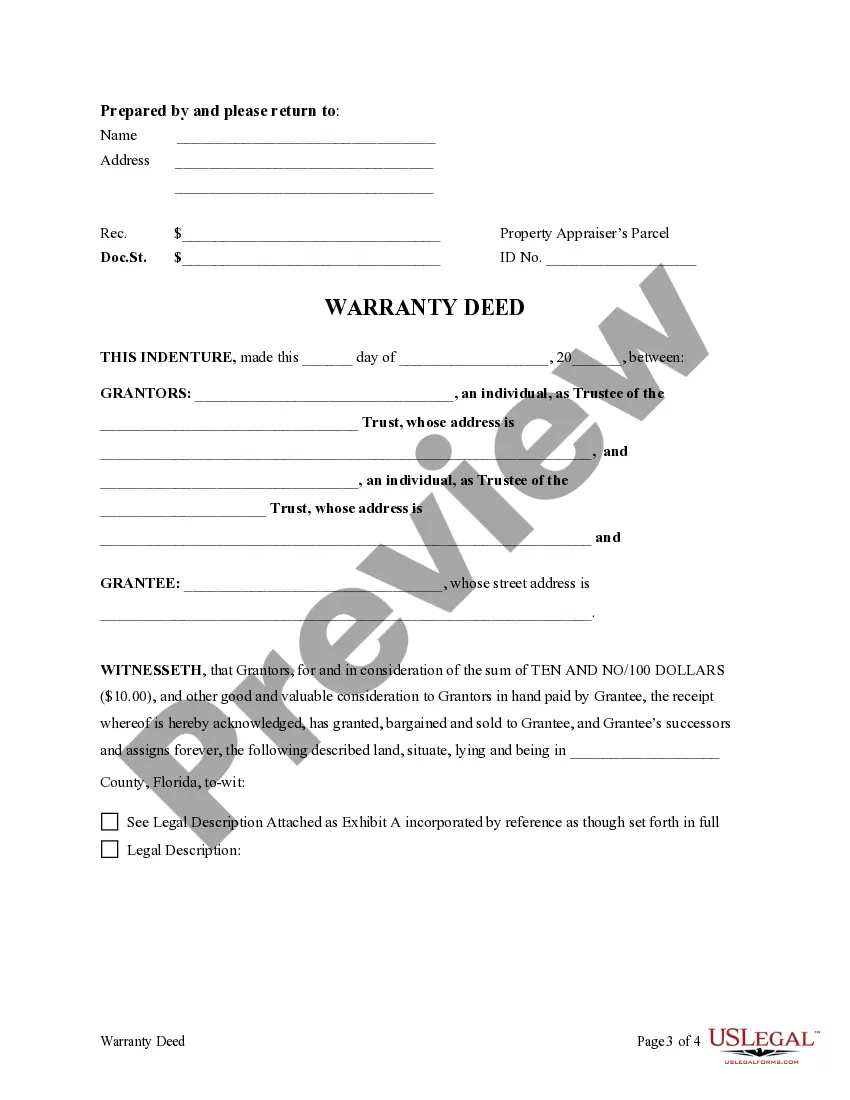

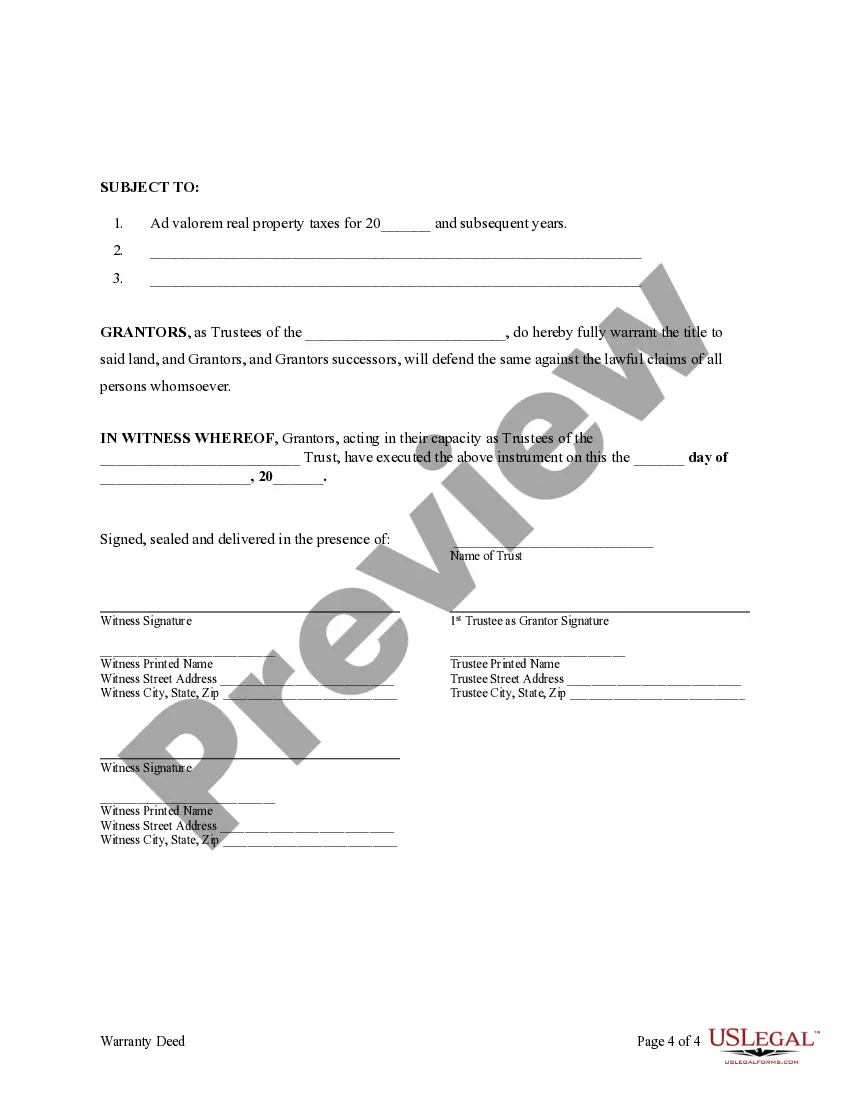

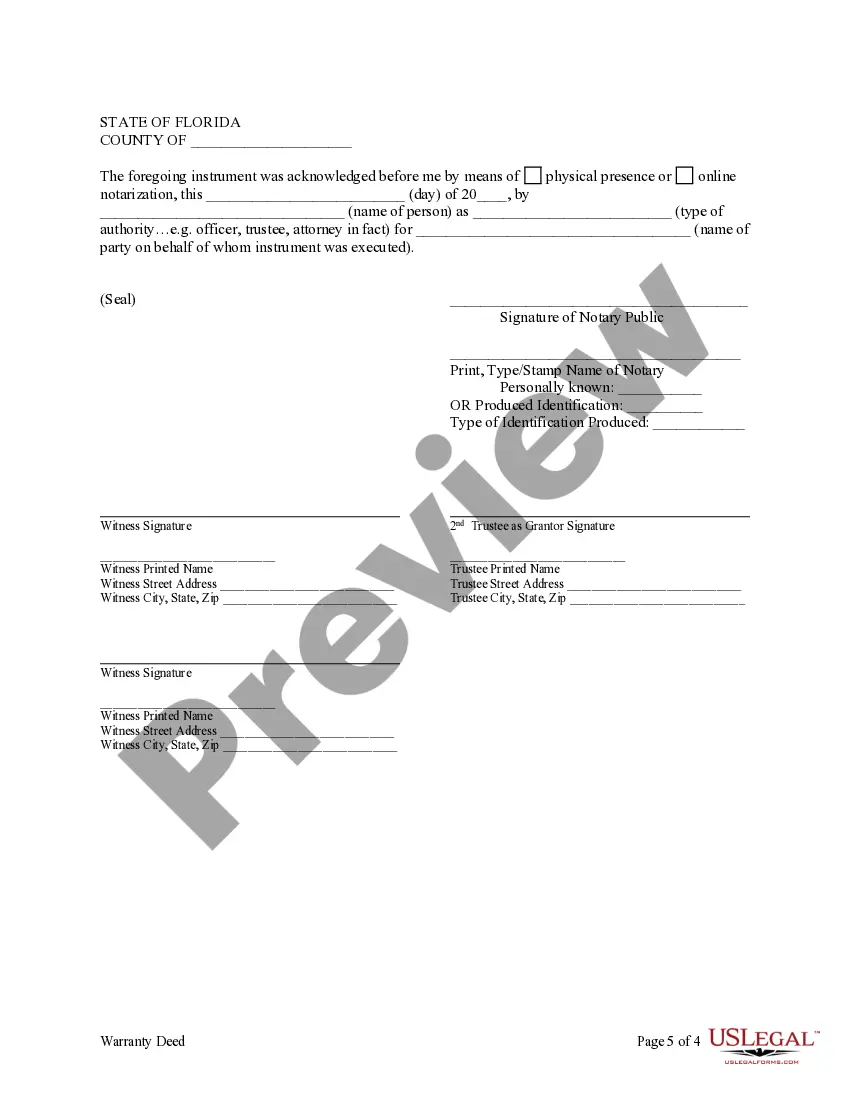

This form is a Warranty Deed where the Grantor is a Trust acting through two individual Trustees and the Grantee is an idividual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

A Gainesville Florida Trust with Two Individual Trustees is a legally binding arrangement in which two trustees are appointed to manage assets and property on behalf of an individual, usually referred to as the settler or granter. This type of trust is commonly utilized by individuals in Gainesville, Florida, seeking to ensure effective management and distribution of their assets while providing flexibility and control. The role of a trustee in this trust structure is crucial, as they hold legal title to the assets and are entrusted to act in the best interest of the settler and beneficiaries. In the case of a Gainesville Florida Trust with Two Individual Trustees, the accountability and decision-making power is shared between the two trustees, ensuring transparency and checks and balances. There are various types of Gainesville Florida Trust — Two Individual Trustee— - to an Individual, each offering different features to meet specific needs: 1. Revocable Trust: This type of trust allows the granter to make changes, amendments, or revoke the trust at any time during their lifetime. It provides flexibility to modify beneficiaries, distribution plans, or appoint new trustees according to changing circumstances. 2. Irrevocable Trust: Unlike a revocable trust, an irrevocable trust cannot be modified or revoked after it is created, unless specific conditions are met. It offers greater asset protection, tax benefits, and ensures the secure distribution of assets as per the granter's wishes. 