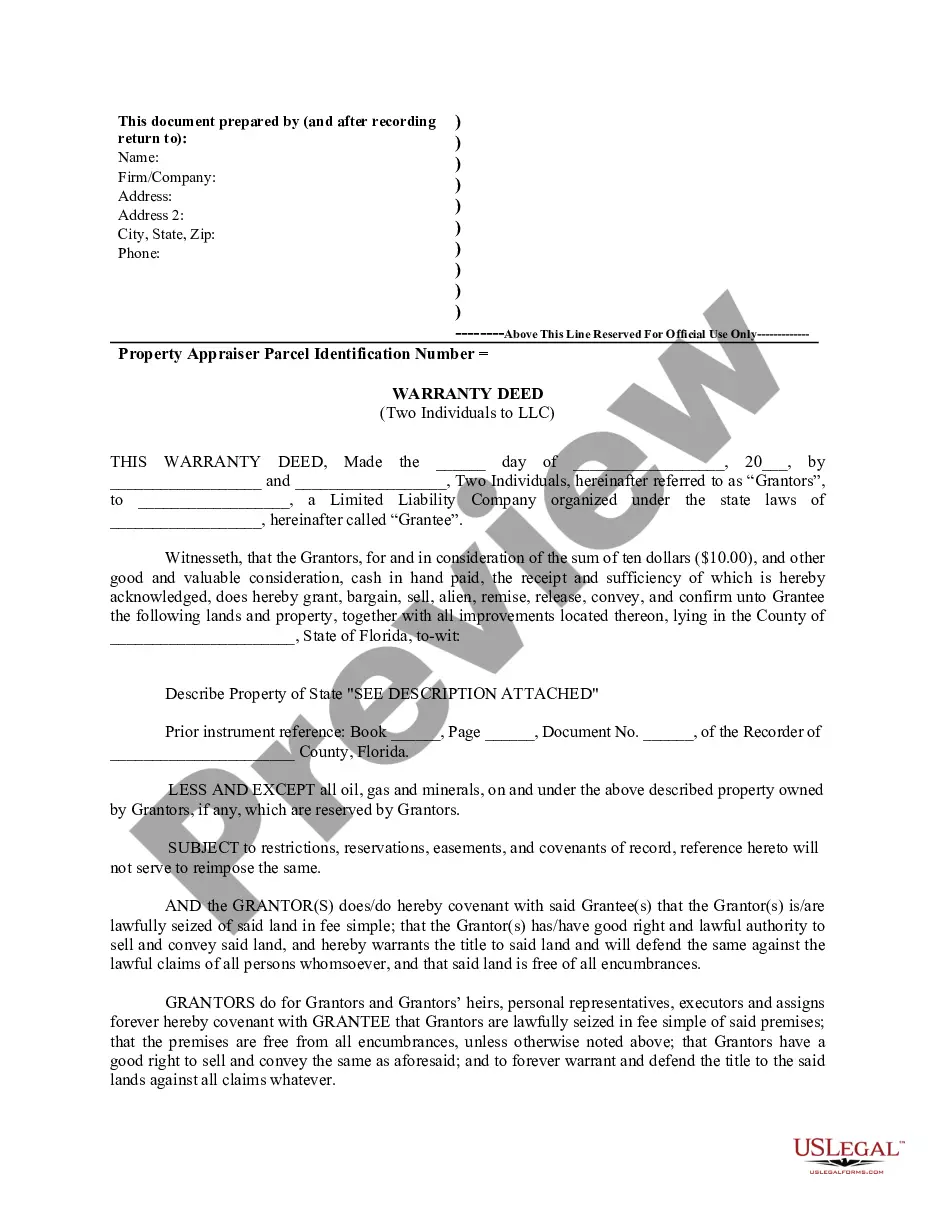

This Warranty Deed from two Individuals to LLC form is a Warranty Deed where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and warrant the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

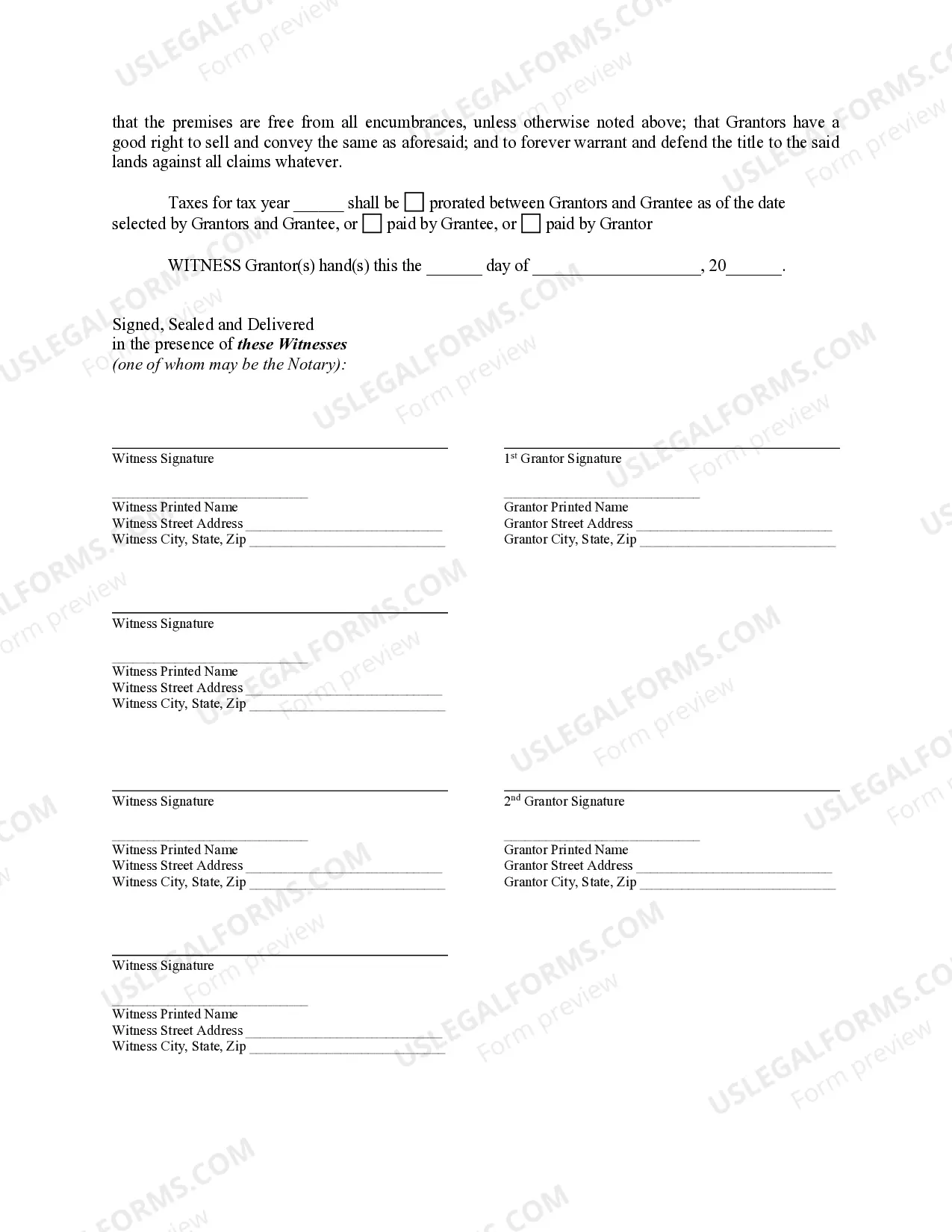

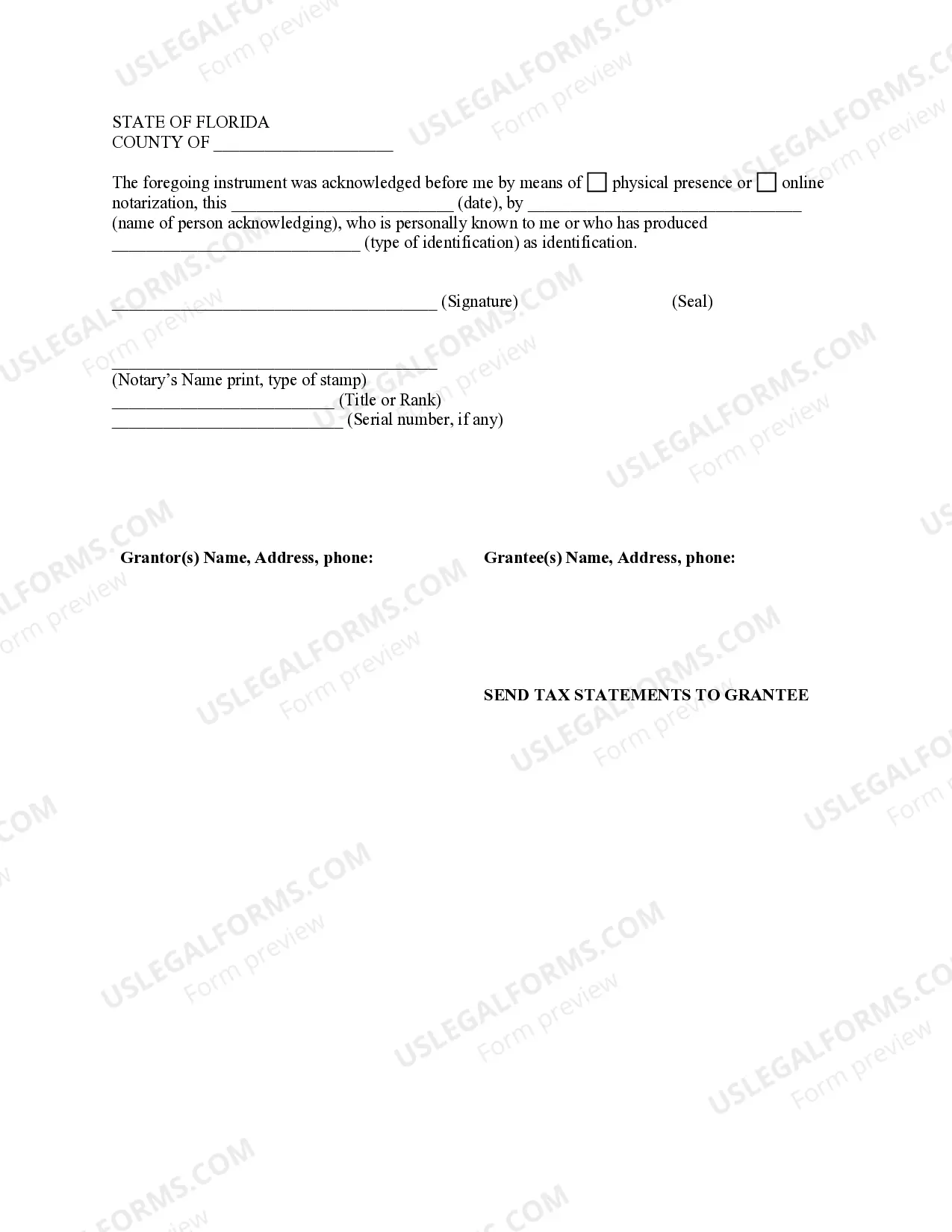

A Hillsborough Florida Warranty Deed from two Individuals to LLC is a legal document used to transfer ownership of a property from two individuals to a limited liability company (LLC) in Hillsborough County, Florida. This type of deed provides a guarantee that the two individuals, known as granters, hold full and clear title to the property and have the authority to sell it to the LLC, known as the grantee. The warranty deed includes several essential elements such as the names and addresses of the granters and the LLC, a detailed legal description of the property, the date of the transfer, and the consideration or payment made for the property. It also contains statements of warranty and promises that the granters have not conveyed the property to anyone else, that the property is free from any liens or encumbrances except those specifically mentioned in the deed, and that the granters will defend the title against any claims. There are different types of Hillsborough Florida Warranty Deeds from two Individuals to LLC, including: 1. General Warranty Deed: This type of deed offers the highest level of protection to the grantee. It guarantees that the granters have the right to sell the property and will defend the title against any claims or defects, even if they arose before the granters acquired the property. 2. Limited Warranty Deed: This type of deed offers a more limited level of protection compared to a general warranty deed. It guarantees that the granters have not caused any defects in the title during their ownership, but it does not cover any defects that may have existed prior to their ownership. 3. Special Warranty Deed: This type of deed is often used in commercial transactions. It guarantees that the granters have not caused any defects in the title during their ownership, but it does not cover any defects that may have existed prior to their ownership or any defects caused by previous owners. When preparing a Hillsborough Florida Warranty Deed from two Individuals to LLC, it is crucial to consult with a qualified real estate attorney to ensure that all legal requirements are met, and the interests of both parties are adequately protected. It is also important to conduct a title search to identify any potential issues or encumbrances before transferring the property to the LLC.