This form is a Quitclaim Deed where the grantor is a limited liability company and the grantees are husband and wife. Grantor conveys and quitclaims any interest grantor might have in the described property to grantees. Grantees take the property as tenants by the entireties, joint tenants with the right of survivorship or as tenants in common. This deed complies with all state statutory laws.

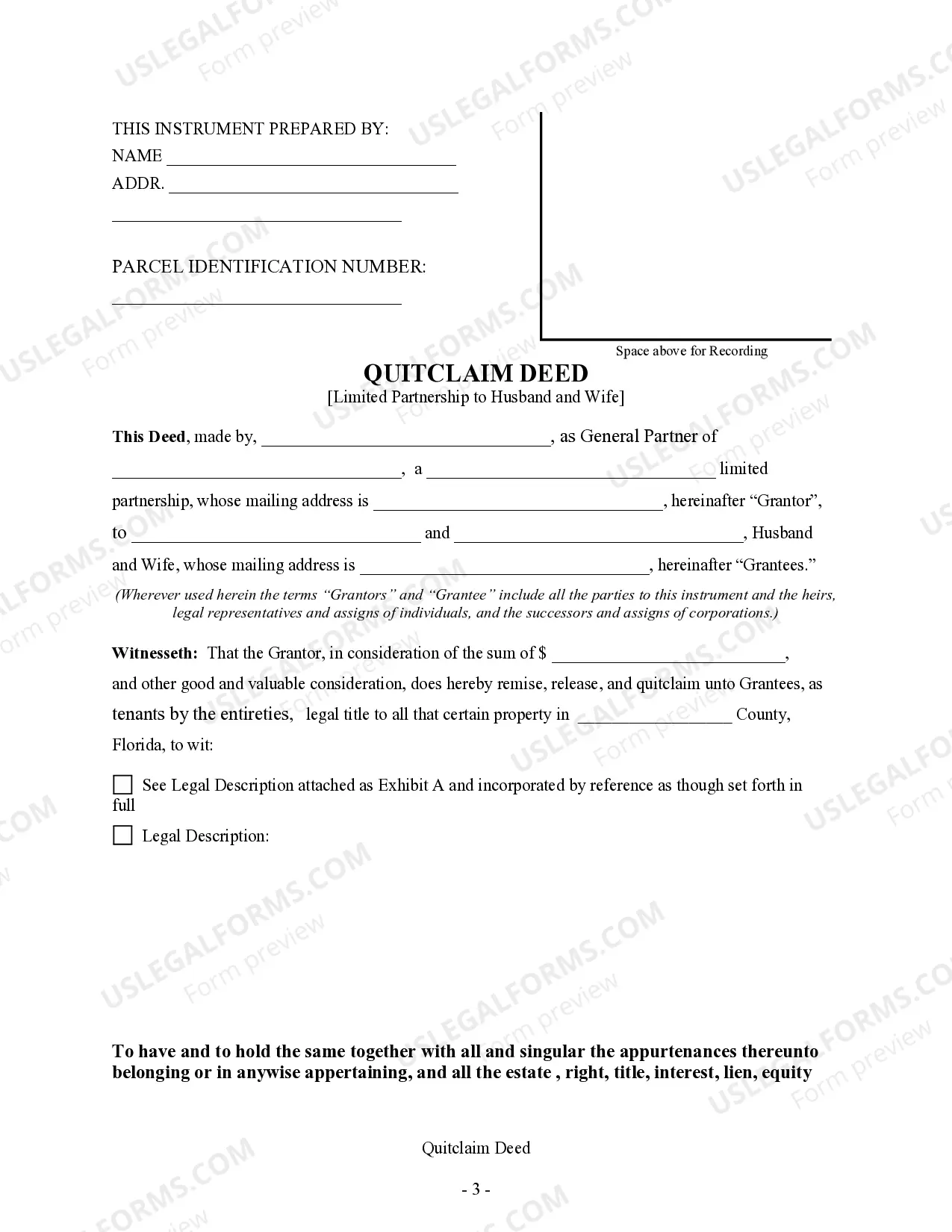

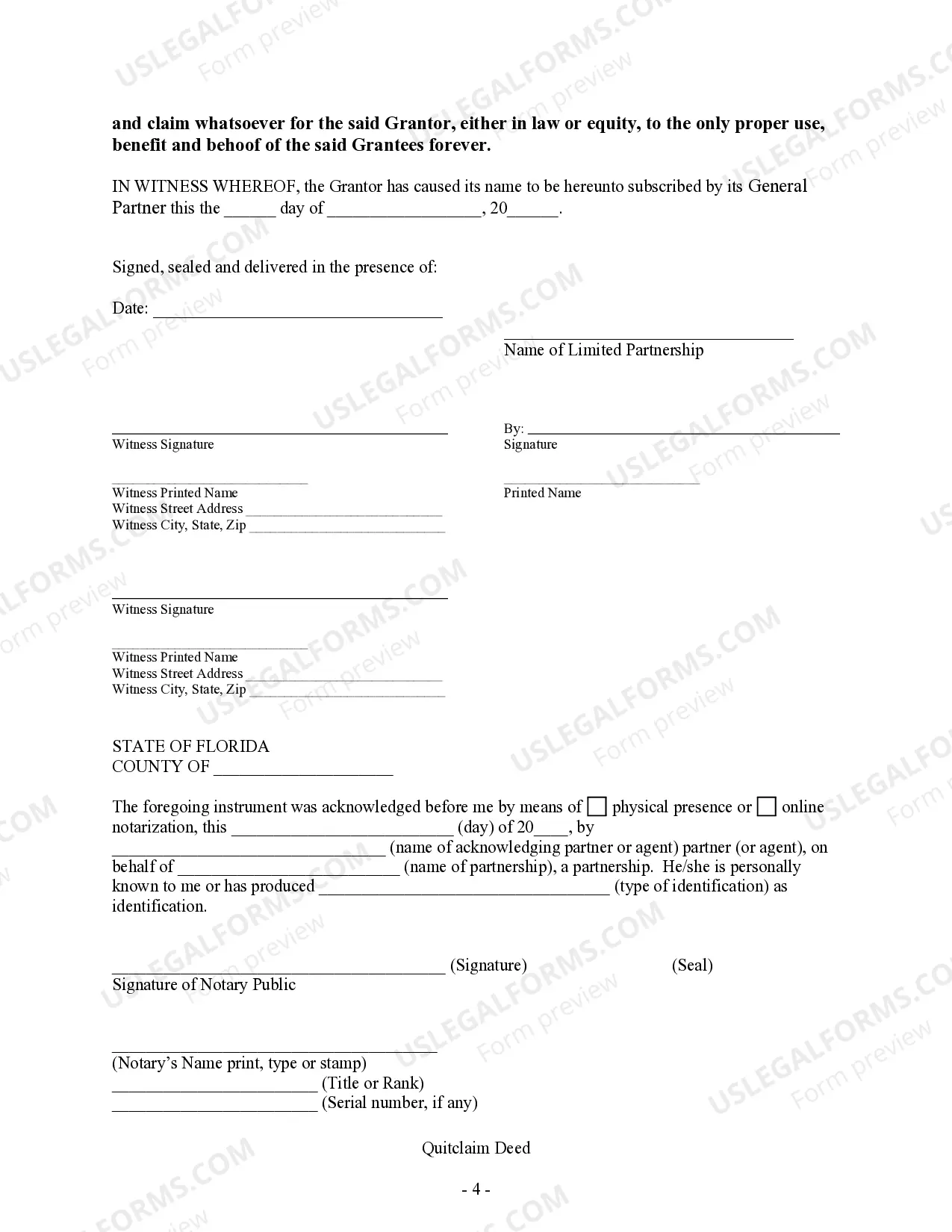

A Cape Coral Florida Quitclaim Deed from a Limited Partnership to a Husband and Wife is a legal document that transfers the ownership interest of a property from a limited partnership to a married couple. This type of deed is commonly used when the limited partnership, as the granter, wishes to convey all its rights, title, and interest in the property to the married couple, known as the grantees. A quitclaim deed is a simple and straightforward way to transfer property ownership without making any warranties or guarantees about the property's title. It allows the limited partnership to release its claim or interest in the property, but it does not provide any assurances against potential liens, encumbrances, or other claims. Key features of a Cape Coral Florida Quitclaim Deed from a Limited Partnership to a Husband and Wife include: 1. Granter: The limited partnership acts as the granter, transferring its interest in the property to the grantees — the husband and wife. 2. Grantees: The husband and wife receive ownership of the property and become the new legal owners. 3. Property Description: The deed should provide an accurate and detailed description of the property being transferred, including its address, lot number, and any other identifying information necessary to establish its location and boundaries. 4. Consideration: While quitclaim deeds do not typically involve a purchase price, they might mention the nominal consideration paid to seal the agreement (e.g., "For ten dollars and other valuable consideration"). 