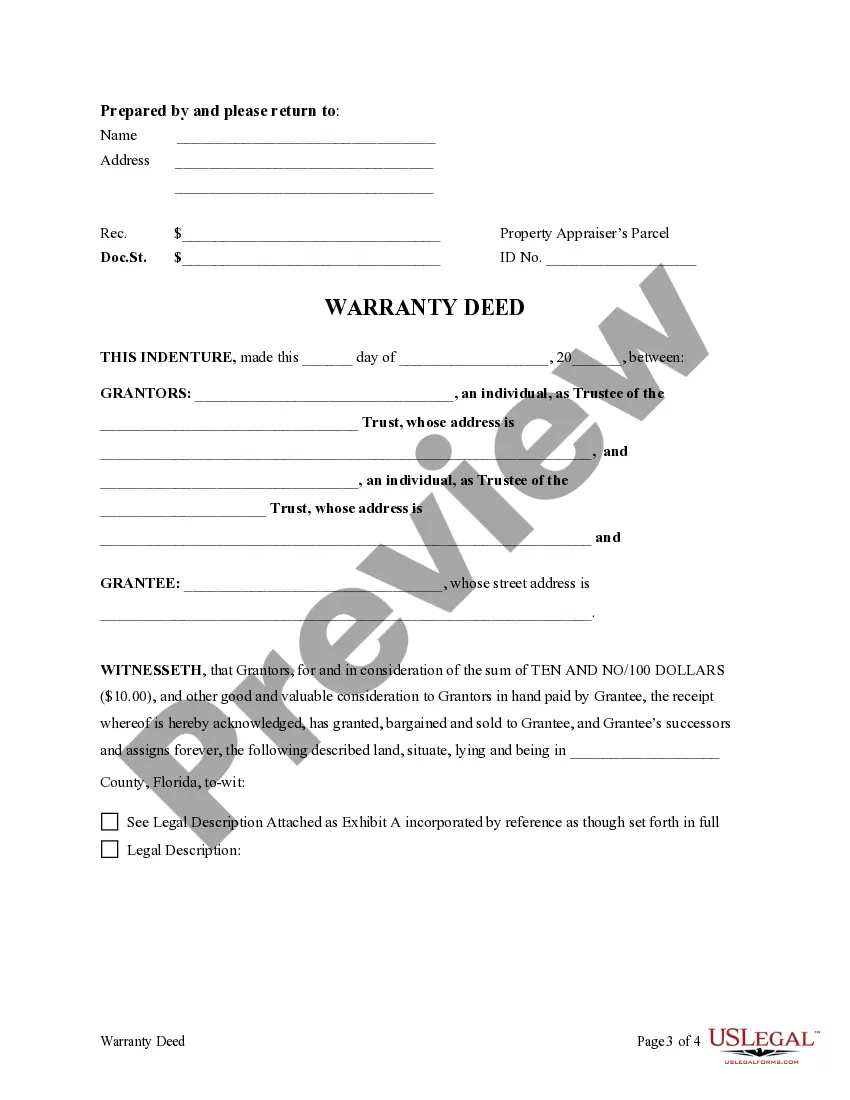

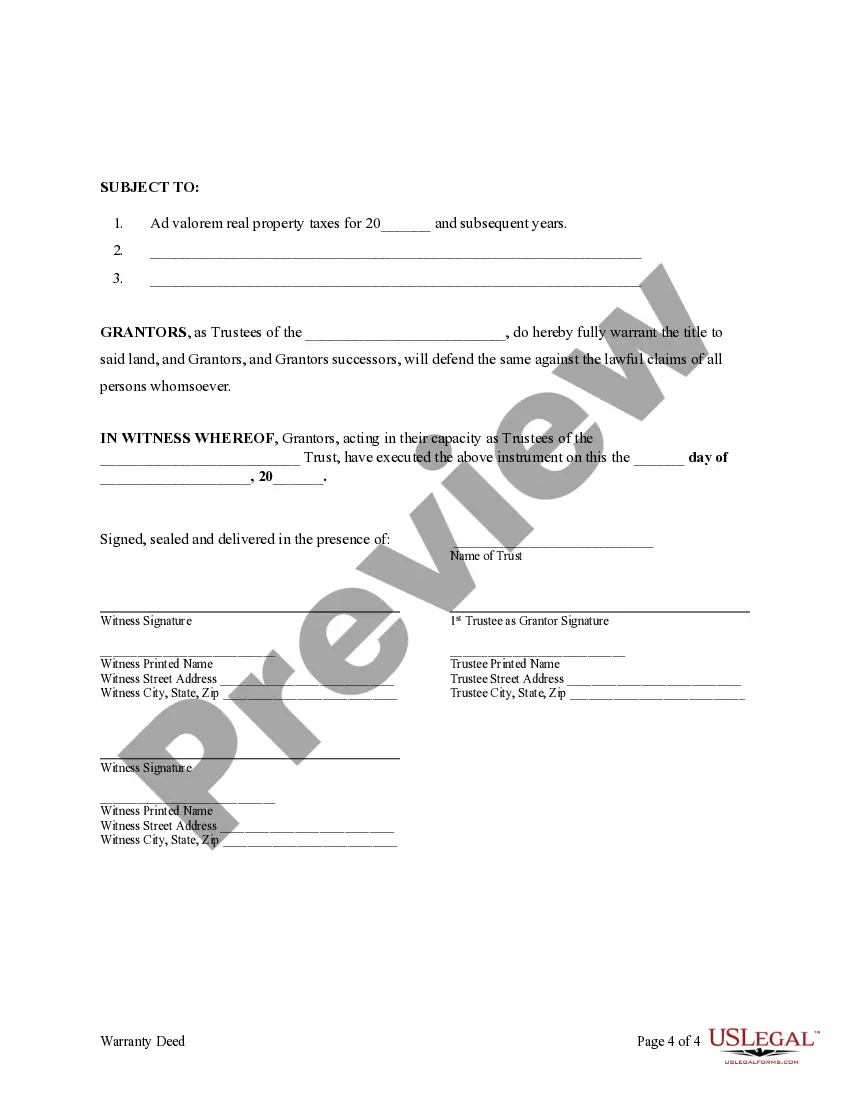

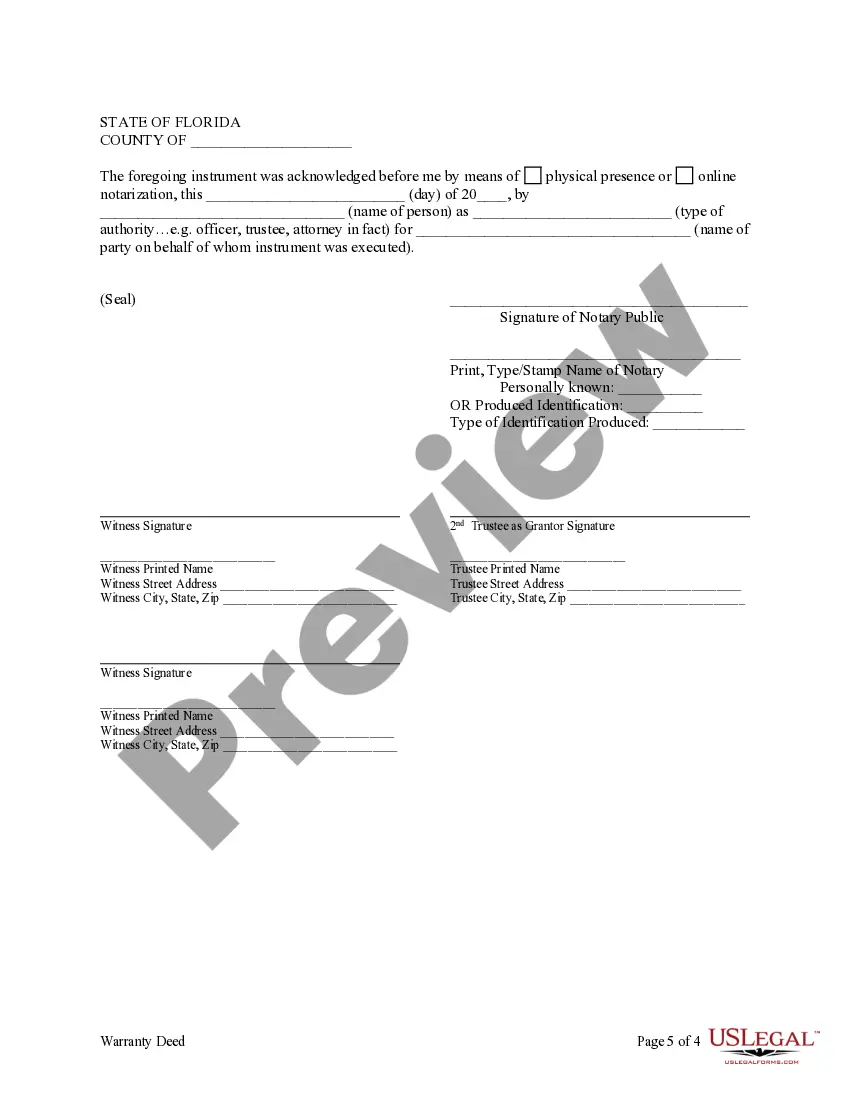

This form is a Warranty Deed where the Grantor is a Trust acting through two individual Trustees and the Grantee is an idividual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Orange Florida Trust — Two Individual Trustee— - to an Individual is a type of trust agreement commonly used in the state of Florida, where two individuals are appointed as trustees to manage and administer the assets and property held within the trust for the benefit of a single individual, referred to as the beneficiary. This trust arrangement provides a structured and legally binding framework to ensure the effective transfer and preservation of assets while safeguarding the interests of the beneficiary. The Orange Florida Trust — Two Individual Trustee— - to an Individual offers several advantages to both the trustees and the beneficiary. First, it allows for a diverse range of expertise, as two trustees bring their individual knowledge and skills to effectively manage and distribute the trust assets. This ensures that the beneficiary's financial and personal needs are adequately addressed. Secondly, by appointing two trustees, the trust is protected against any unexpected circumstances that may arise, such as the disability or death of one trustee. In such cases, the remaining trustee can continue to manage the trust and ensure the smooth execution of its terms. Furthermore, this trust arrangement provides flexibility in decision-making, as both trustees must agree on important matters before any action is taken. This ensures that the beneficiary's interests are always considered, minimizing the risk of mismanagement or disputes between trustees. There are various types of Orange Florida Trust — Two Individual Trustee— - to an Individual, each designed to cater to specific needs and requirements. Some common examples include: 1. Revocable Living Trust: This allows the individual (granter) to retain control over the trust during their lifetime and make changes or revoke it if desired. Upon the granter's death, the trust becomes irrevocable, and the appointed trustees take over the management and distribution of assets to the beneficiary. 