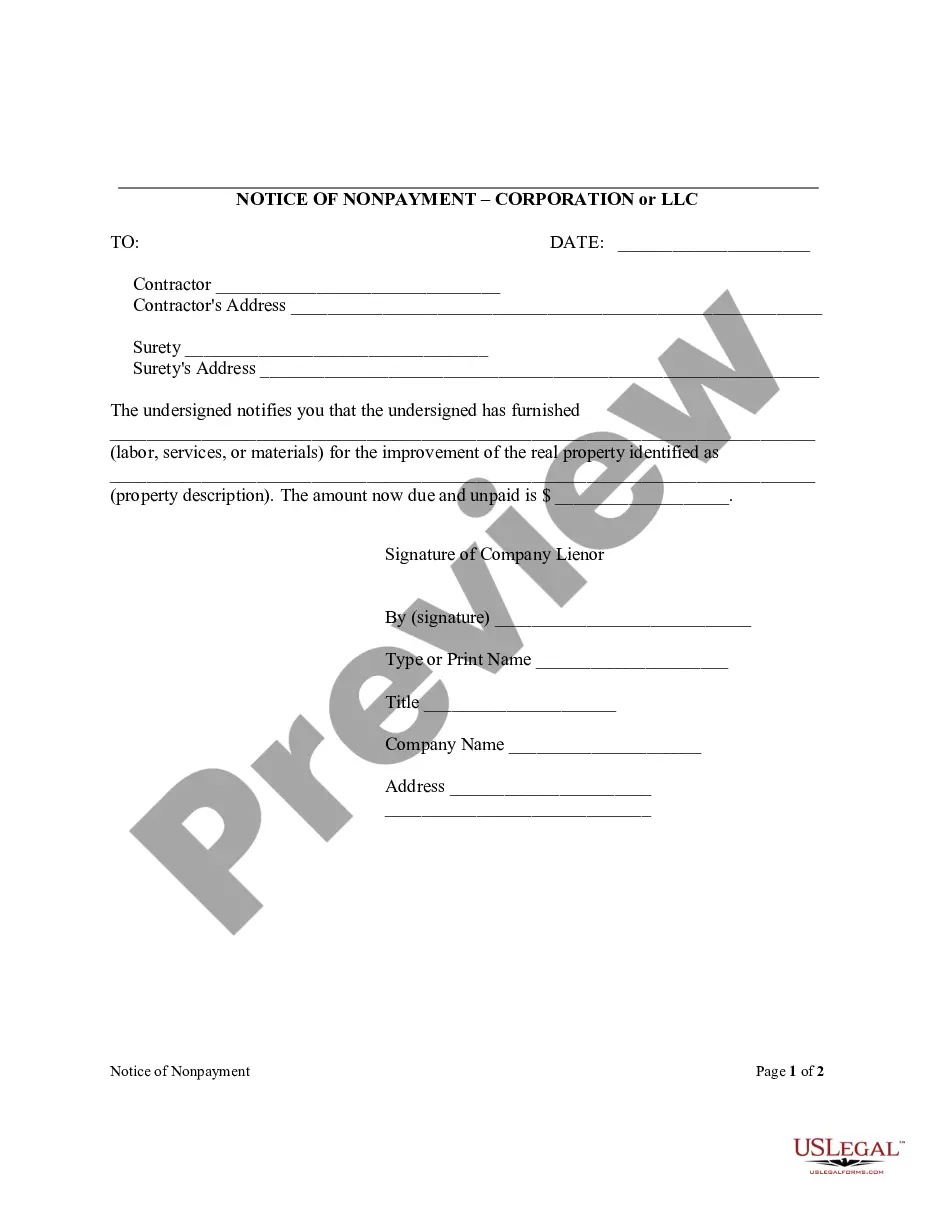

Miami-Dade Florida Notice of Nonpayment - Corporation or LLC

Description

How to fill out Florida Notice Of Nonpayment - Corporation Or LLC?