5. Affidavit of Title: The granter often includes a statement, known as an Affidavit of Title, attesting that they are the rightful owner of the property and have the authority to transfer it. 6. Notarization: To make the quitclaim deed valid, it must be signed and notarized by a certified notary public who acknowledges the signatures of the granter(s) and grantees. 7. Recording: Once executed, the quitclaim deed must be filed with the appropriate county office, typically the Clerk of the Court or Recorder's Office, to ensure it becomes part of the official public records. 8. Types of Cape Coral Florida Quitclaim Deeds: While there may not be specific variations of quitclaim deeds from a limited partnership to a husband and wife in Cape Coral, different nuances might exist based on specific circumstances, such as the number of limited partners involved, additional contingencies, or any unique provisions agreed upon. It is crucial for both the granter and grantees to consult a qualified real estate attorney or legal professional before executing a quitclaim deed. They can provide crucial guidance, ensure compliance with relevant regulations, and address any concerns or potential issues that might arise during the transfer process.A Cape Coral Florida Quitclaim Deed from a Limited Partnership to a Husband and Wife is a legal document that transfers the ownership interest of a property from a limited partnership to a married couple. This type of deed is commonly used when the limited partnership, as the granter, wishes to convey all its rights, title, and interest in the property to the married couple, known as the grantees. A quitclaim deed is a simple and straightforward way to transfer property ownership without making any warranties or guarantees about the property's title. It allows the limited partnership to release its claim or interest in the property, but it does not provide any assurances against potential liens, encumbrances, or other claims. Key features of a Cape Coral Florida