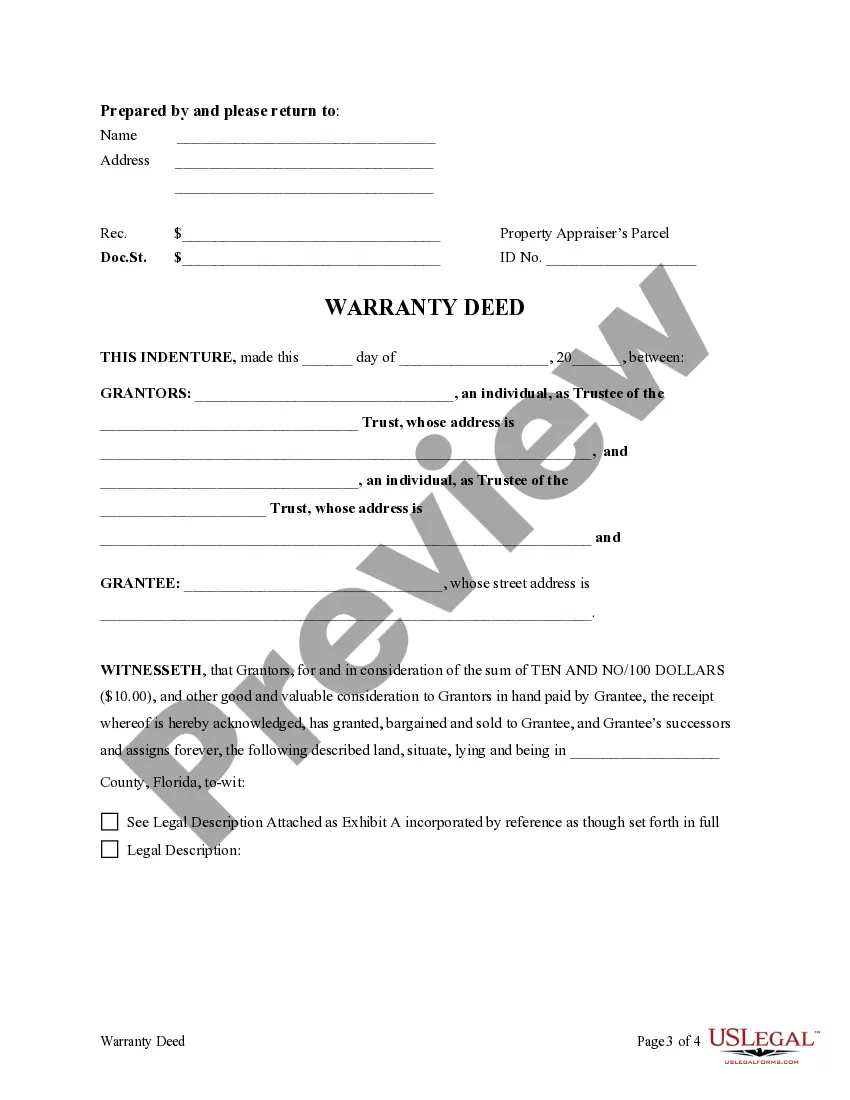

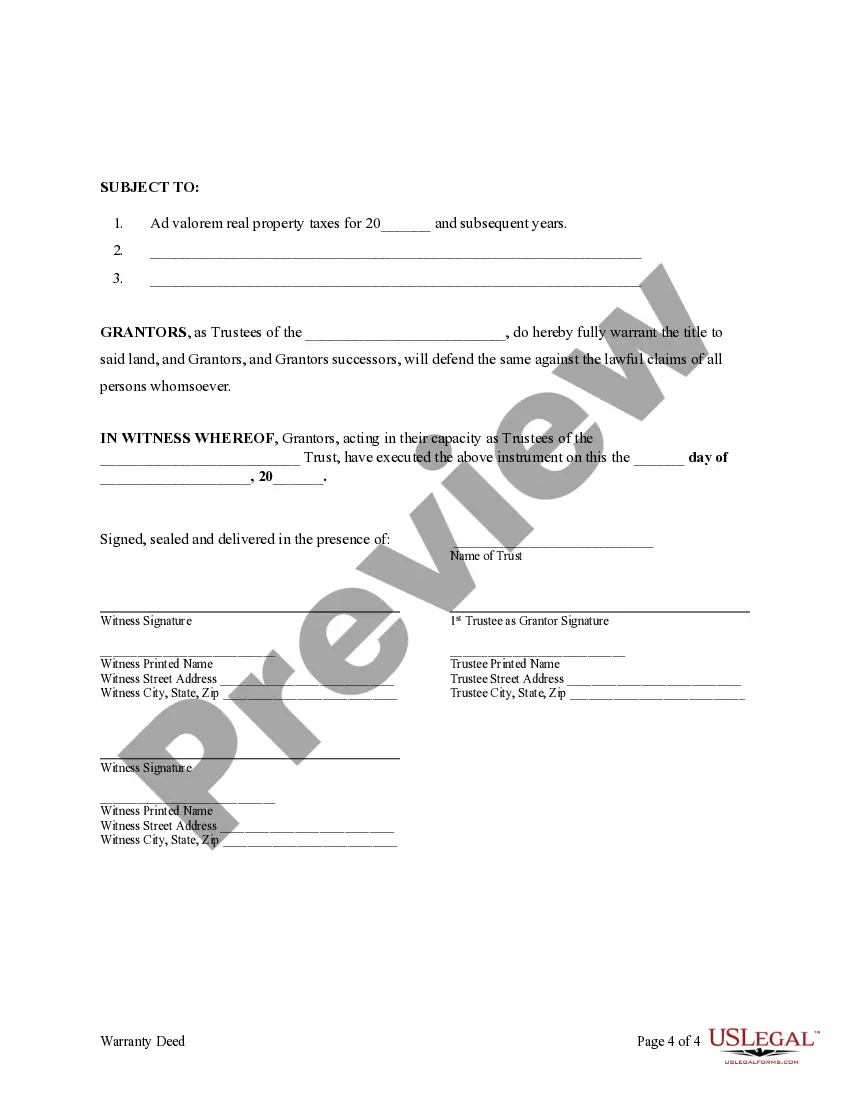

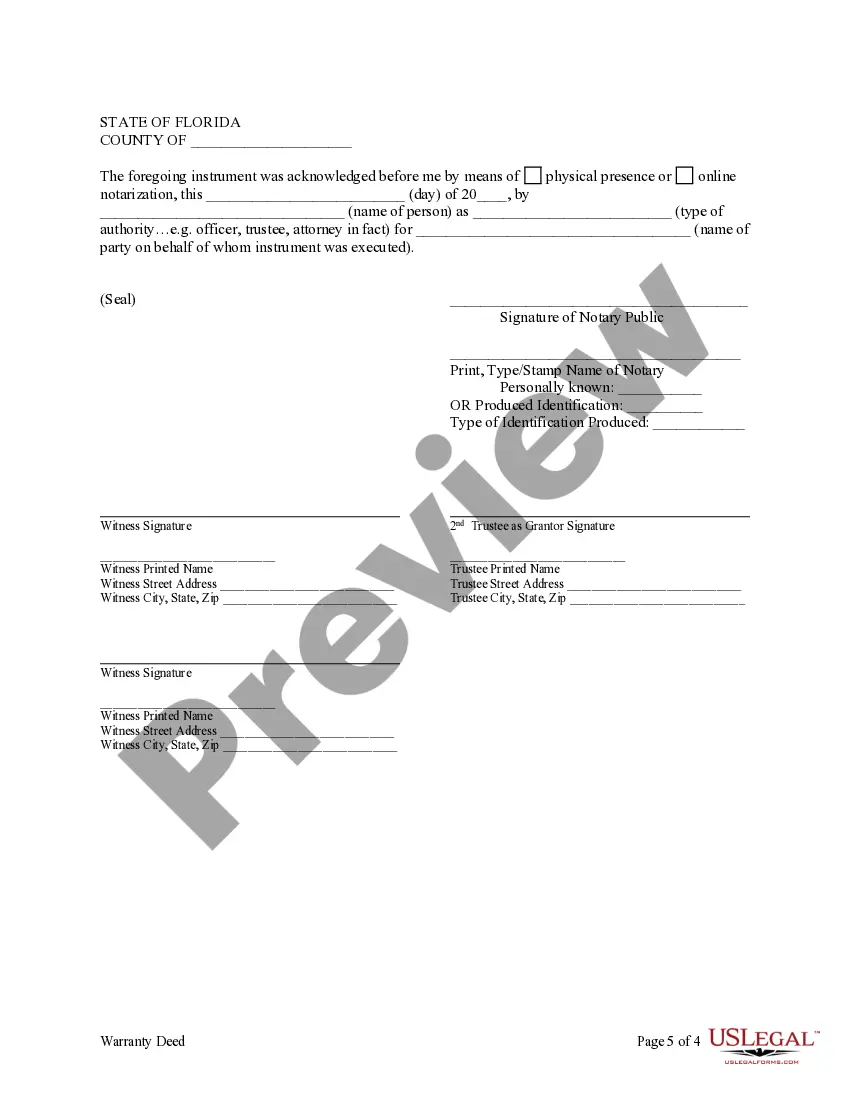

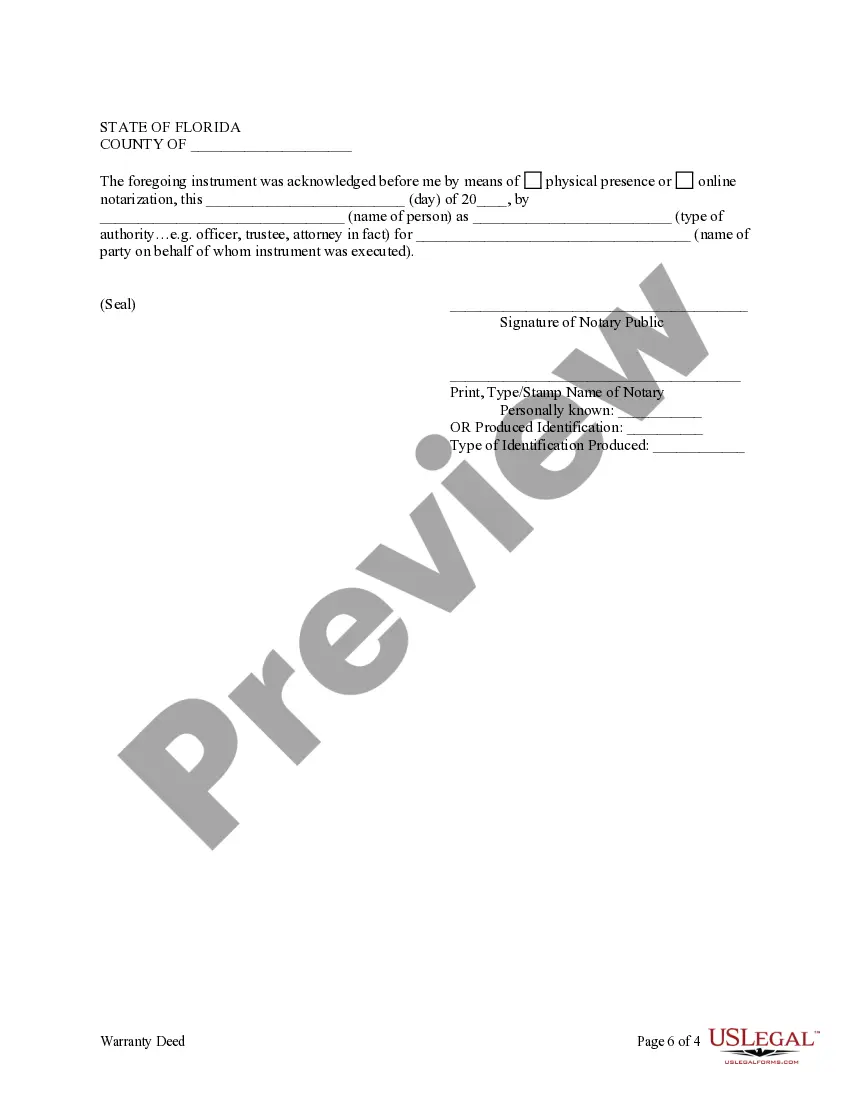

This form is a Warranty Deed where the Grantor is a Trust acting through two individual Trustees and the Grantee is an idividual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Orlando Florida Trust — Two Individual Trustee— - to an Individual: A Comprehensive Overview In Orlando, Florida, trusts are legal entities established to protect and manage assets for individuals or families. The Orlando Florida Trust — Two Individual Trustees – to an Individual is a specific type of trust arrangement where two individuals are appointed as trustees to administer the trust on behalf of a single beneficiary. This detailed description will provide you with a comprehensive understanding of the Orlando Florida Trust — Two Individual Trustees – to an Individual, highlighting its benefits, functioning, and different types. Keywords: Orlando Florida Trust, two individual trustees, individual beneficiary, trust arrangement, asset protection, trust management. Benefits of Orlando Florida Trust — Two Individual Trustees – to an Individual: 1. Asset Protection: The trust shields assets from potential creditors, lawsuits, and other financial risks by legally separating them from personal ownership. 2. Flexible Asset Distribution: Trustees have the authority to distribute trust assets to the beneficiary based on predefined conditions, enabling customized and flexible asset management. 3. Continuity: Having two trustees ensures that the trust administration continues smoothly even if one trustee is incapacitated, unavailable, or wishes to resign. 