2. Irrevocable Trust: Unlike the revocable living trust, this type of trust cannot be modified or revoked by the granter once it is established. The assets transferred to the trust are permanently removed from the granter's estate, offering potential tax benefits, creditor protection, and preservation of asset values. 3. Special Needs Trust: This trust is specifically created to provide financial support and management of assets for individuals with special needs or disabilities. It allows the beneficiary to receive necessary government benefits while still benefiting from the trust assets. In conclusion, Orange Florida Trust — Two Individual Trustee— - to an Individual is a versatile trust arrangement that enables effective management, preservation, and distribution of assets for the benefit of a single individual. It offers flexibility, diversification of skills, and protection against unforeseen circumstances, ensuring the beneficiary's best interests are always kept at the forefront.Orange Florida Trust — Two Individual Trustee— - to an Individual is a type of trust agreement commonly used in the state of Florida, where two individuals are appointed as trustees to manage and administer the assets and property held within the trust for the benefit of a single individual, referred to as the beneficiary. This trust arrangement provides a structured and legally binding framework to ensure the effective transfer and preservation of assets while safeguarding the interests of the beneficiary. The Orange Florida Trust — Two Individual Trustee— - to an Individual offers several advantages to both the trustees and the beneficiary. First, it allows for a diverse range of expertise, as two trustees bring their individual knowledge and skills to effectively manage and distribute the trust assets. This ensures that the beneficiary's financial and personal needs are