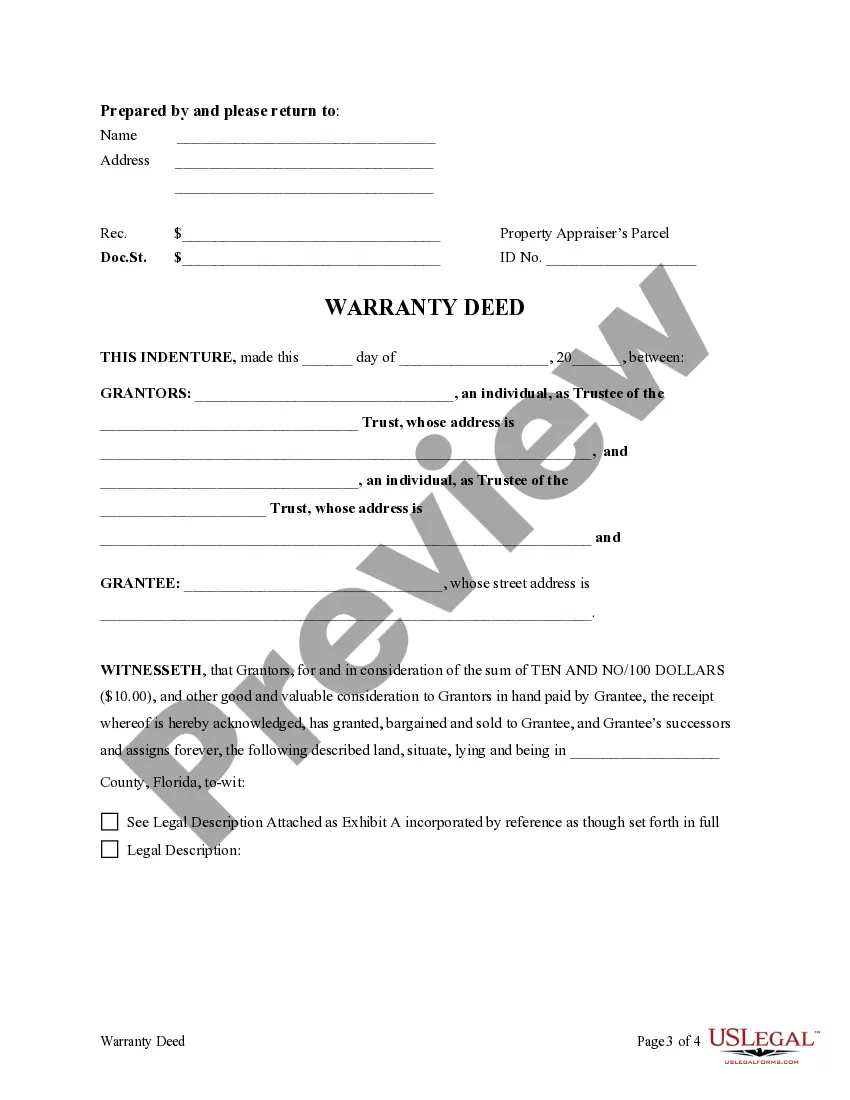

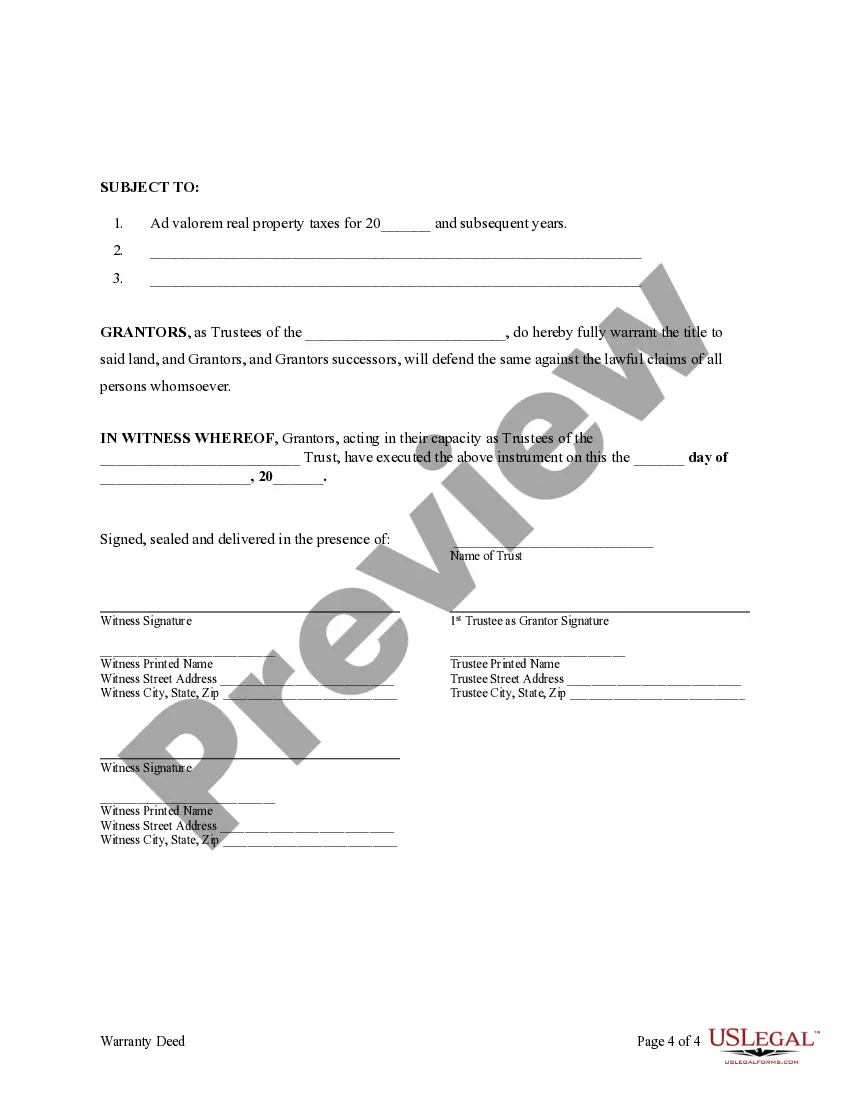

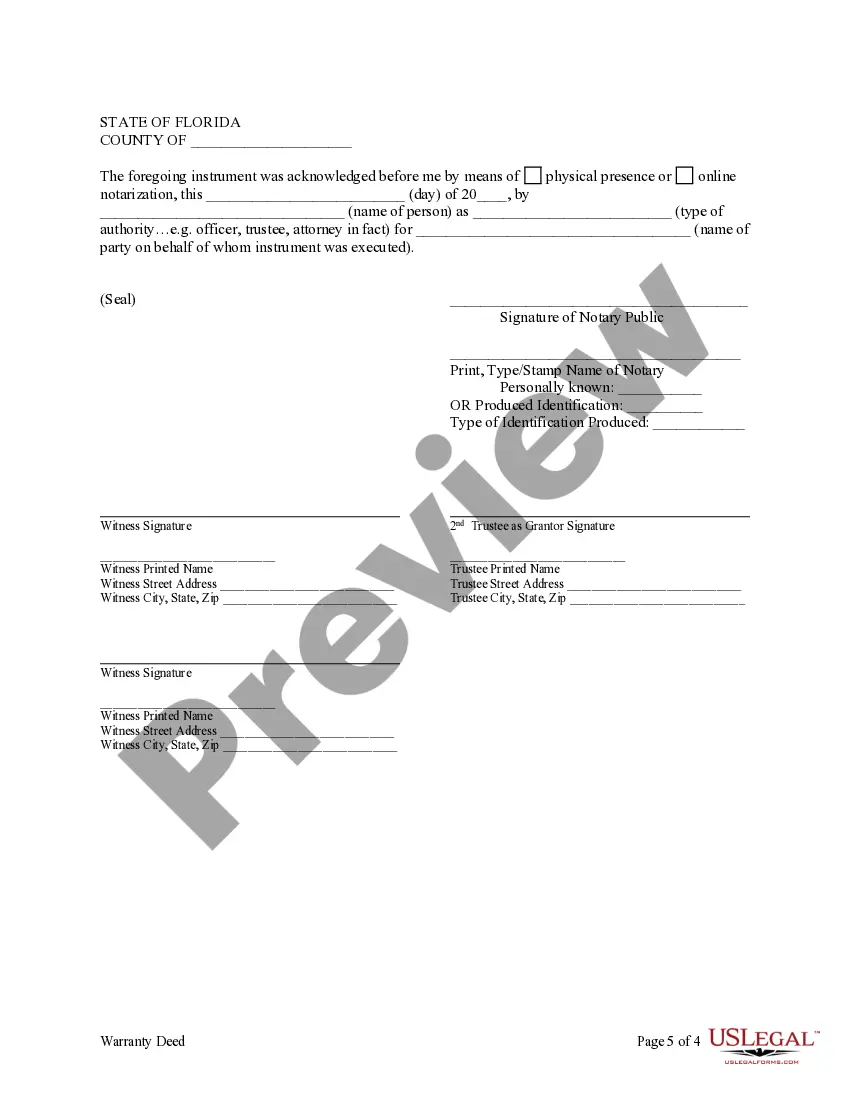

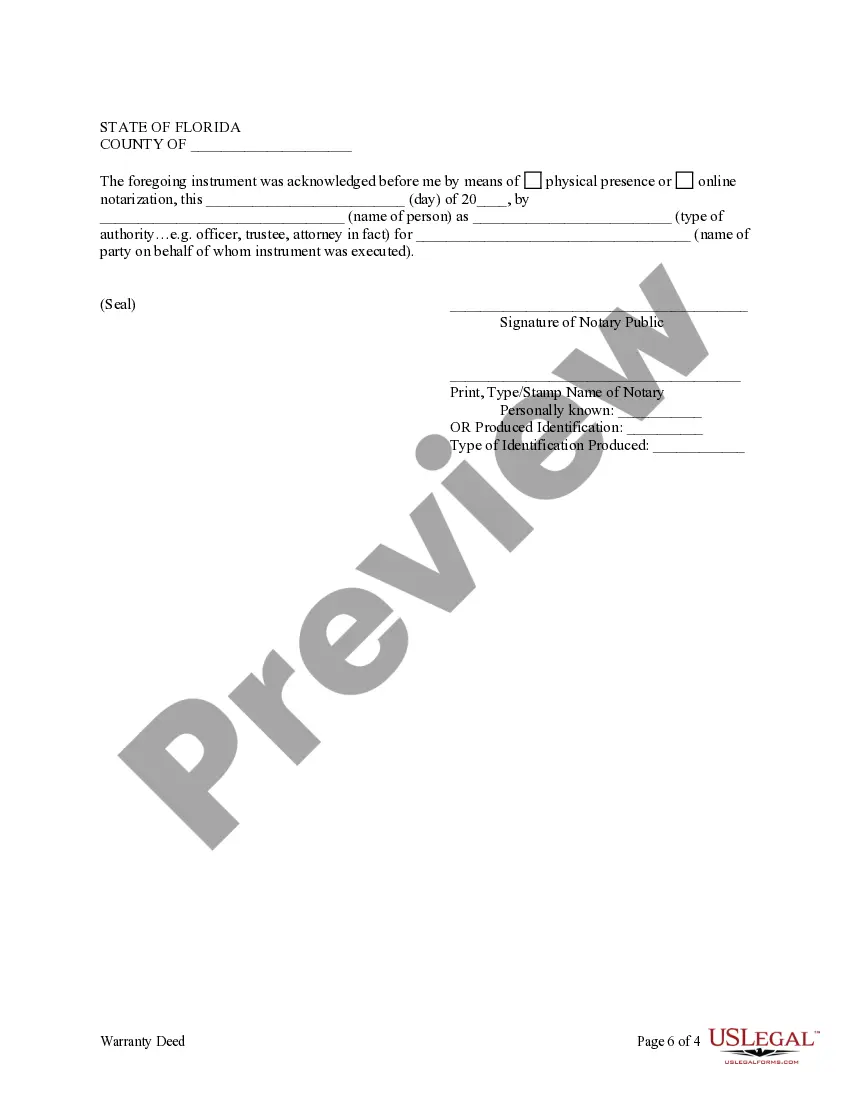

This form is a Warranty Deed where the Grantor is a Trust acting through two individual Trustees and the Grantee is an idividual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Palm Bay Florida Trust - Two Individual Trustees - to an Individual

Description

How to fill out Florida Trust - Two Individual Trustees - To An Individual?

Do you require a trustworthy and economical provider of legal forms to acquire the Palm Bay Florida Trust - Two Individual Trustees - to an Individual? US Legal Forms is your preferred choice.

Whether you need a simple agreement to establish guidelines for living with your partner or a set of forms to help facilitate your separation or divorce through the judicial system, we have you covered. Our platform offers over 85,000 current legal document templates for individual and business purposes. All templates that we provide are not generic and are crafted according to the needs of distinct states and counties.

