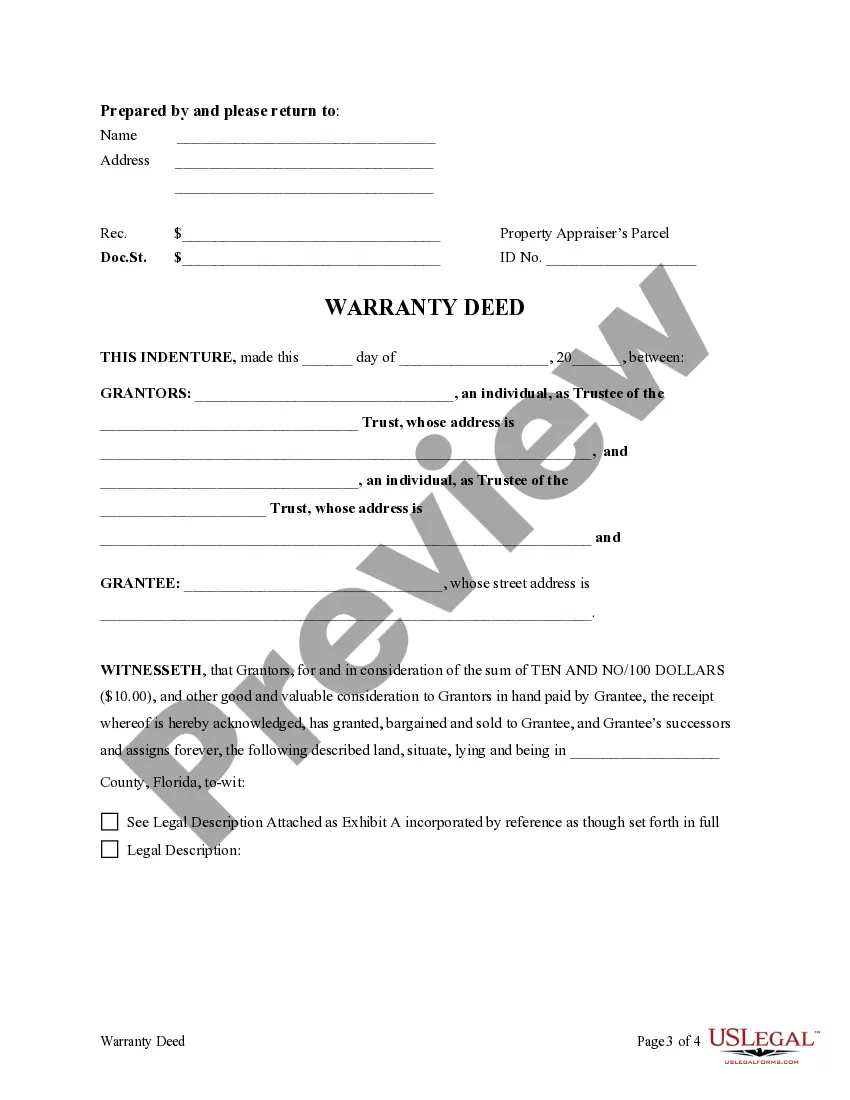

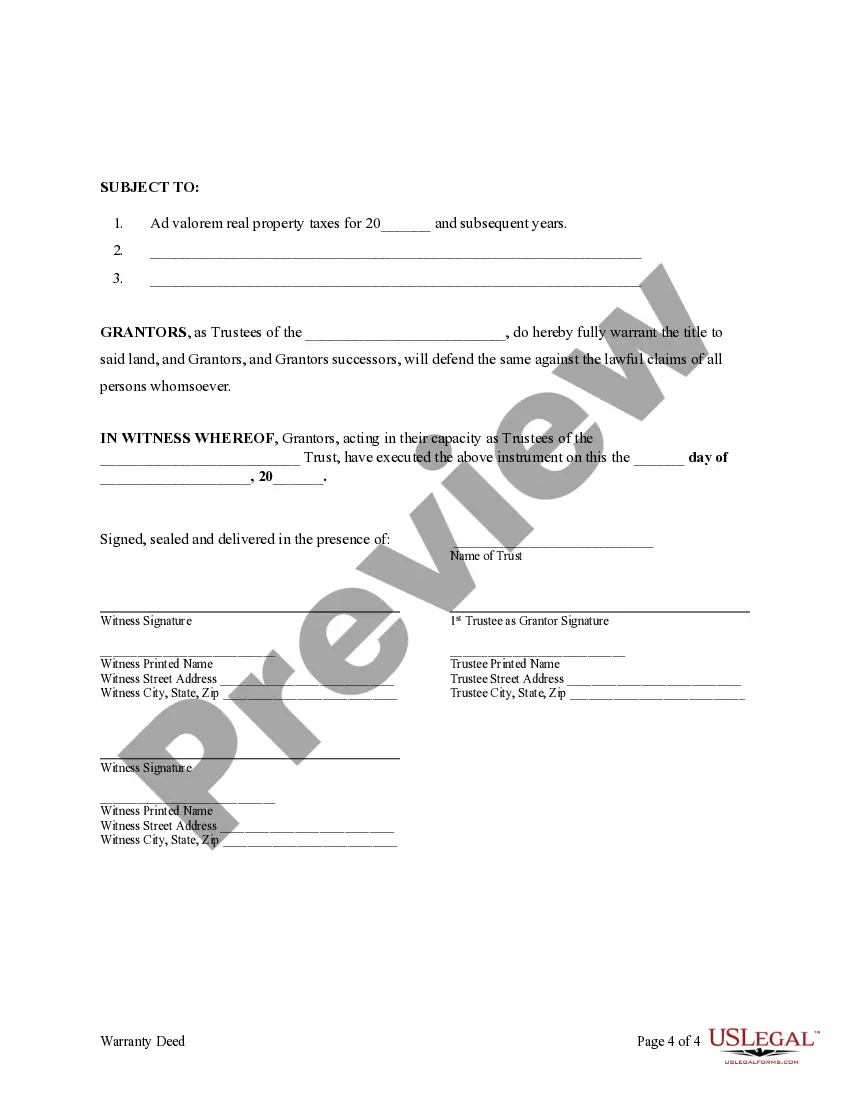

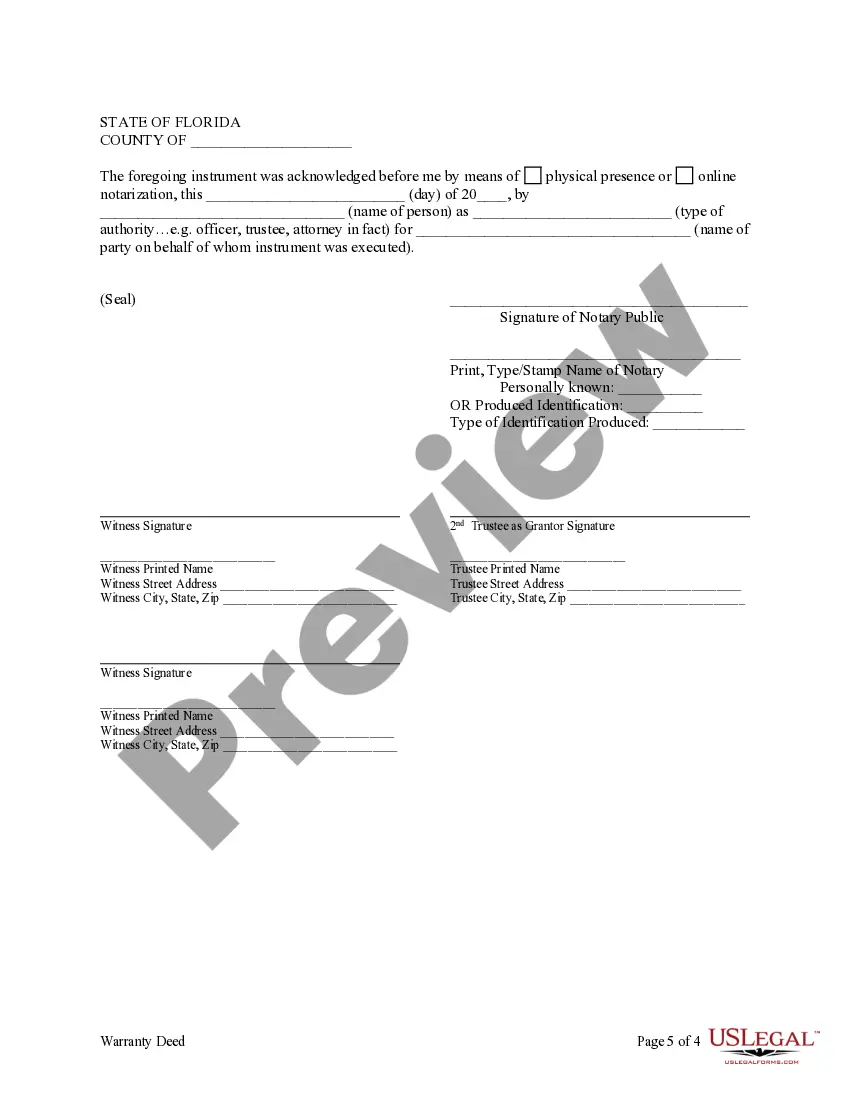

This form is a Warranty Deed where the Grantor is a Trust acting through two individual Trustees and the Grantee is an idividual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

A Palm Beach Florida Trust with Two Individual Trustees is a legally binding arrangement where two individuals, identified as trustees, are appointed to manage and administer a trust on behalf of an individual beneficiary. This type of trust allows the beneficiary to entrust their assets, such as property, financial accounts, or investments, to the trustees, who are responsible for ensuring the assets are protected and used in accordance with the beneficiary's wishes. There are different types of Palm Beach Florida Trusts with Two Individual Trustees, each with its specific purpose and benefits. Some examples include: 1. Revocable Living Trust: This type of trust allows the beneficiary to retain control over their assets during their lifetime, offering the flexibility to modify or revoke the trust if needed. The two individual trustees ensure the smooth management and distribution of assets as per the beneficiary's instructions. 2. Irrevocable Trust: In contrast to a revocable living trust, an irrevocable trust cannot be modified or revoked once established, except under certain circumstances. This trust provides the beneficiary with enhanced protection of assets, as they are no longer considered part of their estate. The two individual trustees play a crucial role in managing the trust's assets and ensuring compliance with legal obligations. 