Orange Florida Notice of Nonpayment — Corporation or LLC is a legal document issued by the state of Florida to notify a corporation or limited liability company (LLC) of their nonpayment of required fees or taxes. This notice serves as an official and formal communication to inform the business entity of their noncompliance with financial obligations. The purpose of the Orange Florida Notice of Nonpayment is to give the corporation or LLC a chance to rectify the situation by promptly paying the outstanding fees or taxes. Failure to respond to the notice within the stipulated time frame may result in serious consequences, including penalties, sanctions, or even dissolution of the business entity. There are primarily two different types of Orange Florida Notice of Nonpayment — one for corporations and anotheforcesCs. These types are further categorized based on the specific delinquency, such as nonpayment of annual report fees, franchise taxes, or any other financial obligations that the business entity is obligated to fulfill according to Florida state laws. Corporations and LCS are required to submit their annual reports and pay the corresponding fees by the specified deadline each year. In case of nonpayment, the state will issue a Notice of Nonpayment to the business entity's registered office address. It is crucial for the corporation or LLC to be vigilant and promptly address any issues regarding nonpayment. The Orange Florida Notice of Nonpayment — Corporation or LLC contains essential information that the business entity should pay attention to. This includes the specific fees or taxes that are due, the payment deadline, any accrued penalties or interest, and the consequences of noncompliance. The notice also provides instructions on how to remedy the situation by making the necessary payments or contacting the relevant state authorities to discuss alternatives. To avoid receiving an Orange Florida Notice of Nonpayment, it is crucial for corporations and LCS to stay on top of their financial obligations. Regular monitoring of payment deadlines, diligent record-keeping, and seeking professional guidance regarding tax and fee obligations are important steps businesses can take to prevent any noncompliance issues. In conclusion, the Orange Florida Notice of Nonpayment — Corporation or LLC is a formal communication sent to corporations and LCS to inform them of their nonpayment of required fees or taxes. Both types of business entities must address this notice promptly to avoid penalties or dissolution. Staying compliant with Florida state laws and obligations is vital for the smooth operation and longevity of any corporation or LLC.

Orange Llc

Category:

State:

Florida

County:

Orange

Control #:

FL-03232A

Format:

Word;

