Pembroke Pines Florida Sworn Statement of Account from Lienor to Contractor - Corporation

Description

How to fill out Florida Sworn Statement Of Account From Lienor To Contractor - Corporation?

Finding authorized templates that conform to your regional regulations can be difficult unless you utilize the US Legal Forms database.

It’s an online collection of over 85,000 legal documents for both personal and professional requirements along with various real-world scenarios.

All the forms are appropriately categorized by application area and jurisdiction, enabling you to access the Pembroke Pines Florida Sworn Statement of Account from Lienor to Contractor - Corporation or LLC as quickly and simply as possible.

Maintaining organized paperwork that adheres to legal standards is highly significant. Take advantage of the US Legal Forms library to always have crucial document templates available for any requirements at your fingertips!

- Review the Preview mode and form details.

- Ensure you select the correct one that aligns with your needs and fully complies with your local jurisdiction standards.

- Look for an alternate template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the appropriate one.

- If it meets your needs, proceed to the next step.

Form popularity

FAQ

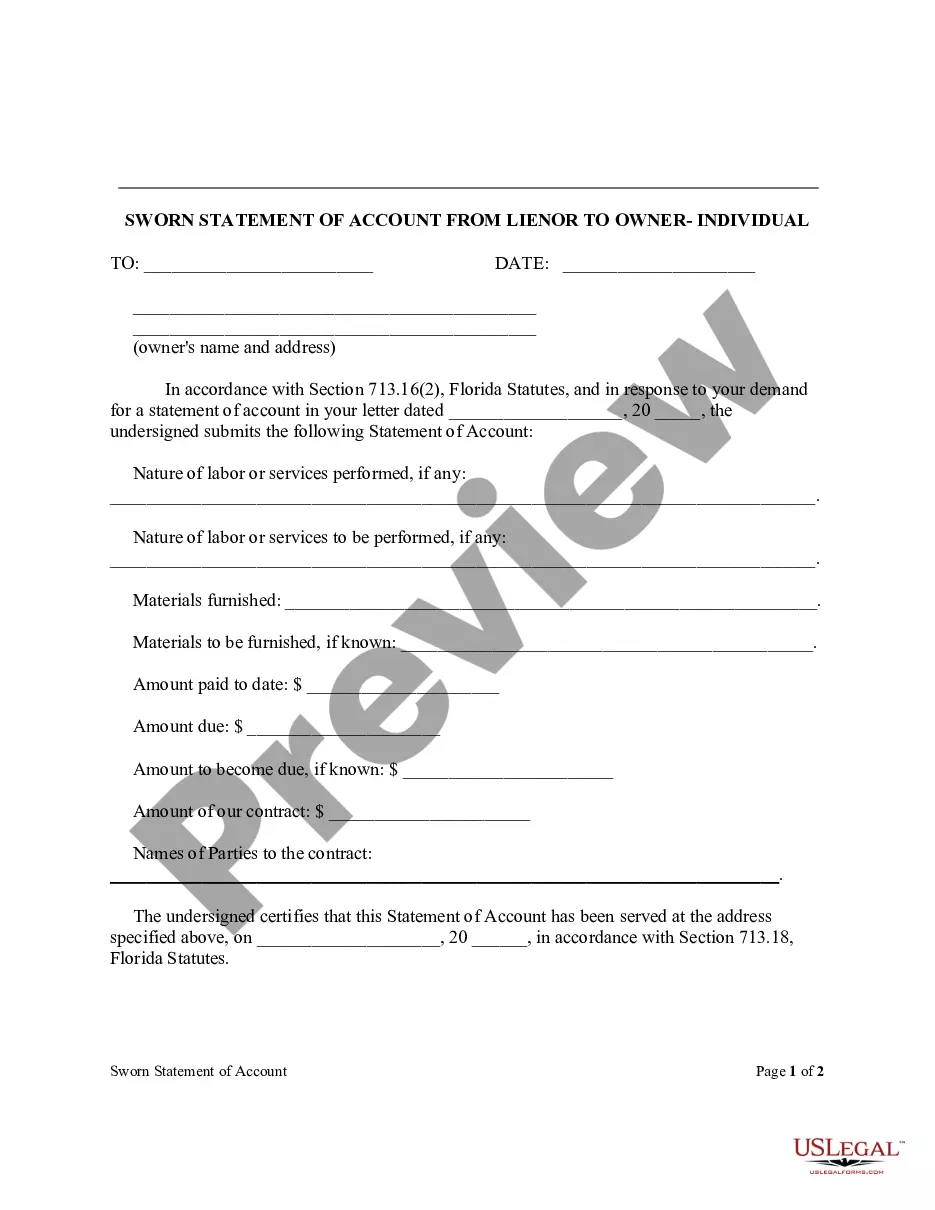

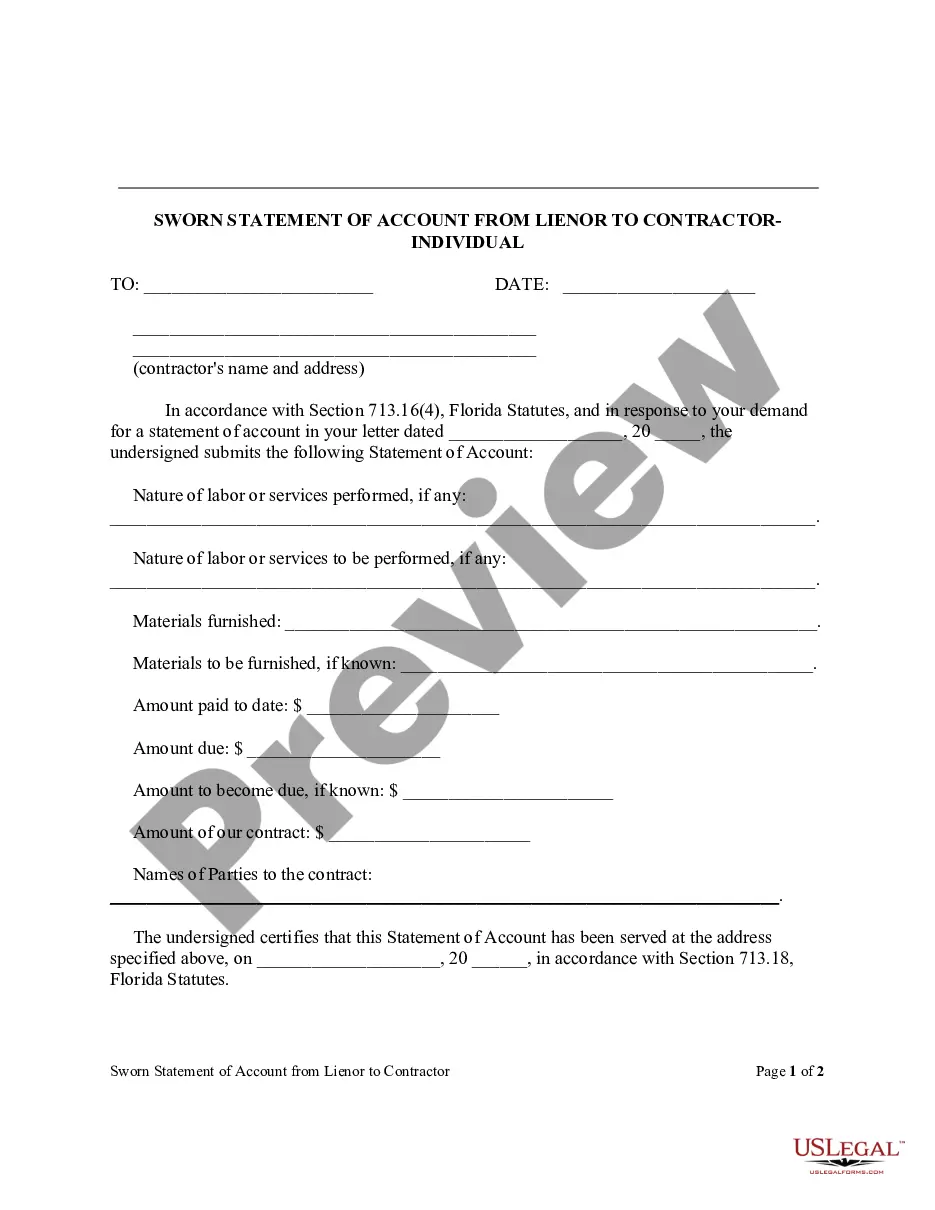

The purpose of a statement of account is to provide a clear and comprehensive overview of all transactions between parties. It helps identify any discrepancies and ensures accuracy in financial records. Additionally, this statement serves as a tool for tracking payments and obligations as the project progresses. For convenient access to such documents, explore the Pembroke Pines Florida Sworn Statement of Account from Lienor to Contractor - Corporation through uslegalforms.

