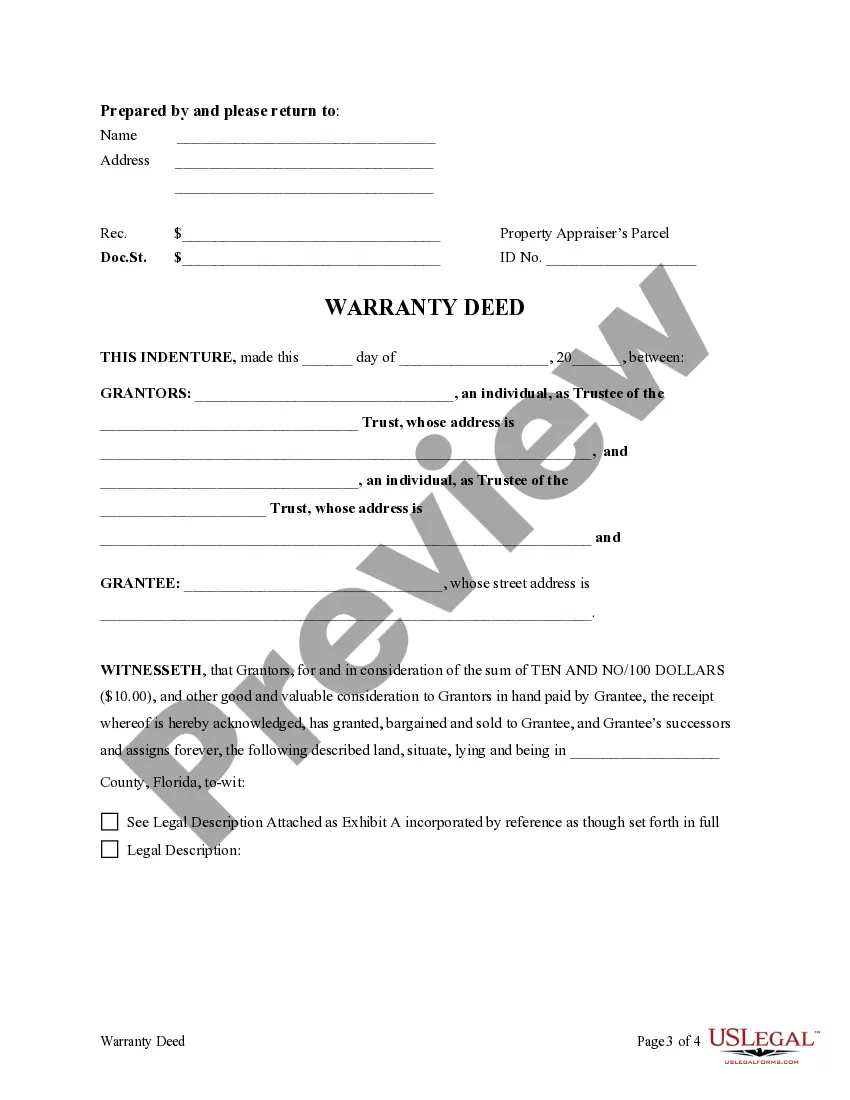

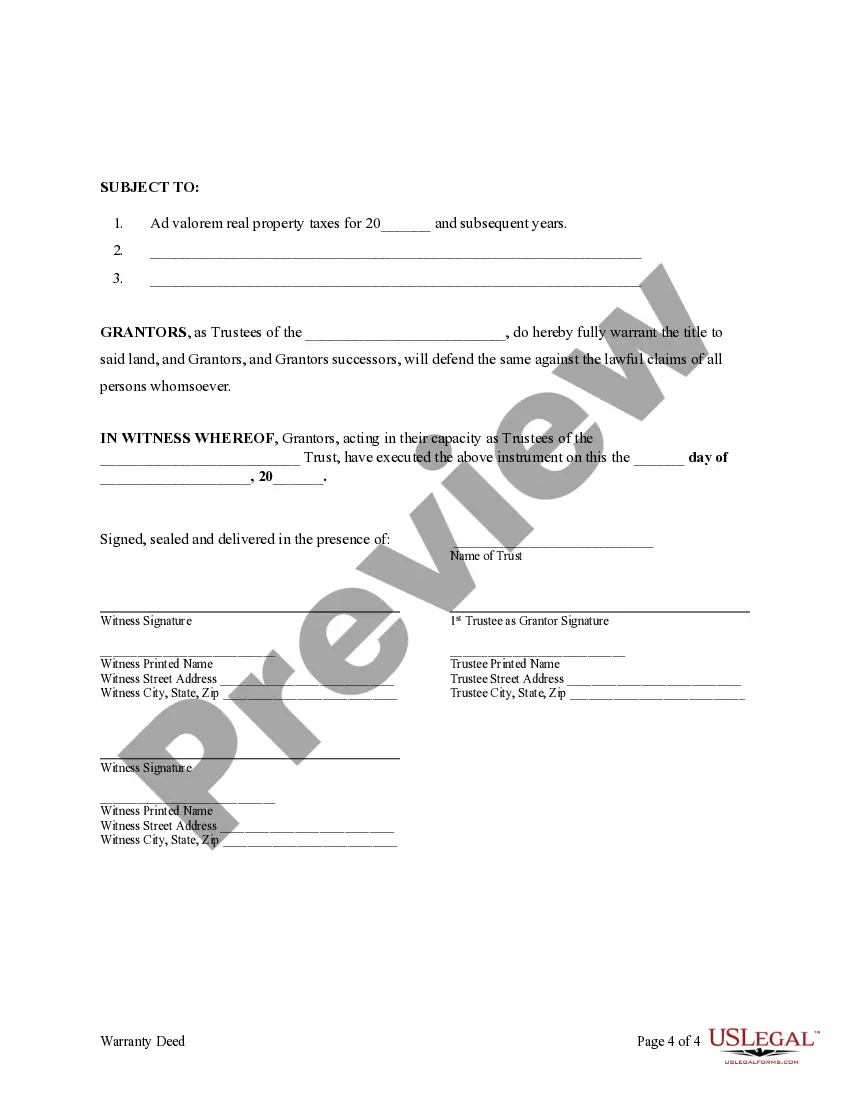

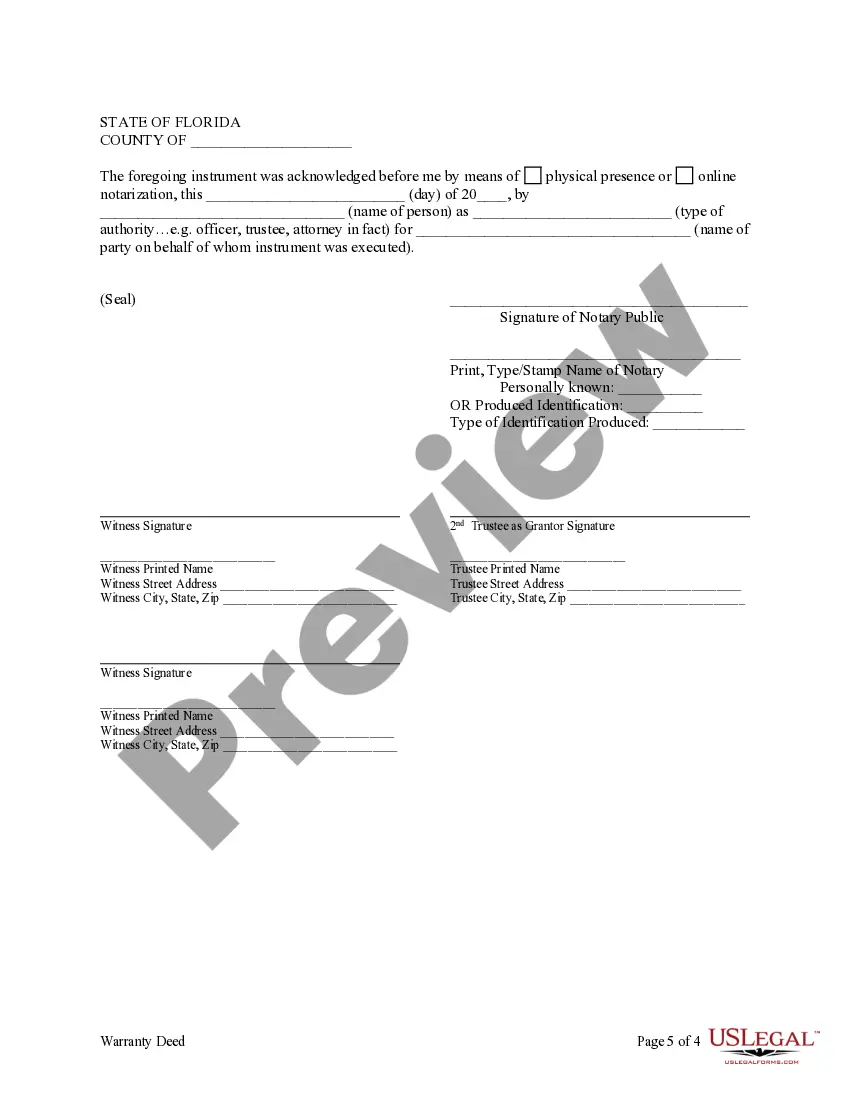

This form is a Warranty Deed where the Grantor is a Trust acting through two individual Trustees and the Grantee is an idividual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Miramar Florida Trust — Two Individual Trustee— - to an Individual In Miramar, Florida, a trust can be established with two individual trustees, serving the purpose of providing financial security and asset management for an individual beneficiary. This legal arrangement allows for the transfer and administration of assets under the fiduciary duty and responsibility of the trustees, ensuring that the beneficiary's interests are protected and their wishes are carried out. The two individual trustees are chosen to jointly manage the trust, bringing different perspectives, skills, and expertise to the table. They are entrusted with making financial decisions, managing investments, distributing funds, and handling any legal or administrative matters related to the trust. Important keywords related to Miramar Florida Trust — Two Individual Trustee— - to an Individual include: 1. Trust: A legal arrangement in which assets are transferred to designated trustees for the benefit of a beneficiary. 2. Miramar, Florida: The specific location where the trust is established, indicating the jurisdiction and legal regulations applicable to the trust. 3. Individual Trustees: Two individuals selected to oversee and manage the trust's assets and affairs. They act in a fiduciary capacity, putting the beneficiary's interests first. 4. Beneficiary: The individual for whom the trust is established, entitled to receive the benefits and assets held within the trust according to its terms. 5. Asset Management: The process of overseeing and managing the financial assets held within the trust, including investments, property, and other valuables. 