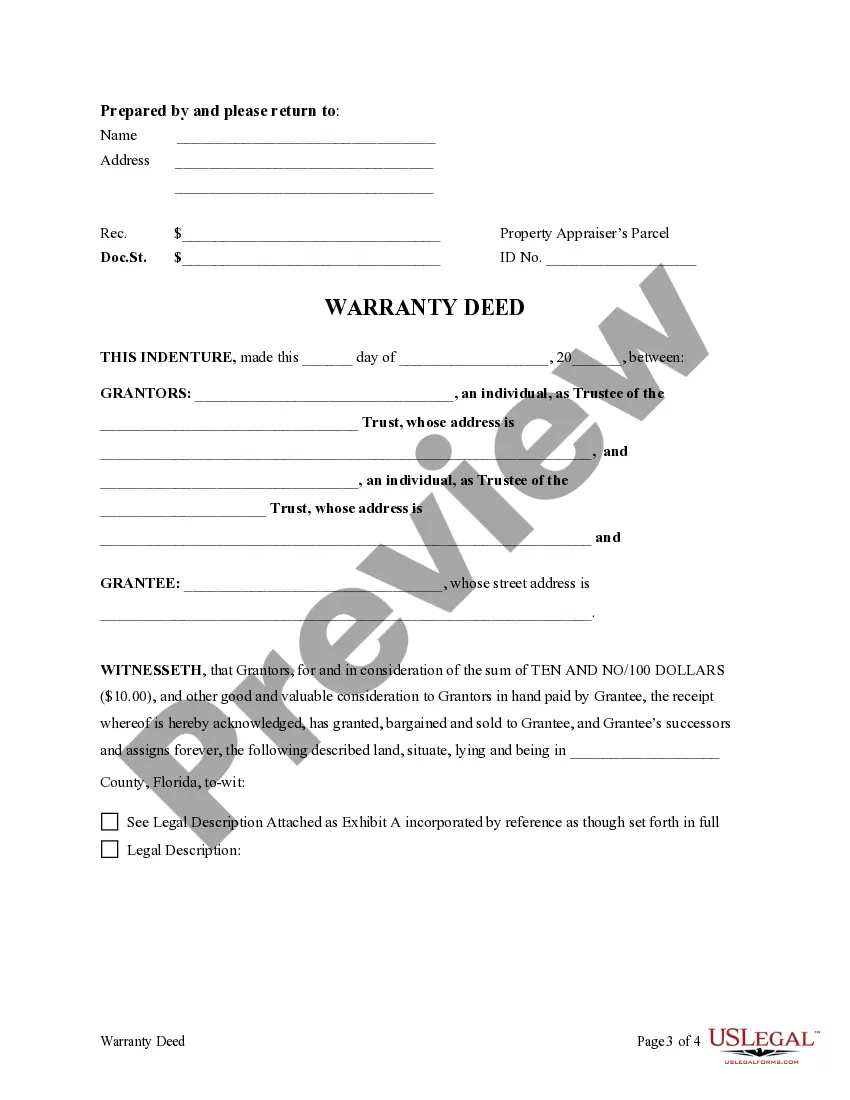

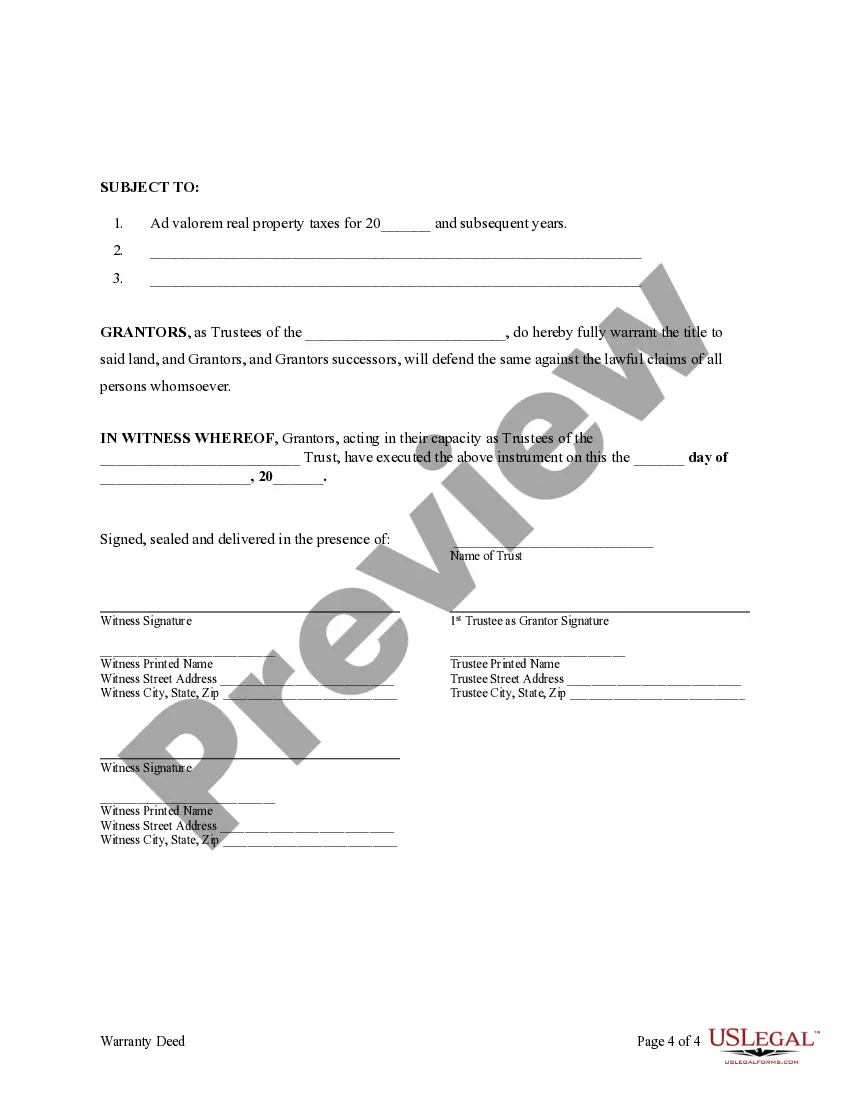

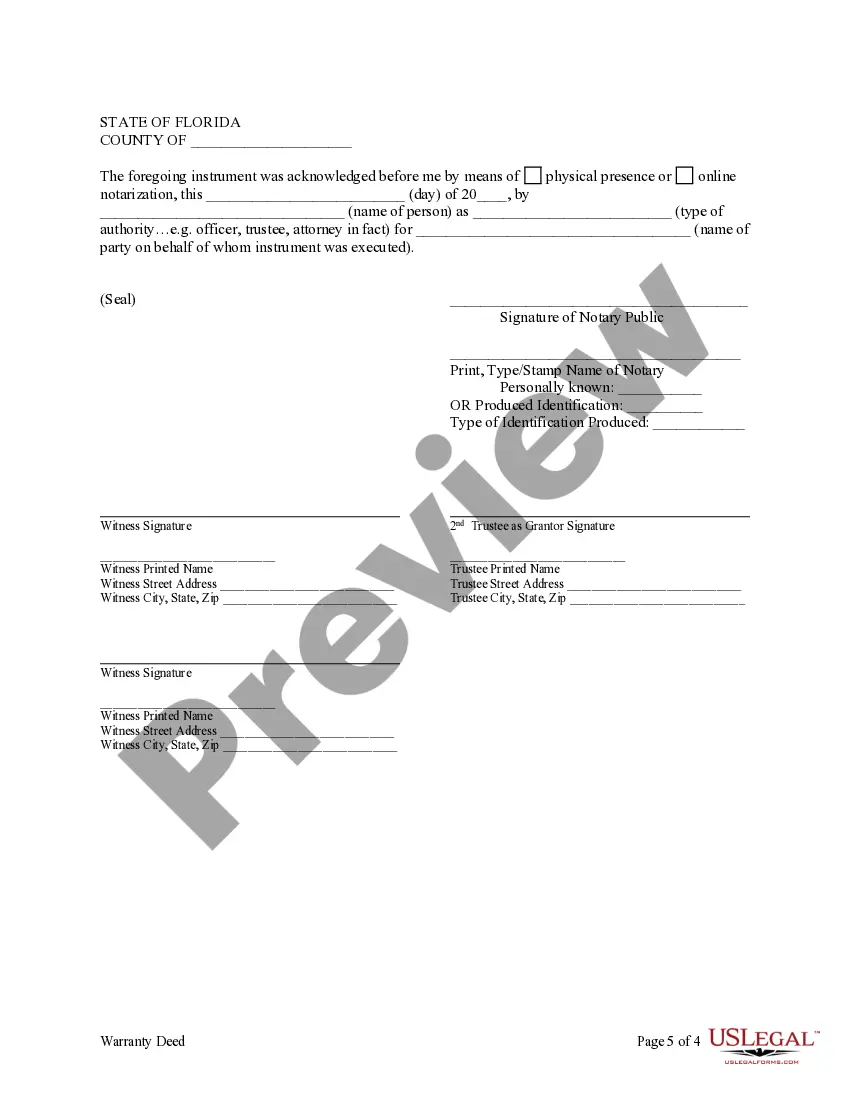

This form is a Warranty Deed where the Grantor is a Trust acting through two individual Trustees and the Grantee is an idividual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Coral Springs Florida Trust — Two Individual Trustee— - to an Individual is a specific type of trust created under Florida law. In this type of trust, two individual trustees are appointed to oversee the trust's assets and administer them in accordance with the granter's (the person who creates the trust) instructions. The primary purpose of such a trust is to ensure the efficient management and distribution of assets to a designated individual beneficiary. The Coral Springs Florida Trust — Two Individual Trustee— - to an Individual offers several benefits. Firstly, by appointing two trustees, it provides an additional layer of accountability and reduces the potential for mismanagement or abuse of the trust assets. Secondly, having two trustees ensures collaborative decision-making and can provide added expertise and perspectives. Additionally, this type of trust allows for the distribution of assets to be more closely tailored to the beneficiary's specific needs and circumstances. Within the broader category of Coral Springs Florida Trust — Two Individual Trustee— - to an Individual, there can be different subtypes based on specific conditions or provisions. Some common variations include: 1. Revocable Living Trust: This type of trust allows the granter to make changes, modifications, or even revoke the trust entirely during their lifetime. It provides flexibility and avoids the need for probate upon the granter's death. 2. Irrevocable Trust: In contrast to a revocable trust, an irrevocable trust cannot be altered or terminated without the consent of the beneficiaries. This type of trust provides tax advantages and asset protection, making it an attractive option for long-term estate planning. 3. Special Needs Trust: This trust is designed to provide financial support to individuals with disabilities without jeopardizing their eligibility for government assistance programs. It ensures that the beneficiary's needs are met while safeguarding their access to essential benefits. 4. Testamentary Trust: This type of trust is established through a will and only takes effect upon the granter's death. It allows the granter to designate specific assets and distribute them as per their wishes, providing continuity and control over the management and distribution of assets postmortem. Creating a Coral Springs Florida Trust — Two Individual Trustee— - to an Individual requires careful consideration and consultation with legal professionals experienced in trust and estate planning. The specific terms and provisions of the trust can be customized to meet individual needs and goals, ensuring a smooth transition of assets and securing the financial well-being of the beneficiary.