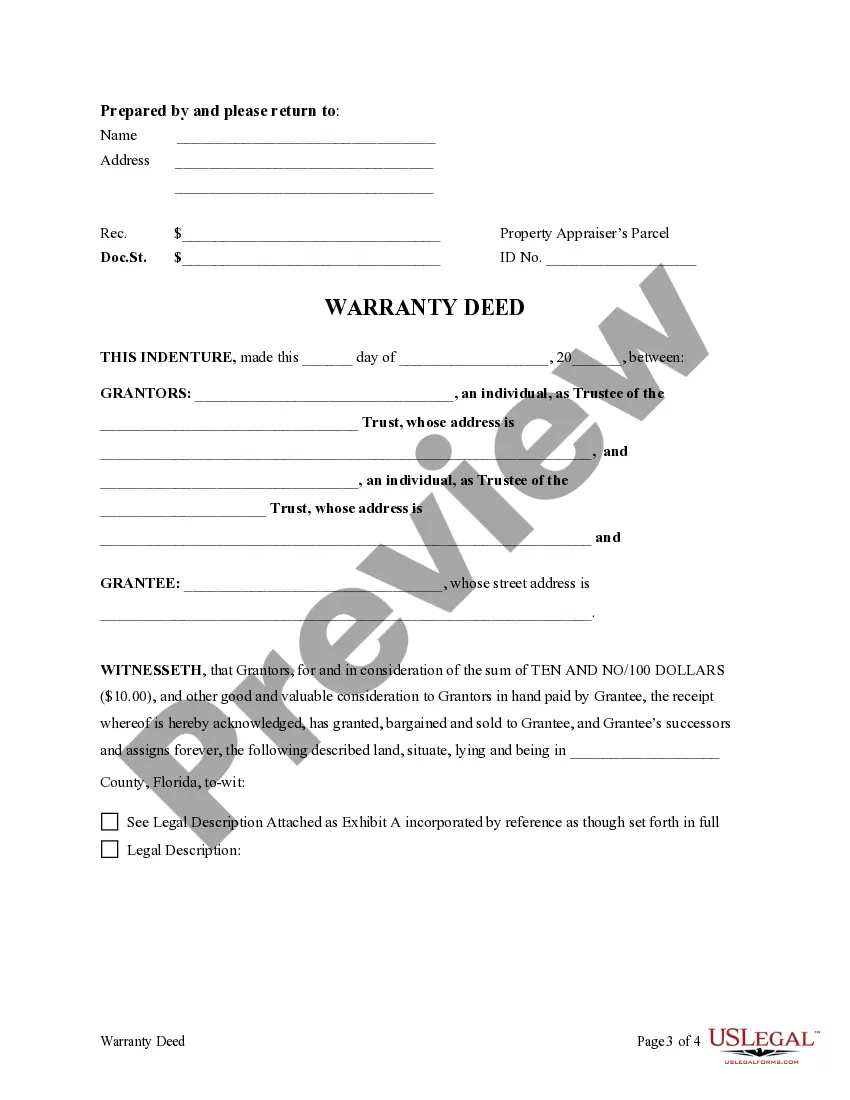

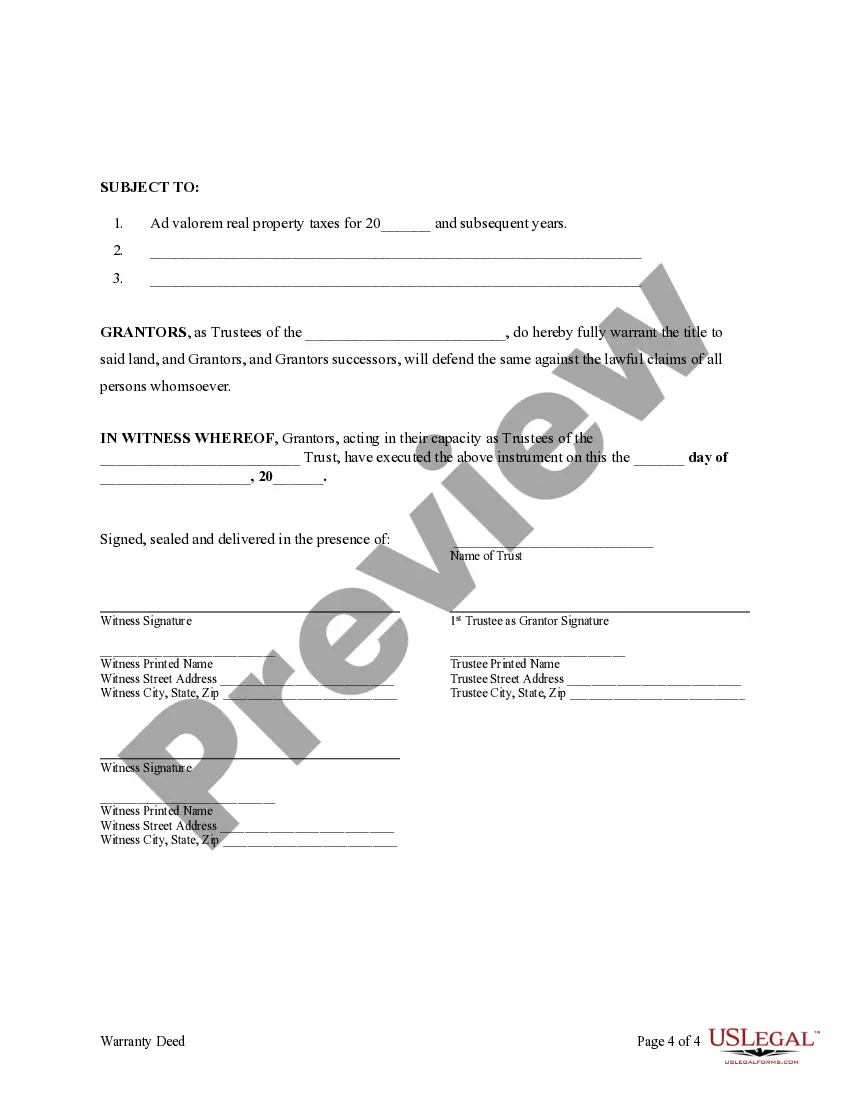

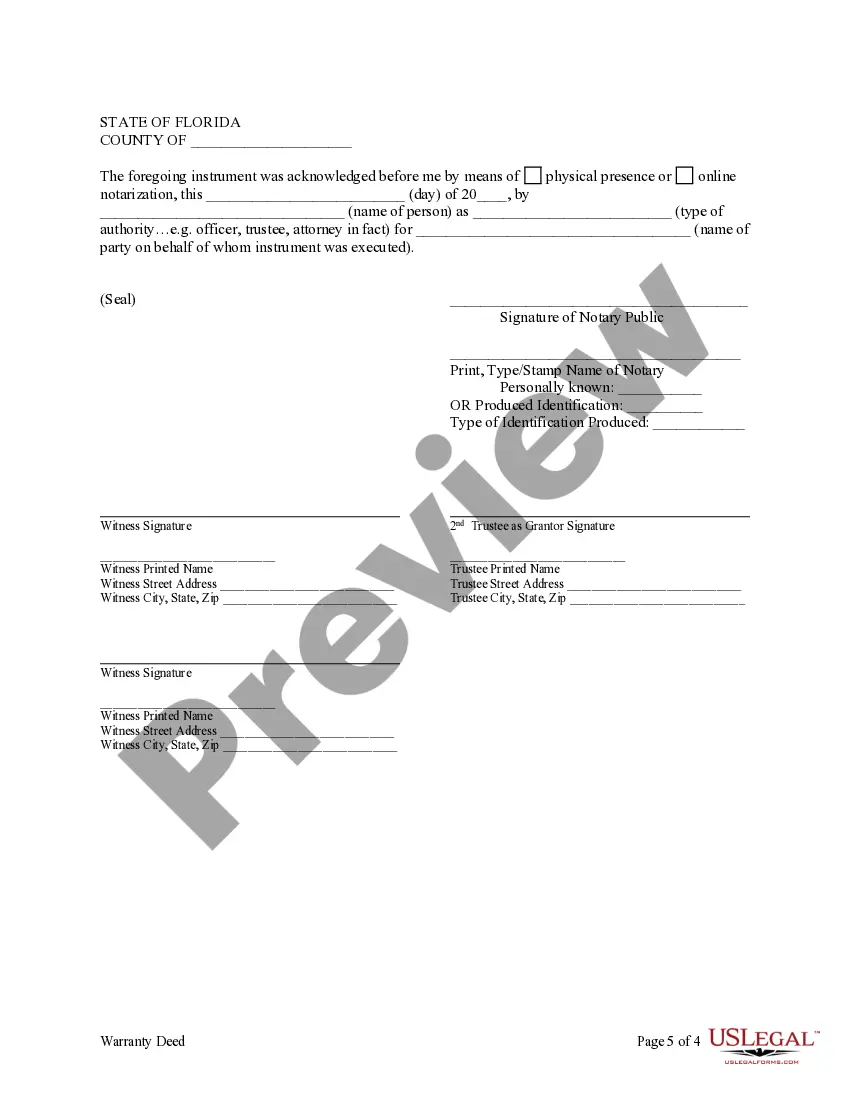

This form is a Warranty Deed where the Grantor is a Trust acting through two individual Trustees and the Grantee is an idividual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Title: Understanding Lakeland Florida Trust — Two Individual Trustee— - to an Individual: A Comprehensive Overview Description: A Lakeland Florida Trust with two individual trustees to an individual is an estate planning tool designed to provide individuals in Lakeland, Florida, with a reliable and effective way to protect their assets, manage their wealth, and ensure the smooth transfer of assets to beneficiaries upon their passing. This type of trust is familiarly known as a "Living Trust" or "Revocable Trust". Two Individual Trustees: In this specific trust arrangement, two individual trustees are appointed to oversee the trust and carry out the provisions set forth by the granter (the person creating the trust). Typically, these trustees are trusted individuals, such as family members or close friends, who are responsible for managing and distributing the assets included in the trust according to the granter's wishes. Benefits of a Lakeland Florida Trust: By establishing a Lakeland Florida Trust with two individual trustees, the granter can enjoy several advantages tailored to their specific circumstances. These benefits include: 1. Asset Protection: Placing assets in a trust helps protect them from potential creditors and legal claims, ensuring they are preserved for designated beneficiaries. 2. Privacy: Unlike a will, a trust allows the transfer of assets to remain private and avoids probate court, allowing for a more discreet distribution of assets. 3. Efficient Estate Administration: In the event of the granter's incapacitation or passing, having two trustees allows for the seamless administration and management of a trust, reducing the risk of delays or disputes commonly associated with single trustee arrangements. 4. Flexibility: A Lakeland Florida Trust can be customized to meet the unique needs and objectives of the granter, including provisions for charitable donations, specific asset distributions, or regular income payments. Different Types of Lakeland Florida Trust — Two Individual Trustees: Within the realm of Lakeland Florida Trusts with two individual trustees, different types may be used based on the individual's specific requirements and financial goals. Some common variations include: 1. Irrevocable Trust: This type of trust, once established, cannot be modified or terminated without the permission of the beneficiaries. It provides enhanced asset protection and more favorable tax planning options. 