4. Privacy: Unlike wills or probate, trust arrangements provide confidentiality as the trust terms and asset distribution remain private affairs. 5. Tax Benefits: Trusts often offer tax advantages, such as minimizing estate taxes and certain income taxes, thereby maximizing the value of assets passed down to beneficiaries. Functioning of Orlando Florida Trust — Two Individual Trustees – to an Individual: 1. Creation: The trust is established by a legal agreement between the trust creator (also known as "granter" or "settler") and the two chosen individual trustees. 2. Trust Document: A detailed trust document is drafted, outlining the terms, conditions, and objectives of the trust, along with asset management instructions and distribution guidelines. 3. Asset Transfer: The granter transfers ownership of selected assets into the trust's name, ensuring they are under the trustees' control while remaining accessible to the beneficiary. 4. Trust Administration: The trustees manage the trust's assets prudently, adhere to the trust document's provisions, execute distributions as specified, and keep accurate records of transactions. 5. Beneficiary Rights: The beneficiary is entitled to receive periodic distributions and has the right to request an accounting of the trust's activities. 6. End of Trust: The trust terminates upon the beneficiary's death or when specified conditions within the trust document are met, after which remaining assets are distributed accordingly. Types of Orlando Florida Trust — Two Individual Trustees – to an Individual: 1. Revocable Living Trust: The granter retains the ability to modify or terminate the trust during their lifetime, providing flexibility and control over assets. It becomes irrevocable upon the granter's death. 