. Utilizing the Lakeland Florida Notice of Nonpayment - Corporation or LLC can help ensure that all required notifications are correctly documented. This practice protects the rights of all involved parties.

In Florida, liens are legal claims placed against property to secure payment for a debt. The process requires adherence to specific rules, including proper documentation and timely filing. The Lakeland Florida Notice of Nonpayment - Corporation or LLC serves as a crucial document to ensure all parties are notified of outstanding debts before a lien is placed. Understanding these rules is essential for both creditors and property owners.

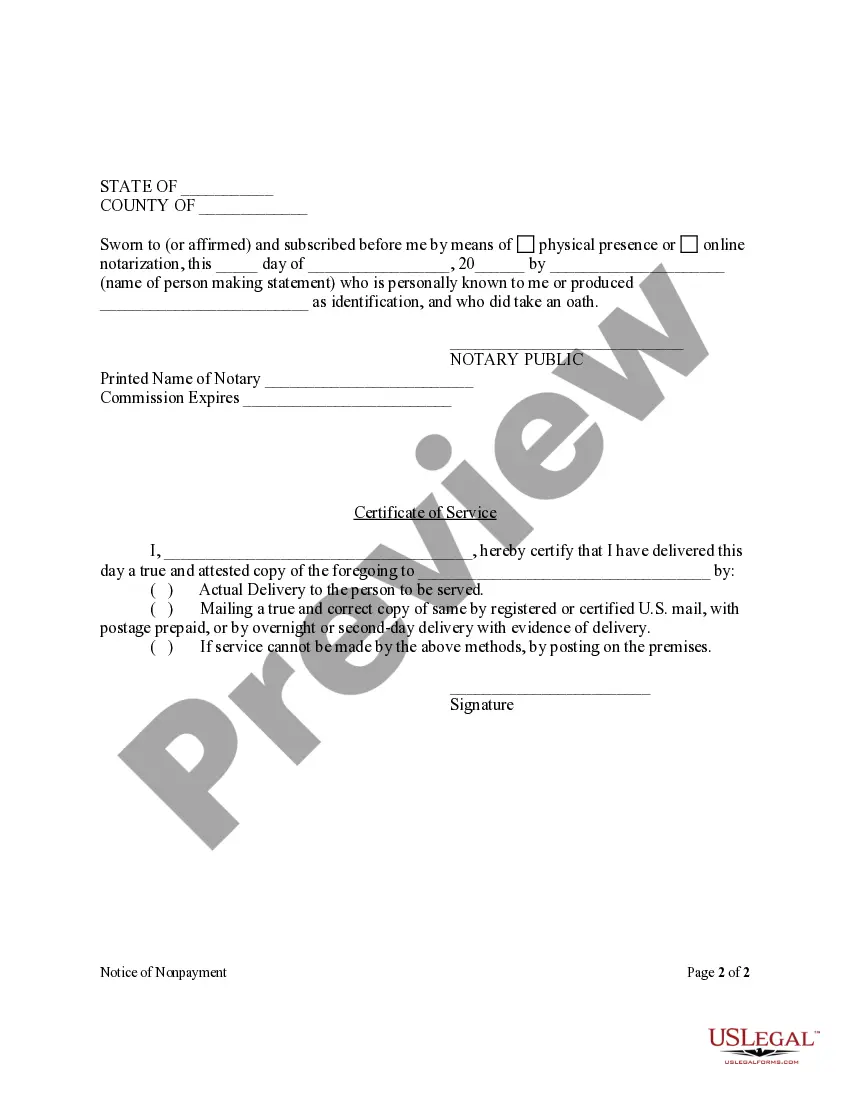

A Notice of Commencement must be filed with the clerk of the circuit court in the county where the property is located. This document provides public notice of the construction and protects your right to file a lien. For help with filing and understanding the implications of a Lakeland Florida Notice of Nonpayment - Corporation or LLC, uslegalforms offers resources that simplify the process.

To file a Notice to Owner in Florida, you first need to fill out a template that includes key project details and signatures. Once completed, deliver it to the owner via certified mail or personal delivery. For your convenience, you can access easy-to-follow forms on uslegalforms, specifically designed for situations like the Lakeland Florida Notice of Nonpayment - Corporation or LLC.

No, a Notice to Owner in Florida does not need to be notarized. However, it must be signed and delivered as per legal guidelines. If you are navigating the complexities of a Lakeland Florida Notice of Nonpayment - Corporation or LLC and need assistance with documentation, uslegalforms provides templates that ensure compliance with state laws.

Writing a Notice to Owner in Florida involves including specific information, such as the property owner’s name, property description, and a statement of your intent to claim a lien. Clarity and accuracy are essential. If you need a template or further guidance, you can find valuable resources on the uslegalforms platform to assist with the Lakeland Florida Notice of Nonpayment - Corporation or LLC context.