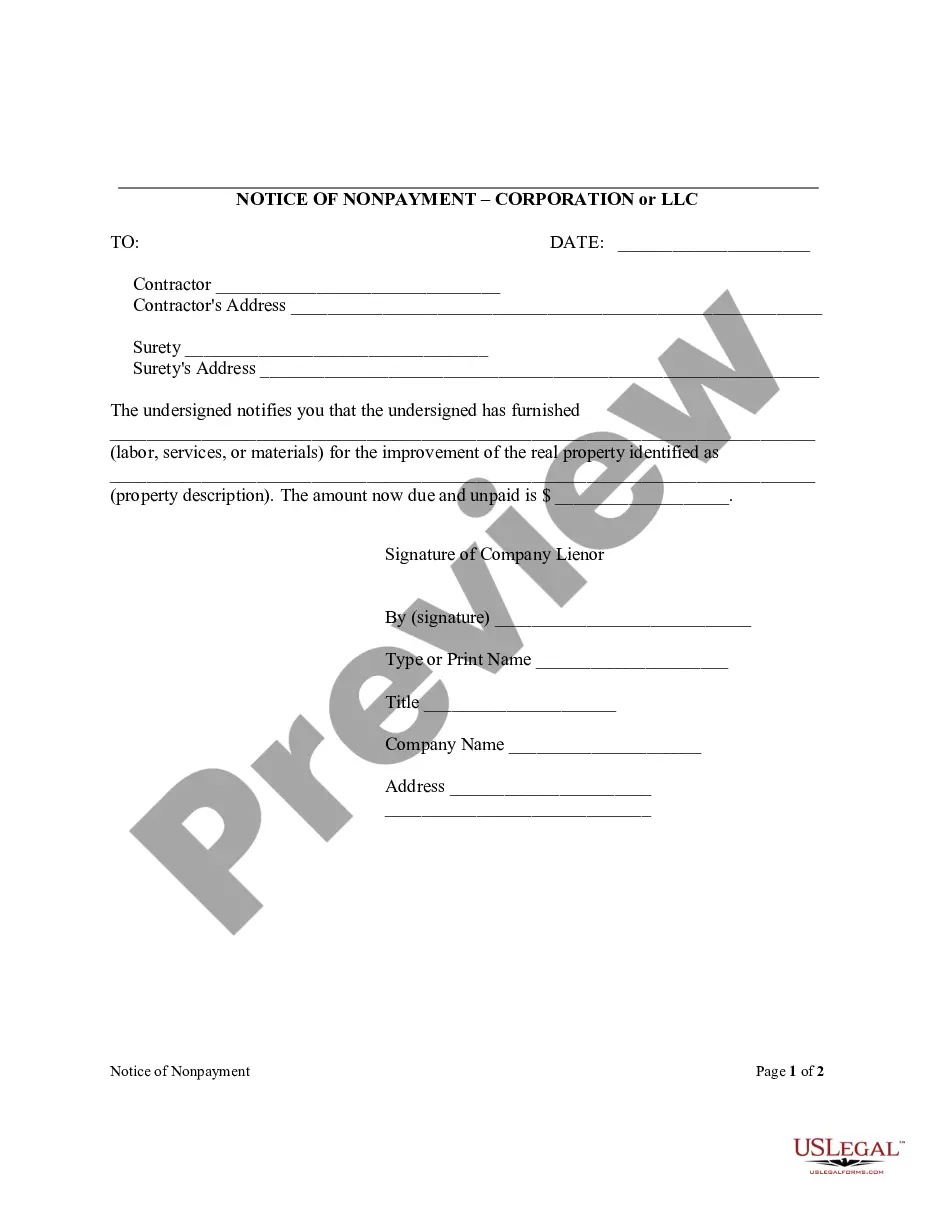

Palm Beach Florida Notice of Nonpayment — Corporation or LLC is an important legal document that serves as a formal notice to inform corporations or limited liability companies (LCS) about nonpayment issues related to their operations. This notice is crucial in ensuring timely payment resolutions and maintaining a healthy business environment in Palm Beach, Florida. This notice aims to protect the rights of both the creditor and debtor by addressing nonpayment concerns promptly and adequately. It helps corporations and LCS recognize and rectify outstanding payment obligations, ensuring that financial transactions are conducted fairly and transparently. Types of Palm Beach Florida Notice of Nonpayment — Corporation or LLC: 1. Notice of Nonpayment — Corporation: This type of notice is specifically directed towards corporations operating within Palm Beach, Florida. It serves as a formal communication to corporations, notifying them about unpaid dues or financial obligations they have not fulfilled. 2. Notice of Nonpayment — LLC: Similarly, this type of notice is designed for limited liability companies operating in Palm Beach, Florida. It acts as an official intimation to LCS regarding outstanding payments that require immediate attention to maintain financial integrity. The Palm Beach Florida Notice of Nonpayment — Corporation or LLC should include essential details to ensure its effectiveness. These details may include: 1. Creditor Information: The notice should clearly state the name, address, and contact information of the creditor initiating the notice. This allows the corporation or LLC to establish direct communication channels for resolution. 2. Debtor Information: It is essential to provide accurate information about the debtor, including their name, registered address, and contact details. This facilitates proper identification and ensures the notice reaches the intended party. 3. Description of Nonpayment: The notice must specify the nature and quantity of the outstanding payment(s), along with any relevant invoice numbers, dates, or other supporting documentation. Clearly outlining the nonpayment issue helps the debtor understand the magnitude of the problem and facilitates a prompt resolution. 4. Deadline for Action: It is crucial to include a clear deadline by which the debtor should address the nonpayment issue. This time frame allows the debtor to rectify the situation within a reasonable period and ensures timely resolution. 5. Legal Ramifications: The notice should mention the potential consequences or legal actions that may arise if the nonpayment issue remains unresolved. This serves as a deterrent and motivates prompt attention to the matter. 