2. Irrevocable Trust: Once established, the terms of this trust cannot be changed, offering greater asset protection. The granter relinquishes control over the assets transferred into the trust. 3. Special Needs Trust: Designed to support individuals with disabilities, this trust safeguards their eligibility for government benefits by supplementing rather than replacing public assistance. 4. Charitable Remainder Trust: This trust enables the granter to donate assets to a charitable organization while retaining income from those assets during their lifetime, with the remainder passing to the charity upon their death. In conclusion, the Orlando Florida Trust — Two Individual Trustees – to an Individual provides a robust framework for asset protection, enhanced estate planning, and personalized wealth management. With the flexibility to choose from different trust types based on specific needs, individuals in Orlando can effectively safeguard their assets and ensure the smooth transfer of wealth to their chosen beneficiaries.Orlando Florida Trust — Two Individual Trustee— - to an Individual: A Comprehensive Overview In Orlando, Florida, trusts are legal entities established to protect and manage assets for individuals or families. The Orlando Florida Trust — Two Individual Trustees – to an Individual is a specific type of trust arrangement where two individuals are appointed as trustees to administer the trust on behalf of a single beneficiary. This detailed description will provide you with a comprehensive understanding of the Orlando Florida Trust — Two Individual Trustees – to an Individual, highlighting its benefits, functioning, and different types. Keywords: Orlando Florida Trust, two individual