If you are looking for a pertinent form, it’s impossible to discover a superior service than the US Legal Forms website – one of the most extensive collections on the web.

With this collection, you can find a vast array of templates for business and personal uses categorized by type and region, or keywords.

Utilizing our premium search feature, obtaining the latest Miami-Dade Florida Notice of Nonpayment - Corporation or LLC is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finish the registration process.

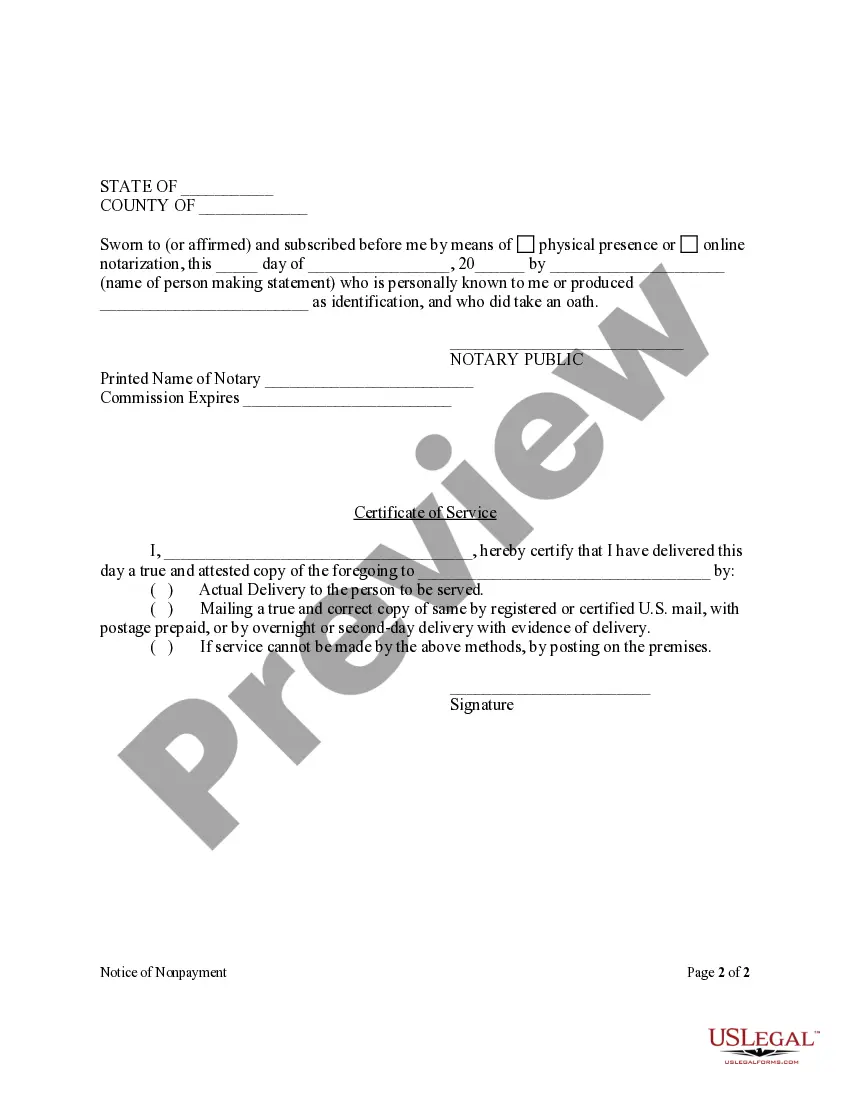

Obtain the template. Select the format and download it onto your device. Make revisions. Complete, edit, print, and sign the received Miami-Dade Florida Notice of Nonpayment - Corporation or LLC.

- Additionally, the relevance of every document is confirmed by a team of qualified attorneys who regularly review the templates on our site and update them in accordance with the latest state and county regulations.