2. Special Needs Trust: Tailored for individuals with disabilities, a special needs trust ensures that the beneficiary's government benefits are not compromised while providing for their supplementary needs and care. 3. Granter Retained Annuity Trust (GREAT): Great allows the granter to transfer assets to the trust while retaining an income stream for a specified period. It serves as an effective estate planning strategy for reducing estate taxes. 4. Charitable Remainder Trust (CRT): This type of trust allows the granter to make a charitable donation during their lifetime while retaining an income stream from the trust's assets. It offers potential income tax deductions and estate tax benefits. In summary, a Lakeland Florida Trust with two individual trustees to an individual allows residents of Lakeland, Florida, to exercise control over the management and distribution of their assets according to their wishes, ensuring a smooth transfer of wealth and the preservation of their legacy. By selecting the appropriate type of trust and trustees, individuals can craft a comprehensive estate plan aligned with their unique financial goals and preferences.Title: Understanding Lakeland Florida Trust — Two Individual Trustee— - to an Individual: A Comprehensive Overview Description: A Lakeland Florida Trust with two individual trustees to an individual is an estate planning tool designed to provide individuals in Lakeland, Florida, with a reliable and effective way to protect their assets, manage their wealth, and ensure the smooth transfer of assets to beneficiaries upon their passing. This type of trust is familiarly known as a "Living Trust" or "Revocable Trust". Two Individual Trustees: In this specific trust arrangement, two individual trustees are appointed to oversee the trust and carry out the provisions set forth by the granter (the person creating the trust). Typically, these trustees are trusted individuals, such as family members or close friends, who are responsible for managing and distributing the assets included in the trust according to the granter's wishes. Benefits of a Lakeland Florida Trust: By establishing a Lakeland Florida Trust with two individual trustees, the granter can enjoy several advantages tailored to their specific circumstances. These benefits include: 1. Asset Protection: Placing assets in a trust helps protect them from potential creditors and legal claims, ensuring they are preserved for designated beneficiaries. 