6. Intentions for Dispute Resolution: If the notice is open to negotiation, settlement, or alternative dispute resolutions, it should be clearly mentioned. This encourages dialogue and negotiation between the parties involved, promoting a fair and harmonious resolution. In conclusion, the Palm Beach Florida Notice of Nonpayment — Corporation or LLC is a vital document used to address nonpayment issues among corporations and limited liability companies in Palm Beach, Florida. By establishing communication, clearly outlining outstanding payments, and providing a timeline for action, this notice helps ensure that financial matters are resolved promptly, maintaining a healthy business environment conducive to growth and integrity.

Palm Beach Florida Notice of Nonpayment - Corporation or LLC

Description

How to fill out Palm Beach Florida Notice Of Nonpayment - Corporation Or LLC?

Are you looking for a trustworthy and affordable legal forms provider to get the Palm Beach Florida Notice of Nonpayment - Corporation or LLC? US Legal Forms is your go-to option.

Whether you need a basic agreement to set regulations for cohabitating with your partner or a set of documents to advance your separation or divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and frameworked based on the requirements of separate state and county.

To download the document, you need to log in account, locate the required template, and click the Download button next to it. Please take into account that you can download your previously purchased form templates anytime from the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Palm Beach Florida Notice of Nonpayment - Corporation or LLC conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to find out who and what the document is intended for.

- Restart the search if the template isn’t suitable for your legal situation.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Palm Beach Florida Notice of Nonpayment - Corporation or LLC in any provided format. You can get back to the website at any time and redownload the document free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending hours learning about legal papers online once and for all.

Form popularity

FAQ

Notices of Commencement are required in Florida. Property owners must get them filed. The only exception is when there is a construction lender on the job, in which event, the property owner is relieved from this duty and the construction lender must make the filing.

A NOTICE OF COMMENCEMENT MUST BE RECORDED AND POSTED ON THE JOB SITE BEFORE THE FIRST INSPECTION. IF YOU INTEND TO OBTAIN FINANCING, CONSULT WITH YOUR LENDER OR AN ATTORNEY BEFORE COMMENCING WORK OR RECORDING YOUR NOTICE OF COMMENCEMENT.

(6) Unless otherwise provided in the notice of commencement or a new or amended notice of commencement, a notice of commencement is not effectual in law or equity against a conveyance, transfer, or mortgage of or lien on the real property described in the notice, or against creditors or subsequent purchasers for a

This notice provides an early message that payments aren't going according to plan. If a party has been shorted on payment, or if payment is not forthcoming at all, this Notice of Nonpayment will inform any recipients of the payment issue.