To download the form, you must Log In to your account, locate the desired template, and click the Download button adjacent to it. Please remember that you can download your previously purchased document templates at any time in the My documents section.

Are you a newcomer to our platform? No concerns. You can create an account with great ease, but before that, ensure to do the following.

Now you can register your account. Then select the subscription option and proceed to checkout. Once the payment is completed, download the Palm Bay Florida Trust - Two Individual Trustees - to an Individual in any available format. You can return to the website whenever necessary and redownload the form without incurring additional costs.

Obtaining current legal forms has never been simpler. Give US Legal Forms a try today, and stop wasting your precious time researching legal documents online for good.

- Verify that the Palm Bay Florida Trust - Two Individual Trustees - to an Individual complies with the laws of your state and locality.

- Examine the form’s specifications (if available) to discover who and what the form is designed for.

- Restart your search if the template does not fit your legal needs.

Form popularity

FAQ

Yes, it is possible to have two trustees for a Palm Bay Florida Trust - Two Individual Trustees - to an Individual. This arrangement can help diversify decision-making and reduce the burden on any one individual. As you set up your trust, make sure you communicate the expectations for each trustee clearly. This clarity will help maintain harmony and efficiency within the trust management.

You can appoint two trustees when establishing a Palm Bay Florida Trust - Two Individual Trustees - to an Individual. This approach can provide checks and balances, ensuring that decisions are made with careful consideration. Just remember to outline the specific responsibilities of each trustee clearly. By doing this, you can establish a cooperative relationship that enhances trust management.

Yes, it is entirely possible to have more than one trustee in a Palm Bay Florida Trust - Two Individual Trustees - to an Individual. By appointing multiple trustees, you can share the responsibilities and leverage the unique strengths of each person. However, it is essential to clearly define each trustee's role to avoid confusion. Consulting a professional can help in setting up a structure that works well for everyone involved.

When you have two trustees in a Palm Bay Florida Trust - Two Individual Trustees - to an Individual, both must agree on major decisions regarding the trust. This requirement can enhance accountability, but it may also lead to delays if the trustees do not see eye to eye. Involving two trustees can create a balanced approach, ensuring that the trust operates in the best interest of the beneficiaries. However, clear guidelines should be established to facilitate effective decision-making.

One significant mistake parents often make when setting up a Palm Bay Florida Trust - Two Individual Trustees - to an Individual is failing to communicate their intentions with family members. This lack of communication can lead to misunderstandings and disputes later. Additionally, not clearly outlining the roles and responsibilities of the trustees can complicate the management of the trust. Proper planning and transparency are crucial to ensuring smooth operations.

Having co-trustees in a Palm Bay Florida Trust - Two Individual Trustees - to an Individual can be beneficial in many cases. Co-trustees can provide checks and balances, ensuring that decisions are fair and well-considered. This arrangement, however, requires both trustees to work together harmoniously. Utilizing a platform like uslegalforms can help streamline the process and clarify the roles of each trustee.

A trust can have multiple trustees, but it is common to see arrangements with one or two. For a Palm Bay Florida Trust - Two Individual Trustees - to an Individual, having two trustees allows for a balanced approach to trust management. More than two trustees can complicate the process, leading to potential disagreements. Thus, it's best to choose the number of trustees based on the complexity of the trust and the needs of the beneficiaries.

Yes, a Palm Bay Florida Trust - Two Individual Trustees - to an Individual can have two trustees. Having two individuals as trustees can bring diverse perspectives and shared responsibilities. This arrangement can enhance decision-making and improve management of the trust assets. However, it's essential for both trustees to communicate effectively to avoid conflicts.

While co-trustees can provide a balanced approach to trust management, there are disadvantages. For instance, differing opinions between co-trustees can lead to conflicts or delays in decision-making. Additionally, both trustees share liability, which can complicate the resolution of disputes. Utilizing a platform like uslegalforms can simplify the process of setting expectations and resolving issues between co-trustees.

In Florida, co-trustees typically must act together unless the trust document stipulates otherwise. In a Palm Bay Florida Trust - Two Individual Trustees - to an Individual, it's crucial for co-trustees to understand their legal obligations. If individual actions are allowed, they must still align with the trust's best interests. Legal guidance can help clarify these expectations and assist co-trustees in navigating their responsibilities.