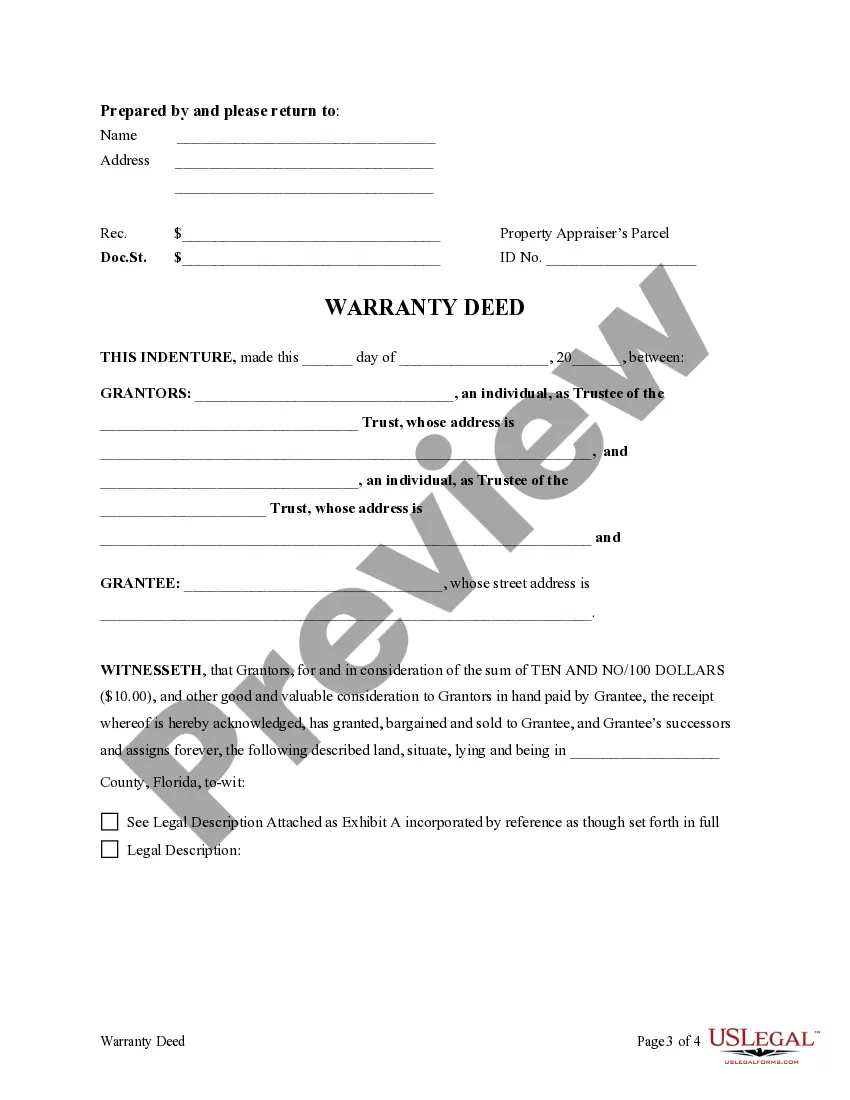

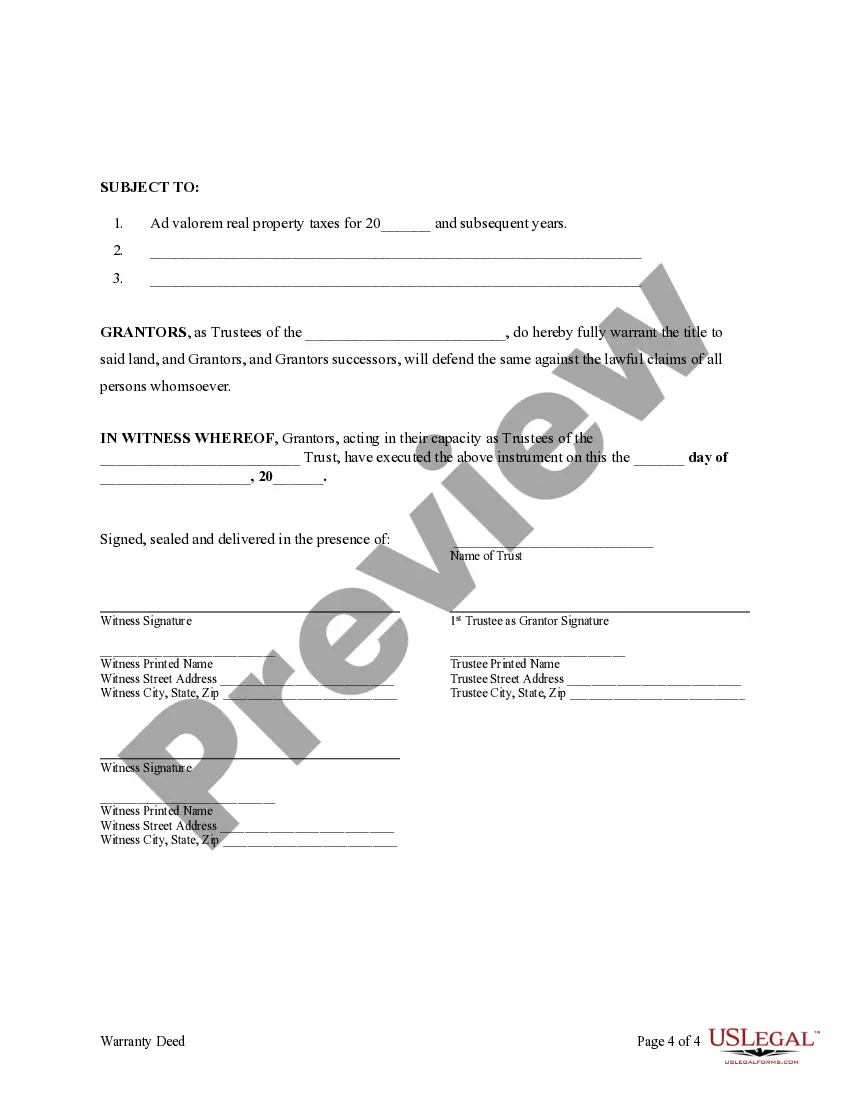

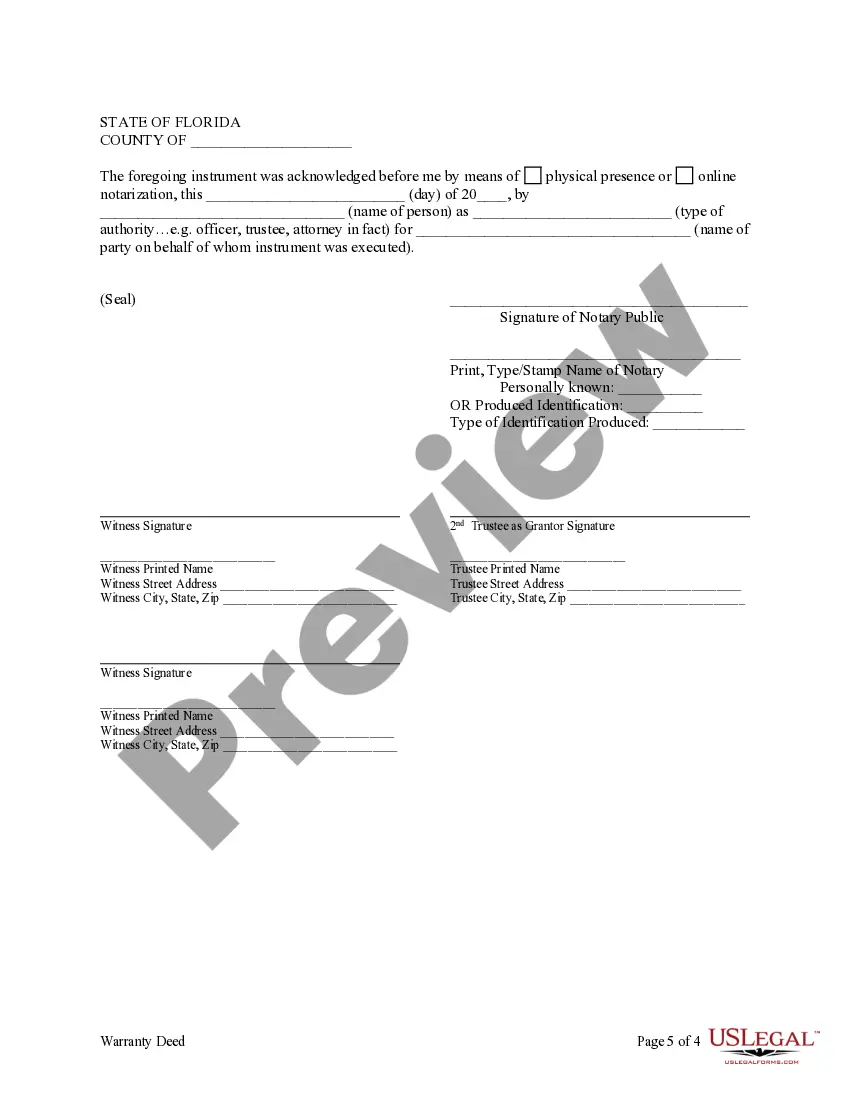

This form is a Warranty Deed where the Grantor is a Trust acting through two individual Trustees and the Grantee is an idividual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Tallahassee Florida Trust — Two Individual Trustee— - to an Individual In Tallahassee, Florida, a trust is a legal entity that allows individuals to manage and distribute their assets in a structured manner. One type of trust that is commonly used in Tallahassee is the Tallahassee Florida Trust with two individual trustees to an individual. This specific trust arrangement involves two individual trustees who are appointed to manage the trust on behalf of an individual beneficiary. The two trustees hold the fiduciary responsibility to administer and protect the assets of the trust in accordance with the terms and conditions set forth in the trust document. One of the key benefits of this type of trust in Tallahassee is the enhanced level of oversight and decision-making power that comes with having two individual trustees. With two trustees, there is a built-in system of checks and balances, reducing the risk of any one trustee making decisions solely on their own. The two individual trustees are typically chosen for their integrity, financial acumen, and ability to collaborate effectively. They are responsible for managing the assets of the trust, investing and growing them wisely, and ensuring that the wishes of the individual beneficiary are fulfilled. The Tallahassee Florida Trust with two individual trustees to an individual can offer various estate planning options tailored to the specific needs and goals of the individual beneficiary. It can provide for the financial security of loved ones, protect assets from creditors, minimize estate taxes, and facilitate a seamless transfer of wealth upon the individual's passing. Some potential variations of this trust arrangement in Tallahassee include: 1. Revocable Living Trust: This type of trust allows the individual beneficiary to retain control over the trust assets during their lifetime and make changes or revoke the trust if desired. The two individual trustees manage the trust during the individual's lifetime and ensure a smooth transition upon their passing. 