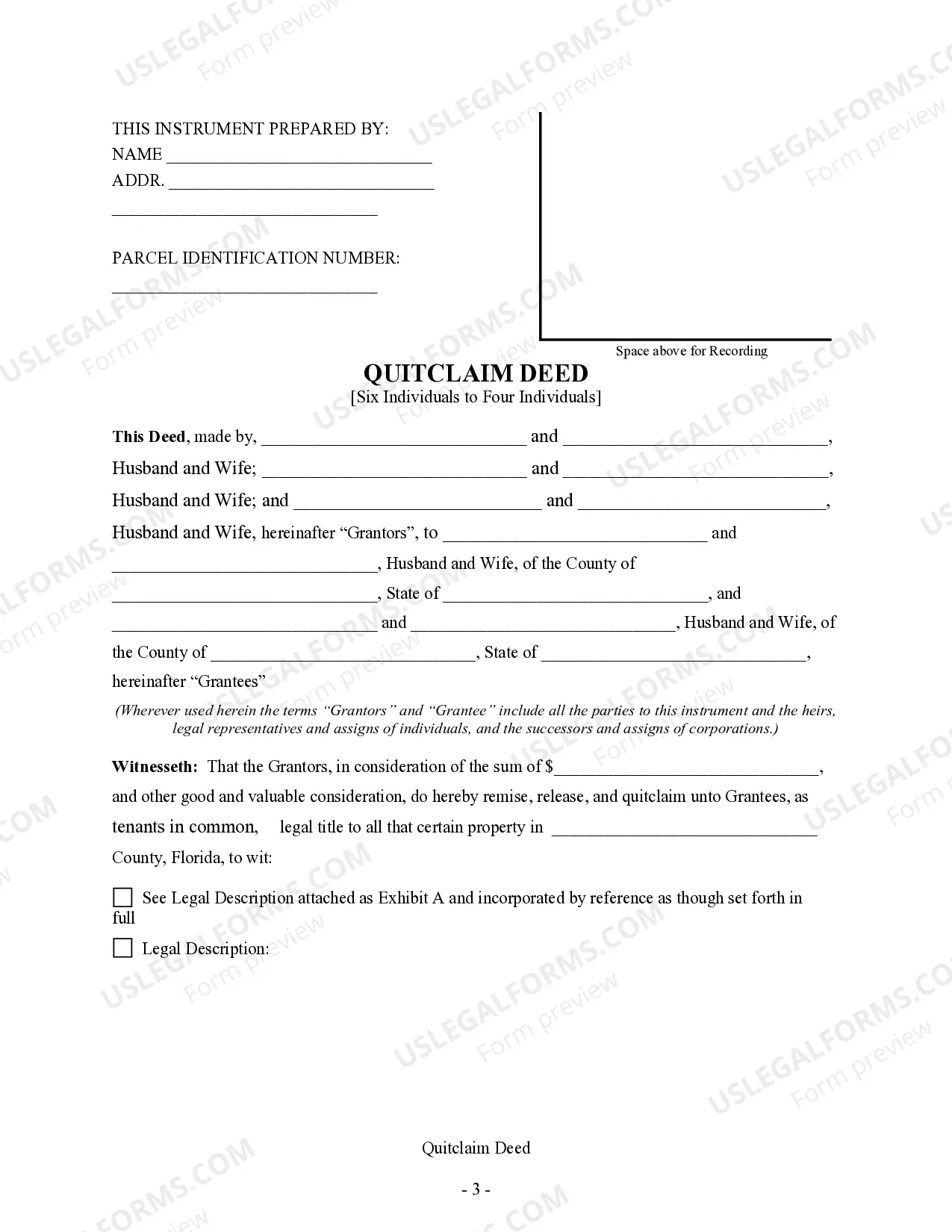

This form is a Quitclaim Deed where the grantors are three married couples and the grantees are two married couples. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

A Miami Gardens Florida Quitclaim Deed is a legal document used to transfer ownership of property from three married couples (a total of six individuals) to two married couples (a total of four individuals). This type of deed is commonly used in real estate transactions when the parties involved have mutual trust, as it transfers whatever interest the granters (the initial owners) have in the property to the grantees (the new owners), without any guarantees or warranties. There are different types of Miami Gardens Florida Quitclaim Deeds that can be used in this scenario, including: 1. Basic Miami Gardens Florida Quitclaim Deed: This is the most common type of deed used to transfer property ownership. It simply conveys the granter's interest in the property without any warranties or promises regarding the title. 2. Miami Gardens Florida Joint Tenancy Quitclaim Deed: In this type of quitclaim deed, the property is transferred to the grantees with the right of survivorship. This means that if one of the grantees passes away, their share automatically goes to the remaining grantees, without the need for probate. 3. Miami Gardens Florida Tenancy in Common Quitclaim Deed: With this type of quitclaim deed, each grantee holds a separate and distinct share in the property. If one of the grantees passes away, their share does not automatically transfer to the remaining grantees but is instead passed on according to their will or state laws. 4. Miami Gardens Florida Life Estate Quitclaim Deed: This type of deed grants the grantees' ownership of the property for the duration of their lives. Once they pass away, ownership reverts to the original granters, or it may be passed on to other specified individuals. It is important to note that a quitclaim deed does not provide any assurances about the title or guarantee that the property is free from liens or encumbrances. It is recommended to consult with a real estate attorney or professional to fully understand the implications and legalities involved in such a property transfer.