This form is a Quitclaim Deed where the grantor is a limited liability company and the grantees are husband and wife. Grantor conveys and quitclaims any interest grantor might have in the described property to grantees. Grantees take the property as tenants by the entireties, joint tenants with the right of survivorship or as tenants in common. This deed complies with all state statutory laws.

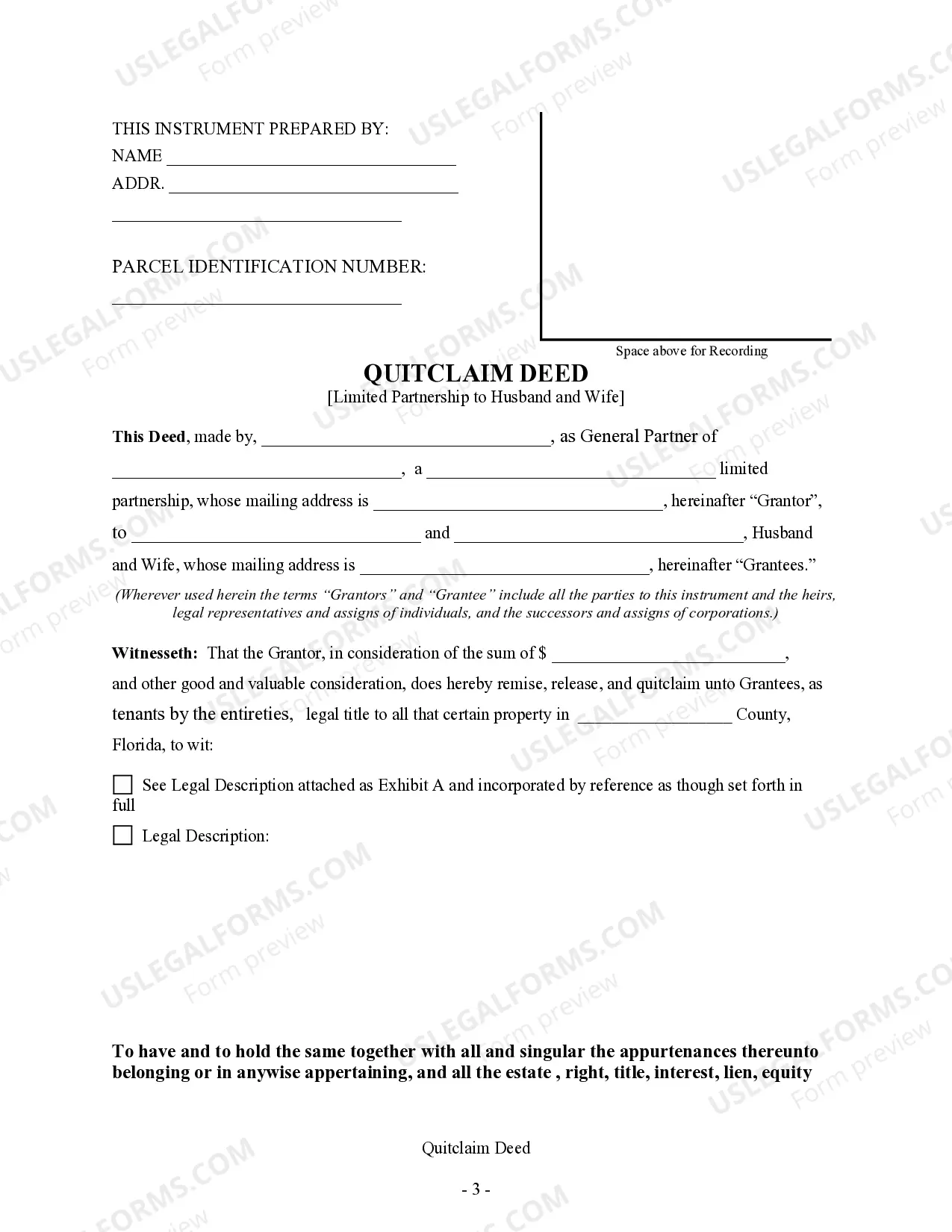

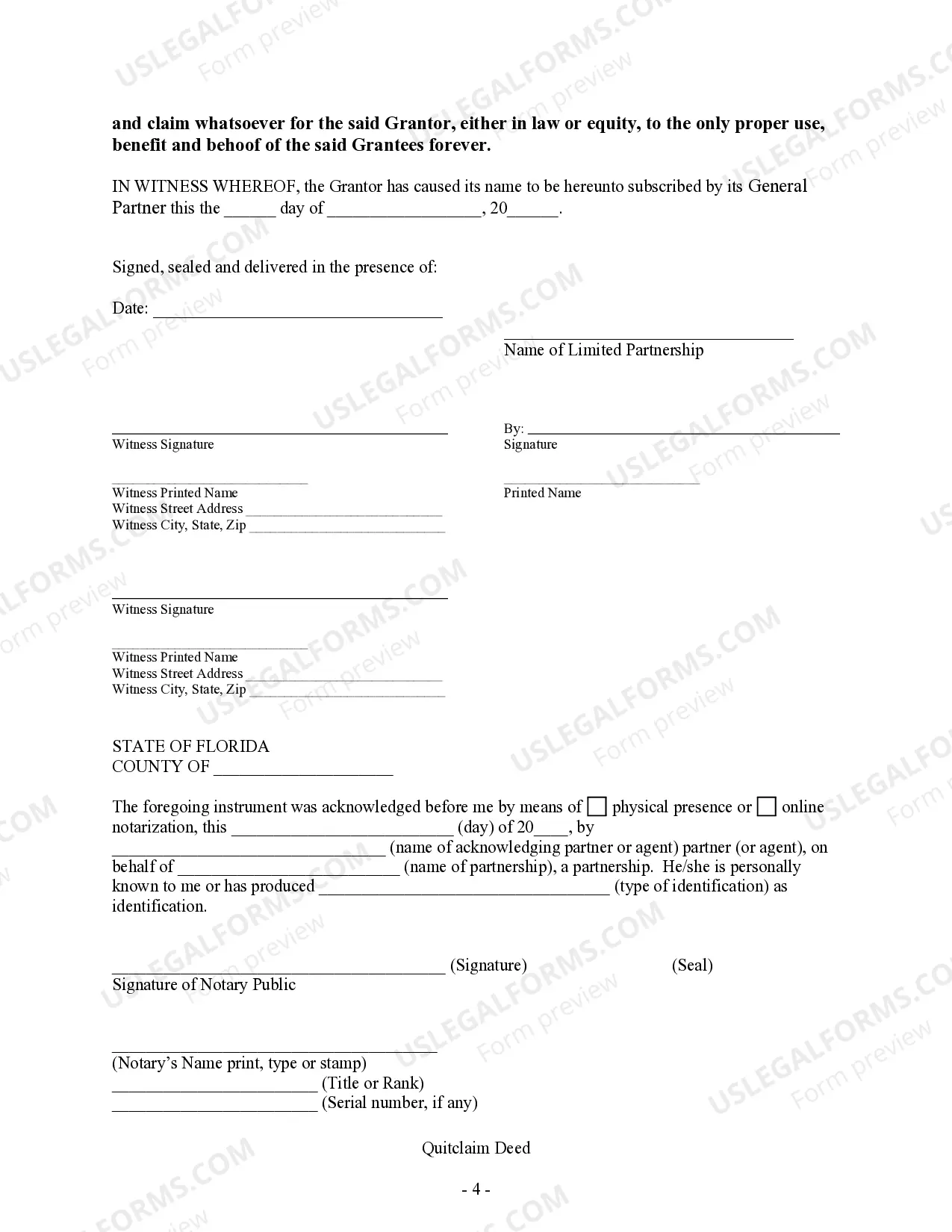

A Lakeland Florida Quitclaim Deed from a Limited Partnership to a Husband and Wife is a legal document that transfers the ownership rights of a property from a limited partnership to a married couple. This type of deed is commonly used in real estate transactions and can be crucial in ensuring a smooth transfer of ownership. With its legal significance, understanding the key aspects of this deed is essential for both the limited partnership and the parties involved. One variety of the Lakeland Florida Quitclaim Deed from a Limited Partnership to a Husband and Wife is the "Joint Tenancy with Rights of Survivorship" deed. This particular type of quitclaim deed ensures that, in the event of demise of one spouse, the surviving spouse automatically becomes the sole owner of the property. This type of quitclaim deed is favored by many couples as it simplifies the eventual transfer of ownership to the surviving spouse and avoids the hassle of probate. Another variation is the "Tenants in Common" deed, which allows the husband and wife to own separate shares of the property. This means that if one of the individuals were to pass away, their share of the property would pass to their beneficiaries according to their will or through the laws of intestacy. Unlike joint