In construction, a statement of account records all financial interactions between the contractor and clients or suppliers. It typically includes invoices, payments, and adjustments relevant to the project. This statement helps maintain transparency and ensures that all parties are informed of their financial obligations. For reliable documentation, you can utilize the Pembroke Pines Florida Sworn Statement of Account from Lienor to Contractor - Corporation.

A statement of account provides an overall summary of multiple transactions over a certain period, while an invoice details a specific transaction for goods or services rendered. The statement reflects an ongoing financial relationship, whereas an invoice acts as a request for payment for a particular sale. Each serves its purpose, but for ongoing projects, a Pembroke Pines Florida Sworn Statement of Account from Lienor to Contractor - Corporation will be beneficial.

The final statement of account in construction summarizes all financial transactions related to a project. It provides a complete record of services rendered, payments received, and outstanding balances. This document is essential for ensuring all parties agree on the financial aspects before project closure. For an accurate document, look into the Pembroke Pines Florida Sworn Statement of Account from Lienor to Contractor - Corporation.

A statement of account should clearly outline all transactions between the lienor and contractor. This includes the amounts billed, payments made, and any adjustments. It should also incorporate project details and relevant dates to enhance clarity. For assistance, consider using the Pembroke Pines Florida Sworn Statement of Account from Lienor to Contractor - Corporation available on uslegalforms.