Rich Text

Instant download

Description

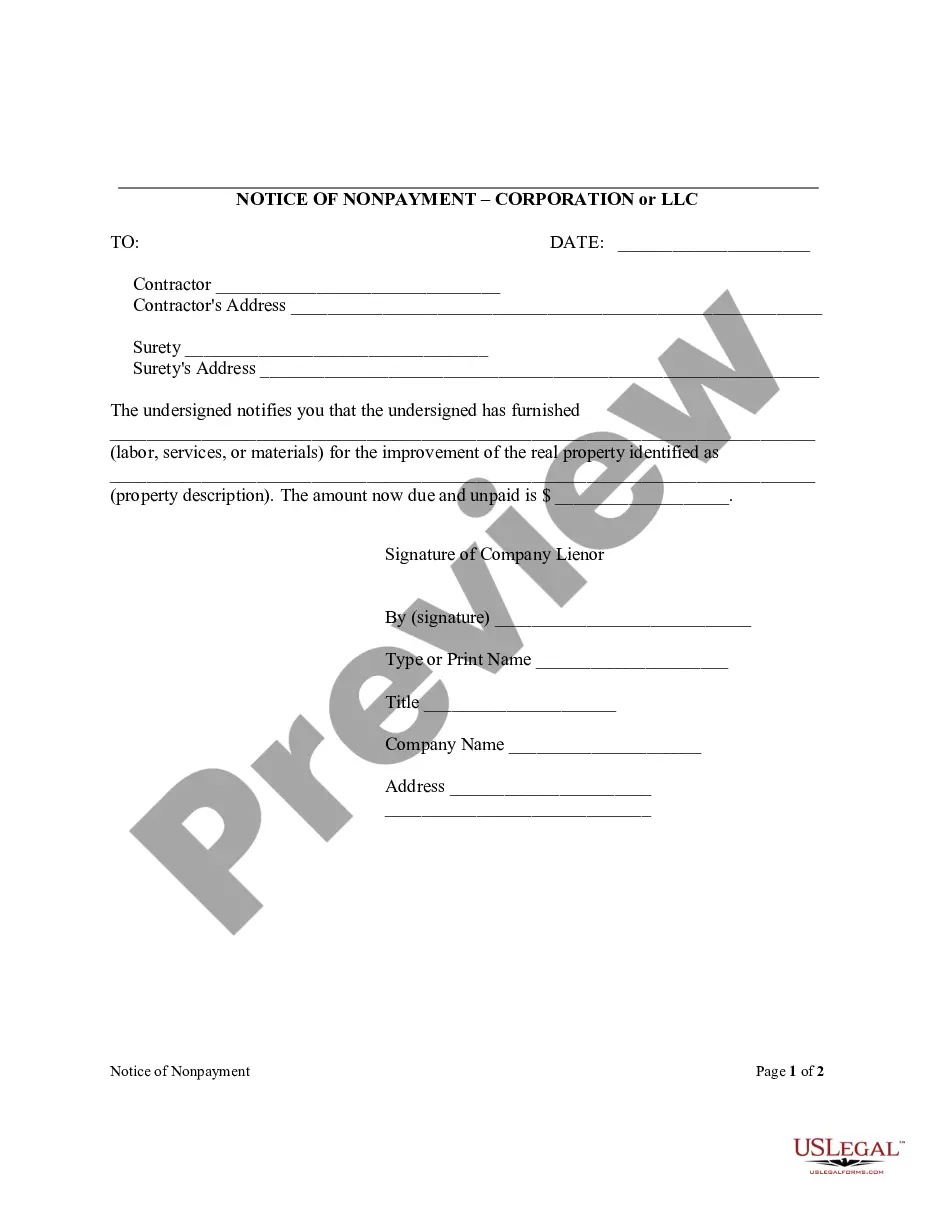

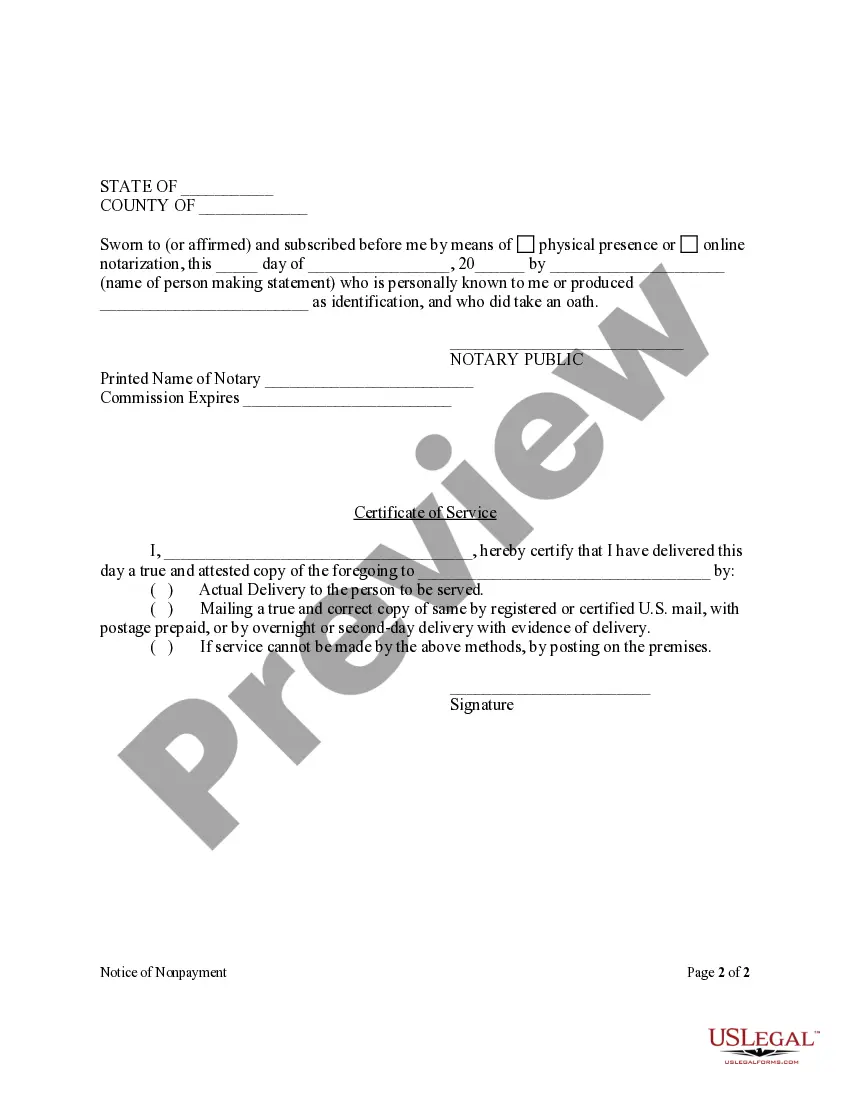

This Notice of Nonpayment is for use by a corporate or LLC lienor to notify a contractor or surety that it has furnished certain labor, services or materials for improvement of real property and to set forth the amount due and unpaid.

Orange Florida Notice of Nonpayment — Corporation or LLC is a legal document issued by the state of Florida to notify a corporation or limited liability company (LLC) of their nonpayment of required fees or taxes. This notice serves as an official and formal communication to inform the business entity of their noncompliance with financial obligations. The purpose of the Orange Florida Notice of Nonpayment is to give the corporation or LLC a chance to rectify the situation by promptly paying the outstanding fees or taxes. Failure to respond to the notice within the stipulated time frame may result in serious consequences, including penalties, sanctions, or even dissolution of the business entity. There are primarily two different types of Orange Florida Notice of Nonpayment — one for corporations and anotheforcesCs. These types are further categorized based on the specific delinquency, such as nonpayment of annual report fees, franchise taxes, or any other financial obligations that the business entity is obligated to fulfill according to Florida state laws. Corporations and LCS are required to submit their annual reports and pay the corresponding fees by the specified deadline each year. In case of nonpayment, the state will issue a Notice of Nonpayment to the business entity's registered office address. It is crucial for the corporation or LLC to be vigilant and promptly