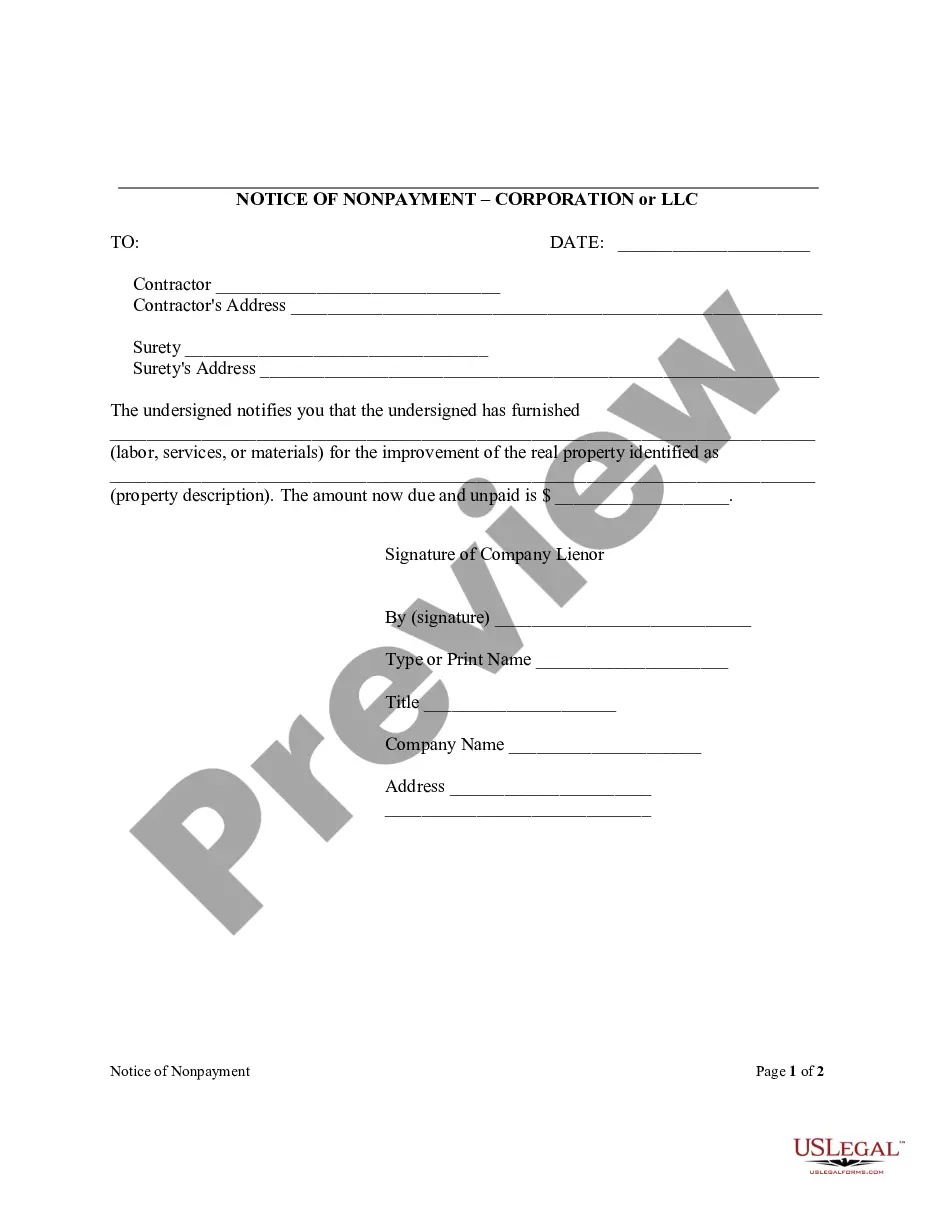

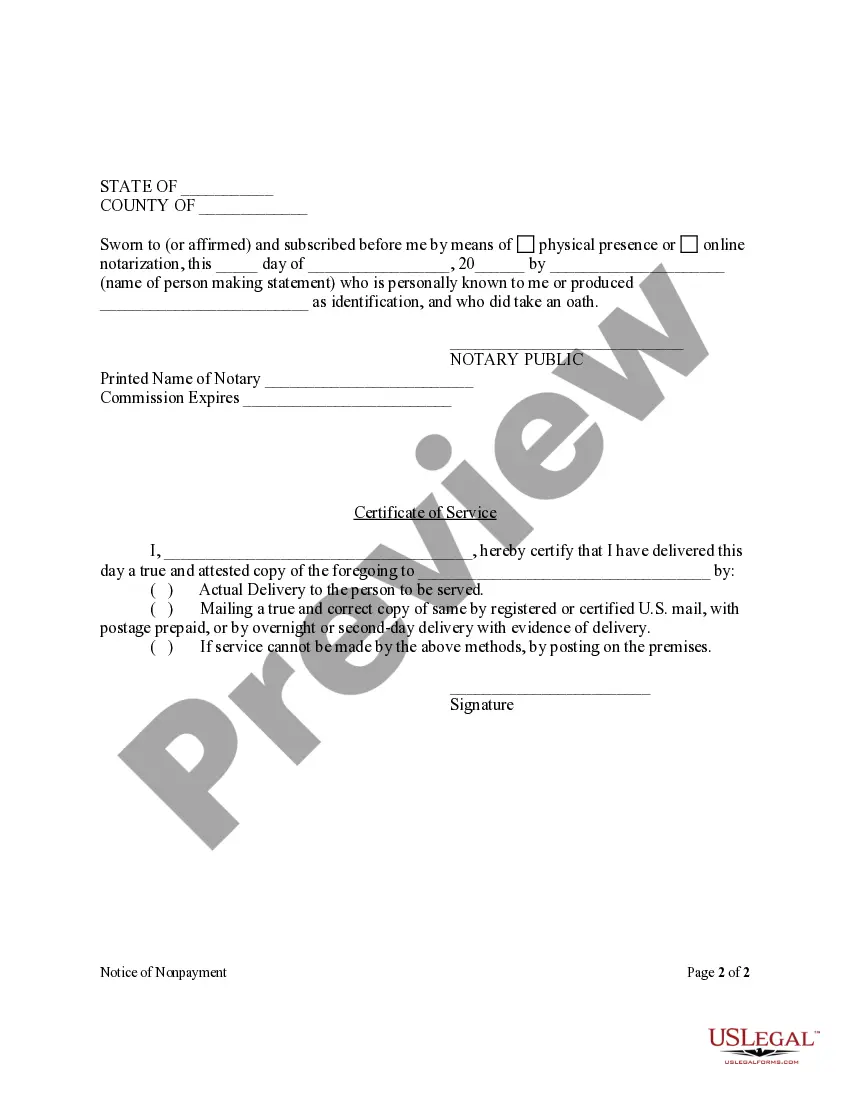

Miramar Florida Notice of Nonpayment — Corporation or LLC is an essential legal document that serves as a formal notice to corporations and limited liability companies (LCS) in Miramar, Florida regarding nonpayment of debts or obligations. This notice is often sent by creditors or vendors to highlight the amount due and request immediate payment. In Miramar, Florida, there are two primary types of Notice of Nonpayment that are specifically tailored for Corporation or LLC entities: 1. Miramar Florida Notice of Nonpayment — Corporation: This version is designed to address nonpayment issues related to corporations registered in Miramar, Florida. It is applicable when a corporation fails to fulfill its financial obligations such as unpaid invoices, overdue bills, or outstanding debts. Creditors or vendors can use this notice to officially inform the corporation about the delinquency and demand payment within a specified timeframe. 2. Miramar Florida Notice of Nonpayment — Limited Liability Company (LLC): This particular notice is created to deal with nonpayment concerns linked to LCS operating within Miramar, Florida. It is utilized when an LLC fails to meet its financial responsibilities, similar to the corporation notice. Creditors or vendors can issue this notice to notify the LLC about pending payments and request prompt settlement. These Miramar Florida Notice of Nonpayment forms have common elements that need to be included to ensure legal compliance and effectiveness. These elements may include: 1. Heading: The heading includes the identification of the notice as "Miramar Florida Notice of Nonpayment — Corporation" or "Miramar Florida Notice of Nonpayment — LLC," depending on the entity type. 2. Sender and recipient details: The notice should clearly state the name, address, and contact information of the sender (creditor/vendor) and the recipient (corporation or LLC). This information helps establish communication channels for corresponding parties. 3. Description of nonpayment: The notice should provide a detailed account of the outstanding payment or debt, including the amount owed, the invoicing date, the due date, and any additional relevant information about the transaction. 