3. Living Trust: Also known as an inter vivos trust, a living trust is established during the granter's lifetime and becomes effective immediately. It allows for the smooth transfer of assets outside of probate, ensuring privacy and reducing administrative costs. 4. Testamentary Trust: This trust is created through a will and becomes effective upon the death of the granter. The two individual trustees named in they will then assume their fiduciary role, managing and distributing the assets according to the settler's instructions. 5. Special Needs Trust: This type of trust is designed to provide financial support and care for individuals with disabilities or special needs while preserving their eligibility for government benefits. The trustees play a crucial role in managing and disbursing funds to meet the beneficiary's unique requirements. Overall, a Gainesville Florida Trust with Two Individual Trustees offers individuals the peace of mind that their assets will be managed appropriately and transferred seamlessly to designated beneficiaries. The specific type of trust chosen depends on the granter's circumstances, goals, and desires for asset protection, taxation, and the efficient management of their estate.A Gainesville Florida Trust with Two Individual Trustees is a legally binding arrangement in which two trustees are appointed to manage assets and property on behalf of an individual, usually referred to as the settler or granter. This type of trust is commonly utilized by individuals in Gainesville, Florida, seeking to ensure effective management and distribution of their assets while providing flexibility and control. The role of a trustee in this trust structure is crucial, as they hold legal title to the assets and are entrusted to act in the best interest of the settler and beneficiaries. In the case of a Gainesville Florida Trust with Two Individual Trustees, the accountability and decision-making power is shared between the two trustees, ensuring transparency and checks and balances. There are