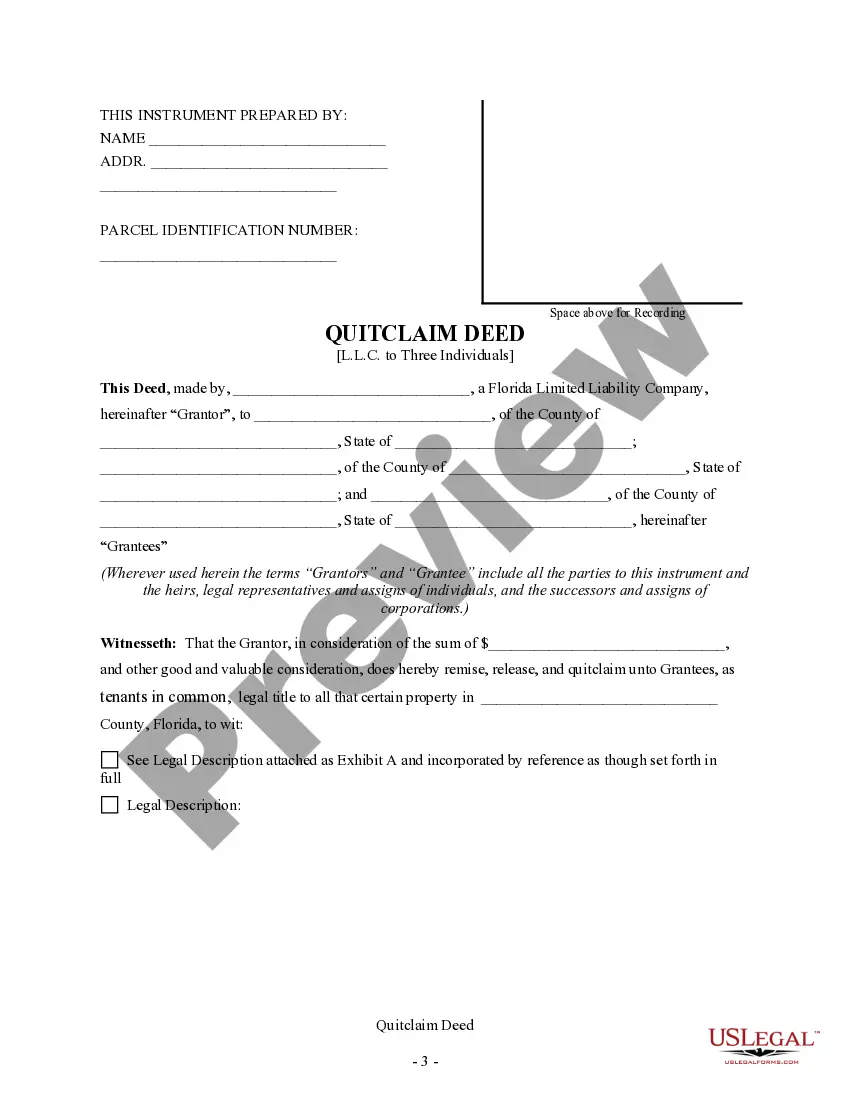

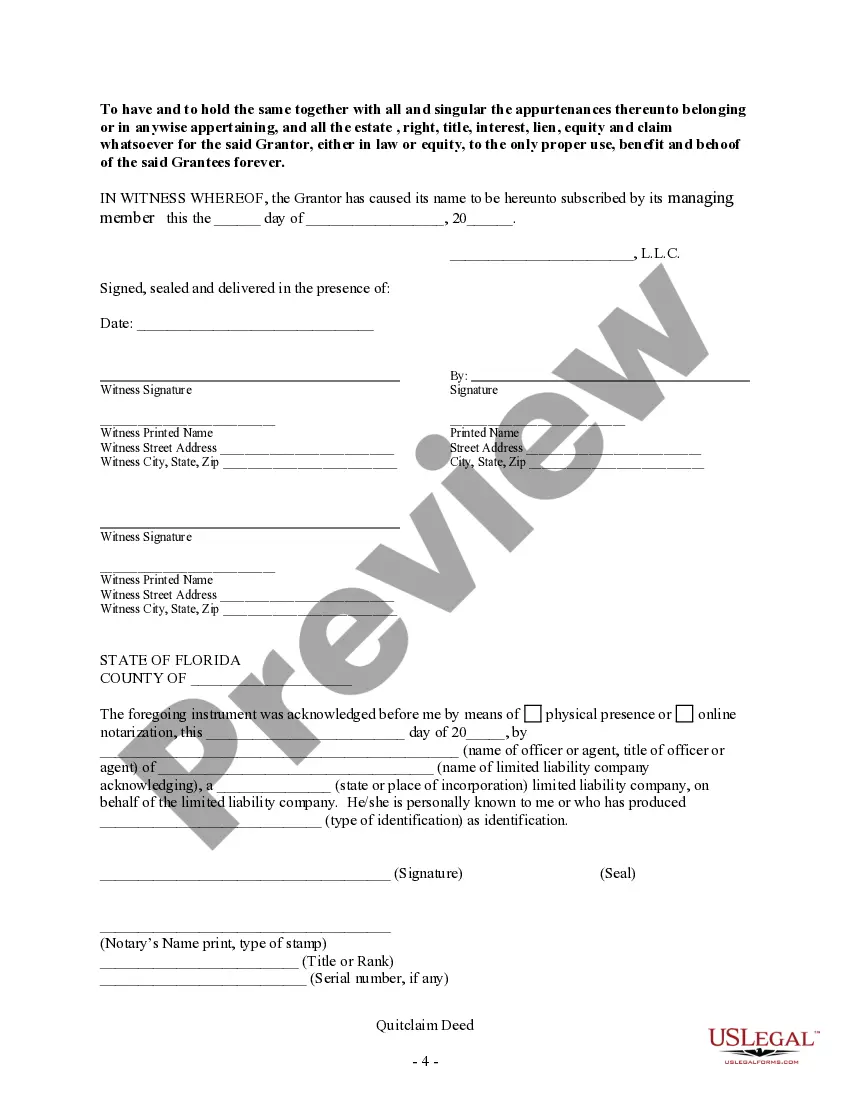

This form is a Quitclaim Deed where the grantor is a limited liability company and the grantees are three individuals. Grantors convey and quitclaim the described property to grantee. The grantees take the property as tenants in common or as joint tenants with the right of survivorship. This deed complies with all state statutory laws.

A Miami-Dade Florida Quitclaim Deed — Limited Liability Company to Three Individuals is a legal document that transfers the ownership interest of a property from a limited liability company (LLC) to three specific individuals, known as grantees. This type of deed is commonly used in real estate transactions within the Miami-Dade County, Florida jurisdiction. Key elements of this deed include the identification of the LLC as the granter (the party transferring the property) and the three individuals as the grantees (the parties receiving the property). The deed should also specify the legal description of the property in detail, including the street address, this ensures accuracy and clarity. It is worth mentioning that different types of Miami-Dade Florida Quitclaim Deed — Limited Liability Company to Three Individuals may arise depending on various factors, such as the nature of the property or the intentions behind the transfer. Here are a few examples: 1. Residential Property Quitclaim Deed: This type of Miami-Dade Florida Quitclaim Deed — Limited Liability Company to Three Individuals specifically pertains to the transfer of ownership of residential properties, such as single-family homes, condos, or townhouses. These deeds may vary slightly depending on the specifics of the property involved. 2. Commercial Property Quitclaim Deed: Commercial properties, such as office buildings, retail spaces, or industrial facilities, require a specialized Miami-Dade Florida Quitclaim Deed — Limited Liability Company to Three Individuals for their transfer. The legal language and clauses within this deed may differ to cater to the unique aspects of commercial real estate transactions. 3. Investment or Rental Property Quitclaim Deed: When an LLC decides to transfer ownership of an investment property or a rental property to three individuals, a dedicated Miami-Dade Florida Quitclaim Deed — Limited Liability Company to Three Individuals will be utilized. This deed will likely include provisions related to rental agreements, leases, or any ongoing tenant obligations. Whether it is a residential, commercial, or investment property, the Miami-Dade Florida Quitclaim Deed — Limited Liability Company to Three Individuals serves as a legally binding instrument to facilitate the transfer of ownership. It is crucial for all parties involved to seek professional legal advice to ensure compliance with local laws and regulations.