tenancy, Tenants in Common does not include the right of survivorship, giving each spouse more flexibility in disposing of their share of the property. Completing a Lakeland Florida Quitclaim Deed from a Limited Partnership to a Husband and Wife involves several crucial steps. First, the deed must include the full legal description of the property, including its boundaries and any easements or encumbrances. Secondly, both the limited partnership and the husband and wife must sign the deed in the presence of a notary public. It is vital to ensure that the intentions of all parties involved are clearly outlined in the deed, including the extent of ownership transferred and any agreed-upon conditions or considerations. By utilizing a Lakeland Florida Quitclaim Deed from a Limited Partnership to a Husband and Wife, the limited partnership grants the married couple legal ownership rights over the property, enabling them to hold and manage it as their own. It is crucial for all parties involved to seek legal advice to ensure compliance with Florida's laws and regulations governing real estate transactions.A Lakeland Florida Quitclaim Deed from a Limited Partnership to a Husband and Wife is a legal document that transfers the ownership rights of a property from a limited partnership to a married couple. This type of deed is commonly used in real estate transactions and can be crucial in ensuring a smooth transfer of ownership. With its legal significance, understanding the key aspects of this deed is essential for both the limited partnership and the parties involved. One variety of the Lakeland Florida Quitclaim Deed from a Limited Partnership to a Husband and Wife is the "Joint Tenancy with Rights of Survivorship" deed. This