2. Privacy: Unlike a will, a trust allows the transfer of assets to remain private and avoids probate court, allowing for a more discreet distribution of assets. 3. Efficient Estate Administration: In the event of the granter's incapacitation or passing, having two trustees allows for the seamless administration and management of a trust, reducing the risk of delays or disputes commonly associated with single trustee arrangements. 4. Flexibility: A Lakeland Florida Trust can be customized to meet the unique needs and objectives of the granter, including provisions for charitable donations, specific asset distributions, or regular income payments. Different Types of Lakeland Florida Trust — Two Individual Trustees: Within the realm of Lakeland Florida Trusts with two individual trustees, different types may be used based on the individual's specific requirements and financial goals. Some common variations include: 1. Irrevocable Trust: This type of trust, once established, cannot be modified or terminated without the permission of the beneficiaries. It provides enhanced asset protection and more favorable tax planning options. 2. Special Needs Trust: Tailored for individuals with disabilities, a special needs trust ensures that the beneficiary's government benefits are not compromised while providing for their supplementary needs and care. 3. Granter Retained Annuity Trust (GREAT): Great allows the granter to transfer assets to the trust while retaining an income stream for a specified period. It serves as an effective estate planning strategy for reducing estate taxes. 4. Charitable Remainder Trust (CRT): This type of trust allows the granter to make a charitable donation during their lifetime while retaining an income stream from the trust's assets. It offers potential income tax deductions and estate tax benefits. In summary, a Lakeland Florida Trust with two individual trustees to an individual allows residents of Lakeland, Florida, to exercise control over the management and distribution of their assets according to their wishes, ensuring a smooth transfer of wealth and the preservation of their legacy. By selecting the appropriate type of trust and trustees, individuals can craft a comprehensive estate plan aligned with their unique financial goals and preferences.