adequately addressed. Secondly, by appointing two trustees, the trust is protected against any unexpected circumstances that may arise, such as the disability or death of one trustee. In such cases, the remaining trustee can continue to manage the trust and ensure the smooth execution of its terms. Furthermore, this trust arrangement provides flexibility in decision-making, as both trustees must agree on important matters before any action is taken. This ensures that the beneficiary's interests are always considered, minimizing the risk of mismanagement or disputes between trustees. There are various types of Orange Florida Trust — Two Individual Trustee— - to an Individual, each designed to cater to specific needs and requirements. Some common examples include: 1. Revocable Living Trust: This allows the individual (granter) to retain control over the trust during their lifetime and make changes or revoke it if desired. Upon the granter's death, the trust becomes irrevocable, and the appointed trustees take over the management and distribution of assets to the beneficiary. 2. Irrevocable Trust: Unlike the revocable living trust, this type of trust cannot be modified or revoked by the granter once it is established. The assets transferred to the trust are permanently removed from the granter's estate, offering potential tax benefits, creditor protection, and preservation of asset values. 3. Special Needs Trust: This trust is specifically created to provide financial support and management of assets for individuals with special needs or disabilities. It allows the beneficiary to receive necessary government benefits while still benefiting from the trust assets. In conclusion, Orange Florida Trust — Two Individual Trustee— - to an Individual is a versatile trust arrangement that enables effective management, preservation, and distribution of assets for the benefit of a single individual. It offers flexibility, diversification of skills, and protection against unforeseen circumstances, ensuring the beneficiary's best interests are always kept at the forefront.