The Broward Florida Sworn Statement of Account from Lie nor to Contractor — Corporation or LLC is a legal document that outlines the financial details of a construction project or services provided by a contractor. This statement is typically used when there is a dispute or pending payment issues between a contractor, who is a Corporation or LLC, and a lie nor (such as a subcontractor, supplier, or labor provider). The purpose of this Sworn Statement of Account is to establish an accurate record of all the services, labor, materials, and expenses related to the project. It serves as documentation for all parties involved to ensure that payments are made according to the agreed-upon terms. The statement provides transparency and allows the lie nor to present a clear breakdown of their charges to the contractor, outlining any outstanding payments due. This detailed document includes essential information such as the project's name and address, the lie nor's (or subcontractor's) legal entity name, address, and description of services provided. It also incorporates a comprehensive breakdown of expenses, including the cost of labor, materials, overhead, any applicable taxes or fees, and any other relevant charges. The Broward, Florida jurisdiction recognizes different variations of the Sworn Statement of Account from Lie nor to Contractor based on the specific circumstances of the project and the parties involved. These variations may include: 1. Sworn Statement of Account from Lie nor to General Contractor — Corporation or LLC: This type identifies the financial details and outstanding payments owed by subcontractors, suppliers, or labor providers to the General Contractor, who is a Corporation or LLC. 2. Sworn Statement of Account from Subcontractor to General Contractor — Corporation or LLC: This Sworn Statement of Account is used when a subcontractor, who is a Corporation or LLC, needs to provide a detailed breakdown of expenses and invoices to the General Contractor for reimbursement or payment purposes. 3. Sworn Statement of Account from Supplier to Contractor — Corporation or LLC: This variation is applied when a supplier, who is a Corporation or LLC, needs to present an itemized account statement to the Contractor outlining the cost of materials, taxes, and any additional charges incurred. These different types of Sworn Statements of Account ensure that the accurate financial records and obligations are maintained throughout the construction project, facilitating transparency, and preventing payment disputes between parties involved.

Sworn Statement Of Account Florida

Category:

State:

Florida

County:

Broward

Control #:

FL-03240A

Format:

Word;

