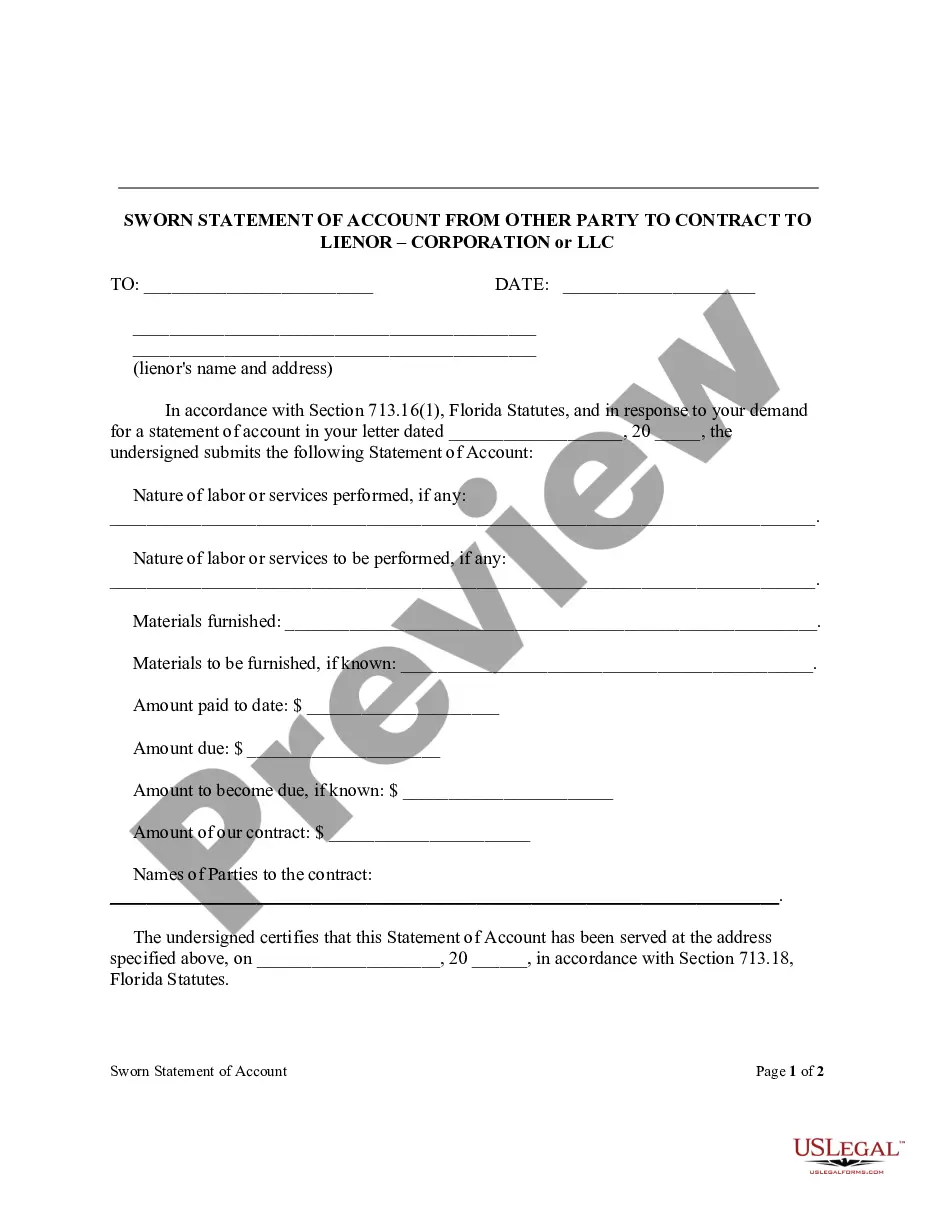

The Palm Bay Florida Sworn Statement of Account from Other Party to Contract to Lie nor — Corporation or LLC is a legal document used to provide a detailed description of the financial transactions between two parties involved in a contractual agreement. It ensures transparency and accuracy regarding the payments made, outstanding balances, and any disputes or discrepancies that need to be addressed. This statement serves as a crucial tool for corporations or limited liability companies (LCS) involved in construction projects, where a lie nor (the party providing labor or materials) may need to request payment from the other party. Key features of the Palm Bay Florida Sworn Statement of Account from Other Party to Contract to Lie nor — Corporation or LLC include: 1. Identification: The statement begins by identifying the corporation or LLC that is providing the sworn account statement. 2. Contract Details: The document outlines the specific details of the contract, including the project's scope, location, start and completion dates, and any amendments or modifications that have been made. 3. Payment Schedule: This section provides a breakdown of the payments issued by the corporation or LLC to the lie nor, including dates, amounts, and payment methods. It serves as evidence of the payments made to fulfill the contractual obligations. 4. Outstanding Balances: If there are any outstanding balances owed to the lie nor, they must be clearly stated, along with the reasons for non-payment, if applicable. This section also includes any agreed-upon interest rates or penalties for late payments. 5. Approved Changes or Extras: If there were any approved changes or extra work that required additional payment, this section highlights the details of such modifications and the corresponding costs. 6. Disputes or Claims: Any disputes or claims relating to the payment or performance of the contract should be listed in this section, along with any supporting documentation or correspondence. Different types of Palm Bay Florida Sworn Statement of Account from Other Party to Contract to Lie nor for Corporations or LCS may include variations in format and content, but the fundamental purpose remains the same: to provide an accurate and detailed record of financial transactions related to a specific contract. Some variations may focus on specific industries, such as construction or real estate, while others may address unique payment terms or specific legal requirements. By utilizing the Palm Bay Florida Sworn Statement of Account from Other Party to Contract to Lie nor — Corporation or LLC correctly, businesses can ensure transparency, maintain proper financial records, and resolve any payment-related issues effectively, minimizing the risks associated with construction projects and contractual disputes.