4. Demand for payment: The notice should explicitly demand payment of the amount owed within a specific timeframe, typically a grace period of 15 to 30 days from the receipt of the notice. This timeframe allows the recipient to resolve the issue before further action is taken. 5. Consequences of nonpayment: It is crucial to outline the potential consequences of continued nonpayment in the notice. This may include legal action, referral to debt collection agencies, or damaging the debtor's creditworthiness. 6. Contact information for inquiries: Provide contact details for the concerned creditor/vendor, enabling the recipient to address any questions or concerns related to the notice and the outstanding payment. Sending a Miramar Florida Notice of Nonpayment — Corporation or LLC demonstrates a creditor/vendor's intent to seek resolution and collect the outstanding debt owed. It is advisable to consult with legal professionals or obtain template forms from trusted sources to ensure compliance with local laws and regulations pertaining to Miramar, Florida.

Miramar Florida Notice of Nonpayment - Corporation or LLC

Description

How to fill out Miramar Florida Notice Of Nonpayment - Corporation Or LLC?

Do you need a reliable and inexpensive legal forms provider to buy the Miramar Florida Notice of Nonpayment - Corporation or LLC? US Legal Forms is your go-to solution.

Whether you require a basic agreement to set rules for cohabitating with your partner or a package of documents to advance your divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and framed in accordance with the requirements of separate state and county.

To download the form, you need to log in account, find the needed form, and click the Download button next to it. Please remember that you can download your previously purchased form templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Miramar Florida Notice of Nonpayment - Corporation or LLC conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to learn who and what the form is intended for.

- Restart the search if the form isn’t good for your specific scenario.

Now you can create your account. Then choose the subscription option and proceed to payment. Once the payment is completed, download the Miramar Florida Notice of Nonpayment - Corporation or LLC in any provided format. You can get back to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about spending your valuable time learning about legal paperwork online for good.