2. Irrevocable Trust: In contrast to a revocable living trust, an irrevocable trust cannot be modified or revoked by the individual beneficiary once established. The two individual trustees manage the trust assets, adhering strictly to the instructions outlined in the trust document. 3. Testamentary Trust: This type of trust is created within an individual's last will and testament and becomes effective upon their death. The two individual trustees named in they will assume responsibility for managing and distributing the trust assets according to the individual's wishes. In conclusion, the Tallahassee Florida Trust with two individual trustees to an individual offers a robust and flexible estate planning tool. Whether it is a revocable living trust, an irrevocable trust, or a testamentary trust, having two trustees ensures efficient asset management and a reliable mechanism for safeguarding the individual's interests and fulfilling their wishes.Tallahassee Florida Trust — Two Individual Trustee— - to an Individual In Tallahassee, Florida, a trust is a legal entity that allows individuals to manage and distribute their assets in a structured manner. One type of trust that is commonly used in Tallahassee is the Tallahassee Florida Trust with two individual trustees to an individual. This specific trust arrangement involves two individual trustees who are appointed to manage the trust on behalf of an individual beneficiary. The two trustees hold the fiduciary responsibility to administer and protect the assets of the trust in accordance with the terms and conditions set forth in the trust document. One of the key benefits of this type of trust in Tallahassee is the enhanced level of oversight and decision-making power that comes with having two individual trustees. With two trustees, there is a built-in system of checks and