Palm Bay Florida Sworn Statement of Account from Other Party to Contract to Lienor - Corporation or LLC

Description

How to fill out Palm Bay Florida Sworn Statement Of Account From Other Party To Contract To Lienor - Corporation Or LLC?

Regardless of social or professional status, completing law-related forms is an unfortunate necessity in today’s world. Too often, it’s almost impossible for a person without any legal education to create this sort of paperwork cfrom the ground up, mostly due to the convoluted terminology and legal subtleties they come with. This is where US Legal Forms can save the day. Our service offers a huge library with more than 85,000 ready-to-use state-specific forms that work for practically any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you require the Palm Bay Florida Sworn Statement of Account from Other Party to Contract to Lienor - Corporation or LLC or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Palm Bay Florida Sworn Statement of Account from Other Party to Contract to Lienor - Corporation or LLC quickly employing our reliable service. If you are already an existing customer, you can proceed to log in to your account to download the needed form.

Nevertheless, if you are a novice to our library, make sure to follow these steps prior to downloading the Palm Bay Florida Sworn Statement of Account from Other Party to Contract to Lienor - Corporation or LLC:

- Ensure the template you have chosen is good for your area considering that the regulations of one state or county do not work for another state or county.

- Preview the form and read a quick description (if available) of cases the paper can be used for.

- If the one you chosen doesn’t suit your needs, you can start over and search for the needed form.

- Click Buy now and choose the subscription plan that suits you the best.

- Access an account {using your login information or create one from scratch.

- Pick the payment method and proceed to download the Palm Bay Florida Sworn Statement of Account from Other Party to Contract to Lienor - Corporation or LLC once the payment is done.

You’re all set! Now you can proceed to print out the form or fill it out online. Should you have any issues locating your purchased forms, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.

Form popularity

FAQ

A contractor's sworn statement is a legal document that outlines all amounts owed by a contractor for work completed, including labor and materials. This document is essential in construction projects and is often required by project owners to establish transparency. When dealing with a Palm Bay Florida Sworn Statement of Account from Other Party to Contract to Lienor - Corporation or LLC, it helps to protect both parties by ensuring that payment obligations are clear and documented.