Florida does not require that you have a written contract to file a mechanics lien, so contracts can be oral, written, express or implied. However, the following parties do not have any rights to file a Florida mechanics lien: Sub-sub-subcontractors (those hired by sub-subs) Suppliers to suppliers.

While not required in some states, not filing the Notice of Commencement in Florida can unfavorably affect your lien rights in the state. A Notice of Commencement is a form that is filled out, recorded, and notarized by the owner of the property.

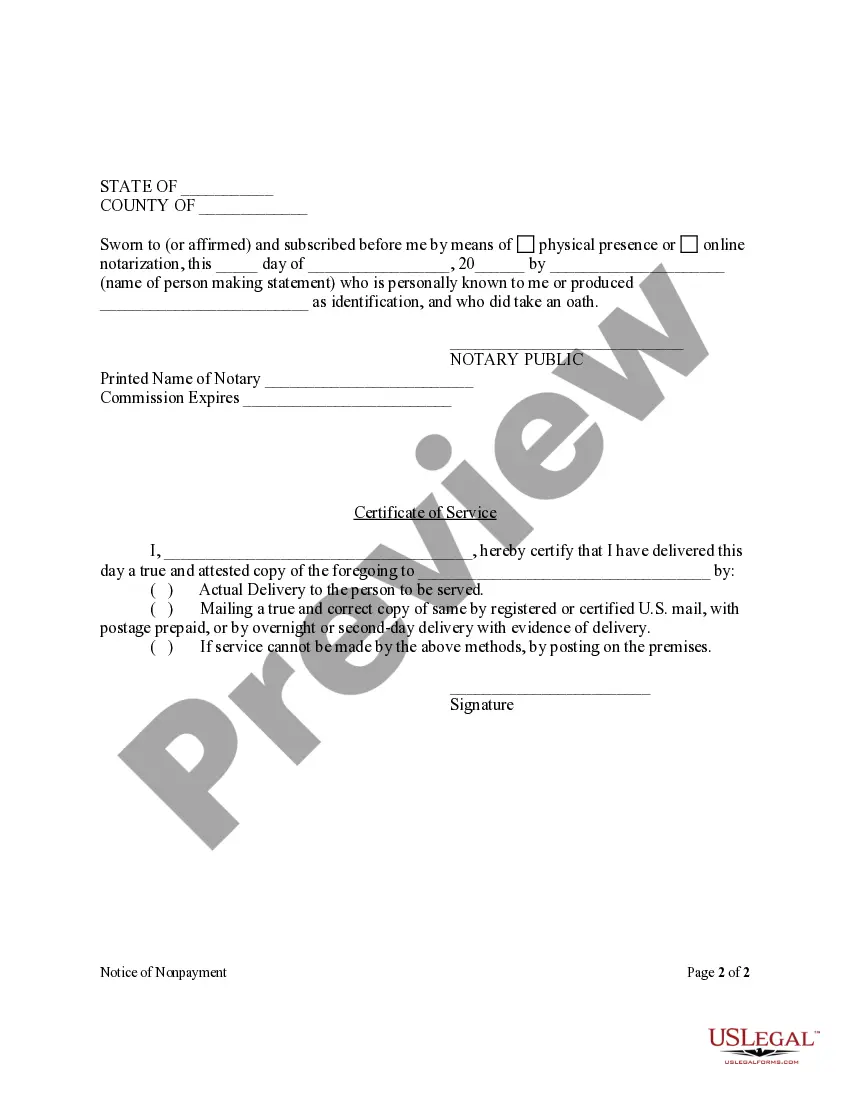

Sign your notice and mail it to the owner via certified mail, return receipt requested or have it personally delivered to the owner. If personally served, you need to receive a signature from an authorize signatory of the owner to prove service was completed.

How to serve a Florida Notice of Nonpayment Prepare the Notice of Nonpayment form. Have your Notice of Nonpayment form notarized. Serve the Notice of Nonpayment form on the general contractor and the surety. Initiate a lawsuit if you do not receive payment. Serve the Florida preliminary notice early.

Florida contractors and suppliers must generally send a preliminary notice within the first 45 days on a construction project. In Florida, preliminary notice is called a Notice to Owner, or NTO.

A stop payment notice, also known as a stop notice, is given to notify the property owner, general contractor, and/or lender that the claimant has not been paid for their services, materials, or equipment in a construction project.

More info

State of Florida. Court Case No. 91389×01, filed 1×22/10.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.