Quitclaim Deed from a Limited Partnership to a Husband and Wife include: 1. Granter: The limited partnership acts as the granter, transferring its interest in the property to the grantees — the husband and wife. 2. Grantees: The husband and wife receive ownership of the property and become the new legal owners. 3. Property Description: The deed should provide an accurate and detailed description of the property being transferred, including its address, lot number, and any other identifying information necessary to establish its location and boundaries. 4. Consideration: While quitclaim deeds do not typically involve a purchase price, they might mention the nominal consideration paid to seal the agreement (e.g., "For ten dollars and other valuable consideration"). 5. Affidavit of Title: The granter often includes a statement, known as an Affidavit of Title, attesting that they are the rightful owner of the property and have the authority to transfer it. 6. Notarization: To make the quitclaim deed valid, it must be signed and notarized by a certified notary public who acknowledges the signatures of the granter(s) and grantees. 7. Recording: Once executed, the quitclaim deed must be filed with the appropriate county office, typically the Clerk of the Court or Recorder's Office, to ensure it becomes part of the official public records. 8. Types of Cape Coral Florida Quitclaim Deeds: While there may not be specific variations of quitclaim deeds from a limited partnership to a husband and wife in Cape Coral, different nuances might exist based on specific circumstances, such as the number of limited partners involved, additional contingencies, or any unique provisions agreed upon. It is crucial for both the granter and grantees to consult a qualified real estate attorney or legal professional before executing a quitclaim deed. They can provide crucial guidance, ensure compliance with relevant regulations, and address any concerns or potential issues that might arise during the transfer process.