trustees, individual beneficiary, trust arrangement, asset protection, trust management. Benefits of Orlando Florida Trust — Two Individual Trustees – to an Individual: 1. Asset Protection: The trust shields assets from potential creditors, lawsuits, and other financial risks by legally separating them from personal ownership. 2. Flexible Asset Distribution: Trustees have the authority to distribute trust assets to the beneficiary based on predefined conditions, enabling customized and flexible asset management. 3. Continuity: Having two trustees ensures that the trust administration continues smoothly even if one trustee is incapacitated, unavailable, or wishes to resign. 4. Privacy: Unlike wills or probate, trust arrangements provide confidentiality as the trust terms and asset distribution remain private affairs. 5. Tax Benefits: Trusts often offer tax advantages, such as minimizing estate taxes and certain income taxes, thereby maximizing the value of assets passed down to beneficiaries. Functioning of Orlando Florida Trust — Two Individual Trustees – to an Individual: 1. Creation: The trust is established by a legal agreement between the trust creator (also known as "granter" or "settler") and the two chosen individual trustees. 2. Trust Document: A detailed trust document is drafted, outlining the terms, conditions, and objectives of the trust, along with asset management instructions and distribution guidelines. 3. Asset Transfer: The granter transfers ownership of selected assets into the trust's name, ensuring they are under the trustees' control while remaining accessible to the beneficiary. 4. Trust Administration: The trustees manage the trust's assets prudently, adhere to the trust document's provisions, execute distributions as specified, and keep accurate records of transactions. 