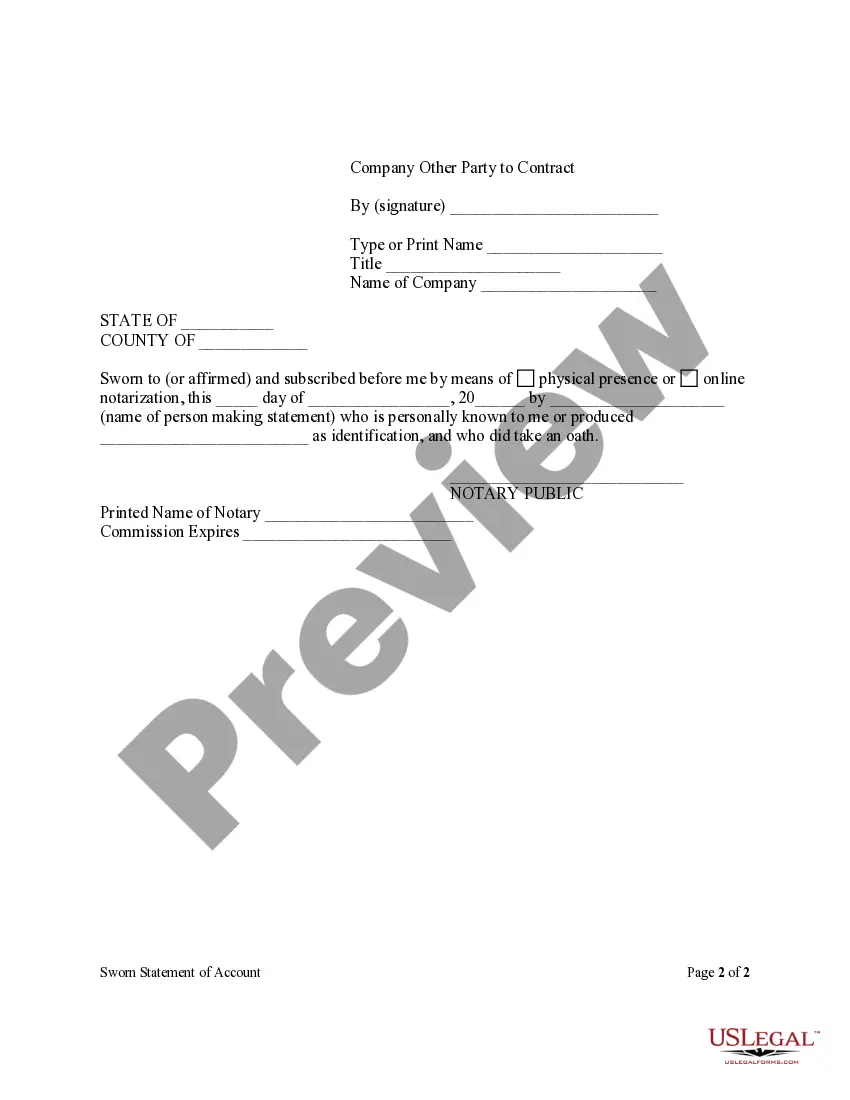

To get a sworn statement notarized, you can start by gathering the document that requires notarization, such as the Palm Bay Florida Sworn Statement of Account from Other Party to Contract to Lienor - Corporation or LLC. Next, visit a notary public who is authorized to witness and certify the signing of documents. Ensure you have valid identification, as the notary will need to verify your identity before notarizing your statement.

Statute 713.16 in Florida pertains to the requirements for a sworn statement of account, detailing what must be included regarding amounts owed. Understanding this statute is crucial for anyone involved in lien processes, ensuring accurate documentation and protection of rights. Incorporating this knowledge is fundamental when managing the Palm Bay Florida Sworn Statement of Account from Other Party to Contract to Lienor - Corporation or LLC.

A sworn statement in Florida is a legal document in which the signer affirms that the information provided is true and correct under penalty of perjury. This type of statement is often used in various legal contexts, including contract disputes and lien claims. It plays a vital role in situations involving the Palm Bay Florida Sworn Statement of Account from Other Party to Contract to Lienor - Corporation or LLC.

Serving someone who avoids service in Florida can be challenging. You may consider methods such as hiring a professional process server or using alternative service methods that comply with Florida laws. Staying persistent and informed will be essential when dealing with the Palm Bay Florida Sworn Statement of Account from Other Party to Contract to Lienor - Corporation or LLC.

In Florida, a notice to owner must generally be served within a specific timeframe before completion of the work to protect lien rights. If the work is complete, it may limit your ability to enforce a claim for unpaid services. However, discussing options with a legal expert can provide clarity on how to approach the Palm Bay Florida Sworn Statement of Account from Other Party to Contract to Lienor - Corporation or LLC.

Serving a notice to owner in Florida generally involves sending the document via certified mail or delivering it personally to the owner or their agent. It’s essential to keep proof of this service, as it may be required later for lien enforcement. Utilizing a trusted platform like US Legal Forms can help streamline this process and ensure compliance with the Palm Bay Florida Sworn Statement of Account from Other Party to Contract to Lienor - Corporation or LLC.

To publish a notice to creditors in Florida, you need to prepare the document and file it with a local newspaper that has an established circulation in the county where the property is located. Ensure that the notice runs for a set period, often once a week for several consecutive weeks. This is an important step in maintaining compliance and serves to protect your interests in the Palm Bay Florida Sworn Statement of Account from Other Party to Contract to Lienor - Corporation or LLC.

In Florida, the notice to owner does not require notarization to be valid. However, it must adhere to specific legal formatting and delivery procedures. Following the correct process ensures that all parties receive proper notification, strengthening any subsequent claims regarding the Palm Bay Florida Sworn Statement of Account from Other Party to Contract to Lienor - Corporation or LLC.

A sworn statement of account is a legal document that outlines the amounts owed to contractors or suppliers for services or materials provided. In Florida, it is crucial for anyone seeking payment through a lien process. This document can facilitate disputes and enhance clarity among parties involved in the Palm Bay Florida Sworn Statement of Account from Other Party to Contract to Lienor - Corporation or LLC.