When communicating with a general contractor, avoid making accusatory statements, assumptions, or emotional outbursts. It’s essential to maintain professionalism and clarity, focusing on facts rather than personal feelings. Additionally, be cautious not to undermine their expertise, especially regarding financial matters like the Pembroke Pines Florida Sworn Statement of Account from Lienor to Contractor - Corporation. Constructive dialogue fosters a better working relationship.

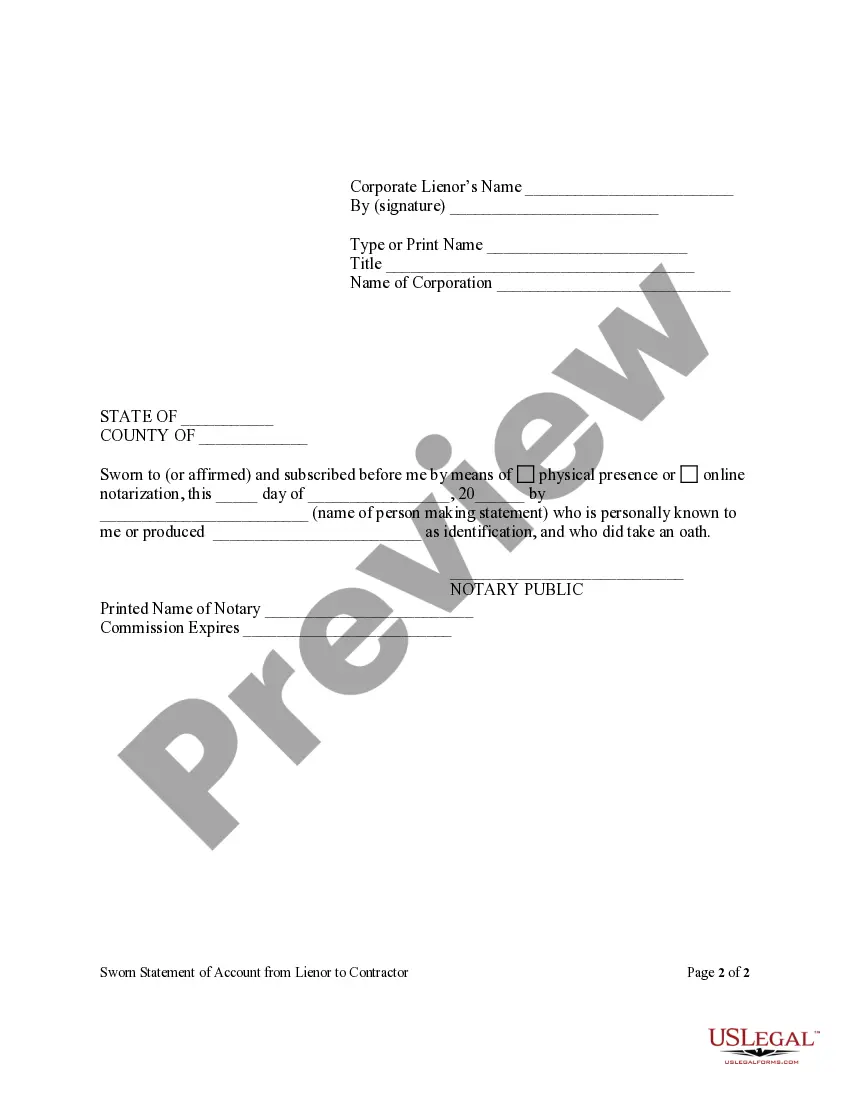

To fill out a contractor's affidavit, start by providing specific details regarding your identity, the nature of the contract, and any payments made. Include all relevant financial information, ensuring it aligns with your Pembroke Pines Florida Sworn Statement of Account from Lienor to Contractor - Corporation. After drafting, sign the affidavit under oath for legal validity. Using resources like uslegalforms can simplify this process.

Filling out an affidavit form involves stating facts pertinent to your case clearly and concisely. Begin with your identity and the purpose of the affidavit, then include the relevant details, ensuring accuracy. Lastly, sign the document under oath as required. For the Pembroke Pines Florida Sworn Statement of Account from Lienor to Contractor - Corporation, accuracy is vital, and uslegalforms provides examples that can assist you in drafting.

The G706 form is a contractor's sworn statement about payments made to subcontractors and suppliers. It ensures that all parties are accounted for in financial transactions during a project. When preparing a Pembroke Pines Florida Sworn Statement of Account from Lienor to Contractor - Corporation, the G706 form can help streamline the payments verification process. This adds an extra layer of security for all involved.

To complete a sworn statement, gather all relevant documentation, including invoices and payment records. Clearly outline the account details, along with any claims for payment, in a structured format. Once you draft your Pembroke Pines Florida Sworn Statement of Account from Lienor to Contractor - Corporation, ensure you sign it under oath. Using templates offered by platforms like uslegalforms can make this process more efficient.