Rich Text

Instant download

Description

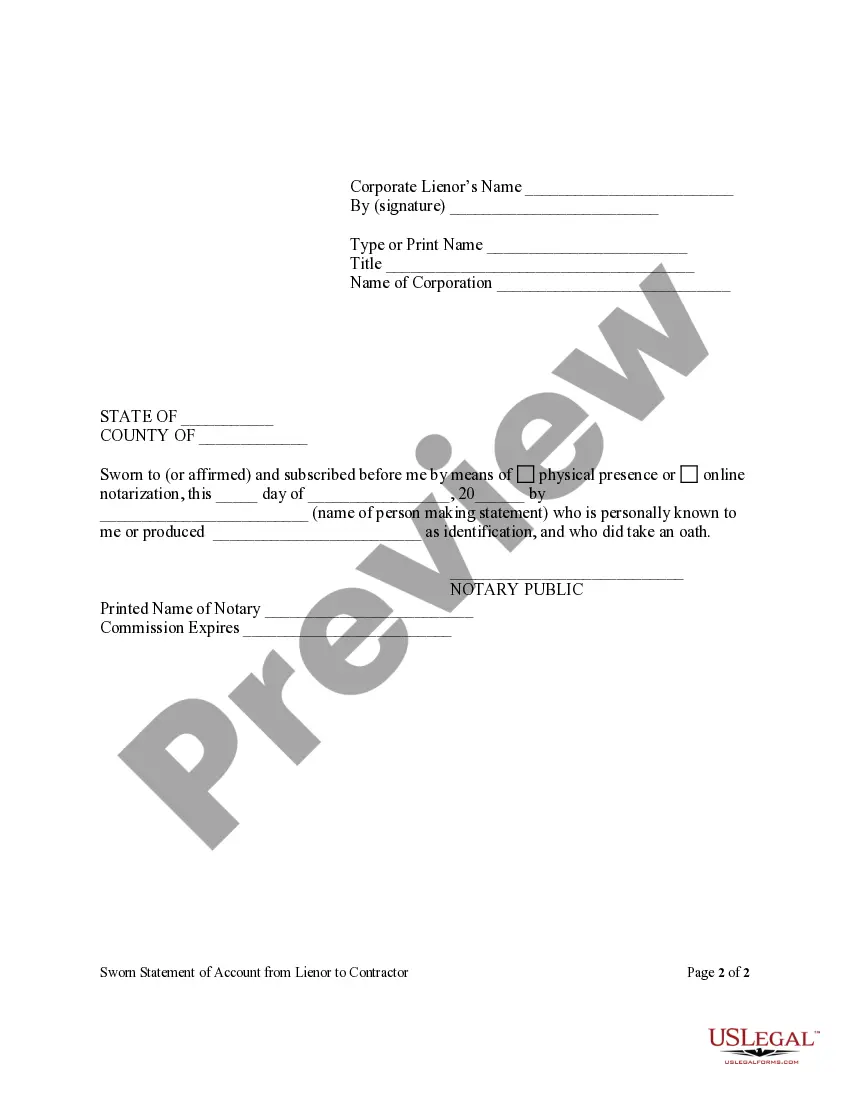

This Sworn Statement of Account from Lienor to Contractor form is for use by a corporate lienor to respond to a contractor's demand for a statement of account and includes the nature of labor or services performed or to be performed, materials furnished or to be furnished, amount paid to date, amount due or to become due, amount of contract and the names of the parties to the contract.

The Broward Florida Sworn Statement of Account from Lie nor to Contractor — Corporation or LLC is a legal document that outlines the financial details of a construction project or services provided by a contractor. This statement is typically used when there is a dispute or pending payment issues between a contractor, who is a Corporation or LLC, and a lie nor (such as a subcontractor, supplier, or labor provider). The purpose of this Sworn Statement of Account is to establish an accurate record of all the services, labor, materials, and expenses related to the project. It serves as documentation for all parties involved to ensure that payments are made according to the agreed-upon terms. The statement provides transparency and allows the lie nor to present a clear breakdown of their charges to the contractor, outlining any outstanding payments due. This detailed document includes essential information such as the project's name and address, the lie nor's (or subcontractor's) legal entity name, address, and description of services provided. It also incorporates a comprehensive breakdown of expenses, including the cost of labor, materials, overhead, any applicable taxes or fees, and any other relevant charges. The Broward, Florida jurisdiction recognizes different variations of the Sworn Statement of Account from Lie nor to Contractor based on the specific circumstances of the project and the parties involved. These variations may include: 1. Sworn Statement of Account from Lie nor to General Contractor — Corporation or LLC: This type identifies the financial details and outstanding payments owed by subcontractors, suppliers, or labor providers to the General Contractor, who is a Corporation or LLC. 2. Sworn Statement of Account from Subcontractor to General Contractor — Corporation or LLC: This Sworn Statement of Account is used when a subcontractor, who is a Corporation or LLC, needs to provide a detailed breakdown of expenses and invoices to the General Contractor for reimbursement or payment purposes. 3. Sworn Statement of Account from Supplier to Contractor — Corporation or LLC: This variation is applied when a supplier, who is a Corporation or LLC, needs to present an itemized account statement to the Contractor outlining the cost of materials, taxes, and any additional charges incurred. These different types of Sworn Statements of Account ensure that the accurate financial records and obligations are maintained throughout the construction project, facilitating transparency, and preventing payment disputes between parties involved.

Free preview

How to fill out Broward Florida Sworn Statement Of Account From Lienor To Contractor - Corporation?

If you’ve already used our service before, log in to your account and save the Broward Florida Sworn Statement of Account from Lienor to Contractor - Corporation or LLC on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your file:

- Make sure you’ve found a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Broward Florida Sworn Statement of Account from Lienor to Contractor - Corporation or LLC. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!