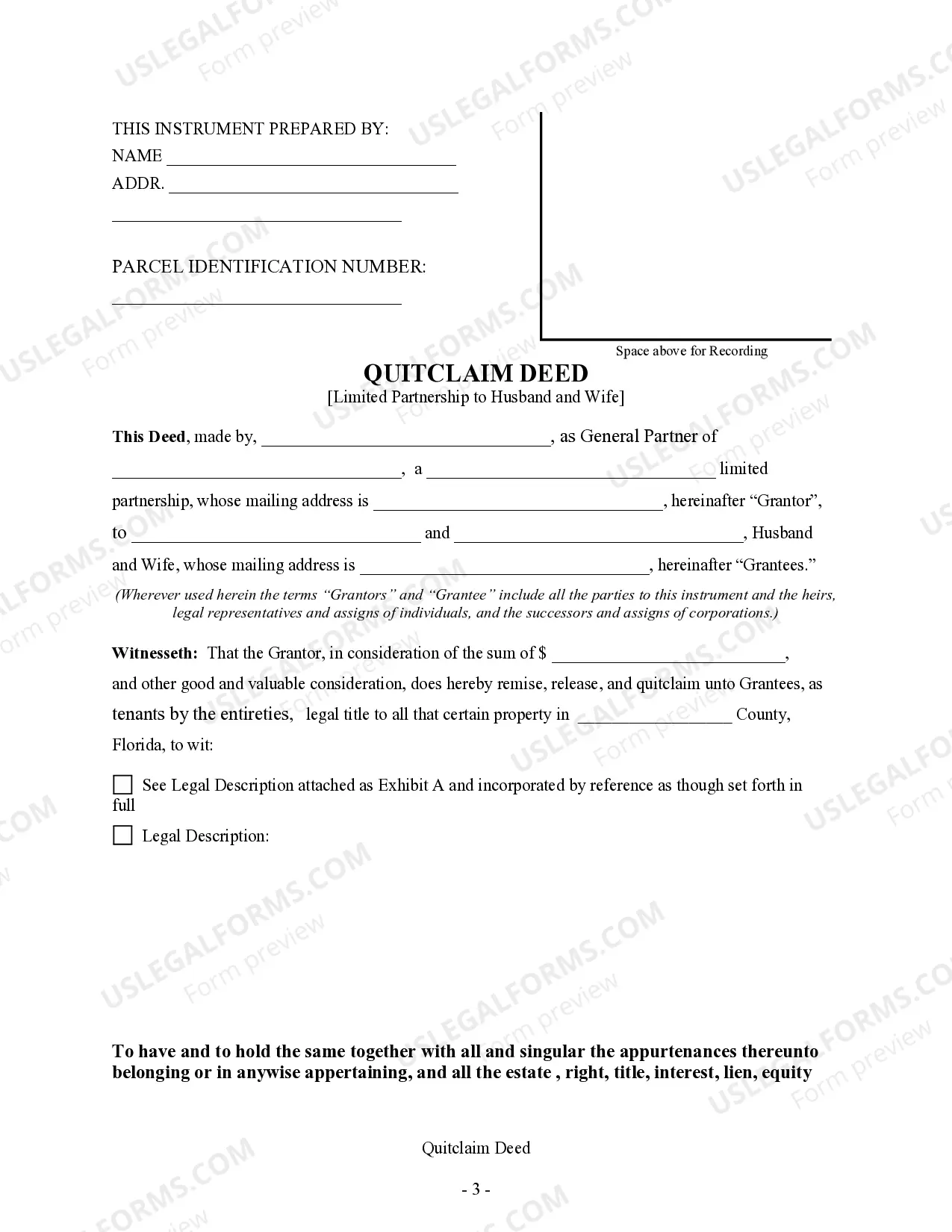

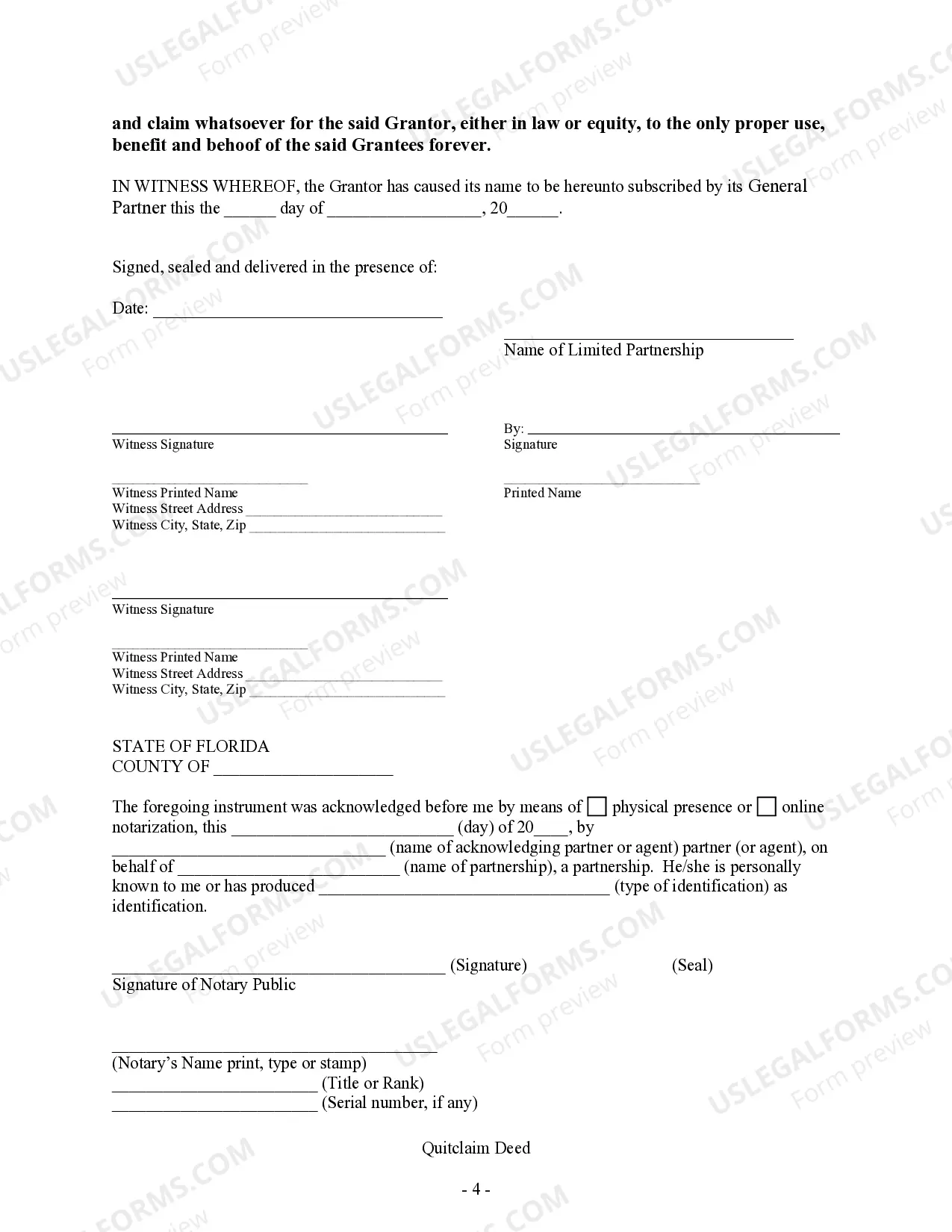

This form is a Quitclaim Deed where the grantor is a limited liability company and the grantees are husband and wife. Grantor conveys and quitclaims any interest grantor might have in the described property to grantees. Grantees take the property as tenants by the entireties, joint tenants with the right of survivorship or as tenants in common. This deed complies with all state statutory laws.

A Jacksonville Florida Quitclaim Deed from a Limited Partnership to a Husband and Wife refers to a legal document that transfers ownership of a property from a limited partnership to a married couple. This type of deed is commonly used when a limited partnership entity wants to release their interest in a property and transfer it to the spouses. The purpose of a quitclaim deed is to provide a swift transfer of property ownership without any guarantees. By executing a quitclaim deed, the limited partnership is essentially conveying their rights, title, and interest in the property to the husband and wife, if they are the intended recipients. However, it's important to note that a quitclaim deed only transfers the interest the limited partnership possesses, without any warranties or assurances about the property's title. In Jacksonville, Florida, there may be different types of quitclaim deeds from a limited partnership to a husband and wife, including: 1. Standard Quitclaim Deed: This is the most common type of quitclaim deed used in real estate transactions. It transfers ownership of the property as is, without any guarantee or warranty from the limited partnership. The deed will contain relevant details such as the names of the parties involved, property description, legal description, and any special considerations or clauses. 2. Enhanced Life Estate or Lady Bird Deed: While not as commonly used in Jacksonville, Florida, this type of quitclaim deed grants the husband and wife the right to retain partial ownership and control over the property during their lifetime. Upon their passing, the property automatically transfers to the designated beneficiaries, bypassing the need for probate. 3. Joint Tenancy with Survivorship: This quitclaim deed establishes joint tenancy between the limited partnership and the husband and wife. It includes a right of survivorship, meaning that if one spouse passes away, their share automatically transfers to the surviving spouse without the need for probate. This type of deed ensures that the property can be easily transferred to the surviving spouse while maintaining legal protection. In conclusion, a Jacksonville Florida Quitclaim Deed from a Limited Partnership to a Husband and Wife is a legal instrument used for transferring property ownership from a limited partnership to a married couple. While there are different types of quitclaim deeds available, the standard quitclaim deed is commonly used in such transactions. It is essential for both the limited partnership and the husband and wife to consult legal professionals and conduct thorough due diligence before executing any deed of this nature to ensure a smooth and legally sound transfer of ownership.