address any issues regarding nonpayment. The Orange Florida Notice of Nonpayment — Corporation or LLC contains essential information that the business entity should pay attention to. This includes the specific fees or taxes that are due, the payment deadline, any accrued penalties or interest, and the consequences of noncompliance. The notice also provides instructions on how to remedy the situation by making the necessary payments or contacting the relevant state authorities to discuss alternatives. To avoid receiving an Orange Florida Notice of Nonpayment, it is crucial for corporations and LCS to stay on top of their financial obligations. Regular monitoring of payment deadlines, diligent record-keeping, and seeking professional guidance regarding tax and fee obligations are important steps businesses can take to prevent any noncompliance issues. In conclusion, the Orange Florida Notice of Nonpayment — Corporation or LLC is a formal communication sent to corporations and LCS to inform them of their nonpayment of required fees or taxes. Both types of business entities must address this notice promptly to avoid penalties or dissolution. Staying compliant with Florida state laws and obligations is vital for the smooth operation and longevity of any corporation or LLC.

Free preview

How to fill out Orange Florida Notice Of Nonpayment - Corporation Or LLC?

If you’ve already utilized our service before, log in to your account and download the Orange Florida Notice of Nonpayment - Corporation or LLC on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Ensure you’ve found a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Orange Florida Notice of Nonpayment - Corporation or LLC. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!