- If you are already familiar with our system and have a registered account, all you need to receive the Miami-Dade Florida Notice of Nonpayment - Corporation or LLC is to Log In to your account and click the Download option.

- If this is your first time using US Legal Forms, just follow the instructions below.

- Ensure you have located the sample you need. Review its details and use the Preview function (if available) to examine its content. If it does not satisfy your needs, use the Search option at the top of the screen to find the suitable file.

- Validate your choice. Click the Buy now option. After that, choose your desired subscription plan and provide information to create an account.

Form popularity

FAQ

In Miami-Dade County, you must file your Notice of Commencement with the Miami-Dade County Clerk's Office. The filing can be done in person or via mail, depending on your preference. Utilizing the USLegalForms service can streamline this process, providing detailed guidance for the Miami-Dade Florida Notice of Nonpayment - Corporation or LLC and ensuring all your paperwork is in order.

In Florida, a Notice of Commencement (NOC) does not require notarization, but it must include specific information such as property details and contractor signatures. To ensure compliance, it’s essential to follow guidelines set by the Florida Statutes. The USLegalForms platform offers resources that help you create the Miami-Dade Florida Notice of Nonpayment - Corporation or LLC correctly, enhancing your peace of mind.

To file a Notice to Owner (NTO) in Florida, begin by preparing the document with essential details about your project and parties involved. You must serve it to the property owner and file your NTO within the required time frame to protect your lien rights. Using the USLegalForms platform simplifies this process, guiding you through each step for the Miami-Dade Florida Notice of Nonpayment - Corporation or LLC effectively.

In Florida, placing a lien without prior notice to the property owner is typically not permitted. A Miami-Dade Florida Notice of Nonpayment - Corporation or LLC serves as a vital step in the process, ensuring that all parties are informed of any pending claims. In cases where notification is overlooked, it may become difficult to enforce your lien rights. It is always advisable to follow the correct procedures to protect your investment.

Generally, you cannot file a lien in Florida without first sending a notice to the owner. The Miami-Dade Florida Notice of Nonpayment - Corporation or LLC is a prerequisite that allows you to claim your rights effectively. Failing to provide this notice can jeopardize your ability to collect payment for services rendered. Familiarizing yourself with this requirement can save you time and prevent future complications.