3. Charitable Trust: A charitable trust allows the beneficiary to contribute their assets towards charitable causes or institutions while receiving certain tax benefits. Two individual trustees oversee the allocation of funds to designated charities, ensuring the beneficiary's philanthropic goals are met. 4. Special Needs Trust: Designed for individuals with disabilities or special needs, this trust ensures the beneficiary's assets are managed to supplement their government benefits and maintain their quality of life. The two individual trustees work together to ensure the trust funds are properly disbursed for the beneficiary's specific needs and requirements. By establishing a Palm Beach Florida Trust with Two Individual Trustees, an individual can enjoy the expertise, accountability, and shared responsibilities of a trustee duo. The trustees act in the best interest of the beneficiary, executing their fiduciary duties diligently, and adhering to the terms and conditions stipulated within the trust agreement. This allows the beneficiary to have peace of mind, knowing that their assets are being managed and protected by capable individuals, who are legally obliged to act in their best interest.A Palm Beach Florida Trust with Two Individual Trustees is a legally binding arrangement where two individuals, identified as trustees, are appointed to manage and administer a trust on behalf of an individual beneficiary. This type of trust allows the beneficiary to entrust their assets, such as property, financial accounts, or investments, to the trustees, who are responsible for ensuring the assets are protected and used in accordance with the beneficiary's wishes. There are different types of Palm Beach Florida Trusts with Two Individual Trustees, each with its specific purpose and benefits. Some examples include: 1. Revocable Living Trust: This type of trust allows the beneficiary to retain control over their assets during their lifetime, offering the flexibility to modify or revoke the trust if needed. The two individual trustees ensure the smooth management and distribution of assets as per the beneficiary's instructions. 2. Irrevocable Trust: In contrast to a revocable living trust, an irrevocable trust cannot be modified or revoked once established, except under certain circumstances. This trust provides the beneficiary with enhanced protection of assets, as they are no longer considered part of their estate. The two individual trustees play a crucial role in managing the trust's assets and ensuring compliance with legal obligations. 3. Charitable Trust: A charitable trust allows the beneficiary to contribute their assets towards charitable causes or institutions while receiving certain tax benefits. Two individual trustees oversee the allocation of funds to designated charities, ensuring the beneficiary's philanthropic goals are met. 4. Special Needs Trust: Designed for individuals with disabilities or special needs, this trust ensures the beneficiary's assets are managed to supplement their government benefits and maintain their quality of life. The two individual trustees work together to ensure the trust funds are properly disbursed for the beneficiary's specific needs and requirements. By establishing a Palm Beach Florida Trust with Two Individual Trustees, an individual can enjoy the expertise, accountability, and shared responsibilities of a trustee duo. The trustees act in the best interest of the beneficiary, executing their fiduciary duties diligently, and adhering to the terms and conditions stipulated within the trust agreement. This allows the beneficiary to have peace of mind, knowing that their assets are being managed and protected by capable individuals, who are legally obliged to act in their best interest.