various types of Gainesville Florida Trust — Two Individual Trustee— - to an Individual, each offering different features to meet specific needs: 1. Revocable Trust: This type of trust allows the granter to make changes, amendments, or revoke the trust at any time during their lifetime. It provides flexibility to modify beneficiaries, distribution plans, or appoint new trustees according to changing circumstances. 2. Irrevocable Trust: Unlike a revocable trust, an irrevocable trust cannot be modified or revoked after it is created, unless specific conditions are met. It offers greater asset protection, tax benefits, and ensures the secure distribution of assets as per the granter's wishes. 3. Living Trust: Also known as an inter vivos trust, a living trust is established during the granter's lifetime and becomes effective immediately. It allows for the smooth transfer of assets outside of probate, ensuring privacy and reducing administrative costs. 4. Testamentary Trust: This trust is created through a will and becomes effective upon the death of the granter. The two individual trustees named in they will then assume their fiduciary role, managing and distributing the assets according to the settler's instructions. 5. Special Needs Trust: This type of trust is designed to provide financial support and care for individuals with disabilities or special needs while preserving their eligibility for government benefits. The trustees play a crucial role in managing and disbursing funds to meet the beneficiary's unique requirements. Overall, a Gainesville Florida Trust with Two Individual Trustees offers individuals the peace of mind that their assets will be managed appropriately and transferred seamlessly to designated beneficiaries. The specific type of trust chosen depends on the granter's circumstances, goals, and desires for asset protection, taxation, and the efficient management of their estate.