6. Fiduciary Duty: The legal obligation of the trustees to act in the best interest of the beneficiary, ensuring loyalty, prudence, and good faith in managing the trust. 7. Financial Security: The primary goal of the trust, providing the beneficiary with a stable and protected financial future through careful management and distribution of the trust's assets. 8. Legal and Administrative Matters: Tasks and responsibilities pertaining to the trust, such as preparing legal documentation, filing tax returns, ensuring compliance with legal requirements, and resolving any disputes that may arise. Different types of Miramar Florida Trust — Two Individual Trustee— - to an Individual could include Irrevocable Trusts, Revocable Trusts, Living Trusts, Testamentary Trusts, Charitable Trusts, Special Needs Trusts, and Family Trusts. Each type of trust serves various purposes and has specific legal implications and requirements. Overall, the Miramar Florida Trust — Two Individual Trustee— - to an Individual offers a personalized and efficient approach to asset management and financial security, with the trustees acting faithfully to protect the beneficiary's interests and fulfill the intentions of the trust.Miramar Florida Trust — Two Individual Trustee— - to an Individual In Miramar, Florida, a trust can be established with two individual trustees, serving the purpose of providing financial security and asset management for an individual beneficiary. This legal arrangement allows for the transfer and administration of assets under the fiduciary duty and responsibility of the trustees, ensuring that the beneficiary's interests are protected and their wishes are carried out. The two individual trustees are chosen to jointly manage the trust, bringing different perspectives, skills, and expertise to the table. They are entrusted with making financial decisions, managing investments, distributing funds, and handling any legal or administrative matters related to the trust. Important keywords related to Miramar Florida Trust — Two Individual Trustee— - to an Individual include: 1. Trust: A legal arrangement in which assets are transferred to designated trustees for the benefit of a beneficiary. 