particular type of quitclaim deed ensures that, in the event of demise of one spouse, the surviving spouse automatically becomes the sole owner of the property. This type of quitclaim deed is favored by many couples as it simplifies the eventual transfer of ownership to the surviving spouse and avoids the hassle of probate. Another variation is the "Tenants in Common" deed, which allows the husband and wife to own separate shares of the property. This means that if one of the individuals were to pass away, their share of the property would pass to their beneficiaries according to their will or through the laws of intestacy. Unlike joint tenancy, Tenants in Common does not include the right of survivorship, giving each spouse more flexibility in disposing of their share of the property. Completing a Lakeland Florida Quitclaim Deed from a Limited Partnership to a Husband and Wife involves several crucial steps. First, the deed must include the full legal description of the property, including its boundaries and any easements or encumbrances. Secondly, both the limited partnership and the husband and wife must sign the deed in the presence of a notary public. It is vital to ensure that the intentions of all parties involved are clearly outlined in the deed, including the extent of ownership transferred and any agreed-upon conditions or considerations. By utilizing a Lakeland Florida Quitclaim Deed from a Limited Partnership to a Husband and Wife, the limited partnership grants the married couple legal ownership rights over the property, enabling them to hold and manage it as their own. It is crucial for all parties involved to seek legal advice to ensure compliance with Florida's laws and regulations governing real estate transactions.