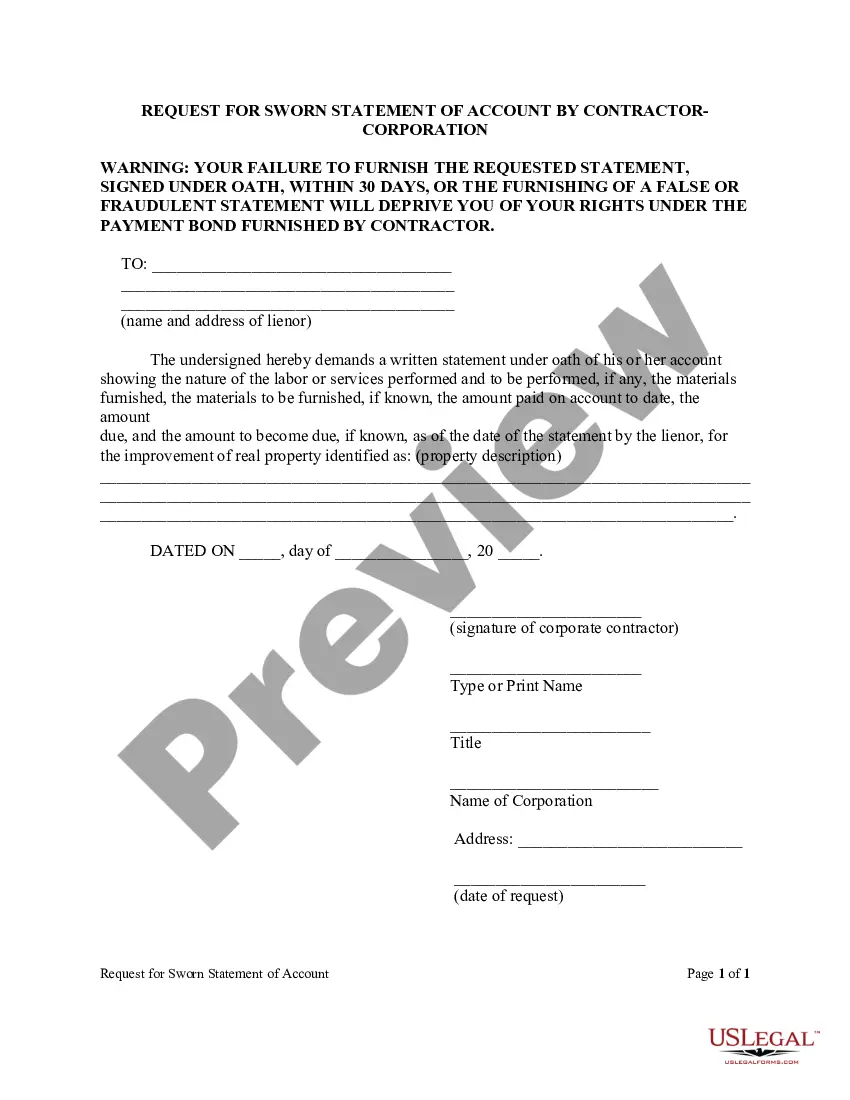

Cape Coral, located in Southwest Florida, is a thriving city known for its waterfront lifestyle and year-round sunny weather. If you're a contractor operating as a Corporation or Limited Liability Company (LLC) in Cape Coral, it's crucial to familiarize yourself with the Request for Sworn Statement of Account process. This statement serves as a legal document through which you can disclose the details of the project, expenses, and payments involved. Here is some essential information regarding Cape Coral's Request for Sworn Statement of Account by Contractor — Corporation or LLC: 1. Purpose: The Request for Sworn Statement of Account is a formal document required by Florida law that enables contractors to obtain a detailed account of financial information related to their construction or improvement projects. It provides transparency, protecting contractors' rights by ensuring they receive proper compensation for completed work, labor, materials, and other related expenses. 2. Filing Requirements: Contractors operating as a Corporation or LLC in Cape Coral must file a Request for Sworn Statement of Account with the appropriate party involved in the project. Typically, this involves submitting the statement to the property owner, general contractor, or lender. 3. Contents of the Sworn Statement: The Request for Sworn Statement of Account should contain pertinent details, including the contractor's information, project description, expenses incurred, payments received, and outstanding balances. It's crucial to provide accurate and comprehensive information to establish a clear picture of the project's financial status. 4. Compliance with Florida Statute 713.16: Cape Coral's Request for Sworn Statement of Account must comply with Florida Statute 713.16, which governs the requirements and procedures for this document. Understanding and adhering to the statute ensures that contractors' rights are protected and prevents potential legal complications. 5. Different Types of Sworn Statement of Account: While there may not be different types of Cape Coral's Request for Sworn Statement of Account based specifically on whether the contractor operates as a Corporation or LLC, the requirement is the same for all contractors engaging in construction or improvement projects within the city. To conclude, contractors in Cape Coral, whether operating as a Corporation or LLC, must comply with the Request for Sworn Statement of Account. This process is essential for maintaining transparency, securing proper compensation, and adhering to legal requirements. By understanding the purpose, filing requirements, contents, and compliance with Florida statutes, contractors can navigate this process effectively.

Cape Coral Florida Request for Sworn Statement of Account by Contractor - Corporation or LLC

Description

How to fill out Cape Coral Florida Request For Sworn Statement Of Account By Contractor - Corporation Or LLC?

If you are searching for a valid form, it’s difficult to find a more convenient service than the US Legal Forms website – probably the most extensive online libraries. Here you can get a large number of form samples for organization and personal purposes by categories and regions, or keywords. Using our high-quality search option, getting the most recent Cape Coral Florida Request for Sworn Statement of Account by Contractor - Corporation or LLC is as easy as 1-2-3. Furthermore, the relevance of every file is confirmed by a group of expert attorneys that regularly check the templates on our platform and update them in accordance with the most recent state and county laws.

If you already know about our system and have an account, all you need to receive the Cape Coral Florida Request for Sworn Statement of Account by Contractor - Corporation or LLC is to log in to your profile and click the Download button.

If you use US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have opened the sample you require. Look at its information and use the Preview function to explore its content. If it doesn’t meet your needs, use the Search field at the top of the screen to find the needed file.

- Affirm your selection. Choose the Buy now button. Next, select the preferred subscription plan and provide credentials to register an account.

- Make the transaction. Use your credit card or PayPal account to finish the registration procedure.

- Receive the form. Pick the file format and save it on your device.

- Make adjustments. Fill out, revise, print, and sign the acquired Cape Coral Florida Request for Sworn Statement of Account by Contractor - Corporation or LLC.

Every single form you add to your profile has no expiration date and is yours permanently. You always have the ability to access them using the My Forms menu, so if you want to get an additional version for enhancing or printing, feel free to return and export it once again anytime.

Make use of the US Legal Forms extensive collection to gain access to the Cape Coral Florida Request for Sworn Statement of Account by Contractor - Corporation or LLC you were looking for and a large number of other professional and state-specific samples on one platform!