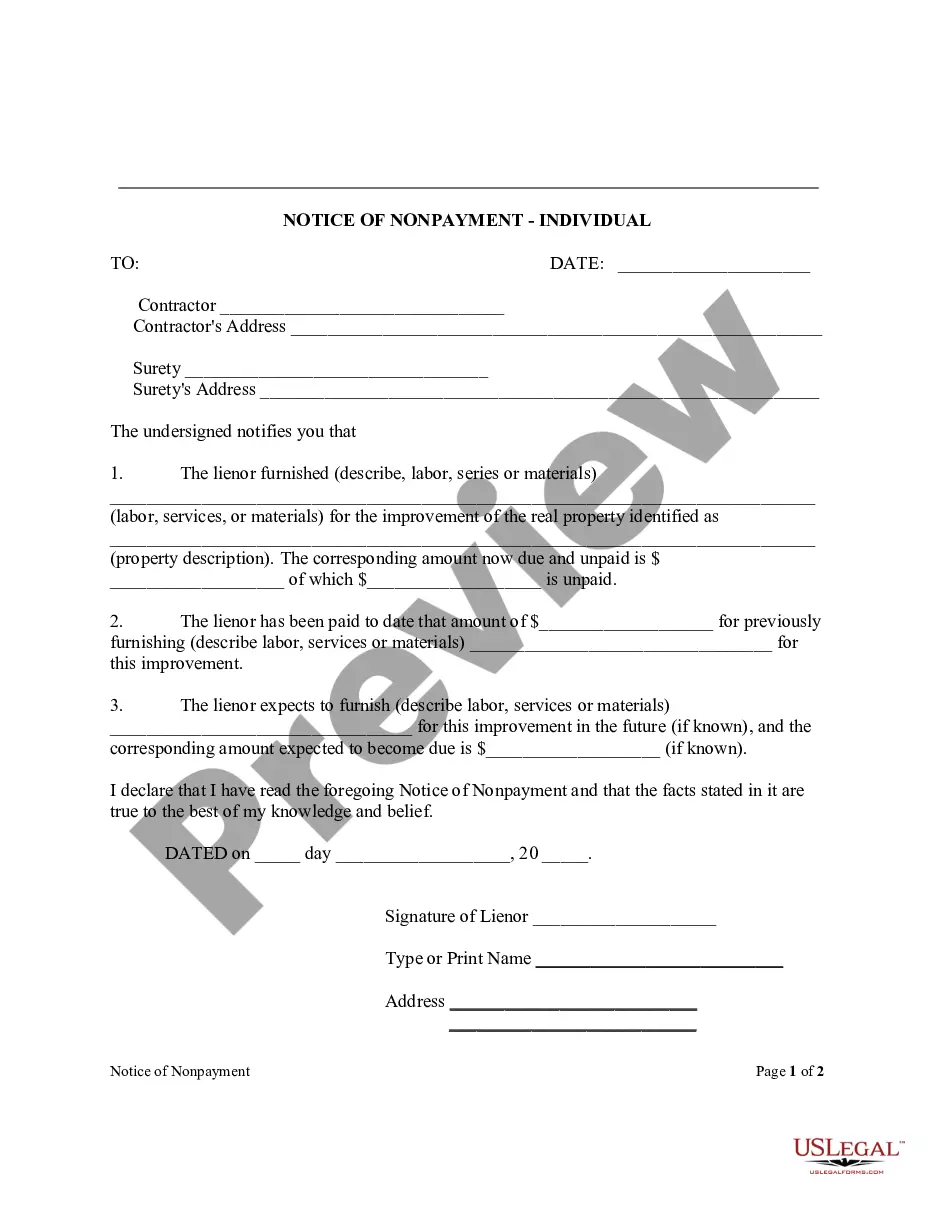

The Notice to Owner (NTO) process in Florida serves as a crucial step for those involved in construction and contracting work. By filing a Miami-Dade Florida Notice of Nonpayment - Corporation or LLC, you notify property owners of your existence and right to payment. This procedure enables contractors, subcontractors, and suppliers to secure their interests in a timely manner. Understanding the NTO process can help you avoid payment disputes in Florida.

In Florida, the rules governing liens require proper notice and documentation to establish a legal claim against property for unpaid debts. A Miami-Dade Florida Notice of Nonpayment - Corporation or LLC is crucial for contractors and suppliers who seek to enforce their rights. The process usually demands that the creditor file a notice within a specific timeframe to ensure their claim is recognized. It's vital to follow these rules carefully to protect your rights in Florida.

A notice of non compliance in Florida addresses violations of a lease or legal agreement. It informs the involved party about specific issues that need correction within a defined timeframe. In conjunction with the Miami-Dade Florida Notice of Nonpayment - Corporation or LLC, this notice is an important tool for enforcing compliance and protecting your interests. US Legal Forms offers templates to assist in creating effective notices of non compliance.

A notice of nonpayment is a formal document that notifies a party about overdue payments. In the context of Miami-Dade Florida Notice of Nonpayment - Corporation or LLC, this notice is crucial for contractors or property owners to ensure timely payment for services rendered or materials supplied. This serves as an essential step in protecting your rights and financial interests. You can create a notice of nonpayment easily using templates from US Legal Forms.

To obtain a copy of a notice of commencement in Florida, you can visit the official records office of your county. Additionally, you can check online through your county's property appraiser or clerk of court website. Using the keyword Miami-Dade Florida Notice of Nonpayment - Corporation or LLC can help you find specific resources related to your needs. If you require assistance in navigating these options, US Legal Forms offers a range of helpful templates and information.