2. Miramar, Florida: The specific location where the trust is established, indicating the jurisdiction and legal regulations applicable to the trust. 3. Individual Trustees: Two individuals selected to oversee and manage the trust's assets and affairs. They act in a fiduciary capacity, putting the beneficiary's interests first. 4. Beneficiary: The individual for whom the trust is established, entitled to receive the benefits and assets held within the trust according to its terms. 5. Asset Management: The process of overseeing and managing the financial assets held within the trust, including investments, property, and other valuables. 6. Fiduciary Duty: The legal obligation of the trustees to act in the best interest of the beneficiary, ensuring loyalty, prudence, and good faith in managing the trust. 7. Financial Security: The primary goal of the trust, providing the beneficiary with a stable and protected financial future through careful management and distribution of the trust's assets. 8. Legal and Administrative Matters: Tasks and responsibilities pertaining to the trust, such as preparing legal documentation, filing tax returns, ensuring compliance with legal requirements, and resolving any disputes that may arise. Different types of Miramar Florida Trust — Two Individual Trustee— - to an Individual could include Irrevocable Trusts, Revocable Trusts, Living Trusts, Testamentary Trusts, Charitable Trusts, Special Needs Trusts, and Family Trusts. Each type of trust serves various purposes and has specific legal implications and requirements. Overall, the Miramar Florida Trust — Two Individual Trustee— - to an Individual offers a personalized and efficient approach to asset management and financial security, with the trustees acting faithfully to protect the beneficiary's interests and fulfill the intentions of the trust.