5. Beneficiary Rights: The beneficiary is entitled to receive periodic distributions and has the right to request an accounting of the trust's activities. 6. End of Trust: The trust terminates upon the beneficiary's death or when specified conditions within the trust document are met, after which remaining assets are distributed accordingly. Types of Orlando Florida Trust — Two Individual Trustees – to an Individual: 1. Revocable Living Trust: The granter retains the ability to modify or terminate the trust during their lifetime, providing flexibility and control over assets. It becomes irrevocable upon the granter's death. 2. Irrevocable Trust: Once established, the terms of this trust cannot be changed, offering greater asset protection. The granter relinquishes control over the assets transferred into the trust. 3. Special Needs Trust: Designed to support individuals with disabilities, this trust safeguards their eligibility for government benefits by supplementing rather than replacing public assistance. 4. Charitable Remainder Trust: This trust enables the granter to donate assets to a charitable organization while retaining income from those assets during their lifetime, with the remainder passing to the charity upon their death. In conclusion, the Orlando Florida Trust — Two Individual Trustees – to an Individual provides a robust framework for asset protection, enhanced estate planning, and personalized wealth management. With the flexibility to choose from different trust types based on specific needs, individuals in Orlando can effectively safeguard their assets and ensure the smooth transfer of wealth to their chosen beneficiaries.