balances, reducing the risk of any one trustee making decisions solely on their own. The two individual trustees are typically chosen for their integrity, financial acumen, and ability to collaborate effectively. They are responsible for managing the assets of the trust, investing and growing them wisely, and ensuring that the wishes of the individual beneficiary are fulfilled. The Tallahassee Florida Trust with two individual trustees to an individual can offer various estate planning options tailored to the specific needs and goals of the individual beneficiary. It can provide for the financial security of loved ones, protect assets from creditors, minimize estate taxes, and facilitate a seamless transfer of wealth upon the individual's passing. Some potential variations of this trust arrangement in Tallahassee include: 1. Revocable Living Trust: This type of trust allows the individual beneficiary to retain control over the trust assets during their lifetime and make changes or revoke the trust if desired. The two individual trustees manage the trust during the individual's lifetime and ensure a smooth transition upon their passing. 2. Irrevocable Trust: In contrast to a revocable living trust, an irrevocable trust cannot be modified or revoked by the individual beneficiary once established. The two individual trustees manage the trust assets, adhering strictly to the instructions outlined in the trust document. 3. Testamentary Trust: This type of trust is created within an individual's last will and testament and becomes effective upon their death. The two individual trustees named in they will assume responsibility for managing and distributing the trust assets according to the individual's wishes. In conclusion, the Tallahassee Florida Trust with two individual trustees to an individual offers a robust and flexible estate planning tool. Whether it is a revocable living trust, an irrevocable trust, or a testamentary trust, having two trustees ensures efficient asset management and a reliable mechanism for safeguarding the individual's interests and fulfilling their wishes.