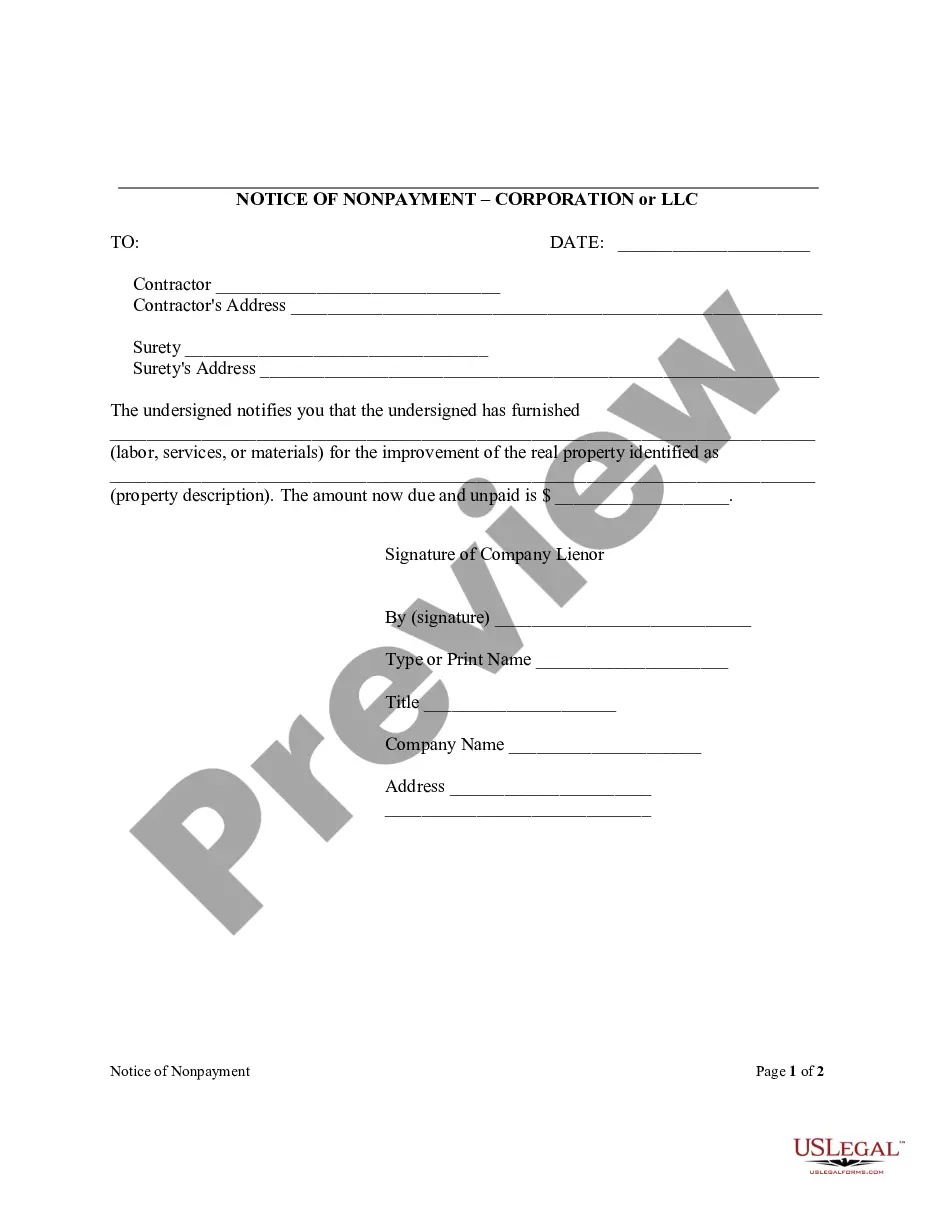

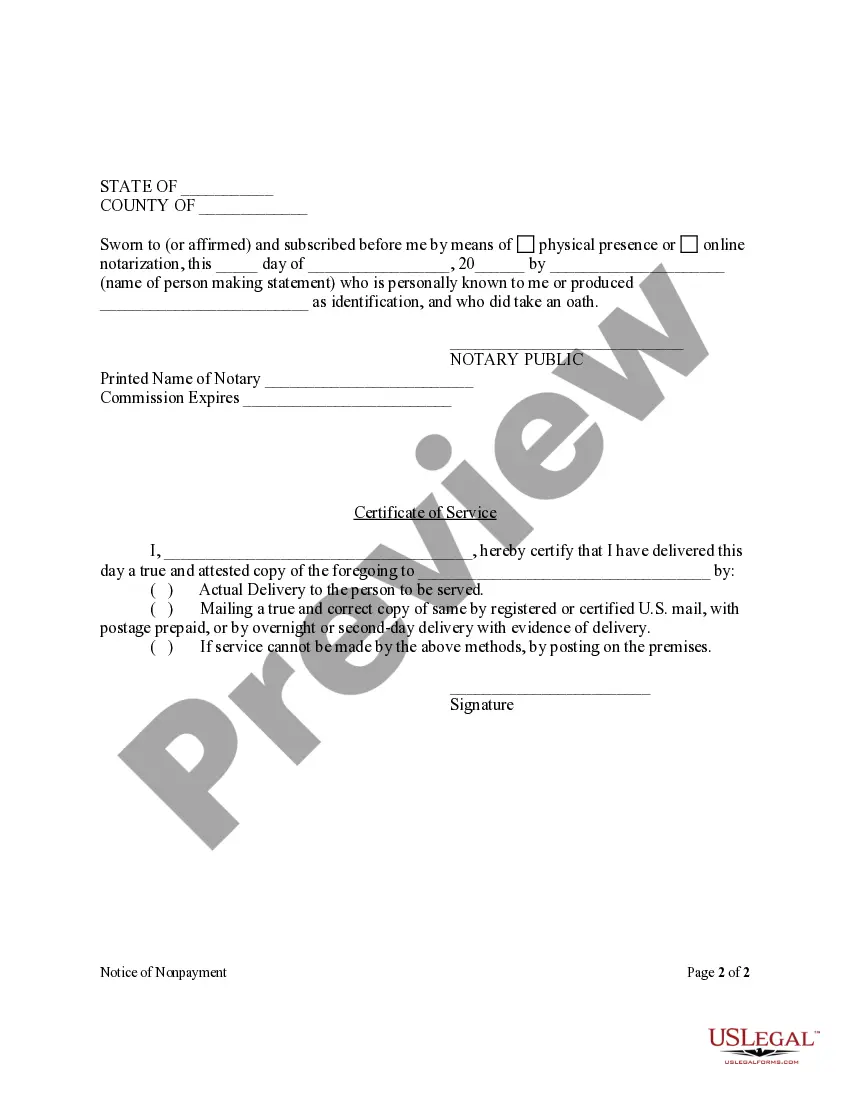

Pembroke Pines Florida Notice of Nonpayment — Corporation or LLC When running a corporation or limited liability company (LLC) in Pembroke Pines, Florida, it's crucial to understand the processes and procedures involved in handling nonpayment issues. In cases where a customer or client fails to pay for goods or services provided by your corporation or LLC, it becomes necessary to issue a "Notice of Nonpayment." This legal document serves as a formal communication to the debtor, notifying them of their outstanding payment and potential consequences if the issue remains unresolved. Pembroke Pines, being a city located in Broward County, Florida, has specific requirements and guidelines for drafting a Notice of Nonpayment for corporations or LCS. It is essential to adhere to these regulations to ensure legal compliance and protect your business's interests. Depending on the circumstances, there might be different types of notices that can be issued in such cases, some of which are: 1. Pembroke Pines Florida Notice of Nonpayment — Corporation— - This type of notice is specifically intended for corporations operating in Pembroke Pines, Florida. It outlines the details of the unpaid invoice, such as the invoice number, date issued, and the amount owed by the customer or client. Additionally, it highlights the consequences and potential legal actions that the corporation may take to recover the payment if the issue is not resolved promptly. 2. Pembroke Pines Florida Notice of Nonpayment — LLC— - Designed specifically for LLCs in Pembroke Pines, Florida, this notice serves as a formal communication when faced with nonpayment issues. It includes similar information as the Corporation Notice of Nonpayment, but tailored to suit the legal requirements and uniqueness of an LLC structure. Regardless of the specific type of notice issued, there are certain essential components that must be included in order to make it legally valid and enforceable: a. Identification Information: — Clearly state the full legal name, address, and relevant identification details of the corporation or LLC sending the notice. b. Debtor Information: — Provide the name and address of the customer or client who owes the unpaid amount. c. Description of Debt: — Provide a detailed description of the goods or services rendered along with the corresponding invoice number, date, and amount, ensuring accuracy and clarity. d. Payment Deadline: — Clearly specify a deadline by which the debtor must make the payment to avoid further action or legal consequences. e. Consequences of Nonpayment: — Highlight the potential actions that the corporation or LLC may take if the debtor fails to address the nonpayment issue within the specified deadline. This may include pursuing legal action, filing a claim, reporting to credit bureaus, or seeking collections through a third-party agency. It is essential to consult with legal professionals familiar with Pembroke Pines and Florida's specific laws and regulations to ensure the accuracy and effectiveness of your Notice of Nonpayment. By taking prompt and appropriate action, corporations and LCS can safeguard their financial interests while maintaining professionalism and integrity in their business practices.

Pembroke Pines Florida Notice of Nonpayment - Corporation or LLC

Description

How to fill out Pembroke Pines Florida Notice Of Nonpayment - Corporation Or LLC?

Do you need a trustworthy and inexpensive legal forms supplier to get the Pembroke Pines Florida Notice of Nonpayment - Corporation or LLC? US Legal Forms is your go-to solution.

Whether you need a simple arrangement to set regulations for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and frameworked in accordance with the requirements of particular state and area.

To download the document, you need to log in account, find the required form, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Pembroke Pines Florida Notice of Nonpayment - Corporation or LLC conforms to the laws of your state and local area.

- Go through the form’s description (if available) to find out who and what the document is good for.

- Restart the search in case the form isn’t good for your legal situation.

Now you can create your account. Then choose the subscription option and proceed to payment. Once the payment is completed, download the Pembroke Pines Florida Notice of Nonpayment - Corporation or LLC in any available format. You can return to the website at any time and redownload the document without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about spending hours learning about legal papers online once and for all.